Abstract

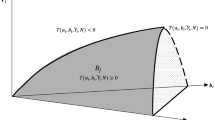

In a successive Cournot oligopoly, we show the welfare effects of entry in the final goods market with no scale economies but with cost difference between the firms. If the input market is very concentrated, entry in the final goods market increases welfare. If the input market is not very concentrated, entry in the final goods market may reduce welfare if the entrant is moderately cost inefficient. Hence, entry in the final goods market is more desirable if (1) the input market is very concentrated or (2) the cost difference between the incumbents and the entrant is either very small or very large. It follows from our analysis that entry increases the profits of the incumbent final goods producers if their marginal costs are sufficiently lower than the entrant’s marginal cost.

Similar content being viewed by others

References

Abiru M, Nahata B, Raychaudhuri S, Waterson M (1998) Equilibrium structures in vertical oligopoly. J Econ Behav Organ 37: 463–480

Anderson SP, de Palma A, Nesterov Y (1995) Oligopolistic competition and the optimal provision of products. Econometrica 63: 1281–1301

Crettez B, Fagart M-C (2009) Does entry improve welfare? A general equilibrium approach to competition policy. J Econ (in press)

Dhillon A, Petrakis E (2002) A generalised wage rigidity result. Int J Indust Organ 20: 285–311

Dixit A, Stiglitz J (1977) Monopolistic competition and optimum product diversity. Am Econ Rev 67: 297–308

Fudenberg D, Tirole J (2000) Pricing a network good to deter entry. J Indust Econ XLVIII: 373–390

Gans J (2007) Concentration-based merger tests and vertical market structure. J Law Econ 50: 661–680

Ghosh A, Morita A (2007a) Free entry and social efficiency under vertical oligopoly. Rand J Econ 38: 539–552

Ghosh A, Morita A (2007b) Social desirability of free entry: a bilateral oligopoly analysis. Int J Indust Organ 25: 925–934

Ghosh A, Saha S (2007) Excess entry in the absence of scale economies. Econ Theory 30: 575–586

Greenhut ML, Ohta H (1976) Related market conditions and interindustrial mergers. Am Econ Rev 66: 267–277

Ishikawa J, Spencer BJ (1999) Rent-shifting export subsidies with an imported intermediate product. J Int Econ 48: 199–232

Klemperer P (1988) Welfare effects of entry into markets with switching costs. J Indust Econ 27: 159–165

Komiya R (1975) Planning in Japan. In: Bornstein M (eds) Economic planning: east and west. Ballinger, Cambridge

Lahiri S, Ono Y (1988) Helping minor firms reduces welfare. Econ J 98: 1199–1202

Mankiw AG, Whinston MD (1986) Free entry and social inefficiency. RAND J Econ 17: 48–58

Matsushima N (2006) Industry profits and free entry in input markets. Econ Lett 93: 329–336

Mukherjee A (2007a) Entry in a Stackelberg perfect equilibrium. Econ Bull 12(33): 1–6

Mukherjee A (2007b) Note on a generalized wage rigidity result. Econ Bull 10(12): 1–9

Mukherjee A (2009) Excessive entry in a bilateral oligopoly. Econ Bull 29: 199–204

Mukherjee A, Mukherjee S (2008) Excess-entry theorem: the implications of licensing. Manchester Sch 76: 675–689

Naylor RA (2002) The effects of entry in bilateral oligopoly. University of Warwick, Mimeo

Okuno-Fujiwara M, Suzumura K (1993) Symmetric Cournot oligopoly and economic welfare: a synthesis. Econ Theory 3: 43–59

Perry MK (1984) Scale economies, imperfect competition, and public policy. J Indust Econ 32: 313–333

Salinger MA (1988) Vertical mergers and market foreclosure. Q J Econ 103: 345–356

Suzumura K, Kiyono K (1987) Entry barriers and economic welfare. Rev Econ Stud 54: 157–167

Tyagi RK (1999) On the effects of downstream entry. Manage Sci 45: 59–73

von Weizsäcker CC (1980) A welfare analysis of barriers to entry. Bell J Econ 11: 399–420

Williamson O (1968) Economies as an antitrust defense: welfare trade-offs. Am Econ Rev 58: 18–36

Yoshida Y (2000) Third-degree price discrimination in input market. Am Econ Rev 90: 240–246

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Mukherjee, A., Broll, U. & Mukherjee, S. The welfare effects of entry: the role of the input market. J Econ 98, 189–201 (2009). https://doi.org/10.1007/s00712-009-0097-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-009-0097-4