Abstract

We consider a pure exchange economy with asymmetric information where individual behavior exhibits ambiguity aversion along the line of maximin expected utility decision making. For such economies, we introduce different notions of maximin value allocations. We also introduce a strong notion of incentive compatibility. We prove the existence and incentive compatibility of the maximin value allocation. We conclude that unlike the Bayesian value allocation approach in Krasa Yannelis (Econometrica 62(4):881–900, 1994), incentive compatibility is related to efficiency rather than to direct exchange of information.

Similar content being viewed by others

Notes

This is a notable difference with the Bayesian approach, where the information partition that individuals use may affect the technical properties of characteristic functions. For some information sharing rules, for instance, the endowment of a coalition may lie outside the consumption sets of its members, so the value of a coalition may not be well defined.

As before by abuse of notation we use the same notation for the algebra generated by this partition.

We define non- random ex post utility functions. The analysis and all the results of the paper would not be affected if a random (state dependent) utility function \(u_{i}:\Omega \times \mathfrak {R}^m_{+}\rightarrow \mathfrak {R}_+\) were adopted.

A version of which was introduced in De Castro and Yannelis (2009).

The private value allocation bears distinct significance because it awards the informational superiority of agents.

This is the \(\mathcal {K}_{i}^{S}\)-measurability assumption imposed on \(e_{i}\), for each \(i\in S\) and \(S\subseteq I\), which means that the endowment itself serves as one informative signal for individuals in any coalition. This is satisfied for instance when for each \(i\in S\) and \(S\subseteq I\) we have that \(\mathcal {F}_{i}\subseteq \mathcal {K}_{i}^{S}\), i.e., whenever individuals use at least their private information in each coalition and the endowments are \(\mathcal {F}_i\)-measurable. Indeed, in that case \(\sigma (e_{i})\subseteq \mathcal {F}_{i}\subseteq \mathcal {K}_{i}^{S}\).

Incidentally, (22) proves that indeed \(\sum _{i\in I}\bar{\lambda }_{i}\upsilon _{i}(\bar{x}_{i},I)=\sum _{i\in I}Sh_{i}(V_{\bar{\lambda },\upsilon })=V_{\bar{\lambda },\upsilon }(I)\), i.e., the Pareto optimality of the value allocation \(\bar{x}\in L_{X}\).

References

Aliprantis, C.D., Burkinshaw, O.: Positive Operators. Academic Press, New York (1985)

Allen, B.: Market games with asymmetric information: the core. Econ. Theory 29, 465487 (2006)

Balder, E., Yannelis, N.C.: On the continuity of expected utility. Econ. Theory 3, 625–643 (1993)

Condie, S., Ganguli, J.V.: Informational efficiency with ambiguous information. Econ. Theory 48(2–3), 229–242 (2011)

da Silva, J.C., Beloso, C.H.: Prudent expectations equilibrium in economies with uncertain delivery. Econ. Theory 39(1), 67–92 (2009)

da Silva, J.C., Beloso, C.H.: General equilibrium in economies with uncertain delivery. Econ. Theory 51(3), 729–755 (2012)

De Castro, L.I., Yannelis, N.C.: Ambiguity aversion solves the conflict between efficiency and incentive compatibility, Discussion paper. Northwestern university (2009)

De Castro, L.I., Chateauneuf, A.: Ambiguity aversion and trade. Econ. Theory 48(2–3), 243–273 (2011)

De Castro, L.I., Pesce, M., Yannelis, N.C.: A new perspective to rational expectations: maximin rational expectations equilibrium, Discussion paper. University of Illinois at Urbana-Champaign (2010)

De Castro, L.I., Pesce, M., Yannelis, N.C.: Core and equilibria under ambiguity. Econ. Theory 48, 519–548 (2011)

De Castro, L., Yannelis, N.C.: An interpretation of Ellsberg’s paradox based on information and incompleteness. Bull. Econ. Theory 1(2), 139–144 (2013)

