Abstract

Previous estimates of inequality of opportunity (IOp) are lower bounds because of the unobservability of the full set of endowed characteristics beyond the sphere of individual responsibility. Knowing the true size of unfair IOp, however, is important for the acceptance of (some) inequality and the design of redistributive policies as underestimating the true amount of IOp might lead to too little redistribution. This paper suggests a fixed effects estimator for IOp which can be interpreted as an upper bound. We illustrate our approach by comparing Germany and the US based on harmonized micro data. We find significant, sizeable and robust differences between lower and upper bound estimates—both for gross and net earnings based on either periodical or permanent income—for both countries.

Similar content being viewed by others

Notes

An exception is Bourguignon et al. (2007) who simulate the magnitude of omitted variable bias to estimate bounds around the true effect of observed circumstances on income inequality.

There are a number of studies investigating social and economic mobility (see, e.g., Corak and Heisz 1999, Björklund and Jäntti 1997, 2009, Kerm 2004 or Björklund et al. 2012b). However, social or economic mobility is only a partial view on IOp, with only parental education or income level as circumstance variable. In addition, only few measures of social mobility can be directly related to IOp—see Van de gaer et al. (2001). On this, see also the evidence and discussion in Brunori et al. (2013).

In contrast, non-parametric methods avoid the arbitrary choice of a functional form on the relationship between outcome, circumstances and effort (e.g. Lefranc et al. 2009, Ferreira and Gignoux 2011 or Aaberge et al. 2011). However, this approach has the drawback that considering more than one circumstance variable is difficult due to practical reasons in the presence of small cell sizes which is usually the case in survey data. Access to large-scale administrative panel data with information on circumstances (family background), which is not available in Germany and rather restrictive in the US, would allow to estimate lower and upper bounds of IOp also non-parametrically.

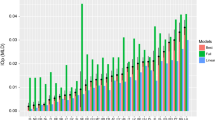

However, note that when looking at yearly regression of income on observed circumstances, individual coefficients may change but the explained variation does not change (much). In addition, we can usually not reject the null that the respective coefficients are statistically equal at the 5 %-level for any pair of years. These results suggest that neither the effect of (observed) circumstances on the outcome nor the unexplained variation varies a lot over time.

We do this, because the variance of logarithms—in contrast to the MLD and other GE-measures—is not a good measure of inequality because it violates the Pigou–Dalton transfer principle as well as the Lorenz criterion (Foster and Ok 1999).

In principle, it would be possible to provide two lower bounds with and without accounting for the indirect effects—as, e.g., done in Bourguignon et al. (2007).

Note that the estimation of the unit-effect relies on the consistent estimation of coefficients in the FE model. Omitting any effort variables that interact with circumstances biases our results upwards, emphasizing that we should interpret our results as upper bounds of IOp.

Note that the income reference period in both surveys is the year before the interview. Hence, we actually cover the period 1983 until 2008 for Germany and 1981 until 2006 for the US.

Due to the log-linear specification it is not possible to include zero earnings. We decided to only include the longest spell (and not all employment spells) for each individual to focus on EOp in earnings and not to account for selection into and out of employment. It would be possible, and potentially interesting, to apply a two-stage approach by also investigating EOp in labor market participation. We leave this for further research.

This is a rather arbitrary restriction. However, as our robustness checks show the number of time points does not qualitatively change the results. On average, we use 6.9 (7.2) years for Germany (the US).

An even better proxy might be household equivalent disposable income. However, accounting for the household context raises other issues—which have not been addressed in the EOp literature—such as whether an individual is responsible for the choices of her spouse or not. In addition, using net earnings is equivalent to household income for singles and for couples in a collective household model with a sharing rule corresponding to the earnings ratio of the two spouses.

In principle, it would be possible to compute more sophisticated measures of permanent income as, e.g., recently proposed by Aaberge et al. (2011). Comparing the results based on annual and permanent incomes is related to the literature looking at the transitory components to earnings variability (see, e.g., Moffitt and Gottschalk 2012). Looking at permanent incomes is interesting itself because of the possibility for individuals to smooth income shocks over time. In addition, it has the advantage that measurement error [e.g. around 20 % of the total variance according to validation studies of the PSID such as Rodgers et al. (1993)] gets averaged away.

