Abstract

This paper analyzes the dynamics of structural polarization and macroeconomic divergence in the context of European integration, where the latter is primarily understood as an increase in economic and financial openness. In the process of estimating the dynamic effects of such an openness shock on 26 EU countries, we develop a taxonomy of European economies that consists of four groups: core, periphery, and catching-up countries in Eastern Europe as well as financial hubs. We show that these four country groups have responded in a distinct way to the openness shock imposed by European integration and argue that the latter should be seen as an evolutionary process that has given rise to different path-dependent developmental trajectories. These trajectories are linked to the sectoral development of European economies and the evolution of their technological capabilities. We propose a set of interrelated policy measures to counteract structural polarization and to promote macroeconomic convergence in Europe.

Similar content being viewed by others

1 Europe between convergence and divergence

Once upon a time, the perspective of deepened economic integration on the European continent seemed to provide a route to successive economic and political convergence of Europe’s nation states. In particular, the establishment of the European Monetary Union (EMU) and the introduction of the Euro had raised high hopes for rapid convergence among member states (e.g. Blanchard and Giavazzi2002). Until the financial crisis of 2007/2008, a series of empirical patterns were indeed pointing towards a process of convergence: increasing integration in terms of trade and investment had resulted in a catching-up process of Eastern European countries (Goedemé and Collado 2016), the integration of financial markets had reached unexpected heights (Baldwin et al. 2015; Hale and Obstfeld 2016), and the successive harmonization of environmental legislation, labor standards and consumer protection regulation had contributed to a partial unification of regulatory environments within Europe. Until the crisis started, most economists and policy-makers therefore reckoned that the Eurozone as well as the wider part of the European Union were undergoing a process of widespread convergence. This belief was strengthened by the fact that major macroeconomic indicators, such as unemployment, economic growth, per-capita-income and interest rates, were indeed converging in pre-crisis times (Gräbner et al. 2017), which was widely interpreted as evidence for overall economic progress within Europe (Giavazzi and Spaventa 2010).

However, even before the crisis, the simultaneous divergence of current account balances had already indicated that the convergence of certain macroeconomic indicators might not reflect long-term structural changes to the benefit of all EU countries (Simonazzi et al. 2013; Storm and Naastepad 2015b; Gräbner et al. 2017). Rather, the observed catching-up process of periphery countries was in large part driven by expansions of private indebtedness and by the corresponding emergence of large-scale housing bubbles in some countries (e.g. Storm and Naastepad 2016; Heimberger and Kapeller 2017). Capital flows and private debt expansion were fostered by the harmonization of interest rates across Eurozone countries and the corresponding regulatory integration of financial markets (Baldwin et al. 2015; Celi et al. 2018). However, after the financial crisis, the debt-driven growth-models of the Eurozone’s periphery countries quickly turned out to be unsustainable: the underlying structural polarization between core and periphery countries became apparent (Gräbner et al. 2017), as the catch-up tendencies observed after the turn of the century had merely obfuscated the emerging structural polarization among EU countries, and large parts of the convergence process eventually proved to be unsustainable.

In this paper, we aim to rationalize the complex dynamics of convergence, divergence and polarization in Europe with reference to theories of path-dependency in international trade (Myrdal 1958; Krugman 1991), where past “success breeds further success and failure begets more failure” which leads, “to a ‘polarisation process’ which inhibits the growth of such [manufacturing, the authors] activities in some areas and concentrates them in others” (Kaldor 1980, p. 88). Theoretically, we argue that European countries follow different developmental trajectories, which are shaped by mechanisms that give rise to path-dependency (Dobusch and Kapeller 2013), such as the presence of increasing returns to scale (in manufacturing) and network externalities that arise from differences in technological capabilities (Arthur 1989) as well as rules and standards that can only be changed at high costs (Heinrich 2014).

We take the increase in economic and financial openness and international economic integration as a conceptual starting point for exploring convergence and divergence in Europe’s more recent past. Using data for 26 EU countries covering the time period from 1960 to 2016, we employ the local projections method proposed by Jordà (2005) to estimate how several macroeconomic variables have responded to the openness shock brought about by European economic integration.

Based on our regression results, we use a hierarchical cluster analysis that points us toward a taxonomy of developmental trajectories across European countries. In this empirical context, we also check whether we are able to identify systematic structural differences in the response of EU economies to increasing economic and financial openness.

We can preview the results as follows: our findings suggest the existence of four structurally different developmental trajectories prevailing in the European Union. While large parts of the debate so far have focused on the different developments in Eurozone core countries (called ‘northern export-oriented capitalisms’ in the political economy literature; see e.g. Iversen et al. 2016) and Eurozone periphery countries (debt-led Southern European capitalisms, e.g. Johnston and Regan 2016Behringer and van Treeck 2017), we propose a typology of four country groups. This typology consists of core and periphery countries, financial hubs and catching-up countries. Our findings stress that – due to different growth models operating within the EU (e.g. Stockhammer 2015; Gräbner et al. 2017) – we can neither expect convergence to occur endogenously, nor can we hope to develop adequate policy conclusions without taking the structural differences between these four country groups seriously. By developing our typology of European countries, we contribute to various streams of literature that make use of such typologies. First, the debate in macroeconomics focuses on whether country groups that vary in terms of their growth models have been affected differently by European (monetary) integration (e.g. Stockhammer 2015, 2016; Gräbner et al. 2017). Second, the comparative political economy literature analyzes whether different varieties of European capitalism and their specific sets of institutions have been equally able to cope with increasing trade and financial openness (e.g. Iversen et al. 2016; Baccaro and Pontusson 2016; Bohle 2018; Regan 2017; Vermeiren 2017; Johnston and Regan 2018). Third, structuralist scholars have studied how the uneven distribution of income and technologies as well as the asymmetric power relations between core and periphery reinforce existing inequalities (e.g. Simonazzi et al. 2013; Cimoli and Porcile 2016; Celi et al. 2018). Fourth, the innovation literature engages with the role of technological capabilities in shaping path dependent trajectories of European countries by focusing on the relevance of non-price competitiveness and sectoral composition (e.g. Dosi et al. 2015; Storm and Naastepad 2015b; Baccaro and Benassi 2017). In our analysis, we bring together these four strands of the literature by studying the effects of increasing economic openness on macroeconomic developments as well as by inspecting trends and changes in the sectoral composition of exports in EU countries in the process of European economic integration.

The remainder of the paper proceeds as follows: the next section aligns our contribution with the existing literature. We proceed by studying the impact of increasing European economic integration on macroeconomic developments in the European Union (Section 3). Our results suggest that country-specific characteristics in the response to the openness shock variable have to be taken into account. Section 4 builds upon this observation and provides both empirical and theoretical arguments for the co-existence of currently diverging developmental trajectories in Europe. Section 5 exploits this taxonomy and shows that the four country groups have indeed responded differently to the openness shock of European integration. Section 6 concludes by suggesting policies that take the various developmental trajectories into account and are geared towards achieving technological and economic convergence in Europe.

2 Literature review and theoretical starting point

This section aligns our contribution with the existing literature by elaborating on its theoretical origins in structuralist and evolutionary theory.

