Abstract

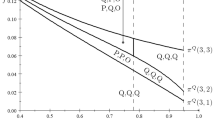

We investigate the effects of increased transparency on prices in the Bertrand duopoly model. Market transparency is defined as the proportion of consumers that are fully informed about the market and thus not captive to one firm. We consider two main cases of strategic interaction, prices as strategic complements and as strategic substitutes. For the former class of games, conventional wisdom concerning prices is confirmed, in that they decrease with market transparency. Consumer welfare always increases with higher transparency but changes in firms’ profits are ambiguous. For the latter class of games, an increase in market transparency may lead to an increase in one of the prices, which implies ambiguous effects on both consumer welfare and firms’ profits. An example with linear demand for differentiated products is also investigated. The results of the paper shed light on the mixed evidence concerning the effects of the Internet on retail markets and may illuminate some of the ongoing related public policy debates.

Similar content being viewed by others

Notes

For multivariate functions, subscripts denote partial derivative taken with respect to the indicated variable, here, e.g., \(D_{j}^{i}=\frac{\partial D^{i} }{\partial p_{j}}\).

There is another condition making Bertrand duopoly with linear cost into a game of strategic complementarities. It was given by Milgrom and Roberts (1990) and is equivalent to the cross-partial derivative of the log-profit function being nonnegative. In our case it is less useful, since it requires imposing additional conditions on the game with imperfect transparency to secure its log-supermodularity.

It is worthwhile to note here that other, more general complementarity conditions such as the single-crossing property (Milgrom and Shannon 1994) or the interval dominance order (Quah and Strulovici 2009) do not appear to be applicable in the present setting, due to the fact the profit function is a sum of different terms.

In their model with Cournot competition, the fact that equilibrium prices may increase in the level of transparency is due entirely to their assumption of strongly decreasing returns to scale in production (or quadratic cost function).

Here, condition (9) is much easier to satisfy for goods that are complements, since \(D_{j}^{i}\) is then \(<0.\)

About these asymmetric equilibria, nothing more can be said at this level of generality, beyond what is given in this paper for equilibria of asymmetric games.

References

Amir, R.: Cournot oligopoly and the theory of supermodular games. Games Econ. Behav. 15, 132–148 (1996a)

Amir, R.: Sensitivity analysis of multisector optimal economic dynamics. J. Math. Econ. 25, 123–141 (1996b)

Amir, R.: Supermodularity and complementarity in economics: an elementary survey. South. Econ. J. 71, 636–660 (2005)

Amir, R., Lambson, V.: On the effects of entry in Cournot markets. Rev. Econ. Stud. 67, 235–254 (2000)

Bailey, J. P.: Intermediation and electronic markets: aggregation and pricing in Internet commerce. Ph.D. Thesis, Technology, Management and Policy, M. I. T. (1998)

Bester, H., Petrakis, E.: Price competition and advertising in oligopoly. Eur. Econ. Rev. 39, 1075–1088 (1995)

Boone, J., Potters, J.: Transparency, prices and welfare with imperfect substitutes. Econ. Lett. 93, 398–404 (2006)

Burdett, K., Judd, K.L.: Equilibrium price dispersion. Econometrica 51, 955–969 (1983)

Brynjolfsson, E., Smith, M.D.: Frictionless commerce? A comparison of Internet and conventional retailers. Manag. Sci. 46, 563–585 (2000)

Echenique, F.: Comparative statics by adaptive dynamics and the correspondence principle. Econometrica 70, 833–844 (2002)

Edlin, A., Shannon, C.: Strict monotonicity in comparative statics. J. Econ. Theory 81, 201–219 (1998)

Hoernig, S.: Existence of equilibrium and comparative statics in differentiated goods Cournot oligopolies. Int. J. Ind. Organ. 21, 989–1020 (2003)

Ireland, J.N.: The provision of information in a Bertrand oligopoly. J. Ind. Econ. 41, 61–76 (1993)

Lee, H.G., Westland, C., Hong, S.: Impacts of electronic marketplaces on product prices: an empirical study of AUCNET case. Int. J. Electron. Commer. 4, 45–60 (2000)

