Abstract

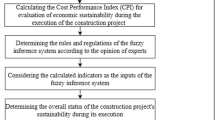

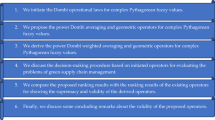

Reliable knowledge of project cash flow is essential for effective project management. Since the nature of project is uncertain and easily effected by different criteria, considering uncertainty has become a vital part of any effective project management approach. Cash, as one of the most important project resources, requires reliable management techniques. In this paper, a new interval type-2 fuzzy project cash flow analysis model based on interval type-2 fuzzy project scheduling is proposed to predict project cash flow in different periods of project life cycle. Despite using type-2 fuzzy sets in various practical problems, they are new to project management; thus, they are used in this paper to address the uncertainty and lack of sufficient knowledge in project activity durations and costs. In the first part, interval type-2 fuzzy project scheduling model is introduced, and then the forward and the backward passes are defined. In order to improve this part, a new flexible and controllable method of interval type-2 fuzzy ranking is introduced. In the second part, a model of cash flow assessment is proposed under an interval type-2 fuzzy environment. This model is able to calculate the minimum and the maximum cash distribution, cash flow of project in different periods and total direct cost of projects in addition to cash flow uncertainty. The presented model provides the manager with a comprehensive insight into the cash required in different stages of project and helps the managers to locate the periods with highest uncertainty. The model also uses the concept of alpha-levels to analyze different levels of risk of uncertainty. For the purpose of illustration, the proposed interval type-2 fuzzy model is used to generate cash flow of main activities of a real construction project in a developing country, and the results are presented. The results present high flexibility of model in expressing and considering uncertainty and vagueness, in addition to its high capability in the risk evaluation. Finally, the results of the case study are used to present the managerial implications.

Similar content being viewed by others

References

Almond B, Remer RS (1979) Models for present-worth analysis of selected industrial cash flow patterns. Eng Process Econ 4(4):455–466

Atkinson R, Crawford L, Ward S (2006) Fundamental uncertainties in projects and the scope of project management. Int J Project Manag 24(8):687–698

Barbosa PS, Pimentel PR (2001) A linear programming model for cash flow management in the Brazilian construction industry. Constr Manag Econ 19(5):469–479

Barraza GA, Back WE, Mata F (2000) Probabilistic monitoring of project performance using SS-curves. J Constr Eng Manag 126(2):142–148

Bezdek JC (1981) Pattern recognition with fuzzy objective function algorithms. Kluwer, Dordrecht

Blyth K, Kaka A (2006) A novel multiple linear regression model for forecasting S-curves. Eng Constr Archit Manag 13(1):82–95

Boussabaine AH, Elhag T (1999) Applying fuzzy techniques to cash flow analysis. Constr Manag Econ 17(6):745–755

Boussabaine AH, Kaka AP (1998) A neural networks approach for cost flow forecasting. Constr Manag Econ 16(4):471–479

Celik E, Gumus AT (2015) An assessment approach for non-governmental organizations in humanitarian relief logistics and an application in Turkey. Technol Econ Dev Econ. doi:10.3846/20294913.2015.1056277

Celikyilmaz A, Turksen IB (2009) Modeling uncertainty with fuzzy logic. Studies in fuzziness and soft computing, vol 240. Springer, Berlin, Heidelberg. ISBN 978-3-540-89923-5

Onar SC, Oztaysi B, Kahraman C (2014) Strategic decision selection using hesitant fuzzy TOPSIS and interval type-2 fuzzy AHP: a case study. Int J Comput Intell Syst 7(5):1002–1021

Chanas S, Kamburowski J (1981) The use of fuzzy variables in PERT. Fuzzy Sets Syst 5(1):11–19

Chen HL, O’Brien WJ, Herbsman ZJ (2005) Assessing the accuracy of cash flow models: the significance of payment conditions. J Constr Eng Manag 131(6):669–676

Chen SM, Lee LW (2010) Fuzzy multiple attributes group decision-making based on the ranking values and the arithmetic operations of interval type-2 fuzzy sets. Expert Syst Appl 37(1):824–833

Chen SM, Yang MW, Lee LW, Yang SW (2012) Fuzzy multiple attributes group decision-making based on ranking interval type-2 fuzzy sets. Expert Syst Appl 39(5):5295–5308