While our analytical approach is informed by a pluralism of theoretical perspectives (Dobusch and Kapeller 2012), it is closely related to the work of Latin American economists whose contributions later became known under the label of ‘structuralism’ (for an overview see Bárcena and Prado 2016). This literature has been characterized by a focus on income inequality and technological change as well as by a critical view of the concept of comparative advantage. Structuralists consider development as a path dependent process, which is why they tend to delineate groups of countries according to their structural features and developmental trajectories. In its simplest form, this approach postulates the existence of ‘core’ and ‘periphery’ countries with political and economic power being distributed strongly in favor of the core. Structuralist theory thus suggests that the location in the core-periphery nexus is essential for understanding the developmental dynamics in a particular country. Given the interest of evolutionary economists in technological change and self-reinforcing learning activities, they have a natural affinity for the classical structuralist idea according to which the uneven distribution of technological capabilities is essential for understanding the emergence of the core-periphery duality in the first place (see e.g. Dosi et al. 1990, 2015; Caldentey 2016; Cimoli and Porcile2016).

In this paper, we will argue that the structural distinction between core and periphery is indeed highly relevant for understanding the effects of European integration. However, our empirical analysis on how openness shocks have affected macroeconomic developments in different countries goes beyond the structuralist literature by arguing that existing classifications of EU countries along core and periphery lines need to be enriched by two additional country groups: first, a group in which the financial sector plays an outstanding role; second, a group consisting of economies that are currently catching up to the richer economies. By doing so, we apply structuralist thought to the analysis of the EU – an approach that has become increasingly popular in recent years (e.g. Simonazzi et al. 2013; Storm and Naastepad 2015c; Stockhammer 2015; Celi et al.2018)Footnote 1. Given this theoretical starting point, our main hypothesis is that European economic integration has impacted differently on EU countries belonging to different groups along the core-periphery nexus, and has reinforced initial differences in technological endowments of European countries.

In this context, our paper builds on the following insights from the current literature. Stockhammer (2015) identifies the major source for divergence in the EMU in a rise of inequality and the resulting decrease of aggregate demand. The increase in inequality in EU member states resulted in the emergence of several variants of either an export-led or a debt-led growth model, where the latter was rendered infeasible after the crisis (see also Gräbner et al. 2017). Due to the resulting polarization in core (i.e. export-oriented) and periphery (i.e. debt-oriented) countries, this argument is closely tied to structuralist thought. When elaborating on the reasons why some countries have seen the emergence of a debt-led rather than an export-led growth model to compensate for the downward pressure in aggregate demand caused by increasing income inequality, Gräbner et al. (2017) stress the relevance of non-price competitiveness, which is essential for being successful in international markets: many periphery countries simply were not able to substitute successfully domestic demand with exports because they were lacking technological capabilities to ensure non-price competitiveness and corresponding export success. This argument relates to the work of Storm and Naastepad (2015b) as well as Dosi et al. (2015), and stresses – in a very structuralist spirit – the relevance of technology gaps, i.e. the uneven distribution of technological capabilities between core and periphery regions in Europe. We will provide ample evidence for this channel in Section 4.3. In the quest for understanding increasing inequality as a root cause of the crisis, Stockhammer (2015) also highlights the role of financial deregulation, which allowed for the accumulation of large current account deficits and surpluses, as well as increased speculation of very rich households. Furthermore, financial liberalization policies since the late 1980s have hampered the development of Southern peripheries by amplifying the risk of speculation and by dismantling their national control mechanisms (see Celi et al. 2018, p. 234-240).

Finally, the literature has pointed out that institutional factors also contribute to economic divergence between European countries. Aside from highlighting the absence of an adequate political and fiscal governance structure (see also De Grauwe 2012), Celi et al. (2018) criticize the lack of directed industrial policies in the EU. By entering the EU, Southern European countries lost important instruments for fostering industrial development, but were obliged to implement liberalization policies, in particular in the area of financial regulation. As a consequence, these countries were unable to catch up in terms of their productive capabilities, and the technological gaps to the core widened further. This development was further amplified by the establishment of the Eurozone: the absence of flexible exchange rates lead to an over-valuation of the Euro for technologically lagging countries, which has harmed their export performance and undermined technological upgrading (see also Bagnai and Mongeau Ospina2017).

In this context, Simonazzi et al. (2013) stress the dependency of periphery countries to the core (particularly Germany). They argue that current-account imbalances in the Eurozone are strongly linked to the German economic model, which is characterized by domestic wage restraint and a change of main import destinations from the South to the East, both mainly at the expense of Southern periphery countries. As long as Germany does not adjust its own export-led growth model, national policies implemented in single periphery countries are insufficient for overcoming the institutional shortcomings leading to polarization and crisis in the Eurozone.

In sum, these results cast doubt on the conventional interpretation of the European Monetary Union as a ‘convergence machine’ (e.g. Goedemé and Collado2016), and lead us to the following three conjectures, which will guide the empirical exercises to come:

First, we expect EU countries to be clustered into heterogeneous country groups, which do not exhibit an endogenous tendency for economic convergence (despite increasing institutional integration and economic openness). To the contrary, in the absence of active policy interventions we contend that European economic integration will reinforce existing inequalities. Second, given the multitude of explanations for the polarization patterns surveyed above, we are sceptical as to whether a dichotomous classification into core and periphery countries can satisfactorily describe the observed complex patterns. Third, we follow the classical structuralist focus on technological gaps in explaining polarization patterns. Therefore, we conjecture that the dynamic distribution of technological capabilities in the EU is important for explaining polarization.

3 The macroeconomic effects of openness shocks in the EU: local projections on the aggregate level

To provide an empirical analysis of convergence and polarization dynamics across the EU’s member countries, we first take a broad look at the macroeconomic effects of increasing trade and financial openness. We do so by estimating the dynamic response of several key variables to increasing economic openness. A large literature is concerned with measuring economic openness in terms of trade and finance, leading to a broad range of available openness indicators (for a review see Gräbner et al. 2018). In this paper, we are particularly interested in the effects of European economic and monetary integration, which has lowered transaction costs and led to a harmonization of several institutional aspects (e.g. De Grauwe 2012). In effect, in pre-crisis times it also triggered the harmonization of interest rates across, and increased capital flows between countries, which fueled lending from the EMU core to the periphery (e.g. Lane and Wälti 2007; Hale and Obstfeld 2016; Fuller2018). Against this backdrop, we construct a dummy variable the following way: for countries that have used the Euro since its inception in 1999, we use 1999 as the year from which the dummy variable is set to 1. For countries that have not used the Euro since its inception, we use their entry to the EU as the year from which the dummy variable is set to 1. For EU countries that are currently not part of the Eurozone, we set the dummy to 1 when the respective country entered the EU or pegged its currency to the Euro. (See the Supplementary Material for more detailed information on the variable construction.)

For the reasons explicated above, this dummy variable captures more dimensions of economic integration than only its monetary aspect: being part of the same currency area also decreased general transaction costs, reduced exchange rate uncertainty between Eurozone countries and increased price transparency (for a thorough exposition see e.g. De Grauwe 2012). Arguably, the treatment that is captured by the dummy variable is exogenous, since it goes back to an exogenous change in the institutional framework, which was not motivated by responding to macroeconomic conditions. In the appendix, we provide more information about this indicator and we replicate all estimations with a continuous measure for economic globalization, where the latter robustness check shows that the results remain qualitatively unchanged.

We estimate the effect of the openness shock dummy variable on eight variables: the unemployment rate; GDP growth; the current account balance in percent of GDP; the share of the financial sector in total value added (in percent); the exports to GDP ratio; the wage share (in percent of GDP at factor cost); GDP per capita (in 1000 dollars at purchasing-power parity); the public debt to GDP ratio; and exports to GDP. We chose this set of variables — the response to the openness shock variable being what we want to estimate — as they play a prominent role in discussions on European macroeconomic developments.

