Abstract

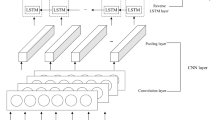

Sentiment analysis has been used in many studies to predict stock market trends. Current sentimental analysis approaches focus only on the upward and downward movement of the price, which is not sufficient for more precise prediction of stock sentiments. Previous studies have focused on the trend (valence) regarding stocks because it represents the upward and downward trend of a stock. However, investors should be attention on trading (arousal) because the stock price increases or decreases even quickly or slowly; they may not to do trade. Therefore, this paper applies the concept of dimensional valence–arousal to define sentiments which intensities of trading and trends of the stock market for data annotation. The paper proposes a deep learning prediction model to predict the intensities of stock dimensional valence–arousal (SDVA), called the hierarchical title–keyword-based attentional hybrid network (HAHTKN). The paper modifies the hierarchical attention network (HAN) to our proposed HAHTKN model, comprising (1) a title encoder, (2) a keyword encoder, (3) a title–keyword encoder, (4) word-level encoder, (5) a sentence-level encoder and (6) stock DVA prediction layer. The experimental results show that the proposed HAHTKN prediction model for the SDVA task outperformed other baseline machine learning models and HAN-based models.

Similar content being viewed by others

Notes

Chinese Knowledge and Information Processing (CKIP) (https://ckip.iis.sinica.edu.tw/).

References

Abdi A, Shamsuddin SM, Hasan S, Piran J (2019) Deep learning-based sentiment classification of evaluative text based on multi-feature fusion. Inf Process Manag 56(4):1245–1259

Abreu J, Fred L, Macêdo D, Zanchettin C (2019) Hierarchical attentional hybrid neural networks for document classification. Proc ICANN 2019:96–402

Agarwal S, Kumar S, Goel U (2019) Stock market response to information diffusion through internet sources: a literature review. Int J Inf Manag 45:118–131

Basak S, Kar S, Saha S, Khaidem L, Dey SR (2019) Predicting the direction of stock market prices using tree-based classifiers. N Am J Econ Finance 47:52–567

Batra R, Daudpota SM (2018) Integrating StockTwits with sentiment analysis for better prediction of stock price movement. Proc iCoMET 2018:1–5

Beninger J, Hamilton-Wright A, Walker H, Trick LM (2020) Machine learning techniques to identify mind-wandering and predict hazard response time in fully immersive driving simulation. Soft Comput. https://doi.org/10.1007/s00500-020-05217-8

Carnicero J, Rojas D (2019) Chapter 8—Healthcare decision-making support based on the application of big data to electronic medical records: a knowledge management cycle. In: Kobeissy F, Alawieh A, Zaraket FA, Wang K (eds) Leveraging biomedical and healthcare data. Academic Press, New York, pp 121–131

Chen YJ, Chen YM, Lu CL (2016a) Enhancement of stock market forecasting using an improved fundamental analysis-based approach. Soft Comput 21(13):3735–3757

Chen W, Cai Y, Lai K, Xie H (2016b) A topic-based sentiment analysis model to predict stock market price movement using Weibo mood. Web Intell 14(4):287–300

Chiang WC, Enke D, Wu T, Wang R (2016) An adaptive stock index trading decision support system. Expert Syst Appl 59:195–207

Ding X, Zhang Y, Liu T, Duan J (2016) Knowledge-driven event embedding for stock prediction. Proc COLING 2016:2133–2142

Dong YH, Chen H, Qian WN, Zhou AY (2015) Micro-blog social moods and Chinese stock market: the influence of emotional valence and arousal on Shanghai composite index volume. Int J Embed Syst 7(2):148–155

Feuerriegel S, Gordon J (2018) Long-term stock index forecasting based on text mining of regulatory disclosures. Decis Support Syst 112:88–97

Gálvez RH, Gravano A (2017) Assessing the usefulness of online message board mining in automatic stock prediction systems. J Comput Sci 19:43–56