Milgrom, P., Roberts, J.: Rationalizability, learning, and equilibrium in games with strategic complementarities. Econometrica 58, 1255–1278 (1990)

Milgrom, P., Roberts, J.: Comparing equilibria. Am. Econ. Rev. 84, 441–459 (1994)

Milgrom, P., Shannon, C.: Monotone comparative statics. Econometrica 62, 157–180 (1994)

Milgrom, P., Roberts, J.: Coalition-proofness and correlation with arbitrary communication possibilities. Games Econ. Behav. 17, 113–128 (1996)

Møllgaard, H.P., Overgaard, P.B.: Market transparency in competition policy. Rivista Di Politica Economica, Selected Papers (2001)

Monaco, A., Sabarwal, T.: Games with strategic complements and substitutes. Econ. Theory 62, 65–91 (2016)

Nilsson, A.: Transparency and competition. SSE/EFI Working Paper Series in Economics and Finance, Stockholm School of Economics, No 298. http://EconPapers.repec.org/RePEc:hhs:hastef:0298. Accessed 15 Dec 2015 (1999)

Prokopovych, P., Yannelis, N.: On strategic complementarities in discontinuous games with totally ordered strategies. J. Math. Econ. 70, 147–153 (2017)

Quah, J.K.-H., Strulovici, B.: Comparative statics, informativeness, and the interval dominance order. Econometrica 77, 1949–1992 (2009)

Roy, S., Sabarwal, T.: Characterizing stability properties in games with strategic substitutes. Games Econ. Behav. 75, 337–353 (2012)

Schultz, C.: Market transparency and product differentiation. Econ. Lett. 83, 173–178 (2004)

Schultz, C.: Transparency on the consumer side and tacit collusion. Eur. Econ. Rev. 49, 279–297 (2005)

Singh, N., Vives, X.: Price and quantity competition in a differentiated duopoly. RAND J. Econ. 15, 546–554 (1984)

Stahl, D.O.: Oligopolistic pricing with sequential consumer search. Am. Econ. Rev. 79, 700–712 (1989)

Topkis, D.: Minimizing a submodular function on a lattice. Oper. Res. 26, 305–321 (1978)

Topkis, D.M.: Supermodularity and Complementarity. Princeton University Press, Princeton, NJ (1998)

Varian, H.: A model of sales. Am. Econ. Rev. 70, 651–659 (1980)

Vives, X.: Nash equilibrium with strategic complementarities. J. Math. Econ. 19, 305–321 (1990)

Vives, X.: Oligopoly Pricing: Old Ideas and New Tools. MIT Press, Cambridge (1999)

Acknowledgements

The authors are grateful to Rabah Amir for numerous conversations and fruitful suggestions on the topic of this paper. The final version of the paper has also benefited from an anonymous reviewer’s comments. Filomena Garcia acknowledges the financial support from national funds by FCT (Fundação para a Ciência e a Tecnologia). This article is part of the project PTDC/IIM-ECO/4546/2014. The authors also thank conference participants at the 27th International Conference on Game Theory in Stony Brook University and at the VII Workshop on Institutions, Individual Behavior and Economic Outcomes in the University of Sassari.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

This section contains all the proofs of Sect. 4.

Proof of Proposition 5

The demand elasticity (in absolute value) of informed consumers is

The absolute value of the elasticity of the uniformed consumers is given by

Setting \(\left| \varepsilon _{D^{i}}\right| \ge \left| \varepsilon _{d_{i}}\right| \) leads (after computations) to the condition \(0\le \gamma \left( a_{j}-p_{j}\right) \), or \(\gamma \ge 0\) .\(\square \)

Proof of Proposition 6

When \(\gamma <0\,\) the imperfect transparency game is of strategic substitutes. Propositions 1 and 5 follow that an increase in the transparency level makes both reaction curves shift up; hence, the equilibrium prices cannot both decrease.

