Abstract

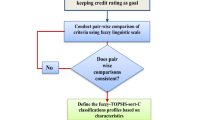

In this paper, first, it is aimed to determine the most important criteria which affect the credit evaluation process. A type-2 trapezoidal fuzzy analytic hierarchy process method is proposed to analyze the criteria influencing the credit evaluation. Then, a ranking of experts is obtained using a type-2 trapezoidal fuzzy Electre (elimination and choice translating reality English) method. Lastly, the applicants’ ranking is determined as a real case. This method is aimed to be used by public and private banks to improve their credit ranking and evaluation strategies. Finally, the applicability and feasibility of the proposed approach are demonstrated by providing the results and sensitivity analysis.

Similar content being viewed by others

References

Abdou HA, Pointon J (2009) Credit scoring and decision making in Egyptian public sector banks. Int J Manag Finance 5(4):391–406

Adams R (2012) Active queue management: a survey. IEEE Commun Surv Tutor 15(3):1425–1476

Albadan J, Gaona P, Montenegro C, Gonzalez-Crespo R, Herrera-Viedma E (2018) Fuzzy logic models for non-programmed decision-making in personnel selection processes based on gamification. Informatica 29(1):1–20

Alberto Carrasco R, Francisca Blasco M, García-Madariaga J, Herrera-Viedma E (2019) A fuzzy linguistic RFM model applied to campaign management. Int J Interact Multimed Artif Intell 5(4):21–27

Amanati S (2014) Design and explanation of the credit ratings of customers model using neural networks. Res J Appl Sci Eng Technol 7(24):5179–5183

Aouam T, Lamrani H, Aguenaou S, Diabat A (2009) A benchmark based AHP model for credit evaluation. Int J Appl Decis Sci 2(2):151–166

Bahrammirzaee A, Ghatari AR, Ahmadi P, Madani K (2011) Hybrid credit ranking intelligent system using expert system and artificial neural networks. Appl Intell 34(1):28–46

Bonissone PP, Decker KS (1986) Selecting uncertainty calculi and granularity: an experiment in trading-off precision and complexity. In: Kanal LH, Lemmer JF (eds) Uncertainty in artificial intelligence. North-Holland, Amsterdam

Celik E, Aydin N, Gumus AT (2014) A multiattribute customer satisfaction evaluation approach for rail transit network: a real case study for Istanbul, Turkey. Transp Policy 36:283–293

Celik E, Gumus AT, Erdogan M (2016) A new extension of the Electre method based upon interval type-2 fuzzy sets for green logistic service providers evaluation. J Test Eval 44(5):1813–1827

Chang CW, Wu CR, Chen HC (2008) Using expert technology to select unstable slicing machine to control wafer slicing quality via fuzzy AHP. Expert Syst Appl 34(3):2210–2220

Chavira DAG, Lopez JCL, Noriega JJS, Valenzuela OA, Carrillo PAA (2017) A credit ranking model for a parafinancial company based on the ELECTRE-III method and a multiobjective evolutionary algorithm. Appl Soft Comput 60:190–201

Chen SM, Lee LW (2010) Fuzzy multiple attributes group decision-making based on the interval type-2 TOPSIS method. Expert Syst Appl 37(4):2790–2798

Chi G, Yu S, Zhou Y (2019) A novel credit evaluation model based on the maximum discrimination of evaluation results. Emerg Mark Finance Trade. https://doi.org/10.1080/1540496X.2019.1643717

Chiang YH, Hung CY (2010) Trade credit evaluation for Taiwan’s broadband communications equipment manufacturers. Int J Manag Decis Mak 11(1):37–54

Dadone P, Vanlandingham HF (2002) Load transfer control for a gantry crane with arbitrary delay constraints. Modal Anal 8(2):135–158

Dereli T, Altun K (2013) Technology evaluation through the use of interval type-2 fuzzy sets and systems. Comput Ind Eng 65(4):624–633

Dodangh J, Mojahed M, Nasehifar V (2010) Ranking of strategic plans in balanced scorecard by using Electre method. Int J Innov Manag Technol 1(3):269

Dong Y (2006) A case based reasoning system for evaluating customer credit. J Jpn Ind Manag Assoc 57(2):144–152