Gao S, Young MT, Qiu JX, Yoon HJ, Christian JB, Fearn PA, Tourassi GD, Ramanthan A (2018) Hierarchical attention networks for information extraction from cancer pathology reports. J Am Med Inf Assoc 25(3):321–330

Gaurav D, Tiwari SM, Goyal A, Gandhi N (2020) Machine intelligence-based algorithms for spam filtering on document labeling. Soft Comput 24:9625–9638

Ge Y, Qiu J, Liu Z, Gu W, Xu L (2020) Beyond negative and positive: exploring the effects of emotions in social media during the stock market crash. Inf Process Manag. https://doi.org/10.1016/j.ipm.2020.102218

Hasan M, Rundensteiner E, Agu E (2019) Automatic emotion detection in text streams by analyzing Twitter data. Int J Data Sci Anal 7(1):35–51

Henrique BM, Sobreiro VA, Kimura H (2018) Stock price prediction using support vector regression on daily and up to the minute prices. J Finance Data Sci 4(3):183–201

Ikonomakis EK, Kotsiantis S, Tampakas V (2005) Text classification using machine learning techniques. WSEAS Trans Comput 4(8):966–974

Ingle V, Deshmukh S (2017) Predictive mining for stock market based on live news TF-IDF features. Int J Auton Comput 2(4):341–365

Islam MR, Al-Shaikhli IFT, Abdulkadir A (2018) A scientific review of soft-computing techniques and methods for stock market prediction. Int J Eng Technol 7(2.5):27–31

Jaeger SR, Roigard CM, Jin D, Vidal L, Ares G (2019) Valence, arousal and sentiment meanings of 33 facial emoji: insights for the use of emoji in consumer research. Food Res Int 119:895–907

Khan W, Malik U, Ghazanfar MA, Azam MA, Alyoubi KH, Alfakeeh AS (2019) Predicting stock market trends using machine learning algorithms via public sentiment and political situation analysis. Soft Comput 24:11019–11043

Kim M, Park EL, Cho S (2018) Stock price prediction through sentiment analysis of corporate disclosures using distributed representation. Intell Data Anal 22(6):1395–1413

Li B, Chan KCC, Ou C, Ruifeng S (2017) Discovering public sentiment in social media for predicting stock movement of publicly listed companies. Inf Syst 69:81–92

Liang W, Xie H, Rao Y, Lau RYK, Wang FL (2018) Universal affective model for readers’ emotion classification over short texts. Expert Syst Appl 114:322–333

Maqsood H, Mehmood I, Maqsood M et al (2019) A local and global event sentiment based efficient stock exchange forecasting using deep learning. Int J Inf Manag 50:432–451

Max P, Simon S, David G et al (2020) The individual dynamics of affective expression on social media. EPJ Data Sci. https://doi.org/10.1140/epjds/s13688-019-0219-3

Nti IK, Adekoya AF, Weyori BA (2020) A systematic review of fundamental and technical analysis of stock market predictions. Artif Intell Rev 53:3007–3057

Oliveira N, Cortez P, Areal N (2017) The impact of microblogging data for stock market prediction: using Twitter to predict returns, volatility, trading volume and survey sentiment indices. Expert Syst Appl 73:125–144

Pagolu VS, Challa RKN, Panda G, Majhi B (2016) Sentiment analysis of Twitter data for predicting stock market movements. In: Proceedings of the 2016 international conference on signal processing, communication, power and embedded system (SCOPES), pp 1345–1350

Patel J, Shah S, Thakkar P, Kotecha K (2015) Predicting stock and stock price index movement using trend deterministic data preparation and machine learning techniques. Expert Syst Appl 42:259–268

Ranco G, Bordino I, Bormetti G, Caldarelli G, Lillo F, Treccani MT (2016) Coupling news sentiment with web browsing data improves prediction of intra-day price dynamics. PLoS ONE 11:e0146576

Rohini M, Surendran D (2020) Toward Alzheimer’s disease classification through machine learning. Soft Comput. https://doi.org/10.1007/s00500-020-05292-x

Russell JA (1980) A circumplex model of affect. J Pers Soc Psychol 36(6):1161–1178

