The haves and have-notes

live on each other.

—Laotzu.

Abstract

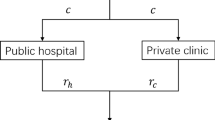

Given a large market of individuals entitled to equal shares of a limited resource, each allowed to buy or sell the shares, we characterize the interim incentive-constrained Pareto frontier subject to market clearance and budget balance. At most two prices—partitioning the type space into at most three tiers and using rations only on the middle tier—are needed to attain any interim Pareto optimum. When the virtual surplus function satisfies a single crossing condition without having to be monotone, the optimal mechanism reduces to a single, posted price and requires neither rationing nor lump sum transfers. We find which types gain, and which types lose, when the social planner chooses a rationing mechanism over the single-price solution, as well as the welfare weight of which type is crucial to the choice. The finding suggests a market-like mechanism to distribute Covid vaccines optimally within the same priority group.

Similar content being viewed by others

References

Akbarpour, M., Budish,E., Dworczak, P., Kominers, S.D.: An economic framework for vaccine prioritization. Working Paper (2021)

Akbarpour, M., Dworczak, P., Kominers, S.D.: Redistributive allocation mechanisms. Working Paper (2020)

Bulow, J., Roberts, J.: The simple economics of optimal auctions. J. Polit. Econ. 97(5), 1060–1090 (1989)

Chien, H.-C.: Incentive Efficient Mechanism for Partnership. Mimeo, New York (2007)

Cramton, P., Gibbons, R., Klemperer, P.: Dissolving a partnership efficiently. Econometrica 55(3), 615–632 (1987)

Dworczak, P., Kominers, S.D., Akbarpour, M.: Redistribution through markets. Econometrica 89(4), 1665–1698 (2021)

Gresik, T.: Incentive-efficient equilibria of two-party sealed-bid bargaining games. J. Econ. Theory 68, 26–48 (1996)

Holmström, B., Myerson, R.: Efficient and durable decision rules with incomplete information. Econometrica 51(6), 1799–1820 (1983)

Kamenica, E., Gentzkow, M.: Bayesian persuasion. Am. Econ. Rev. 101, 2590–2615 (2011)

Kang, M., Zheng, C.Z.: Pareto optimality of allocating the bad. Working Paper (2020). https://economics.uwo.ca/faculty/zheng/research/AllocatingTheBad.pdf

Kang, Z.Y.: Optimal public provision of private goods. Mimeo, Stanford USB, Stanford (2020)

Kittsteiner, T.: Partnerships and double auctions with interdependent valuations. Games Econ. Behav. 44, 54–76 (2003)

Laussel, D., Palfrey, T.: Efficient equilibria in the voluntary contributions mechanism with private information. J. Public Econ. Theory 5, 449–478 (2003)

Ledyard, J., Palfrey, T.: A characterization of interim efficiency with public goods. Econometrica 67, 435–448 (1999)

Ledyard, J., Palfrey, T.: A general characterization of interim efficient mechanisms for independent linear environments. J. Econ. Theory 133, 441–466 (2007)

Loertscher, S., Wasser, C.: Optimal structure and dissolution of partnerships. Theor. Econ. 14, 1063–1114 (2019)

Lu, H., Robert, J.: Optimal trading mechanisms with ex ante unidentifiable traders. J. Econ. Theory 97, 50–80 (2001)

Myerson, R.: Optimal auction design. Math. Oper. Res. 6(1), 58–73 (1981)

Myerson, R., Satterthwaite, M.A.: Efficient mechanisms for bilateral trading. J. Econ. Theory 29, 265–281 (1983)

Mylovanov, T., Tröger, T.: Mechanism design by an informed principal: private values with transferable utility. Rev. Econ. Stud. 81, 1668–1707 (2014)

Pérez-Nievas, M.: Interim efficient allocation mechanisms. Working Paper 00-20, Departmento de Economia, Universidad Carlos III de Madrid (2000)

Reuter, M., Groh, C.-C.: Mechanism design for unequal societies. Discussion Paper No. 228 (2020)

Royden, H.L., Fitzpatrick, P.M.: Real Analysis, 4th edn. Pearson Education, Boston (2010)

Segal, I., Whinston, M.: Property rights and the efficiency of bargaining. J. Eur. Econ. Assoc. 14, 1287–1328 (2016)

Sömet, T., Pathak, P.A., Ünever, U., Persad, G., Truog, R.D., White, D.B.: Categorized priority systems. Humanities: Vantage 159(3), 1294–1299 (2021)

Wilson, R.: Incentive efficiency of double auctions. Econometrica 53, 1101–1105 (1985)

Yang, L., Debo, L., Gupta, V.: Trading time in a congested environment. Manag. Sci. 63, 2377–2395 (2017)

Yang, L., Wang, Z., Cui, S.: A model of queue scalping. Manag. Sci. (2021). https://doi.org/10.1287/mnsc.2020.3865

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Previously titled “Pareto Optimal Hierarchies.” We thank Scott Kominers, two referees and the associate editor for comments and suggestions. Zheng acknowledges financial support from the Social Science and Humanities Research Council of Canada, Insight Grant R4809A04.

Rights and permissions

About this article

Cite this article

Kang, M., Zheng, C.Z. Optimal design for redistributions among endogenous buyers and sellers. Econ Theory 75, 1141–1180 (2023). https://doi.org/10.1007/s00199-022-01442-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-022-01442-4

Keywords

- Market design

- Redistribution

- Interim incentive efficiency

- Interim Pareto optimality

- Ironing

- Rationing

- Endogenous buyers and sellers

- Vaccine distribution