Abstract

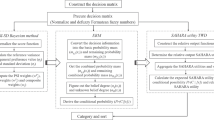

Crowdfunding based on the network platform has become a valuable paradigm for entrepreneurs to seek funding for their initiatives or businesses. Given the issue of information asymmetry, high financing failure rates, and high market risk in crowdfunding project investment, prompt risk identification and assessment can help to lessen the detrimental impact on backers. Therefore, this study presents a risk assessment approach for the risk assessment of crowdfunding project investment by integrating failure mode and effect analysis (FMEA) and the fuzzy super-efficiency slacks-based measure (SBM). Firstly, in addition to the existing parameters of severity, occurrence, and detection, two parameters called the probability of losing control, and the expected costs are attached to the FMEA model for the characteristics of crowdfunding projects. Then, considering the vagueness and uncertainty of FMEA team members in their assessments, the fuzzy super-efficiency SBM method is utilized to prioritize risks and identify critical failure modes. Finally, the effectiveness and applicability of the proposed approach are demonstrated through a case study, further comparative analysis, and agglomerative hierarchical cluster analysis. Consequently, the results of this study provide important references and recommendations for crowdfunding project backers to make rational decisions and optimize resource allocation.

Similar content being viewed by others

Data Availability

The datasets supporting the conclusions of this article are included within the article.

References

Ahlers GKC, Cumming D, Guenther C, Schweizer D (2015) Signaling in equity crowdfunding. Entrep Theory Pract 39(4):955–980

Ahmadi M, Behzadian K, Ardeshir A, Kapelan Z (2017) Comprehensive risk management using fuzzy FMEA and MCDA techniques in highway construction projects. J Civ Eng Manag 23(2):300–310

Akram M, Luqman A, Alcantud JCR (2021) Risk evaluation in failure modes and effects analysis: hybrid TOPSIS and ELECTRE I solutions with Pythagorean fuzzy information. Neural Comput Appl 33(11):5675–5703

Azadi M, Jafarian M, Saen RF, Mirhedayatian SM (2015) A new fuzzy DEA model for evaluation of efficiency and effectiveness of suppliers in sustainable supply chain management context. Comput Oper Res 54:274–285

Belleflamme P, Lambert T, Schwienbacher A (2014) Crowdfunding: tapping the right crowd. J Bus Ventur 29(5):585–609

Bi S, Liu ZY, Usman K (2017) The influence of online information on investing decisions of reward-based crowdfunding. J Bus Res 71:10–18

Borrero-Dominguez C, Cordon-Lagares E, Hernandez-Garrido R (2020) Analysis of success factors in crowdfunding projects based on rewards: a way to obtain financing for socially committed projects. Heliyon 6(4):e03744

Chemla G, Tinn K (2020) Learning through crowdfunding. Manage Sci 66(5):1783–1801

Chen CB, Klein CM (1997) A simple approach to ranking a group of aggregated fuzzy utilities. IEEE Trans Syst Man and Cybern Part B-Cybern 27(1):26–35

Cheng M, Lu YJ (2015) Developing a risk assessment method for complex pipe jacking construction projects. Autom Constr 58:48–59

Duan CY, Chen XQ, Shi H, Liu HC (2022) A new model for failure mode and effects analysis based on k-means clustering within hesitant linguistic environment. IEEE Trans Eng Manage 69(5):1837–1847

Fu Y, Qin Y, Wang WZ, Liu XW, Jia LM (2020) An extended FMEA model based on cumulative prospect theory and type-2 intuitionistic fuzzy VIKOR for the railway train risk prioritization. Entropy. https://doi.org/10.3390/e22121418

Gojkovic R, Duric G, Tadic D, Nestic S, Aleksic A (2021) Evaluation and selection of the quality methods for manufacturing process reliability improvement-intuitionistic fuzzy sets and genetic algorithm approach. Mathematics 9(13):1531

Gul M, Ak MF (2021) A modified failure modes and effects analysis using interval-valued spherical fuzzy extension of TOPSIS method: case study in a marble manufacturing facility. Soft Comput 25(8):6157–6178

He SS, Wang YT, Wang JQ, Cheng PF, Li L (2020) A novel risk assessment model based on failure mode and effect analysis and probabilistic linguistic ELECTRE II method. J Intell Fuzzy Syst 38(4):4675–4691

Hsiao B, Chern CC, Chiu YH, Chiu CR (2011) Using fuzzy super-efficiency slack-based measure data envelopment analysis to evaluate Taiwan’s commercial bank efficiency. Expert Syst Appl 38(8):9147–9156

Hsieh HC, Vu THC (2021) The impact of economic policy uncertainty on crowdfunding success. J Int Finan Markets Inst Money 75:101418

Hu YP, You XY, Wang L, Liu HC (2019) An integrated approach for failure mode and effect analysis based on uncertain linguistic GRA-TOPSIS method. Soft Comput 23(18):8801–8814

