Abstract

When a decision maker is a member of multiple social groups, her actions may cause information to “spill over” from one group to another. We study the nature of these spillovers in an observational learning game where two groups interact via a common player, and where conventions emerge when players follow the decisions of the members of their own groups rather than their own private information. We show that: (i) if a convention develops in one group but not the other group, then the convention spills over via the common player; (ii) when conventions disagree, then the common player’s decision breaks the convention in one group; and (iii) when no convention has developed, then the common player’s decision triggers the same convention in both groups. We also show that information spillovers may reduce welfare, and we investigate the surplus-maximizing timing of spillovers.

Similar content being viewed by others

Notes

Key papers in the observational learning literature include Ali and Kartik (2012), Acemoglu et al. (2011), Bala and Goyal (2001), Banerjee and Fudenberg (2004), Burguet and Vives (2000), Cao et al. (2011), Callander and Horner (2009), Celen and Kariv (2001), Golub and Jackson (2010), Guarino et al. (2011), Guarino and Jehiel (2009), and Smith and Sorensen (2000).

More broadly, our results connect to several literatures, including those on: (i) market-based information aggregation (e.g., Cea-Echenique et al. 2015), which studies the effect of information sharing among traders on market outcomes; (ii) financial intermediation (e.g., Ennis and Keister 2016), which studies the effect of information sharing among depositors on bank runs; and (iii) belief influence (e.g., Jimenez-Martinez 2015), which studies consensus building and information sharing on networks.

We discuss asymmetric priors in the Conclusion and provide a full characterization of equilibrium for this case the Online Appendix.

We discuss the case where k is even in the Conclusion.

The argument is standard—e.g., Banerjee (1992) and Bikhchandani et al. (1992)—so we only sketch it. Player \(1^{g}\) observes her signal, applies Bayes’ Rule to determine her belief, and her strategy is uniquely determined. Player \(2^{g}\) observes her signal and \(1^{g}\)’s decision, applies Bayes’ Rule to determine her belief (as knowledge of \(1^{g}\)’s strategy allows her to determine the set of signals that \(1^{g}\) could have received), and her strategy is uniquely determined. In general, a player uses the strategies of her predecessors to determine the signals they could have received and then employs Bayes’ Rule to determine her belief. Hence, her strategy is also uniquely determined.

If the true state is \(\mathcal {H}\), then with probability c(i, k) player \( i^{g}\) chooses a and obtains 1 and with probability \(1-c(i,k)\) chooses r and obtains 0. If the true state is \(\mathcal {L}\), then player \(i^{g}\) obtains 0 with probability c(i, k) and \(-1\) with probability \(1-c(i,k)\).

Analogous results can be shown for alternative measures of well-being—e.g., the probability that a player is in a “correct” cascade (i.e., a cascade on a in state \( \mathcal {H}\) and on r in state \(\mathcal {L}\)) is higher in an interacting cascade than in a basic cascade under the hypotheses like those of Corollary 2.

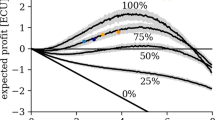

The intuition is twofold. First, moving the common player earlier causes her to aggregate less information; all else equal, this reduces the payoffs of later players. Second, each player moving after the common player benefits from the insertion of players between herself and the common player (since they allow for additional information aggregation when the common player breaks the group’s cascade). The size of this benefit, however, depends on the player’s distance from the common player—it is substantial if she is close and is insignificant if she is far. The sign of \( w(i,k)-w(i,k-2)\) is therefore positive for i near k and negative otherwise.

The details for all of the examples discussed are available upon request.

While it is easily seen that cascades may spill over, may be broken, and may be triggered by the common player when her position is not observed by any other players (before play begins), the specifics depend on her realized position; see the Online Appendix for details.