Emmons, D.R., Scafuri, A.J.: Value allocations: an exposition. In: Aliprantis, C.D., Burkinshaw, O., Rothman, N.J. (eds.) Advances in Equilibrium Theory. Springer, Berlin (1985)

Even, Y., Lehrer, E.: Decomposition-integral: unifying Choquet and the concave integrals. Econ. Theory (2014). doi:10.1007/s00199-013-0780-0

He, W., Yannelis, N.: Equilibrium Theory Under Ambiguity. Mimeo (2013)

Jungbauer, T., Ritzberger, K.: Strategic games beyond expected utility. Econ. Theory 48(2–3), 377–398 (2011)

Koutsougeras, L., Yannelis, N.C.: Incentive compatibility and information superiority of the core of an economy with differential information. Econ. Theory 3, 195–216 (1993)

Krasa, S., Yannelis, N.C.: The value allocation of an economy with differential information. Econometrica 62(4), 881–900 (1994)

Krasa, S., Yannelis, N.C.: Existence and properties of a value allocation for an economy with differential information. J. Math. Econ. 25, 165–179 (1996)

Shapley, L.A.: A value of n-person games. In: Kuhn, H.W., Tucker, A.W. (eds.) Contributions to the Theory of Games. Princeton University Press, Princeton, pp. 307–317 (1953)

Shapley, L.A.: Utility comparisons and the theory of games. In: LaDecision. Edition du CNRS, Paris (1969)

Yannelis, N.C.: The core of an economy with differential information. Econ. Theory 1, 183–198 (1991)

Author information

Authors and Affiliations

Corresponding author

Additional information

We wish to thank two anonymous referees for helpful comments.

Appendix

Appendix

Proof of Theorem 1

The proof follows the one of Krasa and Yannelis (1996). For the sake of completeness we repeat all the steps.

Step I

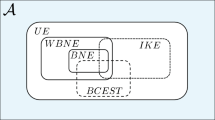

By hypothesis \((A_1)\) of the theorem, \(L_{X_{i}}\) is convex, norm closed and bounded from below and furthermore \(e_{i}\in L_{X_{i}}\), so that \(L_{X_{i}}\ne \emptyset \) for every \(i\in I\). Hence, \(L_X\ne \emptyset \) is nonempty as well. By hypothesis \((A_{2})\) of the theorem, the concavity of \(u_{i}\) implies the concavity of \(\upsilon _{i}\) for each \(i\in I\). Also, by Theorem 2.8 of Balder and Yannelis (1993), since \(u_{i}\) is continuous, concave and bounded, it follows that \(\upsilon _{i}\) is weakly upper semi continuous on \(L_{X_{i}}\) for each \(i\in I\). Let \(\mathcal {A}\) be the (same for all the agents) set of all the finite dimensional subspaces of their \(L^1(\Omega ,\mathcal {F}, \mu _i^{\star };B)\), each one of these subspaces containing all the agents’ projections of initial endowments \(e_{i}\). Then, for each \(\alpha \in \mathcal {A}\) we define the \(L_{X_{i}}^{\alpha }=L_{X_{i}}\cap \alpha \) be the restriction of the consumption set, \(\upsilon _{i}^{\alpha }=\upsilon _{i}\cap \alpha \) is the restriction of the utility function and \(e_{i}^{\alpha }=e_{i}\cap \alpha \) the restriction of the endowment of the \(ith\) agent on the finite dimensional subspace \(\alpha \in \mathcal {A}\). We can construct therefore the \(\alpha \)-finite dimensional commodity space economy