Cioffi DF (2005) A tool for managing projects: an analytic parameterization of the S curve. Int J Project Manage 23(3):215–222

Deng H (2014) Comparing and ranking fuzzy numbers using ideal solutions. Appl Math Model 38(5):1638–1646

Dereli T, Baykasoglu A, Altun K, Durmusoglu A, Türksen IB (2011) Industrial applications of type-2 fuzzy sets and systems: a concise review. Comput Ind 62(2):125–137

Gates M, Scarpa A (1979) Preliminary cumulative cash flow analysis. Cost Engineering 21(6):243–249

Göçken Tolunay (2013) Solution of fuzzy multi-objective project crashing problem. Neural Comput Appl 23(7–8):2167–2175

Gormley FM, Meade N (2007) The utility of cash flow forecasts in the management of corporate cash balances. Eur J Oper Res 182(2):923–935

Hapke M, Slowinski R (1996) Fuzzy priority heuristics for project scheduling. Fuzzy Sets Syst 83(3):291–299

Holland NL, Hobson D Jr (1999) Indirect cost categorization and allocation by construction contractors. J Archit Eng 5(2):49–56

Hsu K (2003) Estimation of a double S-curve model. AACE Int Trans 1:IT13.1–IT13.5

Hwee NG, Tiong RL (2002) Model on cash flow forecasting and risk analysis for contracting firms. Int J Project Manage 20(5):351–363

Jarrah RE, Kulkarni D, O’Connor JT (2007) Cash flow projections for selected TxDoT highway projects. J Constr Eng Manag 133(3):235–241

Jiang A, Issa RR, Malek M (2011) Construction project cash flow planning using the Pareto optimality efficiency network model. J Civil Eng Manag 17(4):510–519

Kaka AP, Price ADF (1991) Net cashflow models: are they reliable? Constr Manag Econ 9(3):291–308

Kaka AP, Price ADF (1993) Modelling standard cost commitment curves for contractors’ cash flow forecasting. Constr Manag Econ 11(4):271–283

Khosrowshahi F, Kaka AP (2007) A decision support model for construction cash flow management. Comput Aided Civil Infrastruct Eng 22(7):527–539

Kiliç M, Kaya İ (2015) Investment project evaluation by a decision making methodology based on type-2 fuzzy sets. Appl Soft Comput 27:399–410

Kumar VS, Hanna AS, Adams T (2000) Assessment of working capital requirements by fuzzy set theory. Eng Constr Archit Manag 7(1):93–103

Lam KC, So ATP, Hu T, Ng T, Yuen RKK, Lo SM et al (2001) An integration of the fuzzy reasoning technique and the fuzzy optimization method in construction project management decision-making. Constr Manag Econ 19(1):63–76

Lee LW, Chen SM (2008) A new method for fuzzy multiple attributes group decision-making based on the arithmetic operations of interval type-2 fuzzy sets. In: IEEE 2008 international conference on machine learning and cybernetics, vol 6, pp 3084–3089

Lee-Kwang H, Song YS, Lee KM (1994) Similarity measure between fuzzy sets and between elements. Fuzzy Sets Syst 62(3):291–293

Liao TW (2015) Two interval type 2 fuzzy TOPSIS material selection methods. Mater Des 88:1088–1099

Maity S, Sil J (2009) Color image segmentation using type-2 fuzzy sets. Int J Comput Electr Eng 1(3):1793–8163

Maravas A, Pantouvakis JP (2010) A study of cash flows in projects with fuzzy activity durations. In: Proceedings of the international conference on computing in civil and building engineering, Nottingham

Maravas A, Pantouvakis JP (2012) Project cash flow analysis in the presence of uncertainty in activity duration and cost. Int J Project Manage 30(3):374–384

McCahon CS, Lee ES (1988) Project network analysis with fuzzy activity times. Comput Math Appl 15(10):829–838

Mendel JM (2003) Type-2 fuzzy sets: some questions and answers. IEEE Connect Newsl IEEE Neural Netw Soc 1:10–13

Mendel JM (2007) Type-2 fuzzy sets and systems: an overview. Comput Intell Mag IEEE 2(1):20–29