Hua Z, Fei LG, Jing XC (2023) An improved risk prioritization method for propulsion system based on heterogeneous information and PageRank algorithm. Expert Syst Appl 212:118798

Huang WC, Zhang Y (2021) Railway dangerous goods transportation system risk assessment: an approach combining FMEA with pessimistic-optimistic fuzzy information axiom considering acceptable risk coefficient. IEEE Trans Reliab 70(1):371–388

Huang GQ, Xiao LM, Zhang GB (2021a) Risk evaluation model for failure mode and effect analysis using intuitionistic fuzzy rough number approach. Soft Comput 25(6):4875–4897

Huang YJ, Huang XK, Xie MN, Cheng W, Shu Q (2021b) A study on the effects of regional differences on agricultural water resource utilization efficiency using super-efficiency SBM model. Sci Rep 11(1):9953

Huang J, Liu HC, Duan CY, Song MS (2022) An improved reliability model for FMEA using probabilistic linguistic term sets and TODIM method. Ann Oper Res 312(1):235–258

Islam MS, Nepal MP, Skitmore M (2019) Modified fuzzy group decision-making approach to cost overrun risk assessment of power plant projects. J Constr Eng Manag. https://doi.org/10.1061/(ASCE)CO.1943-7862.0001593

Jin CX, Ran Y, Zhang GB (2021) Interval-valued q-rung orthopair fuzzy FMEA application to improve risk evaluation process of tool changing manipulator. Appl Soft Comput 104:107192

Jomthanachai S, Wong WP, Lim CP (2021) An application of data envelopment analysis and machine learning approach to risk management. IEEE Access 9:85978–85994

Kleinert S, Volkmann C, Gruenhagen M (2020) Third-party signals in equity crowdfunding: the role of prior financing. Small Bus Econ 54(1):341–365

Koch JA, Siering M (2019) The recipe of successful crowdfunding campaigns an analysis of crowdfunding success factors and their interrelations. Electron Mark 29(4):661–679

Lee J, Lee Y, Kim J (2013) Assessing the risks of Asian development projects: a theoretical framework and empirical findings. J Asian Architecture and Building Engineering 12(1):25–32

Li DM, Li LP (2022) Research on efficiency in credit risk prediction using logistic-SBM model. Wirel Commun Mob Comput 2022:5986295

Li Z, Jin GH, Duan S (2018) Evolutionary game dynamics for financial risk decision-making in global supply chain. Complexity 2018:9034658

Li XY, Xiong Y, Duan CY, Liu HC (2019) Failure mode and effect analysis using interval type-2 fuzzy sets and fuzzy Petri nets. J Intell Fuzzy Syst 37(1):693–709

Li HM, Ji L, Li F et al (2020) Operational safety risk assessment for the water channels of the south-to-north water diversion project based on TODIM-FMEA. Complexity 2020:6691764

Liang TP, Wu SPJ, Huang CC (2019) Why funders invest in crowdfunding projects: role of trust from the dual-process perspective. Inf Manage 56(1):70–84

Liu HC, Liu L, Liu N, Mao LX (2012) Risk evaluation in failure mode and effects analysis with extended VIKOR method under fuzzy environment. Expert Syst Appl 39(17):12926–12934

Liu HC, Liu L, Liu N (2013) Risk evaluation approaches in failure mode and effects analysis: a literature review. Expert Syst Appl 40(2):828–838

Liu HC, You JX, You XY, Shan MM (2015) A novel approach for failure mode and effects analysis using combination weighting and fuzzy VIKOR method. Appl Soft Comput 28:579–588

Liu HC, You JX, Li P, Su Q (2016) Failure mode and effect analysis under uncertainty: an integrated multiple criteria decision making approach. IEEE Trans Reliab 65(3):1380–1392

Liu HC, You XY, Tsung F, Ji P (2018) An improved approach for failure mode and effect analysis involving large group of experts: an application to the healthcare field. Qual Eng 30(4):762–775

Liu HC, Wang LE, Li ZW, Hu YP (2019) Improving risk evaluation in FMEA with cloud model and hierarchical TOPSIS method. IEEE Trans Fuzzy Syst 27(1):84–95

Liu ZM, Wang XY, Sun NN, Li L, Wang D, Liu PD (2021) FMEA using the normalized projection-based TODIM-PROMETHEE II model for blood transfusion. Int J Fuzzy Syst 23(6):1680–1696

Liu JW, Wang DJ, Lin QL, Deng MK (2023) Risk assessment based on FMEA combining DEA and cloud model: a case application in robot-assisted rehabilitation. Expert Syst Appl 214:119119

Lo HW, Liou JJH (2018) A novel multiple-criteria decision-making-based FMEA model for risk assessment. Appl Soft Comput 73:684–696

Lo HW, Shiue W, Liou JJH, Tzeng GH (2020) A hybrid MCDM-based FMEA model for identification of critical failure modes in manufacturing. Soft Comput 24(20):15733–15745

Lovell CAK, Pastor JT (1999) Radial DEA models without inputs or without outputs. Eur J Oper Res 118(1):46–51