Step II

Certainly, the standard results of existence of a cardinal value allocation apply to \(\mathcal {E}^{\alpha }\), as long as \(\mathcal {E}^{\alpha }\) satisfies all the assumptions of Emmons and Scafuri (1985). Continuity of \(\upsilon ^{\alpha }_{i}\) is the only one which is not immediate. However, it follows by the hypothesis \((A_2)\) of the theorem via the Dominated Convergence Theorem, and because \(L^{\alpha }_{X_{i}}\) is a finite dimensional space, that \(\upsilon ^{\alpha }_{i}: L^{\alpha }_{X_{i}}\times 2^{I}\rightarrow \mathfrak {R}_+\) is continuous on \(L^{\alpha }_{X_{i}}\) for each \(S\in 2^{I}\). Hence, there exists a cardinal (in our case, ex ante maximin) value allocation for \(\mathcal {E}^{\alpha }\), i.e., there exists \(x^{\alpha }\in L^{\alpha }_X=\prod \nolimits _{i=1}^n L^{\alpha }_{X_{i}}\) such that:

-

(i)

\(\sum _{i\in I}x^{\alpha }_{i}=\sum _{i\in I}e_{i}^{\alpha }\),

-

(ii)

there exists a \(\lambda ^{\alpha }_{i}\ge 0\) for every agent \(i\), with \(\sum _{i\in I}\lambda ^{\alpha }_{i}=1\), such that \(\lambda ^{\alpha }_{i}\) \(\upsilon ^{\alpha }_{i}(x^{\alpha }_{i},I)=Sh_{i}(V_{\lambda ^{\alpha },\upsilon ^{\alpha }})\), for all \(i\in I\), where \(Sh_{i}(V_{\lambda ^{\alpha },\upsilon ^{\alpha }})\) is the Shapley value of the \(ith\) agent, derived from the TU game \((I,V_{\lambda ^{\alpha },\upsilon ^{\alpha }})\), whose characteristic function \(V_{\lambda ^{\alpha },\upsilon ^{\alpha }}\) is defined for every coalition \(S\subseteq I\) as follows:

$$\begin{aligned} V_{\lambda ^{\alpha },\upsilon ^{\alpha }}(S)=\left\{ \max \limits _{x^{\alpha }\in \prod _{i\in S}L^{\alpha }_{X_{i}}}\sum \limits _{i\in S}\lambda ^{\alpha }_{i} \upsilon _{i}^{\alpha }(x_{i}^{\alpha },S): \sum \limits _{i\in S}x_{i}^{\alpha }=\sum \limits _{i\in S}e_{i}^{\alpha }\right\} . \end{aligned}$$(17)

By denoting \(\sum _{i\in I}e_{i}=e\ge 0\), we have that \(0\le \sum _{i\in I}x^{\alpha }_{i}=\sum _{i\in I}e_{i}^{\alpha }\), which implies that for each \(\mathcal {E}^{\alpha }\) economy and for each cardinal value allocation \(x^{\alpha }\in L^{\alpha }_X\) of this economy, every \(x^{\alpha }_{i}\) lies in the order interval \([0,e]\) of \(\sum _{i\in I}L_{X_{i}}\subset L^1(\Omega ,\mathcal {F}, \mu _i^{\star }\); \(B), i\in I\). We direct the set \(\mathcal {A}\) by inclusion so that \(\{(x^{\alpha }_1,\ldots ,x^{\alpha }_n,\lambda ^{\alpha }_1,\ldots ,\lambda ^{\alpha }_n) : \alpha \in \mathcal {A}\}\) forms a net in \(C=\prod \nolimits _{i=1}^n[0,e] \times \Delta \), where \(\Delta \) is the \((n-1)\)-dimensional simplex. Since \(B\) is an ordered Banach space so is \(L^1(\Omega ,\mathcal {F}, \mu _i^{\star }\); \(B), i\in I\), which implies (see, for example, in Aliprantis and Burkinshaw 1985) that this space has weakly compact order intervals. Hence, the order interval \([0,e]\) is weakly compact, and therefore, \(C\) is compact. It follows that there is a subnet (still indexed by \(\mathcal {A}\) for notational simplicity) \(\{x^{\alpha },\lambda ^{\alpha }\}_{\alpha \in \mathcal {A}}\), which converges to a point \((\bar{x},\bar{\lambda })=(\bar{x}_1,\ldots ,\bar{x}_n,\bar{\lambda }_1,\ldots ,\bar{\lambda }_n)\) in \(C\). We shall show that this limit constitutes an ex ante maximin value allocation for the infinite dimensional commodity space economy \(\mathcal {E}^{ea}=\{(L_{X_{i}}, \upsilon _{i}, e_{i}): i=1,2,\ldots ,n\}\).

