Abstract

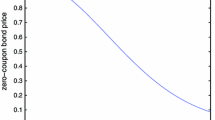

Term structure models describe the evolution of the yield curve through time, without considering the influence of risk, tax, etc. Recently, uncertain processes were initialized and applied to option pricing and currency model. Under the assumption of short interest rate following uncertain processes, this study investigates the term-structure equation. This equation is first derived for valuing zero-coupon bond. Finally, analytic solutions of the uncertain interest rate equation are given when the process of interest rate is assumed to be the uncertain counterparts of the Ho-Lee model and Vasicek model, respectively.

Similar content being viewed by others

References

Black F, Karasinski P (1991) Bond and option pricing when short-term rates are lognormal. Financial Analysts J 47(4):52–59

Black F, Shocles M (1973) The pricing of option and corporate liabilities. J Political Econ 81:637–654

Chen X, Liu B (2010) Existence and uniqueness theorem for uncertain differential equations. Fuzzy Optim Decision Making 9(1):69–81

Chen X (2011a) American option pricing formula for uncertain financial market. Int J Oper Res 8(2):32–37

Chen X (2011b) Uncertain calculus with finite variation processes. http://www.orsc.edu.cn/online/110613.pdf

Cox J, Ingersoll J, Ross S (1985) An intertemporal general equilibrium model of asset prices. Econometrica 53:363–384

Gao J, Zhao J, Ji X (2005) Fuzzy chance-constrained programming for capital budgeting problem with fuzzy decisions. Lecture Notes Artif Intell 3613:304–311

Gao J, Gao X (2008) A new stock model for credibilistic option pricing. J Uncertain Syst 2(4):243–247

Heath D, Jarrow R, Morton A (1990) Bond pricing and the term structure of interest rates: a new methodology for contingent claims valuation. J Financial Quant Analysis 25(3):419–440

Ho TSY, Lee SB (1986) Term structure movements and pricing interest rate contingent claims. J Finance 41:1011–29

Hull J, White A (1990) Pricing interest rate derivative securities. Rev Financial Stud 3:573–592

Liu B (2007) Uncertainty theory, 2nd edn. Springer, Berlin

Liu B (2008) Fuzzy process, hybrid process and uncertain process. J Uncertain Syst 2(1):3–16

Liu B (2009a) Some research problems in uncertainty theory. J Uncertain Syst 3(1):3–10

Liu B (2009b) Theory and practice of uncertain programming, 2nd edn. Springer, Berlin

Liu B (2009c) Uncertain entailment and modus ponens in the framework of uncertain logic. J Uncertain Syst 3(4):243–251

Liu B (2010a) Uncertainty theory: a branch of mathematics for modeling human uncertainty. Springer, Berlin

Liu B (2010b) Uncertain set theory and uncertain inference rule with application to uncertain control. J Uncertain Syst 4(2):83–98

Liu B (2010c) Uncertain risk analysis and uncertain reliability analysis. J Uncertain Syst 4(3):163–170

Liu Y, Chen X (2010) Uncertain currency model and currency option pricing. http://www.orsc.edu.cn/online/091010.pdf

Liu Y, Ha M (2010) Expected value of function of uncertain variables. J Uncertain Syst 4(3):181–186

Merton R (1973) Theory of rational option pricing. Bell J Econ Manag Sci 4(1):141–183

Myneni R (1992) The pricing of the Amerrican option. Ann Appl Probab 2:1–23

Peng J, Yao K (2010) A new option pricing model for stocks in uncertainty markets. Int J Oper Res 7(4):213–224

Rendleman R, Bartter B (1980) The pricing of options on debt securities. J Financial Quant Analysis 15:11–24

Vasicek O (1977) An equilibrium characterization of the term structure. J Finance 5:177–188

Yao K (2012) Uncertain calculus with renewal process. Fuzzy Optim Decis Mak 11(3):285–297

Acknowledgments

This work was supported by National Natural Science Foundation of China (Grant No. 61074193), Program for New Century Excellent Talents in University and Nankai University Project Funds for Young Teachers (Grant No. NKQ1118).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Chen, X., Gao, J. Uncertain term structure model of interest rate. Soft Comput 17, 597–604 (2013). https://doi.org/10.1007/s00500-012-0927-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-012-0927-0