Summary.

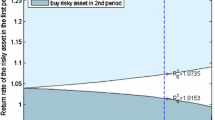

In this paper we study delegated portfolio management when the manager’s ability to short-sell is restricted. Contrary to previous results, we show that under moral hazard, linear performance-adjusted contracts do provide portfolio managers with incentives to gather information. We find that the risk-averse manager’s effort is an increasing function of her share in the portfolio’s return. This result affects the risk-averse investor’s choice of contracts. Unlike previous results, the purely risk-sharing contract is now shown to be suboptimal. Using numerical methods we show that under the optimal linear contract, the manager’s share in the portfolio return is higher than what it is under a purely risk sharing contract. Additionally, this deviation is shown to be: (i) increasing in the manager’s risk aversion and (ii) larger for tighter short-selling restrictions. As the constraint is relaxed the deviation converges to zero.

Similar content being viewed by others

Author information

Authors and Affiliations

Corresponding author

Additional information

Received: 25 July 2002, Revised: 12 December 2004,

JEL Classification Numbers:

D81, D82, J33.

Juan-Pedro Gómez: Correspondence to

An earlier version of the paper was circulated under the title “Providing Managerial Incentives: Do Benchmarks Matter?” We are grateful to an anonymous referee whose comments helped to improve the paper. We also thank comments by Viral Acharya, Alexei Goriaev, Ernst Maug, Kristian Rydqvist, Neil Stoughton, Rangarajan Sundaram, Fernando Zapatero and seminar participants at the 1999 SED meetings in Sardinia, the 1999 Workshop in Mutual Fund Performance at EIASM, Brussels, the 2000 EFA meetings in London, the Bank of Norway, the Stockholm Schools of Economics, the Norwegian School of Management and the 2001 WFA meetings in Tucson. Sharma gratefully acknowledges financial support from the Asociacion Mexicana de Cultura.

Rights and permissions

About this article

Cite this article

Gómez, JP., Sharma, T. Portfolio delegation under short-selling constraints. Economic Theory 28, 173–196 (2006). https://doi.org/10.1007/s00199-004-0615-0

Issue Date:

DOI: https://doi.org/10.1007/s00199-004-0615-0