Abstract

This paper considers the problem of a Principal who faces a privately informed Agent and only knows one moment of the type’s distribution. Preferences are nonlinear in the allocation, and the Principal maximizes her worst-case expected profits. The robustness property of the optimal mechanism imposes restrictions on the Principal’s ex-post payoff function: subject to the allocation being nonzero, ex-post payoffs are linear in the Agent’s type. The robust mechanism entails exclusion of low types, distortions at the intensive margin and efficiency at the top. We show that, under some conditions, distortions in the optimal mechanism are decreasing in types. This monotonicity has relevant consequences for several applications discussed. Our characterization uses an auxiliary zero-sum game played by the Principal and an adversarial Nature who seeks to minimize her expected payoffs which also gives us a characterization of the worst-case distribution from the Principal’s perspective. Applications of our framework to insurance provision, optimal taxation, nonlinear pricing and regulation are discussed.

Similar content being viewed by others

Notes

Kos and Messner (2015) also consider the case in which the seller knows the mean and the variance of the distribution of types. Carrasco et al. (2017) generalize and supersede Carrasco et al. (2015) and Kos and Messner (2015), by considering the case in which the seller knows the first N moments of the distribution of types.

As Proposition 2 below will show, the robust allocation is a second-best solution of a Bayesian model for some given distribution. Therefore, as in any Bayesian model, the second-best allocation may or may not display exclusion when the first-best allocation does not.

The case where \(k\le \underline{\theta }\) leads to zero payoff to the Principal in a trivial way. By considering the Dirac distribution \(\delta _{k}\), one can see that \(\int _{0}^{1}\left( t\left( \theta \right) -c\left( q(\theta )\right) \right) d\delta _{k}\left( \theta \right) =t\left( k\right) -c(q(k))\). Individual rationality implies that \(t\left( k\right) -c\left( q(k)\right) \le s\left( q\left( k\right) ,k\right) \le 0\) since the first-best allocation for type \(k<\underline{\theta }\) is zero.

As long as the total surplus \(s\left( q,\theta \right) \equiv u\left( q,\theta \right) -c\left( q\right) \) is strictly concave and satisfies A4.

We do not allow for overinsurance, i.e., coverage cannot be higher than the full coverage \(q=1\).

Garrett (2014) considers the case of a planner who is ignorant about the disutility of effort. With a maximin criterion over all possible disutility of effort, he shows that simple fixed-price-cost-reimbursement (FPCR) menu implements the robust solution in his case.

To ensure that the argument of the function \(\psi \) is always positive it suffices that \(q=\underline{\eta }-\eta +e\ge 0\), i.e., \(e\ge \varDelta \eta \), for all second-best effort level e. If this condition does not hold, notice that \(q\ge 0\) is a normalization assumption and we could have assumed \(q\ge \underline{q}\), for some \(\underline{q}\in \mathbb {R}\). Hence, taking \(\underline{q}\) sufficiently small, the regulation model would fit all the assumptions.

For the general cost function, solving the ODE (10) (see Lemma’s 2 in “Appendix”) we get the robust allocation as the inverse of the type assignment function:

$$\begin{aligned} \theta \left( q\right) =e^{\xi ^{-1}(q-q_{1})}+\xi ^{-1}e^{\xi ^{-1}q}\int _{q}^{q_{1}}e^{-\xi ^{-1}x}c^{\prime }\left( x\right) \mathrm{d}x. \end{aligned}$$

References

Bergemann, D., Schlag, K.: Pricing without priors. J. Eur. Econ. Assoc. 6(2–3), 560–569 (2008)

Bergemann, D., Schlag, K.: Robust monopoly pricing. J. Econ. Theory 146(6), 2527–2543 (2011)

Bose, S., Ozdenoren, E., Pape, A.: Optimal auctions with ambiguity. Theor. Econ. 1, 411–438 (2006)

Carrasco, V., Farinha Luz, V., Monteiro, P., Moreira, H.: Robust Selling Mechanism. Textos para discussão 641, PUC-Rio (2015)

Carrasco, V., Farinha Luz, V., Kos, N., Messner, M., Monteiro, P., Moreira, H.: Optimal Selling Mechanisms Under Moment Conditions. Mimeo, New York (2017)

Carroll, G.: Informationally robust trade and limits to contagion. J. Econ. Theory 166, 334–361 (2016)