Mendel JM, John RI, Liu F (2006) Interval type-2 fuzzy logic systems made simple. IEEE Trans Fuzzy Syst 14(6):808–821

Mendel J, Wu D (2010) Perceptual computing: aiding people in making subjective judgments, vol 13. Wiley, New York

Mendel JM (2013) Interval type-2 fuzzy logic systems and perceptual computers: their similarities and differences. In: Sadeghian A, Mendel J, Tahayori H (eds) Advances in type-2 fuzzy sets and systems. Springer, New York, pp 3–17

Mousavi SM, Tavakkoli-Moghaddam R, Vahdani B, Hashemi H, Sanjari MJ (2013) A new support vector model-based imperialist competitive algorithm for time estimation in new product development projects. Robot Comput Integr Manuf 29:157–168

Mousavi SM, Vahdani B, Abdollahzade M (2015) An intelligent model for cost prediction in new product development projects. J Intell Fuzzy Syst 29:2047–2057

Navon R (1996) Company-level cash-flow management. J Constr Eng Manag 122(1):22–29

Prade H (1979) Using fuzzy set theory in a scheduling problem: a case study. Fuzzy Sets Syst 2(2):153–165

Qin J, Liu X, Pedrycz W (2015) An extended VIKOR method based on prospect theory for multiple attribute decision making under interval type-2 fuzzy environment. Knowl Based Syst 86:116–130

Renna P, Argoneto P (2012) Capacity investment decision in co-opetitive network by information sharing. Comput Ind Eng 62(1):359–367

Rostamy AA, Takanlou F, AnvaryRostamy A (2013) A fuzzy statistical expert system for cash flow analysis and management under uncertainty. Adv Econ Bus 1(2):89–102

Sari IU, Kahraman C (2015) Interval type-2 fuzzy capital budgeting. Int J Fuzzy Syst. doi:10.1007/s40815-015-0040-5

Singh S, Lokanathan G (1992) Computer-based cash flow model. AACE Int Trans 2:R.5.1–R.5.14

Touran A, Atgun M, Bhurisith I (2004) Analysis of the United States Department of Transportation prompt pay provisions. J Constr Eng Manag 130(5):719–725

Tran L, Duckstein L (2002) Comparison of fuzzy numbers using a fuzzy distance measure. Fuzzy Sets Syst 130(3):331–341

Turk S, John R, Özcan E (2014) Interval type-2 fuzzy sets in supplier selection. Type-2 TOPSIS method. Expert Syst Appl 37(4):2790–2798

Turksen IB (1999) Type I and type II fuzzy system modeling. Fuzzy Sets Syst 106(1):11–34

Vahdani B, Mousavi SM, Mousakhani M, Sharifi M, Hashemi H (2012) A neural network model based on support vector machine for conceptual cost estimation in construction projects. J Optim Ind Eng 10:11–18

Wang W, Liu X, Qin Y (2012) Multi-attribute group decision making models under interval type-2 fuzzy environment. Knowl Based Syst 30:121–128

Xuecheng L (1992) Entropy, distance measure and similarity measure of fuzzy sets and their relations. Fuzzy Sets Syst 52(3):305–318

Yao JS, Chen MS, Lu HF (2006) A fuzzy stochastic single-period model for cash management. Eur J Oper Res 170(1):72–90

Zadeh LA (1974) The concept of a linguistic variable and its application to approximate reasoning. Springer, New York, pp 1–10

Zammori FA, Braglia M, Frosolini M (2009) A fuzzy multi-criteria approach for critical path definition. Int J Project Manage 27(3):278–291

Zhang Z, Zhang S (2013) A novel approach to multi attribute group decision making based on trapezoidal interval type-2 fuzzy soft sets. Appl Math Model 37(7):4948–4971

Acknowledgments

The authors would like thank anonymous reviewers for their valuable comments and recommendations to improve the quality of the primary manuscript.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Mohagheghi, V., Mousavi, S.M. & Vahdani, B. Analyzing project cash flow by a new interval type-2 fuzzy model with an application to construction industry. Neural Comput & Applic 28, 3393–3411 (2017). https://doi.org/10.1007/s00521-016-2235-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00521-016-2235-6