The ‘non-effect’ of race for periodical incomes might be explained with the fact that blacks are more likely to be out of the labor force or even in prison, which leads to underestimated racial wage gaps in cross-sectional data (Chandra 2000).

It should be noted that the upper bounds of IOp decrease if we, e.g., add marital status or number of children, which can be expected to have an indirect impact on annual earnings, in the FE regressions. This provides additional evidence that our results can be interpreted as upper bounds.

This approach is related to approaches estimating what share of inequality can be explained by observable effort variables (see, e.g., Pistolesi 2009). Usually, when measuring the contribution of observable effort, effort is purged from its correlation with observable circumstances. In our approach, effort is purged from both observable circumstances and the individual fixed-effect. Since some (time-invariant) effort possibly belongs to the fixed-effect, inequality due to effort (circumstances) is under(over)-estimated resulting in an upper bound for IOp.

Alms (2008) argues that the ex-post approach treats the unexplained variation as a circumstance which would result in an upper bound. This, however, is only true for a given set of (observed) circumstances. The fact that the ex-post approach gives lower bounds only is also discussed by Aaberge and Colombino (2012). They recognize that for the (ex-post) EOp approach “[...] there might be other exogenous factors that affect individuals’ achievements” which are not captured by the observed circumstances. Hence, the within-type distribution of income might still depend on unobserved circumstances. Their solution (partially) accounts for the within-type inequality and yields an intermediate case with an IOp measure between the lower and the upper bound. Defining the upper bound as in our case (observed vs. unobserved circumstances), gives lower and upper bounds both for the ex-ante and ex-post approaches.

In our application, we have more than 500 types for the lower bound approach. In order to apply the ex-post approach based on percentiles of the earnings distribution, we would need at least 100 observations per cell, i.e. in total more than 50,000 observations per year. Unfortunately, we do not have access to such a large panel data set.

Contrary to Germany, the majority of respondents in the US thinks that larger income differences are necessary as incentives, while 40 % of the respondents think that the most important reason why people live in need is laziness—the numbers are only half as high in Germany.

References

Aaberge R, Colombino U (2012) Accounting for family background when designing optimal income taxes: a microeconometric simulation analysis. J Popul Econ 25(2):741–761

Aaberge R, Mogstad M, Peragine V (2011) Measuring long-term inequality of opportunity. J Public Econ 95(3–4):193–204

Alesina A, Angeletos G-M (2005) Fairness and redistribution. Am Econ Rev 95(4):960–980

Alesina A, Giuliano P (2011) Preferences for redistribution. In: Benhabib J, Jackson MO, Bisin A (eds) Handbook of social economics. North-Holland, Amsterdam, pp 93–132

Alesina A, Glaeser E (2004) Fighting poverty in the US and Europe: a world of difference. Oxford University Press, Oxford

Alms I (2008) Equalizing income versus equalizing opportunity: a comparison of the United States and Germany. Res Econ Inequal 16:129–156

Alms I, Cappelen AW, Lind JT, Sørensen E, Tungodden B (2011) Measuring unfair (in)equality. J Public Econ 95(7–8):488–499

Altonji J, Blank R (1999) Race and gender in the labor market. In: Ashenfelter O, Card D (eds) Handbook of labor economics, vol 3C. North-Holland Elsevier, Amsterdam, pp 3143–3251

Autor D, Katz L, Kearney M (2008) Trends in US wage inequality: revising the revisionists. Rev Econ Stat 90(2):300–323

Bagger J, Christensen BJ, Mortensen DT (2010) Wage and productivity dispersion: labor quality or rent sharing? working paper

Betts J, Roemer J (2006) Equalizing opportunity for racial and socioeconomic groups in the United States through educational finance reform. In: Woessmann L, Peterson P (eds) Schools and the equal opportunity problem. MIT Press, Cambridge, pp 209–238

Björklund A, Jäntti M (1997) Intergenerational income mobility in Sweden compared to the United States. Am Econ Rev 87(5):1009–1018

Björklund A, Jäntti M (2009) Intergenerational income mobility and the role of family background. In: Salverda W, Nolan B, Smeeding T (eds) Handbook of economic inequality. Oxford University Press, Oxford, pp 491–522