Carroll, G.: Robustness and linear contracts. Am. Econ. Rev. 105(2), 536–563 (2015)

Carroll, G.: Robustness and separation in multidimensional screening. Econometrica 85(2), 453–488 (2017)

Einav, L., Finkelstein, A., Ryan, S.P., Schrimpf, P., Cullen, M.R.: Selection on moral hazard in health insurance. Am. Econ. Rev. 103(1), 178–219 (2013)

Frankel, A.: Aligned delegation. Am. Econ. Rev. 104(1), 66–83 (2014)

Garrett, D.: Robustness of simple menus of contracts in cost-based procurement. Games Econ. Behav. 87, 631–641 (2014)

Hale, J.K.: Ordinary Differential Equations. Dover Publications, INC, New York (1969)

Hurwicz, L., Shapiro, L.: Incentive structures maximizing residual gain under incomplete information. Bell J. Econ. 9(1), 180–191 (1978)

Kos, N., Messner, M.: Selling to the Mean (2015). https://doi.org/10.2139/ssrn.2632014

Laffont, J., Tirole, J.: Using cost observation to regulate firms. J. Polit. Econ. 3(1), 614–641 (1986)

Mirrlees, J.: An exploration in the theory of optimum income taxation. Rev. Econ. Stud. 38(2), 175–208 (1971)

Mussa, M., Rosen, S.: Monopoly and product quality. J. Econ. Theory 18(2), 301–317 (1978)

Myerson, R.: Optimal auction design. Math. Oper. Res. 6(1), 58–73 (1981)

Salanié, B.: The Economics of Contracts. MIT Press, Cambridge (1998)

Wolitzky, A.: Mechanism design with maxmin agents: Theory and an application to bilateral trade. Theor. Econ. 11, 971–1004 (2016)

Acknowledgements

Monteiro acknowledges financial support from CNPq of Brazil. Moreira gratefully acknowledges financial support from FAPERJ and CNPq of Brazil

Author information

Authors and Affiliations

Corresponding author

Additional information

We have benefited from conversations with Gabriel Carroll, Nicolas Figueroa, Stephen Morris, Leonardo Rezende and Yuliy Sannikov. We thank Rodrigo Andrade for revising the text.

First Version: June 2015. This work encompasses a previous paper, by a subset of the current authors, that has been presented in several occasions since December 2012.

Appendix

Appendix

1.1 Proof of Lemma 2

Proof

(i) and (ii) The differential system (5) is equivalent to \(\theta \left( \cdot \right) \) solving

The function \(\xi ^{-1}s_{q}(q,\theta )\) is continuously differentiable and defined on a compact set in \(\mathbb {R}^{2}\) and, hence, is Lipschitz in the second argument. By assumption it is defined on a neighborhood of its domain. In particular, it has a unique solution of the ODE on a neighborhood of \(\left( q,\theta \right) =\left( q_{1},1\right) \)\(\textendash \) see for instance Theorem 3.1 (p. 18) of Hale (1969). Let \((q^{*},q_{1}]\) be the left maximal interval of definition of the ODE. We claim that \(\theta \left( \cdot \right) \) is strictly increasing in this interval. First notice that \(\theta ^{\prime }\left( q\right) =0\) implies that

In particular, since \(\theta '(q_{1})=0\), the function \(\theta (\cdot )\) is strictly concave at \(q_{1}\), which implies that it must be increasing slightly below of \(q_{1}\). Now if \(x\in (q^{*},q_{1})\) and y is the minimum of \(\theta (\cdot )\) in \(\left[ x,q_{1}\right] \), then \(y\notin (x,q_{1})\). Indeed, \(\theta ^{\prime }\left( y\right) =0\) and \(\theta ^{\prime \prime }\left( y\right) <0\) imply that \(\theta (\cdot )\) decreases on the right of y. The minimum cannot be \(q_{1}\) since \(\theta (\cdot )\) is increasing on the left of \(q_{1}\). Thus, the minimum must be \(y=x\). The same reasoning implies that \(\theta \left( \cdot \right) \) is strictly increasing. We now define \(\theta \left( q^{*}\right) =\inf \,\theta \left( (q^{*},q_{1}]\right) \). Thus, \(\theta ^{\prime }\left( q^{*}\right) =\lim \limits _{q\downarrow q^{*}}\xi ^{-1}s_{q}\left( q,\theta \left( q\right) \right) =\xi ^{-1}s_{q}\left( q^{*},\theta \left( q^{*}\right) \right) \). By the first part of A2, the maximality of the interval \((q^{*},q_{1}]\) now ensures that \(q^{*}=0\).