We compose a data set for 26 EU countries, which comprises all current EU member countries except Great Britain and Croatia for reasons of data availability, and covers the time period 1960-2016. Data were obtained from AMECO (wage share, current account balance, GDP growth, unemployment, public debt); the World Bank (exports to GDP); and the KLEMS database (share of finance in value added). The panel data are unbalanced.

In order to estimate the effects of openness shocks, we use the ‘local projections’ method of Jordà (2005) for constructing impulse-response functions, which has recently been employed in several papers in the macroeconometric literature (e.g. Jordà and Taylor 2016; Romer and Romer 2017; Nakamura and Steinsson2018)Footnote 2. The basic idea of the local projections method — translated into the research framework of this paper — is to estimate separately the dynamic effects of the openness shock variable that we introduced above on the eight variables of interest based on the following regression equation:

where y represents the respective ‘shock-dependent’ macroeconomic variable of interest, expressed in terms of its projected future change yi, t+k − yi, t in country i from year t to year t + k; βk is the estimated coefficient that represents the effect of the openness shock variable (OSi, t) on the shock-dependent variable y; Zi, t represents a vector of additional control variables that should be understood as ‘pre-treatment variables’ (i.e. controls determined before the ‘treatment’ of the openness shock takes place, see Nakamura and Steinsson 2018); \({\zeta _{i}^{k}}\) are fixed effects at the country level included to control for time-independent country-specific characteristics; \({\eta _{t}^{k}}\) are fixed effects related to time, which allow us to control for global shocks that hit all countries equally; finally, \(\epsilon _{i,t}^{k}\) represents the error term.

The ‘local projections’ method relies on estimating a series of k (fixed effects) regressions based on Eq. 1; the regressions are then used to construct the effect of the ‘openness shock’ on the shock-dependent variable of interest by plotting the estimated openness shock coefficients βk for each time period k (k = 1,..., k = 8). Setting the time horizon at eight years (k = 8) allows for assessing the dynamic effect of the openness shock on the shock-dependent variable during the eight years following the shock. Jordà (2005) shows that the standard linear projection is a direct estimate of the typical impulse response, as derived from a traditional vector autoregression (VAR) model. The uncertainty around the impulse-response-functions can be directly inferred from the standard errors of the estimated coefficients without any need for Monte Carlo simulations.

Figure 1 shows the results. The local projections are performed from year zero, with the first impact of the openness shock felt in the first year. The path of the local projection is then constructed to year eight, where Fig. 1 shows the deviations from the levels in year zero (Jordà and Taylor 2016). Gray areas indicate the confidence bands of the impulse response functions. For all the estimations in Fig. 1, we use panel-corrected standard errors (PCSE)Footnote 3.

The effect of openness shocks in a sample of 26 EU countries. Data: AMECO, KLEMS, World Bank (see data appendix for details); own calculations. The country sample consists of 26 EU countries. Impulse-response functions were derived from local projections (see Eq. 1 and details on pre-treatment controls in the Supplementary Appendix). Standard errors are PCSE-corrected (Beck and Katz 1995) and, hence, robust to cross-section heteroskedasticity and autocorrelation in the residuals

For exemplification purposes, we consider the response of the unemployment rate. As pre-treatment control variables in the unemployment panel, we control for GDP growth and capital accumulation; we also include a lag of the shock-dependent variable as well as lags of the pre-treatment control variables, since these variables might also have an effect on (future) changes in the unemployment rate (see vector Zi, t in Eq. 1). Details on pre-treatment controls for estimating the response of the unemployment rate and the other dependent variables to the openness shock are available in the Supplementary Appendix. Unemployment falls slightly by about 0.3 percentage points in the first two years after the openness shock but then increases in response to rising openness (+ 1 percentage points in year 5), before the response reverts back towards zero. In this context, the results of the openness shock on the GDP growth rate in our sample of 26 EU countries complement the unemployment results: on average, GDP growth responds negatively within the first four years, but over the next years, the response reverts back to (above) zero.

The impulse-response functions in Fig. 1 suggest the following: First, the current account balance in % of GDP is pushed upwards by several percentage points within the first years before the response declines. Second, the share of the financial sector in total value added does not change much in response to the openness shock. Third, the wage share increases slightly over the first three years, but the effect in year 8 after the openness shock is virtually indistinguishable from zero. Fourth, the average response of GDP per capita is negative over the medium-term, but the effect takes several years to materialize (due to substantial standard errors). Fifth, the average response of public debt is basically indistinguishable from zero. Sixth, income inequality starts to increase in response to the openness shock in the medium-term.

Finally, exports to GDP are slightly pushed upwards in the short-term, but the effect declines over time. Notably, we investigated the robustness of the results discussed here by using a different openness shock variable, namely changes in the KOF economic globalization index (Gygli et al. 2019), which is a composite index that measures economic globalization along de facto (such as trade to GDP) and de jure criteria (such as hidden import barriers). While the KOF-variable has less of a clear-cut interpretation compared to our dummy-variable approach, its main advantage is that it offers a continuous instead of binary measure of economic openness taking different facets of the latter into account. Against this backdrop, it is important to note that the results for the impulse-response functions are qualitatively similar for most parts of our sample, as can be verified in the Supplementary Appendix.

The results presented so far portray the average effect of the openness shock variable on the respective shock-dependent variable. However, based on our theoretical considerations in Section 2, we would expect the effects to be heterogeneous across EU member countries. To test this conjecture, we take a closer look at the country fixed effect estimates (\({\zeta _{i}^{k}}\) in Eq. 1).

In doing so, we exploit the fact that the country-fixed effects may be seen as a catch-all variable for time-independent country characteristics such as geography, size and stable institutions of the respective country (e.g. Wooldridge 2010). In other words, similar country-fixed effects point to a similarity in unobserved country-characteristics, while a broad divergence between the estimated country-specific intercepts would suggest the presence of a sizeable amount of heterogeneity among the units of observation. Figure 2 plots the fixed-effects estimates as acquired in our local projection setup and shows that differences in fixed-effect estimates are large and increasing over the projection period. While the first outcome suggests that unobserved individual country characteristics matter for how countries are affected by openness shocks, the increasing variation in the estimated country fixed effects over time implies that the increase in openness coincided with an increase in structural heterogeneity among the units of observation. In the next section, we will investigate whether a more in-depth analysis of the country-fixed effects can highlight similarities in the reactions of certain subgroups to increasing European economic integration.

The evolution of the estimated country fixed effects estimates over the local projections horizon (k = 1,..., k = 8). The grey lines represent the obtained country fixed effects for each country. The red lines illustrate how the heterogeneity of the estimates increases over time by representing the variance of the estimates. For the sake of visibility, the variance of public debt estimates was divided by 10

4 Openness shocks and path dependent developments in Europe: a typology for countries

The country fixed effects estimates from the previous section suggest that the increase in economic openness in Europe has amplified the structural differences among European economies due to the heterogeneous effect of openness on different countries. We now aim for gaining a clearer understanding of this observed heterogeneity. To this end, we start with an inductive approach and analyze the country fixed effect estimates obtained in the previous section by using hierarchical cluster analysis. In doing so, we try to identify suitable subgroups of the European countries in our data set and complement this inductive approach with theoretical considerations. Then we use sectoral export data to study the reasons underlying this structural change in European countries.

