Abstract

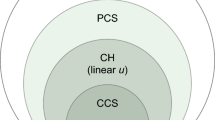

This paper analyzes a family of rules for bankruptcy problems that generalizes the Talmud rule (T) and encompasses both the constrained equal-awards rule (A) and the constrained equal-losses rule (L). The family is defined by means of a parameter \(\theta \in [0,1]\) that can be interpreted as a measure of the distributive power of the rule. We provide a systematic study of the structural properties of the rules within the family and its connections with the existing literature.

Similar content being viewed by others

References

Atkinson AB (1970) On the measurement of inequality. J Econ Theory 2:244–263

Aumann RJ, Maschler M (1985) Game theoretic analysis of a bankruptcy problem from the Talmud. J Econ Theory 36:195–213

Chakravarty SR (1999) Measuring inequality: the axiomatic approach. In: Silber J (eds) The handbook of income inequality measurement, chap 4. Kluwer, Dordrecht

Curiel IJ, Maschler M, Tijs SH (1987) Bankruptcy games. Zeitschrift für Operat Res 31:A143–A159

Dagan N (1996) New characterizations of old bankruptcy rules. Soc Choice Welfare 13:51–59

Dasgupta PS, Sen AK, Starret D (1973) Notes on the measurement of inequality. J Econ Theory 6:180–187

Dominguez D, Thomson W (2006) A new solution to the problem of adjudicating conflicting claims. Econ Theory 28:283–307

Herrero C, Villar A (2001) The three musketeers: four classical solutions to bankruptcy problems. Math Soc Sci 42:307–328

Herrero C, Villar A (2002) Sustainability in bankruptcy problems. TOP 10(2):261–273

Hokari T, Thomson W (2003) Claims problems and weighted generalizations of the Talmud rule. Econ Theory 21:241–261

Kahneman D, Tversky A (1979) Prospect theory: an analysis of decision making under risk. Econometrica 47:263–291

Moreno-Ternero J, Roemer J (2004) Impartiality, solidarity, and priority in the theory of justice. Cowles Foundation Discussion Paper No. 1477

Moreno-Ternero J, Villar A (2004) The Talmud rule and the securement of agents’ awards. Math Soc Sci 47:245–257

Moreno-Ternero J, Villar A (2005) On the relative equitability of a family of taxation rules. J~Public Econ Theory (forthcoming)

Moreno-Ternero J, Villar A (2006) New characterizations of a classical bankruptcy rule. Rev Econ Des (forthcoming)

Moulin H (1987) Equal or proportional division of a surplus, and other methods. Int J Game Theory 16:161–186

Moulin H (2000) Priority rules and other asymmetric rationing methods. Econometrica 68:643–684

Moulin H (2002) Axiomatic cost and surplus-sharing. In: Arrow K, Sen A, Suzumura K (eds) The handbook of social choice and welfare, vol 1, chap 6. North-Holland, New York

O’Neill B (1982) A problem of rights arbitration from the Talmud. Math Soc Sci 2:345–371

Rostchild M, Stiglitz JE (1973) Some further results on the measurement of inequality. J Econ Theory 2:225–243

Thomson W (1987) Monotonic allocation mechanisms. Mimeo, University of Rochester

Thomson W (1996) Consistent allocation rules, RCER Working paper 418, University of Rochester

Thomson W (2000) Condorcet lecture. In: International meeting of the society for social choice and welfare, University of Alicante.

Thomson W (2003) Axiomatic and game-theoretic analysis of bankruptcy and taxation problems: a survey. Math Soc Sci 45:249–297

Yeh CH (2005) Protective properties and the constrained equal awards rule for claims problems. Soc Choice Welfare (forthcoming)

Yeh CH (2006) Secured lower bound, composition up, and minimal rights first for bankruptcy problems. Mimeo, Inst Econ, Academia Sinica, Taiwan

Young P (1987) On dividing an amount according to individual claims or liabilities. Math Operat Res 12:398–414

Young P (1988) Distributive justice in taxation. J Econ Theory 44:321–335

Young P (1994) Equity. Princeton University Press, Princeton

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Moreno-Ternero, J.D., Villar, A. The TAL-Family of Rules for Bankruptcy Problems. Soc Choice Welfare 27, 231–249 (2006). https://doi.org/10.1007/s00355-006-0121-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00355-006-0121-3