A necessary condition for one of the equilibrium prices, say i, to decrease, is

Reordering yields after simplification \(-\left[ a_{i}-2p_{i}^{*}+c_{i} \right] A_{1}>2b_{i}\phi \gamma [a_{j}-2p_{j}^{*}+c_{j}\quad ].\) Using the equilibrium prices (14), we obtain condition (16) after some computations.\(\square \)

Proof of Lemma 3

The sum of the demand effects \(\sum \nolimits _{i=1}^{2}\big ( D^{i}-\frac{1}{2} d_{i}\big ) \) is \(\frac{K}{8b_{i}b_{j}\big ( 4b_{i}b_{j}-\gamma ^{2}\big ) }\times \big [ \big ( a_{i}-c_{i}\big ) b_{j}\big ( A_{2}-2b_{i}\gamma (A_{1}+\big ( 4b_{i}b_{j}-\gamma ^{2}\big ) )\big ) -\big ( a_{j}-c_{j}\big ) b_{i}\big ( 2b_{j}\gamma (A_{1}+\big ( 4b_{i}b_{j}-\gamma ^{2}\big ) )-A_{2}\big ) \big ] ,\) where \(A_{1}\) is as defined in Sect. 4, \(A_{2}=\left( 4b_{i}b_{j}-z^{2}\right) \left( 4b_{i}b_{j}+z^{2}\right) +\phi \left( z^{4}+16b_{i}^{2}b_{j}^{2}\right) >0\), and

We wish to show that

There are four possible cases to be considered:

-

1.

\(A_{2}-2b_{i}\gamma (A_{1}+\left( 4b_{i}b_{j}-\gamma ^{2}\right) )>0\) and \(\left( 2b_{j}\gamma (A_{1}+\left( 4b_{i}b_{j}-\gamma ^{2}\right) )-A_{2}\right) >0\)

-

2.

\(A_{2}-2b_{i}\gamma (A_{1}+\left( 4b_{i}b_{j}-\gamma ^{2}\right) )<0\) and \(\left( 2b_{j}\gamma (A_{1}+\left( 4b_{i}b_{j}-\gamma ^{2}\right) )-A_{2}\right) >0\)

-

3.

\(A_{2}-2b_{i}\gamma (A_{1}+\left( 4b_{i}b_{j}-\gamma ^{2}\right) )>0\) and \(\left( 2b_{j}\gamma (A_{1}+\left( 4b_{i}b_{j}-\gamma ^{2}\right) )-A_{2}\right) <0\)

-

4.

\(A_{2}-2b_{i}\gamma (A_{1}+\left( 4b_{i}b_{j}-\gamma ^{2}\right) )<0\) and \(\left( 2b_{j}\gamma (A_{1}+\left( 4b_{i}b_{j}-\gamma ^{2}\right) )-A_{2}\right) <0\)

Note that in case of \(\gamma <0\) the only possibility is case 3, and in this case (17) is naturally satisfied. Hence, we consider \( \gamma >0\) and we would like to show that (17) is satisfied also in cases 1 and 4 and case 2 is not possible, given our assumptions.

-

Case 1

Using (15) for firm i we can replace \( \left( a_{j}-c_{j}\right) \) in the left-hand side (henceforth LHS) of (17) to obtain a smaller expression. After rearranging this expression, we obtain \(\left( 4b_{i}b_{j}-\gamma ^{2}\right) ^{2}+2\left( 4b_{i}b_{j}-\gamma ^{2}\right) \left( 4b_{i}b_{j}+\gamma ^{2}\right) \phi +\left( \left( 4b_{i}b_{j}+\gamma ^{2}\right) ^{2}-4\gamma ^{2}b_{i}b_{j}\right) \phi ^{2}\) which is positive, given our initial assumptions. Hence, we conclude that (17) holds.

-

Case 4

As before we use (15), but this time for firm j and we can replace \(\left( a_{i}-c_{i}\right) \) in the LHS of (17) to obtain a smaller expression. After rearranging this expression we obtain, the same as in case 1, \(\left( 4b_{i}b_{j}-\gamma ^{2}\right) ^{2}+2\left( 4b_{i}b_{j}-\gamma ^{2}\right) \left( 4b_{i}b_{j}+\gamma ^{2}\right) \phi +\left( \left( 4b_{i}b_{j}+\gamma ^{2}\right) ^{2}-4\gamma ^{2}b_{i}b_{j}\right) \phi ^{2}\) which is positive, given our initial assumptions. Hence, we conclude that ( 17) holds.