References

Acemoglu, D., Dahleh, M., Lobel, I., Ozdaglar, A.: Bayesian learning in social networks. Rev. Econ. Stud. 78, 1201–1236 (2011)

Ali, S., Kartik, N.: Herding with collective preferences. Econ. Theor. 51, 601–626 (2012)

Anderson, L., Holt, C.: Information cascades in the laboratory. Am. Econ. Rev. 87, 847–862 (1997)

Bala, V., Goyal, S.: Conformism and diversity under social learning. Econ. Theor. 17, 101–120 (2001)

Banerjee, A.: A simple model of herd behavior. Q. J. Econ. 107(3), 797–817 (1992)

Banerjee, A., Fudenberg, D.: Word-of-mouth learning. Games Econ. Behav. 46, 1–22 (2004)

Bikhchandani, S., Hirshleifer, D., Welch, I.: A theory of fads, fashion, custom, and cultural change as informational cascades. J. Polit. Econ. 100, 992–1026 (1992)

Burguet, R., Vives, X.: Social learning and costly information acquisition. Econ. Theor. 15, 185–205 (2000)

Cai, H., Chen, Y., Fang, H.: Observational learning: evidence from a randomized natural field experiment. Am. Econ. Rev. 99, 864–882 (2009)

Callander, S., Horner, J.: The wisdom of the minority. J. Econ. Theory 144(e2), 1421–1439 (2009)

Cao, H., Han, B., Hirshleifer, D.: Taking the road less traveled by: does conversation eradicate pernicious cascades? J. Econ. Theory 146(4), 1418–1436 (2011)

Cea-Echenique, S., Herves-Beloso, C., Torres-Martinez, J.: Endogenous differential information. Econ. Theory (2015). doi:10.1007/s00199-015-0924-5

Celen, B., Kariv, S.: An experimental test of observational learning under imperfect information. Econ. Theor. 26, 677–699 (2005)

Celen, B., Kariv, S.: Observational learning under imperfect information. Games Econ. Behav. 47, 72–86 (2001)

Cipriani, M., Guarino, A.: Herd behavior and contagion in financial markets. B.E. J. Theor. Econ. 8(1), article 24 (2008)

Drehmann, M., Oechssler, J., Roider, A.: Herding and contrarian behavior in financial markets: an internet experiment. Am. Econ. Rev. 95(5), 1403–1426 (2005)

Ennis, H., Keister, T.: Optimal banking contracts and financial fragility. Econ. Theor. 61, 335–363 (2016)

Goeree, J., Palfrey, T., Rogers, B., McKelvey, R.: Self-correcting information cascades. Rev. Econ. Stud. 74, 733–762 (2007)

Golub, B., Jackson, M.: Naive learning in social networks and the wisdom of crowds. Am. Econ. J. Microecon. 2(1), 1112–1149 (2010)

Guarino, A., Harmgart, H., Huck, S.: Aggregate information cascades. Games Econ. Behav. 73, 167–185 (2011)

Guarino, A., Jehiel, P.: Social learning with coarse inference. Working Paper, University College of London (2009)

Javorcik, B.: Does foreign direct investment increase the productivity of domestic firms? In search of spillovers through backward linkages. Am. Econ. Rev. 94, 605–627 (2004)

Jimenez-Martinez, A.: A model of belief influence in large social networks. Econ. Theor. 59, 21–59 (2015)

Lindstrom, D., Muñoz-Franco, E.: Migration and the diffusion of modern contraceptive knowledge and use in rural Guatemala. Stud. Fam. Plann. 4, 277–288 (2005)

Lobel, I., Sadler, E.: Preferences, homophily, and social learning. Working Paper, New York University (2014)

Mueller-Frank, M.: A general framework for rational learning in social networks. Theor. Econ. 8, 1–40 (2013)

Rogers, E.: Diffusion of Innovations, 3rd edn. Macmillan Publishing, London (1983)

Smith, L., Sorensen, P.: Pathological outcomes of observational learning. Econometrica 68, 371–398 (2000)

Weizsacker, G.: Do we follow others when we should? A simple test of rational expectation. Am. Econ. Rev. 100, 2340–2360 (2010)

Wu, J.: Helpful laymen in informational cascades. J. Econ. Behav. Organ. 116, 407–415 (2015)

Acknowledgements

Wooders is grateful for financial support from the Australian Research Council’s Discovery Projects funding scheme (Project Number DP140103566).

