Abstract

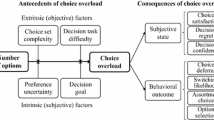

We test the effectiveness of a compensation mechanism, adapted from Varian (Am Econ Rev 84(5):1278–1293, 1994). When a negative externality is produced the mechanism allows agents suffering from it to compensate those who reduce its production, by way of transfers implemented via a two-stage design. We investigate various factors that might affect the likelihood that subjects coordinate on a Pareto optimum: the size of the strategy space, the number of subgame perfect equilibria and inequality of the payoff distribution. Our experimental findings suggest that the mechanism’s effectiveness crucially depends on the final payoff distribution (after transfers). It is also strongly negatively affected by the size of the strategy space. Finally, the impact of the number of equilibria on coordination only has a weak negative effect.

Similar content being viewed by others

Notes

They have continuous strategy sets or a larger number of options to choose.

This is the case for problems of international pollution (some countries pollute or emit carbon and other suffer from it), or river pollution (a firm pollutes a river and stakeholders downstream suffer from it).

The term “externality” was not used in the instructions. Subjects only knew about the two options, A and B, and their corresponding payoffs.

Unless some subjects would choose option A because they are willing to trade off their own material payoff to increase the social efficiency.

Performance is measured by the proportion of Nash play and the speed of convergence towards equilibrium strategies.

In a related game that does not feature supermodularity, Hamaguchi et al. (2003) found that increasing the parameter can even reduce the effectiveness of the mechanism, whereas Chen and Gazzale (2004) delivered the message that such an increase could have a positive effect. Unfortunately, these diverging results are not directly comparable. The games they use differ in many ways: neither the parameter values nor the definitions of efficiency are the same.

Note that if Player 2 chooses \(t_{2}>t_{1}\), transfers are not implemented. This is because what Player 1 receives, \(4*t_{2}\), cannot be larger than what Player 2 gives, \(4*t_{1}\). As a matter of fact, in some treatments 20 % of type 2 players didn’t learn how to avoid this situation.

We are therefore interested in Subgame Perfect Nash Equilibria, but for the sake of completeness it should be mentioned that there are also many other, not subgame perfect, equilibria in this simple game.

The mechanism also has some fairness properties. For instance when applied to a public good framework, it induces a Lindhal equilibrium.

Non parametric tests comparing pairs of treatments were also used. We do not report those results, for they lead to the same conclusions as the econometric analysis of this section. They are available from the authors on demand.

They are available on request from the authors.

Besides, a simple econometric regression showed a significant relationship between individual choices made at a given period and individual choices made at the previous period. In addition, subjects “react” to their partner’s past choice in a way that does not seem to depend on their type. There seems to be no asymmetry in learning due to being a type 1 subject rather than a type 2 subject.

This result confirms that of Charness et al. (2007). In their paper they concluded that cooperation is substantially more likely with payment pairs that bring the mutual-cooperation payoffs closer together.

References

Andreoni J, Varian H (1999) Preplay contracting in the prisoners’ dilemma. Proc Natl Acad Sci 96:10933–10938

Bracht J, Figuières C, Ratto M (2008) Relative performance of two simple incentive mechanisms in a public goods experiment. J Public Econ 92:54–90

Charness G, Frechette GR, Qin C-Z (2007) Endogenous transfers in the prisonerś dilemma game: an experimental test of cooperation and coordination. Games Econ Behav 60:287–306

Chen Y, Gazzale R (2004) When does learning in games generate convergence to nash equilibria? The role of supermodularity in an experimental setting. Am Econ Rev 94(5):1505–1535

Cooper DJ, Van Huyck JB (2003) Evidence on the equivalence of the strategic and extensive form representation of games. J Econ Theory 110:290–308

Cooper RW (1998) Coordination games. Cambridge University Press, Cambridge

Danziger L, Schnytzer A (1991) Implementing the Lindahl voluntary-exchange mechanism. Eur J Polit Econ 7(1):55–64

Fehr E, Gächter S (2000) Fairness and retaliation: the economics of reciprocity. J Econ Perspect 159–181

Fischbacher U (2007) z-tree: Zurich toolbox for ready-made economic experiments. Exp Econ 10(2):171–178

Guttman JM (1978) Understanding collective actions: matching behavior. Am Econ Rev Pap Proc 68(2):251–255

Guttman JM (1987) A non-cournot model of voluntary collective action. Economica 54(213):1–19

Hamaguchi Y, Mitani S, Saijo T (2003) Does the varian mechanism work?—Emissions trading as an example. Int J Bus Econ 2(2):85–96

Iyengar SS, Kamenica E (2010) Choice proliferation, simplicity seeking, and asset allocation. J Public Econ 94(7–8):530–539

Kahneman D (2003) Maps of bounded rationality: psychology for behavioral economics. Am Econ Rev 93(5):1449–1475

Schelling T (1960) The strategy of conflict. Harvard University Press, Cambridge

Simon H (1955) A behavioral model of rational choice. Q J Econ 69:99–118

Varian H (1994) A solution to the problem of externalities when agents are well-informed. Am Econ Rev 84(5):1278–1293

Acknowledgments

We thank Philippe Bontems, Timo Goeschl and Laurent Denant-Beaumont for their constructive suggestions on a preliminary version of this work. Many thanks are also due to the editors of Social Choice and Welfare and to two anonymous referees for their very constructive and kind comments.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Example of instructions (Treatment \(T_3^{3,m}\))

1.1 Instructions

We thank you for agreeing to participate in this experiment on decision making. It will be rewarded and your earnings will depend on your decisions and on decisions taken by other players. Your decisions will be collected through a computer network and processed anonymously. You will specify your choices to the computer in front of you and it will tell you your earnings (in Euros) throughout the experiment. From now until the end of the experiment, we ask you not to communicate with each other. If you have any questions, raise your hand and an assistant will answer you in private.