Björklund A, Jäntti M, Lindquist MJ (2009) Family background and income during the rise of the welfare state: brother correlations in income for Swedish men born 1932–1968. J Public Econ 93(5–6):671–680

Björklund A, Jäntti M, Roemer J (2012a) Equality of opportunity and the distribution of long-run income in Sweden. Soc Choice Welf 39(2–3):675–696

Björklund A, Roine J, Waldenström D (2012) Intergenerational top income mobility in Sweden: capitalist dynasties in the land of equal opportunity? J Public Econ 96(5–6):474–484

Blackburn ML (2007) Estimating wage differentials without logarithms. Labour Econ 14(1):73–98

Bourguignon F, Ferreira FHG, Menéndez M (2007) Inequality of opportunity in Brazil. Rev Income Wealth 53(4):585–618

Brunori P, Ferreira FHG, Peragine V (2013) Inequality of opportunity, income inequality and economic mobility: some international comparisons, IZA DP No. 7155

Chandra A (2000) Labor-market dropouts and the racial wage gap: 1940–1990. Am Econ Rev Pap Proc 90(2):333–338

Checchi D, Peragine V (2010) Inequality of opportunity in Italy. J Econ Inequal 8(4):429–450

Checchi D, Peragine V, Serlenga L. (2010) Fair and unfair income inequalities in Europe, IZA Discussion Paper No. 5025

Corak M, Heisz A (1999) The intergenerational earnings and income mobility of Canadian men: evidence from longitudinal income tax data. J Hum Resour 34(3):504–533

Dardanoni V, Fields GS, Roemer J, Sánchez-Puerta ML (2005) How demanding should equality of opportunity be, and how much have we achieved? In: Morgan S, Grusky D, Fields G (eds) Mobility and inequality: frontiers of research in sociology and economics. Stanford University Press, Stanford, pp 59–82

Devooght K (2008) To each the same and to each his own: a proposal to measure responsibility-sensitive income inequality. Economica 75(298):280–295

Dolls M, Fuest C, Peichl A (2012) Automatic stabilizers and economic crisis: Us vs. Europe. J Public Econ 96(3):279–294

Dunnzlaff L, Neumann D, Niehues J, Peichl A (2011) Equality of opportunity and redistribution in Europe. Res Econ Inequal 19:99–129

Dustmann C, Ludsteck J, Schönberg U (2009) Revisiting the German wage structure. Q J Econ 124(2):843–881

Ferreira FHG, Gignoux J (2011) The measurement of inequality of opportunity: theory and an application to Latin America. Rev Income Wealth 57(4):622–657

Fleurbaey M (1995) Three solutions for the compensation problem. J Econ Theory 65(2):505–521

Fleurbaey M (2008) Fairness, responsibility, and welfare. Oxford University Press, Oxford

Fleurbaey M, Peragine V (2013) Ex ante versus ex post equality of opportunity. Economica 80(317):118–130

Fong C (2001) Social preferences, self-interest, and the demand for redistribution. J Public Econ 82(2):225–246

Foster JE, Ok EA (1999) Lorenz dominance and the variance of logarithms. Econometrica 67(4):901–908

Foster J, Shneyerov A (2000) Path independent inequality measures. J Econ Theory 91(2):199–222

Haisken-DeNew J, Frick J (2003) DTC: desktop compendium to the German socio-economic panel study (GSOEP). DIW

Hugget M, Ventura G, Yaron A (2011) Sources of lifetime inequality. Am Econ Rev 101(7):2923–2954

Katz L, Autor D (1999) Changes in the wage structure and earnings inequality. In: Ashenfelter O, Card D (eds) Handbook of labor economics, vol 3A. North-Holland Elsevier, Amsterdam, pp 1463–1558

Krueger AB, Summers LH (1988) Efficiency wages and the inter-industry wage structure. Econometrica 56(2):259–294

Lefranc A, Pistolesi N, Trannoy A (2008) Inequality of opportunities vs. inequality of outcomes: are Western societies all alike? Rev Income Wealth 54(4):513–546

Lefranc A, Pistolesi N, Trannoy A (2009) Equality of opportunity and luck: definitions and testable conditions, with an application to income in France. J Public Econ 93(11–12):1189–1207

