Abstract

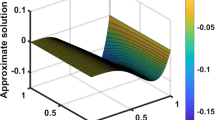

In this paper, we consider two new stock models in which their differential equations are modeled by Liu process in uncertain environment. Firstly, we study the uncertain Schöbel–Zhu–Hull–White hybrid model and obtain its closed European call option pricing using Liu calculus. Also, we solve this model by Monte Carlo simulation to ensure the performance of Monte Carlo method. Our main purpose is to present a new model, uncertain Heston–CIR hybrid model, in which its uncertain differential equations cannot be solved and so we can calculate the option value via Monte Carlo simulation. Finally, some examples are stated for illustrating these models to obtain successful results and show the efficiency of Monte Carlo method.

Similar content being viewed by others

References

Black F, Scholes M (1973) The pricing of options and corporate liabilities. J Polit Econ 81:637–654

Chen X (2011) American option pricing formula for uncertain financial market. Int J Oper Res 8:27–32

Chen X, Liu B (2010) Existence and uniqueness theorem for uncertain differential equations. Fuzzy Optim Decis Mak 9:69–81

Chen X, Liu Y, Ralescu DA (2013) Uncertain stock model with periodic dividends. Fuzzy Optim Decis Mak 12:111–123

Christoffersen P, Heston S, Jacobs K (2009) The shape and term structure of the index option smirk: why multifactor stochastic volatility models work so well. Manag Sci 55:1914–1932

Fan Y, Zhang H (2014) The pricing of Asian options in uncertain volatility model. Math Probl Eng 2014:1–19

Francesco M, Foschi P, Pascucci A (2006) Analysis of an uncertain volatility model. J Appl Math Decis Sci 2006:1–17

Grzelak L, Oosterlee C (2011) On the Heston model with stochastic interest rate. SIAM J Financ Math 2:255–286

Haastrecht A, Lord R, Pelsser A, Schrager D (2009) Pricing long-maturity equity and FX derivatives with stochastic interest rates and stochastic volatility. Insur Math Econ 45:1–28

Heston S (1993) A closed-form solution for options with stochastic volatility with applications to bond and currency options. Rev Financ Stud 6:327–343

Hull J, White A (1990) Pricing interest-rate derivative securities. Rev Financ Stud 3:573–592

Hull J, White A (1993) One factor interest rate models and the valuation of interest rate derivative securities. J Financ Quant Anal 28(235):254

Liu B (2007) Uncertainty theory, 2nd edn. Springer, Berlin

Liu B (2008) Fuzzy process, hybrid process and uncertain process. J Uncertain Syst 2:3–16

Liu B (2009) Some research problems in uncertainty theory. J Uncertain Syst 3:3–10

Liu B (2010) Uncertainty theory: a branch of mathematics for modeling human uncertainty. Springer, Berlin

Liu Y, Ha M (2010) Expected value of function of uncertain variables. J Uncertain Syst 4:181–186

Peng J, Yao K (2010) A new option pricing model for stocks in uncertainty markets. Int J Oper Res 7:213–224

Schobel R, Zhu J (1999) Stochastic volatility with an ornstein uhlenbeck process: an extension. Eur Finance Rev 4:23–46

Stein JC, Stein EM (1991) Stock price distributions with stochastic volatility: an analytic approach. Rev Financ Stud 4:727–752

Vasicek OA (1977) An equilibrium characterization of the term structure. J Financ Econ 5:177–188

Yang X, Shen S (2015) Runge–Kutta method for solving uncertain differential equations. J Uncertain Anal Appl 3:1–12

Yao K, Chen X (2013) A numerical method for solving uncertain differential equations. J Intell Fuzzy Syst 25:825–832

Zhang K, Wang S (2009) A computational scheme for uncertain volatility model in option pricing. Appl Numer Math 59:1754–1767

Zhou Q, Li X (2019) Vulnerable options pricing under uncertain volatility model. J Inequal Appl 315:1–16

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

All authors declare that they have no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Fathi-Vajargah, B., Mirzazadeh, M. & Ghasemalipour, S. An efficient Monte Carlo simulation for new uncertain Heston–CIR hybrid model. Soft Comput 25, 8539–8547 (2021). https://doi.org/10.1007/s00500-021-05702-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-021-05702-8