Author information

Authors and Affiliations

Corresponding author

Additional information

We are grateful to seminar participants at the University of Arizona and the 2015 Information Transmission in Networks conference, as well as several anonymous referees for helpful comments, discussion, and insights.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix: Equilibrium characterization and proofs

Appendix: Equilibrium characterization and proofs

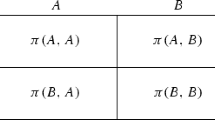

We begin with a few definitions, present three lemmas which completely characterize equilibrium play, and then prove our results. Before we begin, we need some notation. A strategy for player \(i^{g}\) is a function \(\sigma _{i}^{g}:\{a,r\}^{i-1}\times \{H,L\} \rightarrow \{a,r\}\) that maps the profile of decisions of prior players and her own private signal into a decision, and a strategy for player k is a function \(\sigma _{k}:\{a,r\}^{2(k-1)}\times \{H,L\} \rightarrow \{a,r\}\). (Our characterization omits beliefs since these can be easily recovered with Bayes’ Rule.)

A history \(\bar{d}_{i}=(d_{1},\ldots ,d_{i})\) is balanced if, for every odd integer \(j<i\), we have that \(d_{j}\ne d_{j+1}\), and is unbalanced otherwise. A balanced history is one where the cumulative number of a (r) decisions does not exceed the cumulative number of r (a) decisions by more than one as of any player \(1,\ldots ,i\). The empty history and any singleton history are trivially balanced. A history \(\bar{d} _{i}=(d_{1},\ldots ,d_{i})\) is unbalanced on \(\varvec{a}\) if at some point in the profile it switches from a balanced profile to a profile of only a, i.e., if there is an odd \(j<i\) such that (i) \((d_{1},\ldots ,d_{j})\) is balanced and (ii) \(d_{j}=d_{j+1}=\cdots =d_{i}=a\). Let \( D_{i}^{a} \) be the set of i-length histories that are unbalanced on a. Likewise, a history \(\bar{d}_{i}=(d_{1},\ldots ,d_{i})\) is unbalanced on \(\varvec{r}\) if there is an odd \(j<i\) such that (i) \( (d_{1},\ldots ,d_{j}) \) is balanced and (ii) \(d_{j}=d_{j+1}=\cdots =d_{i}=r\) . Let \(D_{i}^{r}\) be the set of i-length histories that are unbalanced on r.

Lemma 1

Equilibrium play for predecessors of the common player.

Let \(i<k\) and \(g\in \{A,B\}\). In equilibrium, \(\bar{d}_{i-1}^{g}\) belongs to a row in Table 2(a) and player \(i^{g}\)’s equilibrium strategy \(\sigma _{i}^{g*}(\bar{d}_{i-1}^{g},x_{i}^{g})\) is given by the last two columns.

Proof

The proof is due to Bikhchandani et al. (1992). \(\square \)

For instance, if player i observes a history that is unbalanced on a, then she chooses a, ignoring her own signal (i.e., if \(\bar{d}_{i}^{g}\in D_{i-1}^{a}\), then Table 2(a) shows that \(\sigma _{i}^{g*}(\bar{d} _{i-1}^{g},H)=\sigma _{i}^{g*}(\bar{d}_{i-1}^{g},L)=a\)). If player i observes a balanced history, then she follows her own signal.

Lemma 2

Equilibrium play for the Common Player.

In equilibrium, \((\bar{d}_{k-1}^{A},\bar{d}_{k-1}^{B})\) belongs to a row in Table 2(b) and the common player’s equilibrium strategy \(\sigma _{k}^{*}(\bar{d}_{k-1}^{A},\bar{d} _{k-1}^{B},x_{k})\) is given by the last two columns.

Proof

The proof is computational. Successive application of Lemma A1 lets us enumerate the set of equilibrium histories and compute the equilibrium probability of each history. We then employ Bayes Rule to compute the common player’s belief and write the table. For details, see the Online Appendix. \(\square \)

The next result identifies the behavior of players moving after the common player.

Lemma 3

Equilibrium after the common player.

Let \(g\in \{A,B\}\).

