Abstract

When focusing on firm’s risk-aversion in industry equilibrium, the number of firms may be either larger or smaller when comparing market equilibrium with and without price uncertainty. In this paper, we introduce risk-averse firms under cost uncertainty in a model of spatial differentiation and show that the impact of uncertainty will increase the number of firms in an industry. With increased uncertainty, the risk premium of the marginal buyer increases by more than the risk premium of the average buyer, so that the price increases by more than the risk premium. When turning to the free entry game, we find that the market generates too many firms.

Similar content being viewed by others

References

Appelbaum, E., and Katz, E. (1986): “Measures of Risk Aversion and Comparative Statics of Industry Equilibrium.” American Economic Review 76: 524–529.

Asplund, M. (2002): “Risk-averse Firms in Oligopoly.” International Journal of Industrial Organization 20: 995–1012.

Baron, D. P. (1971): “Demand Uncertainty and Imperfect Competition.” International Economic Review 12: 192–208.

Calvo-Armengol, A., and Zenou, Y. (2002): “The Importance of Market Integration in Horizontal Product Differentiation.” Journal of Regional Science 42: 793–803.

Drèze, J. (1987): Essays on Economic Decisions under Uncertainty. Cambridge: Cambridge University Press.

Friberg, R., and Martensen, K. (2000): “Variability and Average Profits. Does Oi’s Result Generalize?.” Mimeographed. Stockholm School of Economics.

Gézci, C., Minton, B. A., and Schrand, C. (1997): “Why Firms Use Currency Derivatives.” Journal of Finance 52: 1323–1354.

Ghosal, V. (1996): “Does Uncertainty Influence the Number of Firms in an Industry?” Economics Letters 50: 229–236.

Ghosal, V. (2002): “Impact of Uncertainty and Sunk Costs on Firm Survival and Industry Dynamics.” Mimeographed. Georgia Institute of Technology, Atlanta.

Ghosal, V., and Loungani, P. (2000): “The Differential Impact of Uncertainty on Investment in Small and Large Businesses.” Review of Economics and Statistics 82: 338–343.

Haruna, S. (1996): “Industry Equilibrium, Uncertainty, and Future Markets.” International Journal of Industrial Organization 14: 53–70.

Huang, C. F., and Litzenberger, R. H. (1988): Foundations for Financial Economics. Amsterdam: Elsevier.

Janssen, M., and Rasmusen E. (2002): “Bertrand Competition under Uncertainty.” Journal of Industrial Economics 50: 11–21.

Jellal, M., Thisse, J. F., and Zenou, Y. (1998): “Demand Uncertainty, Mismatch and Employment: A Microeconomic Approach.” CEPR Discussion Paper, 1914.

Leland, H. (1972): “The Theory of the Firm Facing Uncertain Demand.” American Economic Review 62: 278–291.

Li, Y., and Ziemba, W. F. (1993): “Univariate and Multivariate Measures of Risk Aversion and Risk Premiums.” Annals of Operation Research 45: 265–296.

Lintner, J. (1970): “The Market Price of Risk, Size of Market, and Investor’s Risk Aversion.” Review of Economics and Statistics 52: 87–99.

Lui, L. (2003): “A New Foundation for the Mean-variance Analysis.” Mimeo. University of Akron.

Mai, C., Yeh C., and Suwanakul S. (1993): “Price Uncertainty and Production-Location Decisions under Free-entry Oligopoly.” Journal of Regional Science 33: 531–545.

Mossin, J. (1969): “Security Pricing and Investment Criteria in Competitive Markets.” American Economic Review 59: 749–756.

Nance, D. C., Smith C. W., and Smithson C. (1993): “On the Determinants of Corporate Hedging.” Journal of Finance 48: 267–284.

Oi, W. Y. (1961):“The Desirability of Price Instability under Pefect Competition.” Econometrica 29: 58–64.

Pulley, L. B., and Humphrey, D. B. (1993): “Scope Economies: Fixed Costs, Complementarity, and Functional Form.” Journal of Business 66: 437–462.

Rubinstein, M. (1973): “A Comparative Statics Analysis of Risk Premiums.” Journal of Business 12: 605–615.

Rubinstein, M. (1976): “The Valuation of Uncertain Income Streams and the Pricing of Options.” Bell Journal of Economics 7: 407–425.

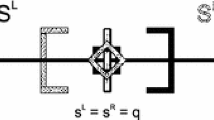

Salop, S. (1979): “Monopolistic Competition with Outside Goods.” Bell Journal of Economics 10: 141–156.

Sandmo, A. (1971): “On the Theory of the Competitive Firm under Price Uncertainty.” American Economic Review 61: 65–73.

Tessiotore, A. (1994): “Market Segmentation and Oligopoly under Uncertainty.” Journal of Economics and Business 46: 65–76.

Tirole J., (1988): The Theory of Industrial Organization. Cambridge, MA: MIT Press.

Wagener, A. (2004): “Linear Risk Tolerance and Mean-Variance Utility Function.” Mimeographed. University of Vienna.

Wambach, A. (1999): “Bertrand Competition under Cost Uncertainty.” International Journal of Industrial Organization 17: 941–951.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Jellal, M., Wolff, FC. Free Entry under Uncertainty. J Econ 85, 39–63 (2005). https://doi.org/10.1007/s00712-005-0114-1

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-005-0114-1