Step III

First notice that since \(L_{X_{i}}\) is convex and norm closed, by Mazur’s Theorem, it is weakly closed as well; hence, the weak limit \(\bar{x}_{i}\) lies actually in \(L_{X_{i}}\), for each \(i\in I\), so we conclude that \(\bar{x}\in L_X\). Moreover, since for each \(\alpha \in \mathcal {A}\) we have \(\sum _{i\in I} x^{\alpha }_{i}=\sum _{i\in I} e^{\alpha }_{i}\), by taking weak limits we conclude that

Step IV

In order to define the ex ante maximin value allocation of the original economy, we verify first that the TU game \((I,V_{\bar{\lambda },\upsilon })\), whose characteristic function \(V_{\bar{\lambda },\upsilon }\) is given for every coalition \(S\subseteq I\) as in (10), is well defined. Indeed, for every \(S\subseteq I\), since \([0,\sum _{i\in S}e_{i}]\) is weakly compact and \(\upsilon _{i}\) is weakly upper semi continuous on this set it follows that \(V_{\bar{\lambda },\upsilon }(S)\) is well defined and so is the Shapley value \(Sh_{i}(V_{\bar{\lambda },\upsilon })\) of each individual \(i\in I\). Next, let \(x^{\star }\in \prod _{i\in S}L_{X_{i}}\) be such that \(\sum _{i\in S}x^{\star }_{i}=\sum _{i\in S}e_{i}\) and \(V_{\bar{\lambda },\upsilon }(S)=\sum _{i\in S}\bar{\lambda }_{i}\upsilon _{i}(x^{\star }_{i},S)\). We have that the sequence \(\{V_{\lambda ^{\alpha },\upsilon ^{\alpha }}(S)\}_{\alpha \in \mathcal {A}}\) is bounded, so we may assume, by passing to a subnet if necessary, that it converges. Since \(\sum _{i\in S}x^{\star }_{i}=\sum _{i\in S}e_{i}\), by denoting \(x^{\star \alpha }_{i}=x^{\star }_{i}\cap \alpha \in \prod _{i\in S}L^{\alpha }_{X_{i}}\), we have that: \(x^{\star \alpha }_{i}\rightarrow x^{\star }\) weakly and \(\sum _{i\in S}x^{\star \alpha }_{i}=\sum _{i\in S}e^{\alpha }_{i}\). Consequently, for each \(\alpha \in \mathcal {A}\), \(V_{\lambda ^{\alpha },\upsilon ^{\alpha }}(S)\ge \sum _{i\in S}\lambda ^{\alpha }_{i}\upsilon ^{\alpha }_{i}(x^{\star \alpha }_{i},S)\). Further, by the definition of the weak upper semicontinuity of \(\upsilon _i\) at \(x^{\star }_i\), for every \(\epsilon >0\), there exists an \(\alpha _{\epsilon }\), such that for every \(\alpha >\alpha _{\epsilon }\) we have

By considering a net \(\epsilon \rightarrow 0\), we can extract a subnet (still indexed by \(\alpha \)) such that \(\liminf _{\alpha }\sum _{i\in S}\lambda ^{\alpha }_i\upsilon _i^{\alpha }(x^{\star \alpha }_{i},S)\ge \sum _{i\in S}\lambda _i\upsilon _i(x_i^{\star },S)\). Hence, we conclude that