-

Case 2

Suppose \(A_{2}-2b_{i}\gamma (A_{1}+\left( 4b_{i}b_{j}-\gamma ^{2}\right) )<0\) and \(\big ( 2b_{j}\gamma (A_{1}+\big ( 4b_{i}b_{j}-\gamma ^{2}\big ) )-A_{2}\big ) >0,\) then \( \gamma \left( b_{i}+b_{j}\right) \left( A_{1}+4b_{i}b_{j}-\gamma ^{2}\right) >A_{2}.\) Using definitions of \(A_{1}\) and \(A_{2}\), this can be rewritten as

$$\begin{aligned}&\gamma ^{4}-\gamma ^{3}\left( b_{i}+b_{j}\right) -4\gamma b_{i}b_{j}\left( b_{i}+b\right) +16b_{i}^{2}b_{j}^{2}\nonumber \\&\quad <-\frac{1}{\phi }\left( 2b_{j}-\gamma \right) \left( 2b_{i}-\gamma \right) \left( 4b_{i}b_{j}-\gamma ^{2}\right) . \end{aligned}$$(18)The right-hand side (henceforth RHS) is negative. We want to show that the LHS is positive; hence, there is a contradiction.

Assume w.l.o.g that \(b_{j}<b_{i}\) and replace in the LHS \(\gamma \) by \( 2b_{j}.\) This way we obtain \((2b_{j})^{4}-\left( b_{i}+b_{j}\right) (2b_{j})^{3}-4b_{i}b_{j}\left( b_{i}+b_{j}\right) 2b_{j}+16b_{j}^{2}b_{i}^{2}=8b_{j}^{2}\left( b_{i}-b_{j}\right) ^{2}>0\). Now we show that

$$\begin{aligned}&\gamma ^{4}-\gamma ^{3}\left( b_{i}+b_{j}\right) -4\gamma b_{i}b_{j}\left( b_{i}+b\right) +16b_{i}^{2}b_{j}^{2}\nonumber \\&\quad >(2b_{j})^{4}-\left( b_{i}+b_{j}\right) (2b_{j})^{3}-4b_{i}b_{j}\left( b_{i}+b_{j}\right) 2b_{j}+16b_{j}^{2}b_{i}^{2} \end{aligned}$$(19)since this means that the LHS of (18) is positive.

To do this, we compute the difference of the left- and the right-hand side of (19). This is positive if and only if \(\left( b_{i}-b_{j}\right) \gamma ^{2}-\gamma ^{3}+2b_{j}\left( b_{i}-b_{j}\right) \gamma +4b_{j}\left( b_{i}^{2}-b_{j}^{2}+2b_{i}b_{j}\right) >0.\) To show this, we add and subtract an additional term \(4b_{i}b_{j}\gamma \) and obtain \(\left( b_{i}-b_{j}\right) \gamma ^{2}+4b_{i}b_{j}\gamma -\gamma ^{3}+2b_{j}\left( b_{i}-b_{j}\right) \gamma +4b_{j}\left( b_{i}^{2}-b_{j}^{2}+2b_{i}b_{j}\right) -4b_{i}b_{j}\gamma =\left( b_{i}-b_{j}\right) \gamma ^{2}+\left( 4b_{i}b_{j}-\gamma ^{2}\right) \gamma +2b_{j}\left( b_{i}-b_{j}\right) \gamma +\) \(4b_{j}\left( b_{i}\left( 2b_{j}-\gamma \right) +b_{i}^{2}-b_{j}^{2}\right) \). This is positive since all the components are positive.