Mozaffari MR, Ostovan S, Wanke PF, Tan Y (2022) Evaluation of multi-stage fuzzy networks in DEA and DEA-R based on liquidity ratios with undesirable outputs. Int J Fuzzy Syst 24(5):2411–2446

Nie WB, Liu WD, Wu ZY, Chen BS, Wu LL (2019) Failure mode and effects analysis by integrating Bayesian fuzzy assessment number and extended gray relational analysis-technique for order preference by similarity to ideal solution method. Qual Reliab Eng Int 35(6):1676–1697

Ozdemir Y, Gul M, Celik E (2017) Assessment of occupational hazards and associated risks in fuzzy environment: a case study of a university chemical laboratory. Hum Ecol Risk Assess 23(4):895–924

Petruzzelli AM, Natalicchio A, Panniello U, Roma P (2019) Understanding the crowdfunding phenomenon and its implications for sustainability. Technol Forecast Soc Chang 141:138–148

Rashidi K, Cullinane K (2019) A comparison of fuzzy DEA and fuzzy TOPSIS in sustainable supplier selection: implications for sourcing strategy. Expert Syst Appl 121:266–281

Tang X, Lu HB, Huang W, Liu SL (2021) Investment decisions and pricing strategies of crowdfunding players: In a two-sided crowdfunding market. Electron Commer Res. https://doi.org/10.1007/s10660-021-09510-y

Tian ZP, Wang JQ, Zhang HY (2018) An integrated approach for failure mode and effects analysis based on fuzzy best-worst, relative entropy, and VIKOR methods. Appl Soft Comput 72:636–646

Tone K (2001) A slacks-based measure of efficiency in data envelopment analysis. Eur J Oper Res 130(3):498–509

Tone K (2002) A slacks-based measure of super-efficiency in data envelopment analysis. Eur J Oper Res 143(1):32–41

Venslaviene S, Stankeviciene J, Vaiciukeviciute A (2021) Assessment of successful drivers of crowdfunding projects based on visual analogue scale matrix for criteria weighting method. Mathematics 9(14):1590

Vismara S (2019) Sustainability in equity crowdfunding. Technol Forecast Soc Chang 141:98–106

Wang ZL, You JX, Liu HC, Wu SM (2017) Failure mode and effect analysis using soft set theory and COPRAS Method. Int J Comput Intell Syst 10(1):1002–1015

Wang W, Zheng HS, Wu YCJ (2020) Prediction of fundraising outcomes for crowdfunding projects based on deep learning: a multimodel comparative study. Soft Comput 24(11):8323–8341

Wang ZC, Ran Y, Chen YF, Yang X, Zhang GB (2022) Group risk assessment in failure mode and effects analysis using a hybrid probabilistic hesitant fuzzy linguistic MCDM method. Expert Syst Appl 188:116013

Yang YY, Guo HX, Wang DY, Ke XL, Li SC, Huang SR (2021) Flood vulnerability and resilience assessment in China based on super-efficiency DEA and SBM-DEA methods. J Hydrol 600:126470

You JX, Deng QW (2020) Manufacturing execution system risk analysis based on an improved failure mode and effects analysis method. J Tongji Univ Nat Sci 48(1):132–138

Yousefi S, Alizadeh A, Hayati J, Baghery M (2018) HSE risk prioritization using robust DEA-FMEA approach with undesirable outputs: a study of automotive parts industry in Iran. Saf Sci 102:144–158

Yu JX, Xu Y, Yu Y, Wu SB (2023) Failure mode and effect analysis using the hesitant intuitionistic fuzzy hybrid GRP approach with ordered comprehensive weights. Qual Reliab Eng Int 39(1):328–352

Yucesan M, Gul M, Celik E (2021) A holistic FMEA approach by fuzzy-based Bayesian network and best-worst method. Complex Intell Syst 7(3):1547–1564

Zheng QH, Liu XW, Wang WZ (2022) A likelihood-based ORESTE method for failure mode and effect analysis (FMEA) based risk analysis problem under interval type-2 fuzzy environment. Qual Reliab Eng Int 38(1):304–325

Funding

This work was supported by the National Natural Science Foundation of China (No. 72171170), the Fundamental Research Funds of the Central Universities (No. 22120210535), and the Shanghai Pujiang Program (Grant No. 20PJ1413700).

Author information

Authors and Affiliations

Contributions

MZ prepared the methodology and wrote the original manuscript; WZ assisted with data curation, investigation, and analyses; CD was in charge of the whole trial, writing—reviewing, and revision. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Informed consent

All authors agree to submit this version and claim that no part of this manuscript has been published or submitted elsewhere.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Zhu, M., Zhou, W. & Duan, C. Integrating FMEA and fuzzy super-efficiency SBM for risk assessment of crowdfunding project investment. Soft Comput 28, 2563–2575 (2024). https://doi.org/10.1007/s00500-023-08534-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-023-08534-w