4.1 Hierarchical clustering of country fixed effects

In order to identify potential clusters of countries that show similarity in their unobserved country characteristics in response to European economic integration, we analyze the country fixed effects obtained in the previous section by using hierarchical cluster analysis (HCA, Tan et al. 2005, p. 515ff). The general idea behind HCA is to separate a set of objects into disjunctive groups, called clusters, where members of the same cluster are similar to each other, but distinct to members of other clusters. In contrast to partitional clustering, hierarchical clustering produces a set of nested clusters that are organized as a tree, usually represented as a dendogram or a factor map (see Fg. 3 below), which also allow for tracking the relation between clusters (see also Tan et al. 2005, p. 526)Footnote 4.

The resulting clusters of countries. Panel (a) illustrates the entire result using a dendogram, panel (b) illustrates how close the countries are to each other by using a factor plot. A factor plot only considers the two most distinguishing dimensions, which together account for about 61.7 % of total distance

The results are presented in Fig. 3. Obviously, Luxembourg is quite distinct from the rest, which can be seen as a first indication that the intuition of separating countries in which the financial sector plays an outsized role into a proper sub-group might be a fruitful approach. The countries can be separated into four further groups. The cluster on the bottom consists of Austria, Denmark, Sweden, the Netherlands, Finland, and Germany. These are the typical ‘core countries’. The cluster on top, consisting of Spain, Cyprus, Portugal, Greece, Italy, France and Belgium corresponds – with the exception of Belgium and (maybe) France – to the classic conception of a European periphery. The remaining two clusters include the Eastern European catch-up countries, Malta and Ireland. Interestingly, these countries are separated into two clusters, of which the smaller one consists of Slovakia, Lithuania, Latvia and Bulgaria, while the other one comprises all other Eastern European countries as well as Malta and Ireland. This result is consistent with recent findings that highlight the presence of different sub-groups in the Eastern European countries (see e.g. Bohle 2018), which exhibit different degrees and intensities in the overall catch-up process observable in Eastern Europe.

All our clustering results are robust, not only with regard to different cluster algorithms, but also regarding the exclusion of smaller economies, such as Malta, Luxembourg, and Cyprus. An extensive robustness analysis exploring all these avenues is presented in the appendix.

In summary, although hierarchical clustering is a purely inductive way of analyzing data that does not exploit theoretical insights other than that involved in variable selection, the results are largely consistent with classifications used in the previous literature.

4.2 A country taxonomy for the EU: delineating clusters with theory and descriptive statistics

Previous taxonomies usually focused on particular subsets of the EU’s member countries. The most common distinction is that of a Eurozone core and a Eurozone periphery (e.g. Simonazzi et al. 2013; Iversen et al. 2016). Since the Eastern European countries are difficult to accommodate in this dichotomous classification, they are – if considered at all – usually treated as a third category (Bohle 2018).

Table 1 summarizes our country groups, which departs slightly from the results of our clustering analysis: although the overall clustering results are intuitive, the focus on the country fixed effects estimates as inputs for the clustering may still understate important differences with regard to some of the EU countries’ specificities in terms of their national regulations and institutions. As can be seen, we go beyond previous classifications and suggest categorizing the European Union’s members into four categories: core, periphery, catching-up countries in Eastern Europe, and financial hubs. While the classification of core – as those countries chracterized by high standards of living, a modern and highly competitive production sector and low unemployment (see Fig. 4a) – and periphery countries – as those countries with less competitive firms, higher unemployment rates and especially burdensome levels of debt (see Fig. 4b) – is rather standard, the group of financial hubs and catch-up countries, as well as the classification of France deserves further explication:

A comparison of our four country groups with the rest of our sample. The averages refer to the period 2000-2015 and are unweighted. In the appendix, we show the population-weighted data, which do not differ markedly. Whiskers indicate the variation of the variables over time and correspond to the temporal mean +/- one standard deviation

First, we add a proper group for financial hubs in the EU because the financial sectors in Luxembourg, the Netherlands, Malta and Ireland are outsized compared to other European countries (e.g. Karwowski et al. 2017; European Central Bank 2016; Schwan 2017, note that the UK is not part of our EU country sample)Footnote 5. In our data, this is reflected by a disproportionate amount of foreign direct investments as well as high levels of private sector debt, an exceptional share of the finance sector in gross output and relatively large incomes derived from the taxation of wealth (see Fig. 4c). On top of that, these four countries also feature an exceptionally large ‘shadow banking sector’ (Beyer and Bräutigam 2016, and chart 2 in European Central Bank 2016), where ‘shadow banking’ is understood as the non-banking part of the financial system, characterized by looser regulations and thinner public safety nets for financial institutions (Ban and Gabor 2017). Moreover, Luxembourg, Ireland, the Netherlands and Malta have followed particularly liberal and finance-friendly policies geared towards attracting foreign capital and the associated rents and profits from other (European) countries. The Netherlands has a prominent role as a hub in the ‘shadow banking system’ (Bakk-Simon et al. 2012; Broos et al. 2012; Beyer and Bräutigam 2016). Ireland has been using a low-tax and low-financial-regulation regime to attract multinational companies as well as leading global financial services firms. These low-regulation policies have played an essential part in the Irish export-led growth model (e.g. Barry and Bergin 2012; Zucman2014). Malta implemented finance-friendly policies that have led to an exceptional growth of its banking sector over the last two decades. Notably, a majority of the banking-sector’s total assets in Malta are foreign-owned (e.g. European Central Bank 2016). Finally, Luxembourg is a financial center with favorable tax policies for high-net worth individuals and institutional investors, leading to an outsized role of finance in the overall economy (e.g. Johannesen and Zucman 2014; Zucman 2015). These considerations lead us to classify these countries as financial hubs, rather than as core or periphery countries.

Second, the Eastern European countries are often termed catching-up countries; they consist of Bulgaria, Romania, Czech Republic, Estonia, Latvia, Lithuania, Hungary, Poland, Slovenia and Slovakia. These countries still display relatively low levels of income, low levels of wages and employment standards and large capital inflows. Moreover, the data indicate a weak foreign ownership position of the Eastern countries (captured in a negative difference between foreign assets and foreign liabilities of more than 75%). At the same time, their share of the industry sector in terms of employment is large in comparison to the other countries in our data set (see Fig. 4d). But along with these similarities, there are also important differences among Eastern countries. Most notably, while we can observe a certain catch-up process in terms of technological capabilities, particular for the Visegrad countries, no such process can be observed in the Baltics (see also below, as well as figure 6 in the Supplementary Material; for more details, see Bohle 2018). Nevertheless, we decided to treat these countries as a single cluster and leave a more detailed classification for future research.

Finally, while the clustering approach suggests that France is currently part of the periphery, classifying this country is difficult and one might also consider it as part of the core (such as, e.g., Artis and Zhang 2001; Campos and Macchiarelli2018). The country can be seen as an intermediate case between core and periphery and its location in the core-periphery nexus is not necessarily in line with its important political role in the EU, which is also determined by its size and its historically close relation to Germany (Gräbner et al. 2017). Nevertheless, we argue that if one focuses on the economic factors, France is closer to the periphery than to the core – especially if we take into account its development in terms of technological capabilities (see Section 4.3 and figure 6 in the Supplementary Material).

4.3 Structural change and the sectoral development of nations: assessing the directedness of technological change

While the previous sections focused primarily on the effects of European economic integration on macroeconomic indicators, we now turn to the mechanisms underlying macroeconomic convergence and divergence between countries. As suggested by the structuralist literature surveyed in Section 2, we focus on analyzing the dynamic distribution of technological capabilities. To this end, we use data on trade and economic complexity (Hidalgo and Hausmann 2009) to construct a measure for the direction of technological change relative to the rest of the world.