1.1.1 Roles

There are two roles in the experiment: role 1 and role 2. We call Player 1 a player who has role 1 and Player 2 a player who has role 2. There are as many Players 1 as Players 2 in the room. You can be a Player 1 or a Player 2. At the beginning of the experiment, the central computer will randomly form pairs with one Player 1 and one Player 2. So, each Player 1 will interact with a Player 2. Pairs remain the same during all the experiment. You will always interact with the same person. You cannot know his/her identity and he/she cannot know yours.

1.1.2 General procedure

The experiment is divided in two parts. The first one lasts one period and the second one lasts 15 periods.

1.1.3 Final earnings

Your final payment for this experiment is calculated as follows: at the end of the experiment, one of the 16 periods (the one from the first part and the 15 ones from the second part) will be randomly drawn for each pair. Your final payment will be the payment that you earned for this specific period.

Once all participants have finished reading the instructions, an assistant will read them aloud. Then, you will have to fill out a short survey to check your understanding of the instructions. Once all participants have finished filling the survey, the experiment will begin. Instructions for the second part will be given to you after the end of the first part.

1.2 Part 1

1.2.1 Procedure

There is only one period in Part 1. The procedure of Part 1 is summarized in Fig. 1.

Only Player 1 has to make a decision: he has to choose between option A and option B.

At the end of Part 1, each player will be informed of:

-

Players 1’s decision,

-

his earning,

-

the other player’s earning.

1.2.2 Payoffs

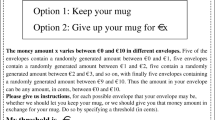

Payoffs are shown in Fig. 2. Player 1’s payoff corresponds to the numbers given in the first row. Player 2’s payoff corresponds to the numbers given in the second row.

1.2.3 Figure 1 explanation

-

If Player 1 chooses option A, Player 1 earns 8 euros and Player 2 earns 32 euros.

-

If Player 1 chooses option B, Player 1 earns 14 euros and Player 2 earns 6 euros.

1.3 Part 2

1.3.1 Procedure

There are 15 periods in Part 2 and each period is divided into two stages. The procedure of each period of Part 2 is summarized in Fig. 3 (next page).

-

In the first stage, both players have to make a decision:

-

Player 1 has to choose one option among three possibilities : 1, 2 or 3.

-

Player 2 has to choose one option among three possibilities : 1, 2 or 3.

At the end of this first stage players will be informed of the other player’s decision.

-

-

In the second stage, only Player 1 has to make a decision: he has to choose between option A and option B (knowing the choices that have been made in the first stage).

At the end of each period, each player will be informed of:

-

all decisions taken,

-

his earning,

-

the other player’s earning.

1.3.2 Payoffs

Payoffs are shown in the Fig. 3. Player 1’s payoff corresponds to the numbers given in the first row. Player 2’s payoff corresponds to the numbers given in the second row.

1.3.3 Figure 2 explanation

-

If Player 1 chooses option 2 in the first stage and if Player 2 chooses option 1 in the first stage,

-

if Player 1 chooses option A in the second stage, Player 1 earns 4 euros and Player 2 earns 16 euros.

-

if Player 1 chooses option B in the second stage, Player 1 earns 10 euros and Player 2 earns 6 euros.

-

Appendix 2: Games played in each treatment

Subgame perfect Nash equilibria are identified by bold characters and Pareto optimum by italic characters (see Tables 9, 10, 11, 12, 13, 14).

Appendix 3: Determinants of the probability to coordinate on a PONE

Regression no | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

nb_options | \(-\)0.698*** | \(-\)0.672*** | ||

(\(-\)0.173) | (\(-\)0.167) | |||

nb_ne_theo | \(-\)0.291** | \(-\)0.024 | ||

(\(-\)0.072) | (\(-\)0.006) | |||

ineq_OPNE=0 | 1.337** | 1.254** | ||

(0.317) | (0.283) | |||

A_per1 | 0.096 | |||

(0.024) | ||||

OPNE_per_n-1 | 1.461*** | |||

(0.347) | ||||

cons | 2.842*** | 1.225** | \(-\)0.937** | 1.888*** |

\(\rho \) | 0.581*** | 0.602*** | 0.468*** | 0.403*** |

Log likelihood | \(-\)880.9 | \(-\)885.6 | \(-\)317.7 | \(-\)827.7 |

N | 1,740 | 1,740 | 585 | 1,1740 |

Rights and permissions

About this article

Cite this article

Midler, E., Figuières, C. & Willinger, M. Choice overload, coordination and inequality: three hurdles to the effectiveness of the compensation mechanism?. Soc Choice Welf 45, 513–535 (2015). https://doi.org/10.1007/s00355-014-0840-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00355-014-0840-9