- LA3.1 : :

-

(Player \(k+1^{g}\).) In equilibrium, \( \bar{d}_{k{}}^{g}=(\bar{d}_{k-1{}}^{g},d_{k})\) belongs to a row in Table 3(a) and player \(k+1^{g}\)’s equilibrium strategy \(\sigma _{k+1}^{g*}(\bar{d}_{k}^{g},x_{k+1}^{g})\) is given by the last two columns.

- LA3.2 : :

-

(Player \(k+2^{g}\).) In equilibrium, \( \bar{d}_{k+1{}}^{g}=(\bar{d}_{k-1}^{g},d_{k},d_{k+1}^{g})\) belongs to a row in Table 3(b) and player \(k+2^{g}\)’s equilibrium strategy \(\sigma _{k+2}^{g*}(\bar{d}_{k+1}^{g},x_{k+2}^{g})\) is given by the last two columns.

- LA3.3 : :

-

(Subsequent players.) Let \(i>k+2\). In equilibrium, \(\bar{d}_{i-1{}}^{g}=(\bar{d}_{k-1}^{g},d_{k},d_{k+1}^{g},d_{k+2}^{g},\ldots ,d_{i-1}^{g})\) belongs to a row in Table 3(c) and player \(i^{g}\)’s equilibrium strategy \(\sigma _{i}^{g*}(\bar{d}_{i-1}^{g},x_{i}^{g})\) is given by the last two columns.

For instance, if \(\bar{d}_{k-1}^{g}\in D_{k-1}^{a}\) and \(d_{k}=a\), then the top row of Table 3(a) shows that player \(k+1^{g}\) is in a cascade on a.

Proof

The proof is a computational exercise that mirrors the Proof of Lemma 2. The details are in the Online Appendix. \(\square \)

Proof of Proposition 1

Lemma 1 shows that, in equilibrium, player i observes a history \(\bar{d}_{i-1}\) in either \( D_{i-1}^{a}\), \(D_{i-1}^{b}\), or \(D_{i-1}^{r}\). For histories where the number of a decisions exceeds the number of r decisions by two or more, we have \(\bar{d}_{i-1}\in D_{i-1}^{a}\) and player i chooses a by Table 2. Likewise, for histories \(\bar{d}_{i-1}\in D_{i-1}^{r}\), the number of r decisions exceeds the number of a decisions by two or more, and she chooses r. Otherwise, player i observes a history in \(D_{i-1}^{b}\) in which case she follows her own signal. \(\square \)

Proof of Proposition 2

Follows directly from Lemma 2 since a cascade on a (r) occurs when a group’s history is in \( D_{k-1}^{a} \) (\(D_{k-1}^{r}\)) by Lemma 1. \(\square \)

Proof of Proposition 3

Follows from Lemmas 2 and 3. We illustrate with P3.1. Since both groups are in cascades on a, we have that \(\bar{d}_{k-1}^{A}\) and \(\bar{d}_{k-1}^{B}\) are in \(D_{k-1}^{a}\). Thus, Lemma 2 gives that the common player chooses a. Hence, successive application of Lemma 3 gives that every subsequent player in group g chooses a. The remaining cases are analogous.

Proof of Proposition 4

The proof is a computation exercise and omitted. The details are in the Online Appendix. \(\square \)

Proof of Proposition 5

In a basic cascade, the players’ asymptotic payoff is

In an interacting cascade, the payoff of the common player is

Hence, \(w(k,k)\ge \lim _{i\rightarrow \infty }w^{B}(i)\) if and only if

equivalently,

Since \(p\in (1/2,1),\) then \(\lambda =2p(1-p)\in (0,1/2)\). If \(k\ge 5,\) then \(1-3\lambda ^{k-2}>0\) and \(\lambda ^{\frac{3}{2}}-\lambda ^{\frac{k}{2}}>0\), and hence \(w(k,k)>\lim _{i\rightarrow \infty }w^{B}(i)\). While if \(k=3,\) then \(\lambda ^{\frac{3}{2}}-\lambda ^{\frac{k}{2}}=0\) and \(1-3\lambda \ge 0\) if \(\lambda \le 1/3\) (i.e., \(p\ge \frac{1}{6}\sqrt{3}+\frac{1}{2}\)), and hence \(w(k,k)\ge \lim _{i\rightarrow \infty }w^{B}(i)\). Since \( w^{B}(j)<\lim _{i\rightarrow \infty }w^{B}(i)\) for each j, then \( w(k,k)>w^{B}(i)\) for all i if either \(k\ge 5\) or \(k=3\) and \(p\ge \frac{1 }{6}\sqrt{3}+\frac{1}{2}\).