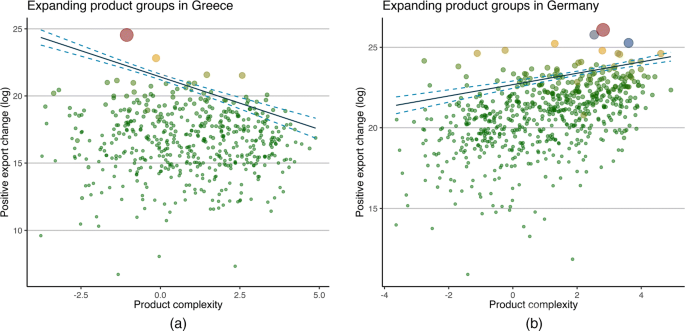

In particular, we compare trade volumes of all countries on the SITC-V2 4-digit product level over the two time periods 1995-1999 (pre-Eurozone and pre-crisis) and 2010-2014 (post-Eurozone and post -crisis) to assess the changes in a country’s export basket. For each country, we regress the log of the positive and negative difference in the value of exports on the average product complexity (PCI, see Hidalgo and Hausmann 2009) and weight the observations according to the share of the product in the country’s export-basket in 2012-2014. This allows us to understand, for a given country, whether export values change more drastically for more or less complex products. The weights ensure that we pay more attention to products that have recently played an important role in the country’s export-basket.

Define \(P_{c}^{+}\) as the set of products for which country c has increased its exports in 2010-2014 as compared to 1995-1999 and ϕc, i = 1 if \(i\in P_{c}^{+}\) and zero otherwise. We then estimate the following two equations for each country:

and

In both equations, πc, i, t is the total export of product i by country c in period t ∈ ({1995,...,1999},{2010,...,2014}), and \(\overline {\text {PCI}}_{c,i}={\sum }_{t}\left [\frac {\pi _{c,i,t}}{{\sum }_{t}\pi _{c,i,t}}\text {PCI}_{i,t}\right ]\), where PCIi, t is the product complexity of product i in year t as defined in Hidalgo and Hausmann (2009). The weights ωc, i for the WLS estimation are given by \(\omega _{c,i}=\frac {{\sum }_{t}\pi _{c,i,t}}{{\sum }_{i}{\sum }_{t}\pi _{c,i,t}}\), i.e. the share of product i in the country’s export basket in 2012-2014. This way, we obtain two estimates for each country, \(\hat {\beta }_{c}^{+}\) and \(\hat {\beta }_{c}^{-}\), the first for the products for which the country has increased its export value, and the second for the remaining products.

By calculating a weighted average of these two coefficients, one arrives at a final estimate for the direction of technological change in the countries under investigation. To this end, define

as the sum of increases in exports of country c and

as the sum of all the absolute values of the losses in exports of country c. Then the final estimate for the direction of technological change in country c is defined as follows:

If 𝜃c > 0, this indicates a relative increase in exports of more complex products for this country. In other words, if 𝜃c > 0, more complex products become relatively more important for this country’s export-basket (vice versa for 𝜃c < 0). Figure 5 provides an illustration of the results. It shows the respective regression lines as well as the composition of the underlying data for the cases of Greece and Germany with regard to expanding products (i.e. \(i\in P_{c}^{+}\)). It indicates that greater expansion of exports in Germany (right panel) is associated with higher product complexity, while greater expansion of exports in Greece (left panel) is associated with a lower technological complexity, partially driven by a reversal towards being a producer of primary inputs (such as refined oil).

The directedness of technological change in Greece and Germany. While export expansion in Germany is positively correlated with product complexity, the inverse holds for Greece. The size and color of the points represent the average share of the products in the countries’ export basket in 2012-2014. The regression line stems from the WLS estimation as described above. Dashed lines illustrate the estimation errors. Data: Atlas of Economic Complexity in its 12-2017 version (see data appendix for details); own calculations

Although the country-specific results do not always show such clear trends as in the examples given in Fig. 5 (for details on the other EU countries see the appendix), in sum they point to a clear pattern of the sectoral developments across Europe from the perspective of international competitiveness: we find that higher levels of overall complexity before the onset of the Eurozone (in 1999) are, on average, associated with stronger gains of complexity measured in terms of the expansion and decline of individual sectors for the larger part of the observed countries (Fig. 6, upper panel). While this result is broadly consistent with the Kaldorian prediction that “success breeds success” (Kaldor 1980), a more nuanced interpretation of this overall quadratic relationship is given in the lower panel of Fig. 6: although the catching-up of Eastern Europe has an imprint on overall developments, patterns consistent with Kaldorian effects can be identified within the Eastern European countries, where they are rather pronounced, as well as (with a weaker intensity) among all the remaining EU countries. Thereby, large parts of the variety in the results for the Eastern European catch-up economies seem to be moderated by their geographical proximity to Europe’s industrial core (Stöllinger 2016).

The patterns of technological change as depicted in Fig. 6 also allow us to emphasize four further observations. First, there is still considerable heterogeneity within the typically proposed country-groups: core countries differ in their development, mirroring the fact that some of these countries struggle to hold on to their position, while others, mostly Germany, have managed to expand their technological dominance (e.g. Storm and Naastepad 2015a). In fact, Germany is the only example of the core countries that finds itself above the value predicted by a quadratic model fitted to the data. Second, the upper panel of Fig. 6 shows that we cannot find a single periphery country with a decidedly positive technological development: Portugal is the only periphery country that manages to surpass the predicted value, albeit this country has started from a relatively low level of complexity. Third, we find that while most Eastern catch-up countries perform better than the prediction, two exceptions are actually located markedly below the regression line. This indicates that the economic catch-up process of Eastern European countries is not necessarily tied to a technological catch-up process, as evidenced most forcefully by the outliers Bulgaria and Lithuania. Fourth, the heterogeneity among financial hub countries is particularly large, but can be explained by their different financialization strategies: Ireland’s role as a corporate tax haven manifests itself in a massive technological upgrading (e.g. Regan and Brazys 2018), while strategies of the Netherlands and Malta are associated with more pronounced deindustrialization (e.g. Visser et al.2016).

As international competitiveness and technological capabilities are of prime importance for assessing the future developmental trajectories within given political and institutional constraints (Hidalgo and Hausmann 2009; Cristelli et al. 2015), it is important to note that we cannot observe convergence in terms of technological capabilities in the current European framework. Quite on the contrary, our results point to the possibility that some countries in Eastern Europe might indeed manage eventually to catch-up to the core (Czech Republic, Poland, Hungary and Slovakia), while others (such as Bulgaria or the Baltic countries) are much more likely to join the European periphery (Stöllinger 2016).

5 The accentuation of polarization through openness shocks: local projections on the disaggregated level

On the basis of the taxonomy of countries developed in this paper, we proceed by further corroborating our intuition that the four country groups – core, periphery, and catching up countries, as well as financial hubs – respond differently to openness shocks. In order to estimate the dynamic response of eight key variables to an impulse of increasing openness that results from exogenous changes in European economic integration, we again make use of the econometric framework introduced in Section 3: we estimate impulse-response functions based on regression (1), but this time separately for each of the four country groups.

Figure 7 shows the dynamic effects of the openness shock variable on our four main shock-dependent variables (with four additional variables covered in Fig. 8)Footnote 6. The first column is based on the subsample for the six EU core countries; the second column for the six EU periphery countries; the third column for the four financial hubs; and the fourth column for the ten catch-up countries. (See the taxonomy in Table 1 for details on the country groups.)