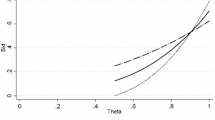

(iii) For any \(\xi >0\), define \(\theta ^{\xi }\left( q\right) \) as the solution of the ODE (10). Let \(\underline{\theta }^{\xi }=\theta ^{\xi }\left( 0\right) \) and \(q^{\xi }:\left[ \underline{\theta }^{\xi },1\right] \rightarrow \mathbb {R}_{+}\) denote the inverse of \(\theta ^{\xi }\left( \cdot \right) \). The continuity will be also obvious by the argument that follows from Theorem 3.2 (p. 20) of Hale (1969). We now prove monotonicity in \(\xi \). For any \(\xi >0\) and \(\left( q,\theta \right) \in \mathbb {R}_{+}\times \left[ 0,1\right] \), the mapping \(\xi \mapsto \xi ^{-1}s_{q}(q,\theta )\) is differentiable \(\textendash \) see Theorem 3.3 (p. 21) of Hale (1969). Hence, the solution \(\theta ^{\xi }\left( q\right) \) is differentiable in \(\xi \). Consider a fixed \(\xi >0\) and if \(k\left( q\right) \equiv \frac{\partial \theta ^{\xi }\left( q\right) }{\partial \xi }\), then

Define \(a\left( q\right) =s_{q}\left( q,\theta ^{\xi }\left( q\right) \right) \) and \(b\left( q\right) =s_{q\theta }\left( q,\theta ^{\xi }\left( q\right) \right) \). Thus,

We prove that \(k\left( q\right) \ge 0\). Let \(P\left( q\right) \equiv e^{\int _{q}^{q_{1}}\xi ^{-1}b\left( x\right) \mathrm{d}x}>0\). Then,

Thus, \(P\left( q\right) k\left( q\right) \ge P\left( q_{1}\right) k\left( q_{1}\right) =0\).

(iv) Let \(\theta ^{0}\left( q\right) =\lim _{\xi \downarrow 0}\theta ^{\xi }\left( q\right) \ge 0\). Integrating the differential equation (10) we get

Since \(s_{q}\left( q,\theta ^{\xi }\left( q\right) \right) >0\), we have that as \(\xi \rightarrow 0\), \(s_{q}\left( q,\theta ^{\xi }\left( q\right) \right) \rightarrow s_{q}\left( q,\theta ^{0}\left( q\right) \right) =0\), for almost all \(q\in \left[ 0,1\right] \). The condition \(s_{q\theta }>0\) implies that \(q^{FB}\left( \theta ^{0}\left( q\right) \right) =q\), for almost all \(q\in \left[ 0,1\right] \). Since \(\theta ^{0}\left( q\right) \) is strictly increasing and \(\theta ^{\xi }\left( \cdot \right) \) is strictly increasing for any \(\xi >0\), the convergence occurs for all \(q\in \left[ 0,1\right] \). Finally, notice that, for all \(q\in \left[ 0,1\right] \) and \(\xi >0\),

Hence, (11) implies that \(\frac{\mathrm{d}\theta ^{\xi }\left( q\right) }{\mathrm{d}q}=\xi ^{-1}s_{q}\left( q,\theta ^{\xi }\left( q\right) \right) \) converges uniformly to zero as \(\xi \rightarrow \infty \), and hence \(\theta ^{\xi }\left( \cdot \right) \) converges uniformly to 1.