Lillard LA, Weiss Y (1979) Components of variation in panel earnings data: American scientists, 1960–70. Econometrica 47(2):437–454

Luongo P (2010) The implication of partial observability of circumstances on the measurement of EOp, mimeo. University of Bari, Bari

Magnac T, Pistolesi N, Roux S (2013) Post schooling human capital investments and the life cycle variance of earnings, IDEI Working Papers 765

Meghir C, Pistaferri L (2010) Earnings, consumption and lifecycle choices. In: Ashenfelter O, Card D (eds) Handbook of labor economics, vol 4b. Elsevier, Amsterdam, pp 773–854

Moffitt RA, Gottschalk P (2012) Trends in the transitory variance of male earnings: methods and evidence. J Hum Resour 47(1):204–236

OECD (2011) Growing income inequality in OECD countries: what drives it and how can policy tackle it? OECD Forum on Tackling Inequality, Paris 2 May

Ooghe E, Peichl A (2011) Fair and efficient taxation under partial control: theory and evidence, CESifo Working Paper Series 3518

Piketty T (1995) Social mobility and redistributive politics. Q J Econ 110(3):551–584

Piketty T, Saez E (2007) How progressive is the US federal tax system? A historical and international perspective. J Econ Perspect 21(1):3–24

Pistolesi N (2009) Inequality of opportunity in the land of opportunities, 1968–2001. J Econ Inequal 7(4):411–433

Rodgers W, Brown C, Duncan GJ (1993) Errors in survey reports of earnings. Hours worked and hourly wages. J Am Stat Assoc 88(424):1208–1218

Roemer JE (1993) A pragmatic theory of responsibility for the egalitarian planer. Philos Public Aff 22(2):146–166

Roemer JE (1998) Equality of opportunity. Harvard University Press, Cambridge

Roemer JE, Aaberge R, Colombino U, Fritzell J, Jenkins SP, Marx I, Page M, Pommer E, Ruiz-Castillo J, Segundo MJS, Trans T, Wagner GG, Zubiri I (2003) To what extent do fiscal regimes equalize opportunities for income acquisition among citizens? J Public Econ 87(3–4):539–565

Schnabel K, Alfeld C, Eccles J, Köller O, Baumert J (2002) Parental influence on students’ educational choices in the U.S.A. and Germany: different ramifications—same effect? J Vocat Behav 60:178–198

Shorrocks A (1980) The class of additively decomposable inequality measures. Econometrica 48(3):613–625

Solon G (1999) Intergenerational mobility in the labor market. In: Ashenfelter O, Card D (eds) Handbook of labor economics, vol 3A. North-Holland Elsevier, Amsterdam, pp 1761–1800

Van de gaer D (1993) Equality of opportunity and investment in human capital. Working Paper, KU Leuven

Van de gaer D, Schokkaert E, Martinez M (2001) Three meanings of intergenerational mobility. Economica 68:519–537

Van Kerm P (2004) What lies behind income mobility? Reranking and distributional change in Belgium, Western Germany and the USA. Economica 71(281):223–239

Wagner GG, Frick JR, Schupp J (2007) The German socio-economic panel (SOEP): scope, evolution and enhancements. Schmoller’s Jahrbuch J Appl Soc Sci Stud 127(1):139–169

Acknowledgments

We are grateful for financial support by Deutsche Forschungsgemeinschaft DFG (GRK1461 and PE1675). We would like to thank two anonymous referees, Marc Fleurbaey (the Editor), Rolf Aaberge, Ingvild Almås, Paolo Brunori, Koen Caminada, Koen Decanq, Philipp Doerrenberg, Dan Hamermesh, David Jaeger, Peter Kuhn, Dirk Neumann, Nico Pestel, Erwin Ooghe, Andrew Oswald, John Roemer, Sebastian Siegloch, Chris Taber, Alain Trannoy and Philippe Van Kerm as well as seminar and conference participants in Ann Arbor, Bonn, Canazei, Cologne, Marseille, Milan and Rome for helpful comments and suggestions. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Niehues, J., Peichl, A. Upper bounds of inequality of opportunity: theory and evidence for Germany and the US. Soc Choice Welf 43, 73–99 (2014). https://doi.org/10.1007/s00355-013-0770-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00355-013-0770-y