If \(k=3\) and \(p<\frac{1}{6}\sqrt{3}+\frac{1}{2}\), then \(w(k,k)<\lim _{i \rightarrow \infty }w^{B}(i)\), so there is some i such that \( w(k,k)<w^{B}(i)\). \(\square \)

Proof of Proposition 6

We prove the result by establishing that the gain from moving the common player exceeds the loss when p is large. Since players in positions 1, \(\ldots \), \(k-3\) in both groups are unaffected by the move, we only need to show that the (i) minimum gain for players \(k-2^{A}\), \(k-1^{A}\), \(k-2^{B}\), and \(k-1^{B}\) exceeds the (ii) maximum loss for the common player and players \(k+1^{A}\), \( k+1^{B}\), \(\ldots \), \(N^{A}\), and \(N^{B}\). With this in mind, we proceed by constructing a (i\(^{\prime }\)) lower bound on the gain and (ii\(^{\prime }\)) an upper bound on the loss. We then establish that (i\(^{\prime }\)) is strictly greater than (ii\(^{\prime }\)) when p is sufficiently close to 1. The desired result follows.

First, we compute a lower bound on the gain for players \(k-2^{A}\), \(k-1^{A}\) , \(k-2^{B}\), and \(k-1^{B}\). Table 4 computes the gain to each of these players. It is clear from the table that the total gain to all four players is at least \(G(p)=2(2p-1)\lambda ^{\frac{k-1}{2}}\Lambda (k-3)\).

Second, we compute an upper bound on the loss for the common player and subsequent players in both groups. Table 5 computes the loss to each of these players. A bit of algebra shows that every row of Table 5 is less than or equal to

Consequently, the loss to the common player and all subsequent players is at most \(L(p)=2(N-k+\frac{1}{2})T(p)\).

We now establish that \(G(p)\ge L(p)\) for p sufficiently close to 1, this then implies that the move of the common player is surplus improving. To do this, consider the related inequality

Observe that \(G(p)=\frac{2p-1}{1-\lambda }\lambda ^{\frac{k-1}{2}}\text {LHS} (p)\) and that \(L(p)=\frac{2p-1}{1-\lambda }\lambda ^{\frac{k-1}{2}}(\text {RHS }_{1}(p)+\text {RHS}_{2}(p)).\) Note that (i) \(\text {LHS}(1)=2\), (ii) \(\text { RHS}_{1}(1)=0\), and (iii) \(\text {RHS}_{2}(1)=0\). The first and second equalities are obvious. The third equality follows from the fact that \( (1-\lambda )\lambda ^{\frac{5}{2}}(\frac{\Lambda (k-1)^{2}}{\lambda ^{k/2}}- \frac{\Lambda (k-3)^{2}}{\lambda ^{k/2}})=2\lambda -\lambda ^{\frac{k-1}{2} }(1+\lambda )\), which equals 0 when \(p=1\) since \(k>1\). It follows that (1) is true with strict inequality when \(p=1\). Since both sides of (1) are continuous in p, there is a \(p_{k}\), with \(\frac{1 }{2}<p_{k}<1\), such that (1) is true for all \(p\ge p_{k}\). At every \(p\in [p_{k},1)\), we have that \(\frac{2p-1}{1-\lambda }\lambda ^{\frac{k-1}{2}}>0\). Multiplying both sides of (1) by \(\frac{ 2p-1}{1-\lambda }\lambda ^{\frac{k-1}{2}}\) shows that \(G(p)\ge L(p)\). \(\square \)

Rights and permissions

About this article

Cite this article

Fisher, J.C.D., Wooders, J. Interacting information cascades: on the movement of conventions between groups. Econ Theory 63, 211–231 (2017). https://doi.org/10.1007/s00199-016-1013-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-016-1013-0