1.2 Proof of Proposition 2

Proof

Consider an arbitrary \(q\in \mathscr {Q}\). From Tonelli’s theorem,

Hence,

Note that \(s\left( q\left( 1\right) ,1\right) \le s\left( q_{1},1\right) =s\left( q^{\xi }\left( 1\right) ,1\right) \). Since \(s_{q\theta }>0,\)\(q(\theta )=0\) pointwise maximizes the expression above for each \(\theta \in [0,\underline{\theta ^{\xi }]}\). Define, for each \(\theta \in \left( \underline{\theta }^{\xi },1\right) \), the function \(h\left( q,\theta \right) \equiv s(q,\theta )-\frac{1-F^{\xi }(\theta )}{f^{\xi }(\theta )}s_{\theta }(q,\theta )\). Then,

If \(q<q^{\xi }\left( \theta \right) \) then \(s_{q\theta }(q,\theta )>0\) and \(\frac{s_{q}(q,\theta )}{s_{q\theta }(q,\theta )}\ge \frac{s_{q}(q^{\xi }(\theta ),\theta )}{s_{q\theta }(q^{\xi }(\theta ),\theta )}\), which implies \(h_{q}\left( q,\theta \right) \ge 0\). Analogously, if \(q\in \left( q^{\xi }\left( \theta \right) ,q^{FB}\left( \theta \right) \right] \), then \(h_{q}\left( q,\theta \right) \le 0\). For any \(q>q^{FB}\left( \theta \right) \), it is easy to see that \(h_{q}\left( q,\theta \right) <0\). Hence, \(q^{\xi }\left( \theta \right) \) maximizes \(h\left( \cdot ;\theta \right) \) pointwise. Since \(q^{\xi }\in \mathscr {Q}\) and \(q^{\xi }\left( \theta \right) \le q^{FB}\left( \theta \right) \le q_{1}\), for all \(\theta \in \left[ 0,1\right] \), then \(q^{\xi }\) is an optimal allocation.

1.3 Proof of Lemma 3

Proof

(i) From Lemma 2 (iii), this function is continuous and strictly increasing. Using (9), we have that

Lemma 2 implies that \(\underline{\theta }^{\xi }\) converges to 1 as \(\xi \rightarrow \infty \). This implies \(\int _{0}^{1}\theta \mathrm{d}F^{\xi }(\theta )\rightarrow 1\), as \(\xi \rightarrow \infty \). On the other hand, by Lemma 2, if \(\xi \rightarrow 0\) then \(q^{\xi }\left( \theta \right) \rightarrow q^{FB}\left( \theta \right) \) and hence \(\underline{\theta }^{\xi }\rightarrow \underline{\theta }\). Convergence to the first-best allocation also implies that \(\gamma ^{\xi }(\cdot )\rightarrow \infty \) as \(\xi \rightarrow 0\). Therefore, \(\int _{0}^{1}\theta \mathrm{d}F^{\xi }(\theta )\rightarrow \underline{\theta }\).

(ii) Since \(\theta ^{\xi }\left( q\right) \) is continuous in \(\xi \), for any q and \(k>\underline{\theta }\), by the intermediate value theorem, there must exist \(\xi ^{*}>0\) such that \(\int _{0}^{1}\theta \mathrm{d}F^{\xi ^{*}}(\theta )=k\) .

1.3.1 Proof of Proposition 3

Proof

First notice that \(F^{*}\) has support \(\left[ \underline{\theta }^{*},1\right] \). Proposition 1 implies that \(F^{*}\) minimizes expected profits, given ex-post payoff function \(\varPi ^{*}\). Proposition 2 implies that \(q^{*}\) maximizes the Principal’s payoff, given distribution \(F^{*}\).

1.4 Proof of Proposition 4

Proof

The wedge \(w\left( \theta \right) =s_{q}\left( q\left( \theta \right) ,\theta \right) \) is decreasing if and only if

Using (10) this condition is equivalent to

where we are making the dependence on \(\xi \) explicit. Since \(s_{q}\left( q_{1},\theta ^{\xi }\left( q_{1}\right) \right) =s_{q}\left( q_{1},1\right) =0\) and \(s_{qq}\left( q_{1},1\right) <0\) (by A1), the inequality is true for \(\theta \ge \underline{\theta }^{\xi }\) when \(\xi \rightarrow \infty \). By Lemma 3 (i), we have that the function \(\xi \rightarrow \int _{0}^{1}\theta \mathrm{d}F^{\xi }(\theta )\) is continuous and strictly increasing from \((0,\infty )\) into \((\underline{\theta },1)\). Therefore, the result immediately follows.

Rights and permissions

About this article

Cite this article

Carrasco, V., Luz, V.F., Monteiro, P.K. et al. Robust mechanisms: the curvature case. Econ Theory 68, 203–222 (2019). https://doi.org/10.1007/s00199-018-1120-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-018-1120-1