Drake JH, Starkey A, Owusu G, Burke EK (2020) Multiobjective evolutionary algorithms for strategic deployment of resources in operational units. Eur J Oper Res 282(2):729–740

Emel AB, Oral M, Reisman A, Yolalan R (2003) A credit scoring approach for the commercial banking sector. Socio-Econ Plan Sci 37(2):103–123

Estes R, Reimer M (1977) A Study of the effect of qualified auditors ‘opinions on bankers’ lending decisions. Account Bus Res 7(28):250–259

Fan J, Ren B, Cai JM (2004) Design of customer credit evaluation system for e-business. In: 2004 IEEE international conference on systems, man and cybernetics, vol 1. IEEE, pp 392–397

Fu J, Fang J, Wang W (2017) Research on construction and application of comprehensive credit evaluation system of bid inviter’s. In: ICCREM 2017, pp 182–193

Govindan K, Jepsen MB (2016) ELECTRE: a comprehensive literature review on methodologies and applications. Eur J Oper Res 250(1):1–29

Gumus AT (2009) Evaluation of hazardous waste transportation firms by using a two step fuzzy-AHP and TOPSIS methodology. Expert Syst Appl 36(2):4067–4074

Hartman A (1981) Reaching consensus using the Delphi technique. Educ Leadersh 38(6):495–497

Hsu PF, Wu CR, Li YT (2008) Selection of infectious medical waste disposal firms by using the analytic hierarchy process and sensitivity analysis. Waste Manag 28(8):1386–1394

İç YT (2019) A multi-objective credit evaluation model using MOORA method and goal programming. Arab J Sci Eng 45(3):2035–2048

Ighravwe DE, Oke SA, Adebiyi KA (2017) A weighted goal programming model for maintenance workforce optimisation for a process industry. Asia-Pac J Sci Technol 22(4):1–18

Kahraman C, Sari İU, Turanoğlu E (2012) Fuzzy analytic hierarchy process with type-2 fuzzy sets. Uncertain Model Knowl Eng Decis Mak 2012:201–206

Lee LW, Chen SM (2008) Fuzzy multiple attributes group decision-making based on the extension of TOPSIS method and interval type-2 fuzzy sets. In: 2008 international conference on machine learning and cybernetics, vol 6. IEEE, pp 3260–3265

Li H, Santos CA, Fuciec A, Gonzalez T, Jain S, Marquez C, Zhang A (2018) Optimizing the labor strategy of a professional service firm. IEEE Trans Eng Manag 66(3):443–458

McClanahan A (2014) Bad credit: the character of credit scoring. Representations 126(1):31–57

Minmin G, Li W (2013) A multi-stage stochastic fuzzy methodology for credit evaluation. In: Proceedings of the 2012 international conference on communication, electronics and automation engineering. Springer, Berlin, pp 441–447

Mirshahi S, Cao N (2018) Fuzzy relational compositions can be useful for customers credit scoring in financial industry. In: International conference on information processing and management of uncertainty in knowledge-based systems. Springer, Cham, pp 28–39

Murry JW Jr, Hammons JO (1995) Delphi: a versatile methodology for conducting qualitative research. Rev High Educ 18(4):423–436

Niroomand S, Mirzaei N, Hadi-Vencheh A (2018) A simple mathematical programming model for countries’ credit ranking problem. Int J Finance Econ 2018:1–12

Peng H (2017) Construction basis of C2C e-commerce credit evaluation index. J Electron Commer Organ 15(4):11–23

Ren J, Wang J, Cheng P, Hu C (2018) Multi-criterion group decision-making method for hybrid generalized hesitant fuzzy linguistic Jisuanji Jicheng Zhizao Xitong. Comput Integr Manuf Syst 24(9):2367–2376

Robbins SP (1994) Management. Prentice-Hall, Upper Saddle River

Roy A, Sural S, Majumdar AK, Vaidya J, Atluri V (2019) Enabling workforce optimization in constrained attribute based access control systems. IEEE Trans Emerg Top Comput. https://doi.org/10.1109/TETC.2019.2944787

Saaty TL (1977) A scaling method for priorities in hierarchical structures. J Math Psychol 15(3):234–281

