Abstract

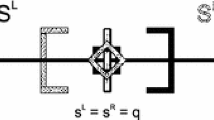

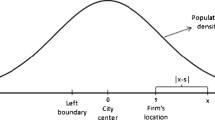

This note investigates the incidence of unit and ad valorem taxes in a framework in which firms can set discriminatory prices. In contrast with previous results obtained in Hotelling’s and Vickrey-Salop’s models the ad valorem tax does not affect the location of the firms nor the profits of rivals when firms have different marginal production costs. From the point of view of the unit tax it is neutral as in the standard f.o.b. pricing models.

Similar content being viewed by others

References

Anderson SP, de Palma A (1988) Spatial price discrimination with heterogeneous products. Rev Econ Stud 55: 573–592

Anderson SP, de Palma A, Kreider B (2001) Tax incidence in differentiated product oligopoly. J Public Econ 81: 173–192

Gupta B (1992) Sequential entry and deterrence with competitive spatial price discrimination. Econ Lett 38: 487–490

Hamilton JH, Thisse J-F, Weskamp A (1989) Spatial discrimination: Bertrand vs. Cournot in a model of location choice. Reg Sci Urban Econ 19: 87–102

Hoover EM (1937) Spatial price discrimination. Rev Econ Stud 4: 182–191

Hurter A, Lederer P (1985) Spatial competition with discriminatory pricing. Reg Sci Urban Econ 15: 541–553

Kay JA, Keen MJ (1983) How should commodities be taxed? Market structure, product heterogeneity and the optimal structure of commodity taxes. Eur Econ Rev 23: 339–358

Kitahara M, Matsumura T (2006) Tax effects in a model of product differentiation: a note. J Econ 89: 75–82

Lederer P, Hurter A (1986) Competition of firms: discriminatory pricing and location. Econometrica 54: 623–640

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Casado-Izaga, F.J. Tax effects in a model of spatial price discrimination: a note. J Econ 99, 277–282 (2010). https://doi.org/10.1007/s00712-010-0109-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-010-0109-4