Abstract

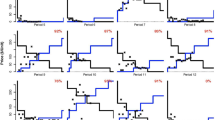

The pure exchange model is the foundation of the neoclassical theory of value, yet equilibrium predictions and price adjustment dynamics for this model remained untested prior to the experiment reported in this paper. With the exchange economy replicated several times, prices and allocations in most experiment sessions adjust toward the competitive equilibrium in continuous double auction trading, though adjustment is much slower than in previous commodity flow (or perishable good) double auction market experiments. Price adjustment is evaluated by comparing its extent within each market replication (or trading period) to its extent across trading periods. More price adjustment occurs within trading periods than across trading periods, so price adjustment data are evaluated with the disequilibrium Hahn process model (Hahn and Negishi in Econometrica 30:463–469, 1962) of within-period trades. This paper introduces a stochastic version the Hahn process model and demonstrates that a linear approximation to this stochastic model yields an autoregressive process with a near unit root when the adjustment rate is low. In effect, the autoregressive price adjustment model studied extensively by time series econometricians over the past 30 years can be viewed as a reduced form of a stochastic disequilibrium exchange economy price adjustment model. Estimation of the model demonstrates that price adjustment in the exchange economy experiment is considerably slower than in economies without income effects, which suggests that the price discovery process may be a significant factor in the slow adjustment documented by applied econometricians.

Similar content being viewed by others

References

Anderson C.M., Plott C.R., Shimomura K.-I., Granat S.: Global instability in experimental general equilibrium: the scarf example. J Econ Theory 115, 209–249 (2004)

Arrow K.J., Hahn F.: General Competitive Analysis. North-Holland, Amsterdam (1971)

Arrow K.J., Hurwicz L.: On the stability of the competitive equilibrium, I. Econometrica 26, 522–552 (1958)

Arrow K.J., Block H.D., Hurwicz L.: On the stability of the competitive equilibrium, II. Econometrica 27, 82–109 (1959)

Azariadis C., Kaas L.: Is dynamic general equilibrium a theory of everything?. Econ Theory 32, 13–41 (2007)

Barsky R.B., De Long J.B.: Why does the stock market fluctuate?. Q J Econ 108, 291–311 (1993)

Cox J.S.: On testing the utility hypothesis. Econ J 107, 1054–1078 (1997)

Davidson R., MacKinnon J.G.: Estimation and Inference in Econometrics. Oxford University Press, Oxford (1993)

Davidson D., Suppes P., Siegel S.: Decision Making: An Experimental Approach. Stanford University Press, Stanford (1957)

Dickey D.A., Fuller W.A.: Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74, 427–431 (1979)

Easley D., Ledyard J.O.: Theories of price formation and exchange in double oral auctions. In: Friedman, D., Rust, J. (eds) The Double Auction Market: Institutions, Theories, and Evidence, pp. 63–97. Addison-Wesley, Reading (1993)

Elliott G., Rothenberg T.J., Stock J.H.: Efficient tests for an autoregressive unit root. Econometrica 64, 813–836 (1996)

Enders W.: Applied Econometric Time Series. Wiley, New York (1995)

Friedman D.: A simple testable model of price formation in the double auction market. J Econ Behav Organ 15, 47–70 (1991)

Gjerstad S.: The competitive market paradox. J Econ Dyn Control 31, 1753–1780 (2007)

Gjerstad S., Dickhaut J.: Price formation in double auctions. Games Econ Behav 22, 1–29 (1998)

Gjerstad, S., Shachat, J.: Individual Rationality and Market Efficiency. Purdue University Economics Department, Working Paper 1204 (2007)

Hahn F.H., Negishi T.: A theorem on non-tatonnement stability. Econometrica 30, 463–469 (1962)

Lian P., Plott C.R.: General equilibrium, markets, macroeconomics and money in a laboratory experimental environment. Econ Theory 12, 21–75 (1998)

Lothian J.R., Taylor M.P.: Real exchange rate behavior: the recent float from the perspective of the past two centuries. J Polit Econ 104, 488–509 (1996)

Rogoff K.: The purchasing power parity puzzle. J Econ Lit 34, 647–668 (1996)

Scarf H.: Some examples of global instability of the competitive equilibrium. Int Econ Rev 1, 157–172 (1960)

Smith V.L.: An experimental study of competitive market behavior. J Polit Econ LXX, 111–137 (1962)

Smith V.L.: Experimental economics: induced value theory. Am Econ Rev 66, 274–279 (1976)

Smith V.L.: Microeconomic systems as an experimental science. Am Econ Rev 72, 923–955 (1982)

Taylor A.M.: Potential pitfalls for the purchasing-power-parity puzzle? sampling and specification biases in mean-reversion tests of the law of one price. Econometrica 69, 473–498 (2001)

Taylor A.M., Taylor M.P.: The purchasing power parity debate. J Econ Perspect 18, 135–158 (2004)

Walras L.: Elements of Pure Economics. Translated by William Jaffé. R.D. Irwin, Homewood (1874)

Williams, A.W., Smith, V.L., Ledyard, J.O., Gjerstad, S.: Concurrent trading in two experimental markets with demand interdependence. Econ Theory 16, 511–528 (2000). Reprinted in Studies in Economic Theory: Advances in Experimental Markets, Springer, 2001

Wilson R.B.: On equilibria of bid-ask markets. In: Feiwel, G.W. (eds) Arrow and the ascent of modern economic theory, pp. 375–414. New York University Press, New York (1987)

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper has benefitted from comments by seminar participants at the Econometric Society World Congress (London; 2005), SAET (Vigo, Spain; 2005), ESA (Nottingham, UK; 2006), University of California, Santa Cruz (2006), University of Alaska, Anchorage (2008), University of Central Florida (2008), NSF/NBER Decentralization Conference (Tulane University; 2008), and SAET (Ischia, Italy; 2009).

Electronic Supplementary Material

The Below are the Electronic Supplementary Material.

Rights and permissions

About this article

Cite this article

Gjerstad, S. Price dynamics in an exchange economy. Econ Theory 52, 461–500 (2013). https://doi.org/10.1007/s00199-011-0651-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-011-0651-5

Keywords

- Competitive equilibrium

- Disequilibrium dynamics

- Continuous double auction

- Experimental economics

- Exchange economy

- Hahn process

- Tatonnement

- Time series

- Unit root tests