Summarizing, we have shown that the LHS of (18) is positive; hence, it cannot be less than the RHS, which is negative. That is why \( A_{2}-2b_{i}\gamma (A_{1}+\left( 4b_{i}b_{j}-\gamma ^{2}\right) )<0\ \)and\(\ 2b_{j}\gamma (A_{1}+\left( 4b_{i}b_{j}-\gamma ^{2}\right) )-A_{2}>0\) is a contradiction.\(\square \)

Proof of Proposition 7

The indirect effect on firm i’s equilibrium output is given by \( [A_{1}A_{3}\left( a_{j}-c_{j}\right) -16b_{j}^{2}b_{i}\phi ^{3}\gamma ^{3}\left( a_{i}-c_{i}\right) ]\gamma /4A_{4}^{2}\), where \(A_{1}\) is as defined in Sect. 4,

\(A_{3}=\phi ^{2}\left( \gamma ^{4}+4b_{i}b_{j}\left( 4b_{i}b_{j}-\gamma ^{2}\right) \right) +2\phi \left( 4b_{i}b_{j}-\gamma ^{2}\right) \left( 4b_{i}b_{j}{+}\gamma ^{2}\right) +\left( 4b_{i}b_{j}{-}\gamma ^{2}\right) ^{2}>0,\) and

\(A_{4}=\phi ^{2}\left( \left( 4b_{i}b_{j}+\gamma ^{2}\right) ^{2}\!-4\gamma ^{2}b_{i}b_{j}\right) +2\phi \left( 4b_{i}b_{j}{-}\gamma ^{2}\right) \left( 4b_{i}b_{j}{+}\gamma ^{2}\right) +\left( 4b_{i}b_{j}{-}\gamma ^{2}\right) ^{2}>0.\)

If \(\gamma <0,\) the indirect effect is negative. For the case \(\gamma >0\), observe that the sign of the indirect effect is the same as the sign of the numerator. Assume it is negative, then

Conditions (20) and (15) are in contradiction since \(\frac{A_{1}A_{3}}{8b_{j}b_{i}\phi ^{3}\gamma ^{3}}> \frac{\gamma \left( 4b_{i}b_{j}-\gamma ^{2}\left( 1-\phi \right) \right) }{ \left( 4b_{i}b_{j}\left( 1+\phi \right) -\gamma ^{2}\right) }\). Therefore, the indirect effect of a \(\phi \) increase on total equilibrium output of a firm is positive if \(\gamma >0\).\(\square \)

Proof of Proposition 8

This is based on the same idea as above, namely one can check (after some computations) that the demand effect outweighs the indirect effect when both firms are active in the market in equilibrium (computational details available upon request).\(\square \)

Proof of Proposition 9

Let \(\gamma >0\). From Lemma 3 the sum of the demand effects is positive and from Proposition 7, the indirect effects are positive as well. If \(\gamma <0\) we conclude by Proposition 8 that the sum of both firms’ outputs increases when \(\phi \) increases.\(\square \)

Proof of Proposition 10

The derivative of equilibrium profit with respect to \(\phi \) is given by

where

\(\frac{\partial }{\partial \phi }\varPi ^{i}(p_{1}^{*},p_{2}^{*})\) is positive if \(\gamma <0\), or when the goods are complements. If \(\gamma >0,\) \(D_{j}^{i}>0\) and \(p_{j}^{*\prime }(\phi )<0\), hence a negative demand effect is enough for \(\frac{\partial }{\partial \phi }\varPi ^{i}(p_{i}^{*},p_{j}^{*})<0.\) \(\square \)

Proof of Proposition 11

We have \(\frac{d}{d\phi }W(p_{1}^{*}(\phi ),p_{2}^{*}(\phi ),\phi )=T_{1}+T_{2},\) where

and

\(T_{1}\) consists of the indirect effects of \(\phi \) on total equilibrium outputs of the firms, weighted by their margins. Hence, when \(\gamma >0,\) it is positive and when \(\gamma <0,\) it is negative.

\(T_{2}\) is always positive (all necessary computations can be provided upon request), and to show this we need to use the fact that (15) must hold for both firms.

Hence, if \(\gamma>0\,,\ T_{1}+T_{2}>0\). If \(\gamma <0\), \(T_{1}+T_{2}>0\) as well, but showing this requires direct computation and condition (15) for both firms (computational details upon request).\(\square \)

Rights and permissions

About this article

Cite this article

Cosandier, C., Garcia, F. & Knauff, M. Price competition with differentiated goods and incomplete product awareness. Econ Theory 66, 681–705 (2018). https://doi.org/10.1007/s00199-017-1050-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-017-1050-3

Keywords

- Bertrand duopoly

- Market transparency

- Consumers awareness

- Supermodular games

- Strategic complements/substitutes