Response of four key variables to openness shocks. Data: AMECO, World Bank (see data appendix for details); own calculations. Impulse-response functions were derived from local projections (see Eq. 1 and details on pre-treatment controls in the Supplementary Appendix). Core countries in column 1 refers to the subgroup of six core countries; Periphery countries in column 2 refers to the subgroup of six periphery countries; Financial hubs in column 3 refers to the subgroup of four financial hubs; Catch-up countries in column 4 refers to the subgroup of ten Eastern European countries. See Table 1 for the exact taxonomy of countries

Response of four key variables to openness shocks. Data: AMECO, KLEMS (see data appendix for details); own calculations. For details on the country groups, see notes in Fig. 7

We find support for our hypothesis from Section 2 that, on average, unemployment rates in the four country groups have responded differently to the openness shock. While the response of unemployment in the core subgroup is basically indistinguishable from zero, unemployment has been strongly pushed upwards in the Southern periphery (by about three percentage points in the medium-term). While the particular developmental model in the financial hubs has allowed their economies to respond with a slight decline in the unemployment rate in the years after the openness shock, the Eastern European countries have, on average, seen a decrease in the unemployment rates in the first two years after the shock, followed by a medium-term increase in unemployment that only dissipates several years after the shock. The results for GDP growth basically correspond to the results regarding unemployment: we do not see much of an effect in the core and in the financial hubs, but there is clearly a negative response in the periphery, and a phased response in Eastern Europe. The openness shock variable has clearly had a negative effect on GDP per capita in the periphery. Furthermore, we see an initial negative effect for the group of core countries, though, in this case, GDP per capita returns to its initial level once a couple of periods have passed; but the financial hubs benefiting from their finance-friendly growth models – which may harm other European countries by fostering a race-to-the-bottom in regulatory standards – have seen a positive response of GDP per capita. Furthermore, Fig. 7 shows that the wage share, on average, has responded positively in core countries but negatively in periphery groups, while the impact on the wage share in financial hubs and Eastern European countries is more difficult to differentiate from zero.

From Fig. 8, we can see the response of four additional variables to an impulse of increasing openness. We again find pronounced differences in the dynamic effects across our four country groups: while public debt goes down in response to the shock in the financial hubs and does not change markedly in the Eastern European countries, it increases strongly in the core but even more so in the periphery countries, with the effect increasing over time. Furthermore, Fig. 8 shows that the effect of the openness shock is close to zero for the EU core, only turning positively significant eight years after the shock. The average response of the current account balance in periphery countries to the openness shock is positive. This rather unexpected result can be explained by the substantial improvements in current accounts that followed once austerity measures were put in place in the periphery from 2010 onwards. In the financial hubs, the current account has been pushed upwards, while for the Eastern European countries, the current account tended to improve over the first years after the openness shock before it deteriorated. In terms of the effect of openness on the share of the financial sector in value added, we find that there is an upward pushing response in the periphery; in the core, the average effect on the size of finance is less pronounced, while the share of the financial sector even goes down in the Eastern European countries. We do not find an effect for the group of financial hubs, which might be due to the fact that these policies had already been in place before.

Finally, in terms of the effect of increasing openness on exports to GDP, we find that the average response of the core is negative after eight years, while there is an increase in the periphery group. For the Eastern European countries, the response is on the positive side, while the financial hubs tend to see a boost in exports to GDP in the short-term, followed by a reversal in the years to follow. As in Section 3, we have again checked the robustness of the results discussed here by using the KOF economic globalization index (Gygli et al. 2019) as an alternative openness shock variable. Grosso modo, the results for the impulse-response functions of the four country groups are qualitatively similar (see the Supplementary Appendix).

Summing up, the four country groups on which we elaborate in this paper have responded to openness shocks in a distinct way. The results indicate that the complex dynamics of macroeconomic convergence and structural polarization in Europe can be better understood if one takes into account how the response of these country groups to European economic integration (which is characterized by increasing trade and financial openness) has shaped their developmental paths. In fact, European (monetary) integration should be seen as an evolutionary process that has given rise to path-dependency. Notably, the results discussed in this section portray the average response of the relevant shock-dependent variable to the openness shock variable in the respective country group. In other words: while the analysis in this paper has shown that there are strong reasons for distinguishing core, periphery, and catching-up countries, as well as financial hubs, it is still important to keep in mind that, although member countries of a particular group share important features, the experiences of the individual members within those country groups have not been completely homogeneous. Bohle (2018), for example, points to differences in the growth regimes and configurations of Eastern European capitalisms, as she distinguishes between a dependent export-driven regime in the Visegrad countries and a dependent debt-driven regime in the Baltic States. Similarly, one could argue that within the group of core countries, Germany – with its superior (non-price) competitiveness and strong export sector, its size and political power – is of particular relevance for understanding current developmental trajectories (e.g. Simonazzi et al. 2013). Nonetheless, our results in this paper suggest that important insights into the complexity of path dependent trajectories in Europe can be gained by accounting for country clusters that can be distinguished based on important characteristics that separate them from other country groups.

6 Conclusions and policy implications

This paper has analyzed the effects of increasing economic and financial openness on macroeconomic performance in the context of European integration. Using a data set of 26 EU countries, we have shown that country-specific characteristics have to be accounted for in order to understand how openness shocks have shaped path dependent developmental trajectories. Our results suggest that the focus on a dichotomy of core and periphery countries in the existing literature might fall short of explaining the nuances of current developmental trajectories in Europe. Indeed, we find that a taxonomy consisting of core and periphery countries, as well as financial hubs and catching-up economies is more suitable when it comes to understanding the evolutionary process that has been triggered by European integration – a process that has given rise to different path-dependent trajectories, partly by shaping new paths and opportunities, partly by reinforcing pre-existing tendencies. By using sectoral export data to study structural change, we illustrate that Europe is currently characterized by non-convergence in terms of technological capabilities, which are of prime importance for prospects of future economic development (e.g. Hidalgo and Hausmann 2009; Dosi et al.2015).

The observed polarization in Europe provides a rationale for reconsidering current economic policies and institutions (see also Celi et al. 2018). Current EU-level initiatives can be found in the Europe 2020 strategy (European Commission 2010). Its goals include making European economies more knowledge and innovation intensive, and to render them more sustainable in environmental and social matters. In order to reach these targets, the Commission has focused on a horizontal industrial policy approach by proposing commonly shared development aims and by trying to ensure framework conditions that are favorable to industrial competitiveness, as opposed to a more targeted (vertical) industrial policy that is anchored in the consideration of national specificities and that targets specific sectors and firms (Pianta 2015; Peneder 2017). Another policy initiative concerned with industrial policy was launched in 2014 and is referred to as the Industrial Compact (European Commission 2014). It is mainly concerned with reviving industrial activities in Europe and shows some similarity to the Europe 2020 strategy (Pianta 2015). Furthermore, the Commission President Jean-Claude Juncker came up with the so-called Investment Plan for Europe in 2014. It sets up the European Fund for Strategic Investment (EFSI), which consists of funds both from the EU and the European Investment Bank. The aim of the fund is to provide finance to private initiatives and thereby to mobilize a multiple of private sector funds. As of December 2017, €51 billion of funding were approved, to which €257 billion private funds were related (European Commission 2017).