On the other hand, let \(y^{\alpha }\in \prod _{i\in S}L^{\alpha }_{X_{i}}\), for each \(\alpha \in \mathcal {A}\), be such that it satisfies \(\sum _{i\in S}y^{\alpha }_{i}=\sum _{i\in S}e^{\alpha }_{i}\) and \(\sum _{i\in S}\lambda ^{\alpha }_{i}\upsilon ^{\alpha }_{i}(y^{\alpha }_{i},S)= V_{\lambda ^{\alpha },\upsilon ^{\alpha }}(S)\). Certainly \(y^{\alpha }\) converges weakly to \(y\in \prod _{i\in S} L_{X_{i}}\) and \(\sum _{i\in S}y_{i}=\sum _{i\in S}e_{i}\). It follows that

where the fourth line follows from the weak upper semi continuity of \(\upsilon _{i}\) and the last from the fact that \(y\in L_{X_{i}}\) is feasible and the definition of \(V_{\bar{\lambda },\upsilon }(S)\). Therefore, from (19) and (20), we conclude that \(\lim _{\alpha }V_{\lambda ^{\alpha },\upsilon ^{\alpha }}(S)= V_{\bar{\lambda },\upsilon }(S)\), and therefore,

Step V

We finally prove that \(\bar{\lambda }_{i}\upsilon _{i}(\bar{x}_{i},I)= Sh_{i}(V_{\bar{\lambda },\upsilon })\), for all \(i\in I\).

By definition of the (ex ante maximin) value allocation for each \(\alpha \in \mathcal {A}\), we have:

Therefore, \(\lim _{\alpha }\sup \lambda ^{\alpha }_{i}\upsilon ^{\alpha }_{i}(x^{\alpha }_{i},I)=\lim _{\alpha }\sup Sh_{i}(V_{\lambda ^{\alpha },\upsilon ^{\alpha }})\).

It follows that \(\bar{\lambda }_{i}\lim _{\alpha }\sup \upsilon ^{\alpha }_{i}(x^{\alpha }_{i},I)=\lim _{\alpha }\sup Sh_{i}(V_{\lambda ^{\alpha },\upsilon ^{\alpha }})\). By the weak upper semi continuity of \(\upsilon _{i}\), since \(x^{\alpha }_{i}\rightarrow \bar{x}_{i}\) weakly, it follows that \(\bar{\lambda }_{i}\upsilon _{i}(\bar{x}_{i},I)\ge \bar{\lambda }_{i}\lim _{\alpha }\sup \upsilon ^{\alpha }_{i}(x^{\alpha }_{i},I)\), \(\forall i\in I\). Hence, we conclude that \(\bar{\lambda }_{i}\upsilon _{i}(\bar{x}_{i},I)\ge \lim _{\alpha } \sup Sh_{i}(V_{\lambda ^{\alpha },\upsilon ^{\alpha }})\) and further, by the previous step, we infer that \(\bar{\lambda }_{i}\upsilon _{i}(\bar{x}_{i},I)\ge Sh_{i}(V_{\bar{\lambda },\upsilon }), \forall i\in I\). Suppose that the above inequality is strict for some \(i\in I\). Summing up over \(i\in I\), we have \(\sum _{i\in I}\bar{\lambda }_{i}\upsilon _{i}(\bar{x}_{i},I)>\sum _{i\in I}Sh_{i}(V_{\bar{\lambda },\upsilon })\) and further, since \(\sum _{i\in I}Sh_{i}(V_{\bar{\lambda },\upsilon })=V_{\bar{\lambda },\upsilon }(I)\), it follows that

However, by (18) and the definition of \(V_{\bar{\lambda },\upsilon }(I)\), it must be \(\sum _{i\in I}\bar{\lambda }_{i}\upsilon _{i}(\bar{x}_{i},I)\le V_{\bar{\lambda },\upsilon }(I)\), which together with (21) imply \(V_{\bar{\lambda },\upsilon }(I)\ge \sum _{i\in I}\bar{\lambda }_{i}\upsilon _{i}(\bar{x}_{i},I)>V_{\bar{\lambda },\upsilon }(I)\), which is a clear contradiction. Therefore, it must be

as desiredFootnote 10. Now, (18) along with (22) prove the claim of the theorem. \(\square \)

