Summary.

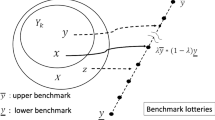

Traditional analysis of auctions assumes that each bidder's beliefs about opponents' valuations are represented by a probability measure. Motivated by experimental findings such as the Ellsberg Paradox, this paper examines the consequences of relaxing this assumption in the first and second price sealed bid auctions with independent private values. The multiple priors model of Gilboa and Schmeidler [Journal of Mathematical Economics, 18 (1989), 141–153] is adopted specifically to represent the bidders' (and the auctioneer's) preferences. The unique equilibrium bidding strategy in the first price auction is derived. Moreover, under an interesting parametric specialization of the model, it is shown that the first price auction Pareto dominates the second price auction.

Similar content being viewed by others

Author information

Authors and Affiliations

Additional information

Received: December 15, 1995; revised version: February 19, 1997

Rights and permissions

About this article

Cite this article

Lo, K. Sealed bid auctions with uncertainty averse bidders. Economic Theory 12, 1–20 (1998). https://doi.org/10.1007/s001990050209

Issue Date:

DOI: https://doi.org/10.1007/s001990050209