In line with existing proposals for alternative economic policies (see e.g. Cimoli et al. 2015; Celi et al. 2018; Mazzucato 2015; Pianta 2015), our results suggest a targeted approach to industrial policy. Figure 9 summarizes our policy proposals. Specifically, in light of the increasing polarization, it will be necessary to enhance economic capabilities in the European periphery and to increase non-price competitiveness in these countries. This will involve substantial public sector investment, which should be seen as a European project. A public investment strategy would not only modernize and diversify existing economic structures; it would also provide the necessary demand stimulus to lift major parts of Europe out of stagnation. Such an initiative could be financed through additional revenues or through external financing. While the former could consist of a European corporate tax or a European wealth tax, the latter might come from the European Investment Bank or the ECB (see also Pianta 2015). In exchange, the expansion of balance sheets in the periphery’s banking sector needs to be constrained to avoid future doom-loops between bank risks and sovereign risks that push up public debt (e.g. Beck2012).

Making Europe more equitable must involve a continuation of the catch-up process in Eastern European countries in terms of living standards, which involves assuring that wages grow faster than in the rest of Europe and labor standards be adjusted to the higher levels prevalent in other European countries. Yet, convergence policies would not only increase living standards, but also provide a stimulus to aggregate demand and reduce inner-European tensions related to migration and job displacement. In order to make sure that the respective countries retain and further improve their competitiveness, such a policy has to be accompanied by targeted (vertical) industrial policies (see e.g. Cimoli et al. 2015; Mazzucato 2015).

The core countries (especially Germany) have been running significant current account surpluses for several years (e.g. Gräbner et al. 2017). This means that they possess considerable resources to improve the social cohesion of their societies by reducing unemployment and tackling social inequality through policies that tend to support the domestic economy and reduce the current account. One of these policies consists of increased spending on public infrastructure in order to create more equality of opportunity while at the same time reducing unemployment by adding to aggregate demand. Another possibility is to pursue policies that lead to higher wage growth for the low- and middle-class (e.g. by minimum wage laws, centralized wage bargaining and labor protection legislation).

Finally, in terms of moving towards more sustainability in Europe, we argue in favor of a re-regulation of the financial sector, especially in the financial hubs. Here, the goal must be to shrink and restrict the financial sector in order to dampen effectively the impact of destabilizing speculation, tax evasion and the relocation of assets. Moreover, the observation of particularly low corporate taxes in the financial hubs (which attract corporate profits through tax incentives) suggests that a European initiative leading to a substantial increase in the corporate tax rate is required to counteract the existing race-to-the-bottom in regulatory standards (e.g. Egger et al. 2019). Increasing corporate (as well as wealth and inheritance) taxes would also provide the public sector with the necessary resources to pursue targeted industrial and social policies.

Notes

Current investigations are predated by early European dependency theorists such as Musto (1981), who predicted more than 30 years ago that the unequal structures of EU member states, in particular in terms of technological capabilities, will lead to structural crises, which can only be prevented by using active industrial and structural policies. Our conclusions presented in Section 6 align very well with the policy implications developed by Musto (1981).

The local projections method is a robust estimation procedure. Even though the econometric technique is well-suited for the question at hand, we cannot completely rule out the potential for non-linear responses that might be caused by structural breaks such as the introduction of the Euro – a problem that haunts virtually all panel-econometric techniques.

Beck and Katz (1995) argue that the OLS-PCSE estimator is well-suited for panel models such as ours and allows us to avoid biased standard errors due to contemporaneous correlation across units and unit level heteroscedasticity.

Specifically, we apply Ward’s minimum variance method. More details on the method selection process are given in the appendix.

The existence of a proper group of ‘financial hubs’ should not eschew the fact that (i) Europe as a whole is more financialized than most other world regions and (ii) financialization has played an important role for the development in the Southern periphery countries, e.g. by facilitating speculative bubbles (for more details see p. 234ff in Celi et al. 2018). However, the countries in our ‘financial hubs’ group are particularly financialized, where we follow the definition of Epstein(2005, p. 3) who sees ‘financialization’ as “the increasing role of financial motives, financial markets, financial actors, and financial institutions in the operation of the domestic and international economies.” On financializaton, see also Hein et al. (2008), Palley (2013) and Celi et al. (2018).

Note that, while the standard errors in Fig. 1 are panel-corrected standard errors (Beck and Katz 1995) and, hence, robust to heteroskedasticity and autocorrelation in the residuals, we have not been able to perform the same adjustment for the country subgroups in Figs. 7 and 8. The reason is that the PCSE-correction requires that the number of years covered is not too much larger than the number of countries in the cross-sectional dimension of the data. When we subset the full country sample into our four groups, this requirement is not fulfilled because the number of countries in the regressions drops markedly. As a consequence, the gray standard error bands depicted in Figs. 7 and 8 might be too small, i.e. we might somewhat underestimate the degree of uncertainty around the point estimates in the impulse-response function.

References

Arthur W B (1989) Competing technologies, increasing returns, and Lock-In by historical events. Econ J 99(394):116–131

Artis M, Zhang W (2001) Core and periphery in EMU: a cluster analysis. Economic Issues 6(2):47–58

Atlas of Economic Complexity (2001) The Atlas of Economic Complexity at Harvard CID. Center for International Development at Harvard University

Baccaro L, Pontusson J (2016) Rethinking comparative political economy: The growth model perspective. Polit Soc 44(2):175–207

Baccaro L, Benassi C (2017) Throwing out the ballast: growth models and the liberalization of German industrial relations. Socio-Econ Rev 15(1):85–115

Bagnai A, Mongeau Ospina C A (2017) Monetary integration vs. real disintegration: single currency and productivity divergence in the euro area. J Econ Policy Reform 7(2):1–15

Bakk-Simon K, Borgioli S, Giron C, Hempell H, Maddaloni A, Recine F, Rosati S (2012) Shadow banking in the euro area. an overview. ECB Occasional Paper Series 133

Baldwin R, Beck T, Bénassy-Quéré A, Blanchard O, Corsetti G, De Grauwe P, den Haan W, Giavazzi F, Gros D, Kalemli-Ozcan S, Micossi S, Papaioannou E, Pesenti P, Pissarides C, Tabellini G, di Mauro B W (2015) Rebooting the Eurozone: Step 1-agreeing a crisis narrative. CEPR Policy Insight 85(5):1142–1158

Ban C, Gabor D (2017) The political economy of shadow banking. Rev Int Polit Econ 23(6):901–914

Bárcena A, Prado A (eds) (2016) Neostructuralism and heterodox thinkingin Latin America and the Caribbean in the early twenty-first century. ECLAC, Santiago

Barry F, Bergin A (2012) Inward investment and irish exports over the recession and beyond. The World Econ 35(10):1291–1304

Beck N, Katz J N (1995) What To Do (and Not to Do) with Time-Series Cross-Section Data. Amer Polit Sci Rev 89(03):634–647

Beck T (ed) (2012) Banking union for europe - risks and challenges. CEPR, London

Behringer J, van Treeck T (2017) Varieties of Capitalism and Growth Regimes: The role of income distribution. FMM Working Paper 9

Beyer K M, Bräutigam L (2016) Das europäische Schattenbankensystem. ICAE Working Paper 56

Blanchard O, Giavazzi F (2002) Current Account Deficits in the Euro Area: The End of the Feldstein-Horioka Puzzle?. Brook Papers Econ Activ 33(2):147–210

Bohle D (2018) European integration, capitalist diversity and crises trajectories on europe’s eastern periphery. Polit Econ 33(1):1–15

Broos M, Carlier K, Kakes J, Klaaijsen E (2012) Shadow Banking: An exploratory study for the Netherlands. DNB Occasional Studies 10/5

Caldentey E P (2016) A time to reflect on opportunities for debate and dialogue between (neo)structualism and heterodox schools of thought. In: Bárcena A, Prado A (eds) Neostructualism and heterodox thinking in latin america and the caribbean in the early twenty-first century. ECLAC Books, Santiago, pp 32–83