Proof of Theorem 2

Let \(x\in L_{X}\) be an interim maximin value allocation for \(\mathcal {E}^{i}\). According to remark 6, \(x\) is a Pareto optimal allocation. Suppose that \(x\) is not transfer (interim) maximin coalitional incentive compatible. Then, there exist a coalition \(S\subset I\), two different states \(a\) and \(b\) of \(\Omega \) and \(z\in \mathfrak {R}^{mS}_{+}\), where \(\sum _{i\in S}z_{i}=\sum _{i\in S}[e_{i}(a)+x_{i}(b)-e_{i}(b)]\), such that

-

(i)

\({\mathcal K}_{i}^{I}(a)={\mathcal K}_{i}^{I}(b)\) if and only if \(i\in I{\setminus }S\),

-

(ii)

\(u_{i}(x_{i}(a))=u_{i}(x_{i}(b))\), for all \(i\in I{\setminus }S\),

-

(iii)

\({\underline{u}}_{i}(a,y_{i},I)>{\underline{u}}_{i}(a,x_{i},I)\) for all \(i\in S\), where for all \(i\in S\)

$$\begin{aligned} y_{i}(\omega )={\left\{ \begin{array}{ll}z_{i}, &{}\quad \text{ if }~ \omega =a\\ x_{i}(\omega ), &{}\quad \text{ otherwise }.\end{array}\right. } \end{aligned}$$(23)

We will construct a feasible allocation \(w\in L_{X}\) for \(\mathcal {E}^{i}\) that Pareto improves upon \(x\) at the state \(a\), which is a contradiction. To this end, for each \(i\in I{\setminus }S\) define the assignment \(w_i\), such that

and for each \(i\in S\) define the assignment \(w_i\), such that

By construction, we have that \(w_{i}\in L_{X_{i}}\) for all \(i\in S\). Moreover, by the measurability of the endowments and (i) above, we have for all \(i\in I{\setminus }S\) that \(e_{i}(a)=e_{i}(b)\), so

Therefore, \(w_{i}\in L_{X_{i}}\) for all \(i\in I{\setminus }S\) as well, so that finally \(w\in L_{X}\). For this allocation we have at the state \(a\): \(w_{i}(a)=e_{i}(a)+x_{i}(b)-e_{i}(b)\), for all \(i \in I{\setminus }S\) and \(w_{i}(a)=z_i\), for all \(i\in S\). Therefore,

i.e., \(w\) is feasible in the state \(a\in \Omega \), which is an arbitrary state, so \(w\) is feasible for all other states as well. We conclude therefore that \(w\) is a feasible allocation for \(\mathcal {E}^i\).

Next, by (26) and condition (ii) above, it follows that \(u_{i}(w_{i}(a))=u_{i}(x_{i}(b))=u_{i}(x_{i}(a))\), for all \(i\in I{\setminus }S\). This in turn implies the following for all \(i\in I{\setminus }S\):

Therefore, \(\underline{u}_{i}(a, w_{i},I) \ge \underline{u}_{i}(a, x_{i},I)\), for all \(i\in I{\setminus }S\), while by (iii) above \(\underline{u}_{i}(a, w_{i}, I) > \underline{u}_{i}(a, x_{i}, I)\), for all \(i\in S\), which (according to Definition (3)) contradicts the Pareto optimality of the interim maximin value allocation \(x\).\(\square \)

Rights and permissions

About this article

Cite this article

Angelopoulos, A., Koutsougeras, L.C. Value allocation under ambiguity. Econ Theory 59, 147–167 (2015). https://doi.org/10.1007/s00199-014-0812-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-014-0812-4