Abstract

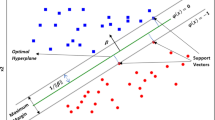

Credit risk and business failure classification and prediction are a major topic in financial risk management and corporate finance decision making. In this work, an adaptive sequential-filtering learning system for credit risk modeling. It is basically a three-stage sequential system for credit risk and business failure classification is presented. First, different statistical filters are applied separately to perform a preselection of relevant patterns. Second, genetic algorithms are applied to preselected patterns for refinement purpose. Finally, structural risk minimization approach based on support vector machine uses refined patterns for prediction purpose. We used three credit databases and two data partition schemes: (i) random split with 80% for learning and 20% testing, and (ii) tenfold cross-validation technique. Results from all three data sets and for all partition techniques show the effectiveness of the proposed adaptive sequential-filtering learning system for credit risk modeling against single support vector machines each with specific statistical filter-based patterns. In addition, it outperformed various models validated on the same databases. It is concluded that the presented adaptive sequential system is promising for credit risk monitoring.

Similar content being viewed by others

Change history

19 May 2021

A Correction to this paper has been published: https://doi.org/10.1007/s00500-021-05882-3

References

Bequé A, Lessmann S (2017) Extreme learning machines for credit scoring: an empirical evaluation. Expert Syst Appl 86:42–53

Chen M-Y (2012) Visualization and dynamic evaluation model of corporate financial structure with self-organizing map and support vector regression. Appl Soft Comput 12:2274–2288

Chuang C-L, Huang S-T (2011) A hybrid neural network approach for credit scoring. Expert Syst 28(2):185–196

Dahiya S, Handa SS, Singh NP (2017) A feature selection enabled hybrid-bagging algorithm for credit risk evaluation. Expert Syst 34(6):e12217

Divsalar M, Firouzabadi AK, Sadeghi M, Behrooz AH, Alavi AH (2011) Towards the prediction of business failure via computational intelligence techniques. Expert Syst 28(3):209–226

Gicić A, Subasi A (2019) Credit scoring for a microcredit data set using the synthetic minority oversampling technique and ensemble classifiers. Expert Syst 36(2):e12363

Goldberg DE, Holland JH (1988) Genetic algorithms and machine learning. Mach Learn 3:95–99

Guo Y, He J, Xu L, Liu W (2019) A novel multi-objective particle swarm optimization for comprehensible credit scoring. Soft Comput 23:9009–9023

Hu Y-C (2020) A multivariate grey prediction model with grey relational analysis for bankruptcy prediction problems. Soft Comput 24:4259–4268

Lahmiri S (2016) Features selection, data mining and finacial risk classification: a comparative study. Intell Syst Account Finance Manag 23:265–275

Lahmiri S (2017) A two-step system for direct bank telemarketing outcome classification. Intell Syst Account Finance Manag 24:49–55

Lahmiri S, Bekiros S (2019) Can machine learning approaches predict corporate bankruptcy? Evidence from a qualitative experimental design. Quant Finance 19(9):1569–1577

Lahmiri S, Shmuel A (2019) Detection of Parkinson’s disease based on voice patterns ranking and optimized support vector machine. Biomed Signal Process Control 49:427–433

Lahmiri, S., Gargour, C. & Gabrea, M. (2012). Statistical features selection and pathologies detection in retina digital images. IEEE Industrial Electronics Conference, 1585–1590.

Lahmiri S, Bekiros S, Giakoumelou A, Bezzina F (2020) Performance assessment of ensemble learning systems in financial data classification. Intell Syst Account Finance Manag 27(1):3–9

Li H, Sun J (2011) On performance of case-based reasoning in Chinese business failure prediction from sensitivity, specificity, positive and negative values. Appl Soft Comput 11:460–467

Li H, Sun J, Li J-C, Yan X-Y (2013) Forecasting business failure using two-stage ensemble of multivariate discriminant analysis and logistic regression. Expert Syst 30(5):385–397

Li H, Li C-J, Wu X-J, Sun J (2014) Statistics-based wrapper for feature selection: an implementation on financial distress identification with support vector machine. Appl Soft Comput 19:57–67

Lin F, Liang D, Yeh C-C, Huang J-C (2014) Novel feature selection methods to financial distress prediction. Expert Syst Appl 41:2472–2483

Lin W-C, Lu Y-H, Tsai C-F (2019) Feature selection in single and ensemble learning-based bankruptcy prediction models. Expert Syst 36(1):e12335

Luo C (2018) A comparison analysis for credit scoring using bagging ensembles. Expert Syst. https://doi.org/10.1111/exsy.12297

Mantas CJ, Castellano JG, Moral-García S, Abellán J (2019) A comparison of random forest based algorithms: random credal random forest versus oblique random forest. Soft Comput 23:10739–10754

Pezzella F, Morganti G, Ciaschetti G (2007) A genetic algorithm for the flexible job-shop scheduling problem. Comput Oper Res 35:3202–3212

Serrano-Cinca C, Gutiérrez-Nieto B (2013) Partial least square discriminant analysis for bankruptcy prediction. Decis Support Syst 54:1245–1255

Song X, Ding Y, Huang J, Ge Y (2010) Feature selection for support vector machine in financial crisis prediction: a case study in China. Expert Syst 27(4):299–310

Sreekantha DK, Kulkarni RV (2012) Expert system design for credit risk evaluation using neuro-fuzzy logic. Expert Syst 29(1):56–69

Tsai C-F (2008) Financial decision support using neural networks and support vector machines. Expert Syst 25(4):380–393

Vapnik VN (1995) The nature of statistical learning theory. Springer, New York

Wang G, Ma J, Yang S (2014) An improved boosting based on feature selection for corporate bankruptcy prediction. Expert Syst Appl 41:2353–2361

Zhang Z, He J, Gao G, Tian Y (2019) Sparse multi-criteria optimization classifier for credit risk evaluation. Soft Comput 23:3053–3066

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical approval

The article does not contain any studies with human participants or animals performed by any of the authors.

Informed consent

Informed consent was obtained from all individual participants included in the study.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The original article has been updated: Due to first author name update.

Rights and permissions

About this article

Cite this article

Lahmiri, S., Giakoumelou, A. & Bekiros, S. An adaptive sequential-filtering learning system for credit risk modeling. Soft Comput 25, 8817–8824 (2021). https://doi.org/10.1007/s00500-021-05833-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-021-05833-y