Salehan M, Kim D (2020) An investigation of predictors of information diffusion in social media: evidence from sentiment mining of Twitter messages. HICSS. https://doi.org/10.24251/HICSS.2020.098

Saumya S, Singh JP, Kumar P (2016) Predicting stock movements using social network. Proc I3E 2016:567–572

Shah D, Isah H, Zulkernine F (2018) Predicting the effects of news sentiments on the stock market. In: Proceedings of 2018 IEEE international conference on big data (IEEE big data), pp 10–13

Shang C, You F (2019) Data analytics and machine learning for smart process manufacturing: recent advances and perspectives in the big data era. Engineering 5:1010–1016

Shi L, Teng Z, Wang L, Zhang Y, Binder A (2018) DeepClue: visual interpretation of text-based deep stock prediction. IEEE Trans Knowl Data Eng 31(6):1094–1108

Song S, Huang H, Ruan T (2019) Abstractive text summarization using LSTM-CNN based deep learning. Multimed Tools Appl 78(1):857–875

Stefan F, Helmut P (2014) News-based trading strategies. Decis Support Syst 90:65–74

Tsaptsinos A (2017) Lyrics-based music genre classification using a hierarchical attention network. Proc ISMIR 2017:694–701

Vanstone BJ, Gepp A, Harris G (2019) Do news and sentiment play a role in stock price prediction? Appl Intell 49(11):3815–3820

Wang Y (2017) Stock market forecasting with financial micro-blog based on sentiment and time series analysis. J Shanghai Jiaotong Univ (Sci) 22(2):173–179

Wang F, Zhang Y, Rao Q, Li K, Zhang H (2016) Exploring mutual information-based sentimental analysis with kernel-based extreme learning machine for stock prediction. Soft Comput 21(12):3193–3205

Warriner AB, Kuperman V, Brysbaert M (2013) Norms of valence, arousal, and dominance for 13,915 English lemmas. Behav Res Methods 45(4):1191–1207

Wu J, Yu L, Chang P (2014) An intelligent stock trading system using comprehensive features. Appl Soft Comput 23:39–50

Wu GG, Hou TC, Lin J (2019a) Can economic news predict Taiwan stock market returns. Asia Pac Manag Rev 24(19):54–59

Wu J, Yang C, Liu K, Huang M (2019b) A deep learning model for dimensional valence–arousal intensity prediction in stock market. Proc IEEE iCAST 2019:1–6

Yadav R, Kumar AV, Kumar A (2019) News-based supervised sentiment analysis for prediction of futures buying behavior. IIMB Manag Rev 31(2):157–166

Yang Z, Yang D, Dyer C, He X, Smola A, Hovy E (2016) Hierarchical attention networks for document classification. In: Proceedings of the 2016 conference of the North American chapter of the association for computational linguistics: human language technologies (NAACL HLT), pp 1480–1489

Ying H, Zhuang F, Zhang F et al (2018) Sequential recommender system based on hierarchical attention network. In: Proceedings of the IJCAI-ECAI-18, pp 3926–3932

Zhang J, Cui S, Xu Y, Li Q, Li Y (2018a) A novel data-driven stock price trend prediction system. Expert Syst Appl 97:60–69

Zhang X, Zhang Y, Wang S, Yao T, Fang B, Yu PS (2018b) Improving stock market prediction via heterogeneous information fusion. Knowl Based Syst 143:236–247

Acknowledgments

This research was partially supported by the Ministry of Science and Technology, Taiwan (Grant No. MOST-107-2218-E-031-002-MY2 and MOST-109-2221-E-031-003).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

We wish to confirm that there are no known conflicts of interest associated with this publication and there has been no significant financial support for this work that could have influenced its outcome.

Additional information

Communicated by V. Loia.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Wu, JL., Huang, MT., Yang, CS. et al. Sentiment analysis of stock markets using a novel dimensional valence–arousal approach. Soft Comput 25, 4433–4450 (2021). https://doi.org/10.1007/s00500-020-05454-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-020-05454-x