Sari IU, Behret H, Kahraman C (2012) Risk governance of urban rail systems using fuzzy AHP: the case of Istanbul. Int J Uncertain Fuzziness Knowl Based Syst 20(01):67–79

Serengil Şİ, Özpınar A (2016) Workforce optimization for bank operation centers: a machine learning approach. Int J Interact Multimed Artif Intell 4(6):81–86

Siu KB, Yang H (2007) Expected shortfall under a model with market and credit risks. In: Hidden Markov models in finance. Springer, Boston, pp 91–100

Soheil S, Kaveh KD (2010) Application of a fuzzy TOPSIS method base on modified preference ratio and fuzzy distance measurement in assessment of traffic police center performance. Appl Soft Comput 10(4):1028–1039

Sun J, Lang J, Fujita H, Li H (2018) Imbalanced enterprise credit evaluation with DTE-SBD: decision tree ensemble based on SMOTE and bagging with differentiated sampling rates. Inf Sci 425:76–91

Sung WC (2001) Application of Delphi method, a qualitative and quantitative analysis, to the healthcare management. J Healthc Manag 2(2):11–19

Wang TC, Chen YH (2006) Applying rough sets theory to corporate credit ratings. In: IEEE international conference on service operations and logistics, and informatics, 2006. SOLI’06. IEEE, pp 132–136

Wang JQ, Peng JJ, Zhang HY, Liu T, Chen XH (2015) An uncertain linguistic multi-criteria group decision-making method based on a cloud model. Group Decis Negot 24(1):171–192

Wang D, Zhu Y, Chen X (2018) Method development and comparative study of P2P agricultural loan selection. In: 2018 15th international conference on service systems and service management (ICSSSM). IEEE, pp 1–6

Wu JY, Van Brunt V, Zhang WR, Bezdek JC (1988) Tower packing evaluation using linguistic variables. Comput Math Appl 15(10):863–869

Xiao Z, Xia S, Gong K, Li D (2012) The trapezoidal fuzzy soft set and its application in MCDM. Appl Math Model 36(12):5844–5855

Yong W, Dan T, Ling Z (2018) Empirical study on credit classification of E-commerce sellers based on FCM algorithm. In: Proceedings of the 2018 international conference on internet and e-business. ACM, pp 130–134

Yu S, Chi G (2017) Weight optimization model based on the maximum discriminating power of credit evaluation result. In: Proceedings of the international conference on business and information management, pp 6–11

Yu X, Zhang S, Liao X, Qi X (2018) ELECTRE methods in prioritized MCDM environment. Inf Sci 424:301–316

Yu J, Yao J, Chen Y (2019) Credit scoring with AHP and fuzzy comprehensive evaluation based on behavioural data from Weibo platform. Tehnički vjesnik 26(2):462–470

Yurdakul M, Ic YT (2004) AHP approach in the credit evaluation of the manufacturing firms in Turkey. Int J Prod Econ 88(3):269–289

Zadeh LA (1965) Information and control. Fuzzy Sets 8(3):338–353

Zhang Z, Wen J, Wang X, Zhao C (2018) A novel crowd evaluation method for security and trustworthiness of online social networks platforms based on signaling theory. J Comput Sci 26

Zhibin X (2011) Credit evaluation modelling based on selfadaptive genetic fuzzy neural network. J Syst Simul 23(3):490–496

Zhu X, Wang F, Wang H, Liang C, Tang R, Sun X, Li J (2014) TOPSIS method for quality credit evaluation: a case of air-conditioning market in China. J Comput Sci 5(2):99–105

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interests.

Ethical approval

All procedures performed in studies involving human participants were in accordance with the ethical standards of the institutional and/or national research committee and with the 1964 Helsinki Declaration and its later amendments or comparable ethical standards. This article does not contain any studies with animals performed by any of the authors.

Additional information

Communicated by V. Loia.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ayyildiz, E., Taskin Gumus, A. & Erkan, M. Individual credit ranking by an integrated interval type-2 trapezoidal fuzzy Electre methodology. Soft Comput 24, 16149–16163 (2020). https://doi.org/10.1007/s00500-020-04929-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-020-04929-1