Campos N F, Macchiarelli C (2018) Symmetry and convergence in monetary unions. LSE Discussion Paper Series 131/2018

Celi G, Ginzburg A, Guarascio D, Simonazzi A (2018) Crisis in the european monetary union a Core-Periphery perspective. Routledge, London

Cimoli M, Dosi G, Stiglitz J E (2015) The rationale for industrial and innovation policy. Intereconomics 50(3):126–132

Cimoli M, Porcile G (2016) Productivity and structural change: structuralism and its dialogue with other heterodox currents. In: Bárcena A, Prado A (eds) Neostructualism and heterodox thinking in latin america and the caribbean in the early twenty-first century. ECLAC Books, Santiago, pp 205–221

Cristelli M, Tacchella A, Pietronero L (2015) The heterogeneous dynamics of economic complexity. PLoS ONE 10(2):e0117174

De Grauwe P (2012) Economics of monetary union. Oxford University Press., Oxford

Dobusch L, Kapeller J (2012) Heterodox United vs. Mainstream City? Sketching a Framework for Interested Pluralism in Economics. J Econ Issues 46(4):1035–1058

Dobusch L, Kapeller J (2013) Breaking new paths: Theory and method in path dependence research. Schmalenbach Bus Rev 65(3):288–311

Dosi G, Pavitt K, Soete L (1990) The economics of technical change and international trade. New York University Press, New York

Dosi G, Grazzi M, Moschella D (2015) Technology and costs in international competitiveness: From countries and sectors to firms. Res Policy 44:1795–1814

Egger P H, Nigai S, Strecker N M (2019) The taxing deed of globalization. Am Econ Rev 109(2):353–390

Epstein G A (2005) Financialization in the world economy. Edward Elgar, Cheltenham

European Commission (2010) Europe 2020 A strategy for smart sustainable and inclusive growth. Communication from the Commission, Brussels

European Commission (2014) For a european industrial renaissance. Communication from the Commission, Brussels

European Central Bank (2016) Report on financial structures. Technical report

European Commission (2017) EIB Group figures as of 31/12/17 Online: [8.2.2018]

Fuller G W (2018) Exporting assets: EMU and the financial drivers of european macroeconomic imbalances. Polit Econ 23(2):174–191

Giavazzi F, Spaventa L (2010) Why the current account matters in a monetary union: Lessons from the financial crisis in the euro area. CEPR Discussion Paper 8008

Goedemé T, Collado D (2016) The EU convergence machine at work. To the Benefit of the EU’s Poorest Citizens?. J Common Market Stud 54(5):1142–1158

Gräbner C, Heimberger P, Kapeller J, Schütz B (2017) Is Europe disintegrating? Macroeconomic divergence, structural polarization, trade and fragility. ICAE Working Paper 64

Gräbner C, Heimberger P, Kapeller J, Springholz F (2018) Understanding economic openness: a review of existing measures. ICAE Working Paper 82

Gräbner C, Heimberger P, Kapeller J, Schütz B (2019) Replication data for: Structural change in times of increasing openness. https://doi.org/10.7910/DVN/H89PXL

Gygli S, Haelg F, Potrafke N, Sturm J E (2019) The KOF Globalisation Index - revisited. Rev Int Organ 14(3):543–574

Hale G, Obstfeld M (2016) The euro and the geography of international debt flows. J Eur Econ Assoc 14(1):115–144

Heimberger P, Kapeller J (2017) The performativity of potential output: Pro-cyclicality and path dependency in coordinating European fiscal policies. Rev Int Polit Econ 24(5):904–928

Hein E, Niechoj T, Spahn P, Truger A (eds) (2008) Finance-led Capitalism? Macroeconomic Effects of Changes in the Financial Sector. Metropolis, Marburg

Heinrich T (2014) Standard wars, tied standards, and network externality induced path dependence in the ICT sector. Technol Forecast Soc Chang 81:309–320

Hidalgo C A, Hausmann R (2009) The building blocks of economic complexity. Proc Natl Acad Sci 106(26):10570–10575

Iversen T, Soskice D, Hope D (2016) The eurozone and political economic institutions. Ann Rev Polit Sci 19(1):163–185

Johannesen N, Zucman G (2014) The end of bank secrecy? an evaluation of the g20 tax haven crackdown. Amer Econ J Econ Policy 6(1):65–91

Johnston A, Regan A (2016) European monetary integration and the incompatibility of national varieties of capitalism. J Common Mark Stud 54(2):318–336

Johnston A, Regan A (2018) Introduction: Is the European Union Capable of Integrating Diverse Models of Capitalism?. Polit Econ 23(2):145–159

Jordà Ò (2005) Estimation and inference of impulse responses by local projections. Am Econ Rev 95(1):161–182

Jordà Ò, Taylor A M (2016) The time for austerity: Estimating the average treatment effect of fiscal policy. Econ J 126(590):219–255

Kaldor N (1980) The Foundations of Free Trade Theory and their Implications for the Current World Recession. In: Malinvaud E, Fitoussi J P (eds) Unemployment in western countries. Springer, London, pp 85–100

Karwowski E, Shabani M, Stockhammer E (2017) Financialization: Dimensions and determinants. a Cross-Country study. Kingston University London Discussion Paper 2017/1

Krugman P (1991) Increasing returns and economic geography. J Polit Econ 99(3):483–499

Lane P, Wälti S (2007) The euro and financial integration. In: Cobham D (ed) The travails of the eurozone. Palgrave, Munich, pp 208–232

Mazzucato M (2015) Innovation systems: From fixing market failures to creating markets. Intereconomics 3:120–125

Musto S A (1981) Die süderweiterung der europäischen Gemeinschaft. Kyklos 34(2):242–273

Myrdal G (1958) Economic Theory and Underdeveloped Regions. Vora & Co Publishers, Bombay

Nakamura E, Steinsson J (2018) Identification in Macroeconomics. Journal of Economic Perspectives forthcoming

Palley T (2013) Financialization: the economics of finance capital domination. Palgrave Macmillan, New York

Peneder M (2017) Competitiveness and industrial policy: from rationalities of failure towards the ability to evolve. Camb J Econ 41(2):829–858

Pianta M (2015) What is to be produced? the case for industrial policy. Intereconomics 3:139–145

Regan A (2017) The imbalance of capitalisms in the Eurozone: Can the north and south of Europe converge? Comp Eur Polit 15(6):969–990

Regan A, Brazys S (2018) Celtic Phoenix or Leprechaun Economics? The Politics of an FDI-led Growth Model in Europe. Polit Econ 23(2):223–238

Romer C D, Romer D H (2017) New evidence on the aftermath of financial crises in advanced countries. Am Econ Rev 107(10):3072–3118

Schwan M (2017) Which roads lead to Wall Street? The financialization of regions in the European Union. Comp Eur Polit 15(4):661–683

Simonazzi A, Ginzburg A, Nocella G (2013) Economic relations between Germany and southern europe. Camb J Econ 37(3):653–675

Stockhammer E (2015) Rising inequality as a cause of the present crisis. Camb J Econ 39(3):935–958

Stockhammer E, Wildauer R (2016) Debt-driven growth? Wealth, distribution and demand in OECD countries. Camb J Econ 40(6):1609–1634

Stöllinger R (2016) Structural change and global value chains. Empirica 43 (4):801–829

Storm S, Naastepad CWM (2015a) Crisis and recovery in the German economy: The real lessons. Struct Chang Econ Dyn 32:11–24

Storm S, Naastepad CWM (2015b) Europe’s Hunger Games: Income Distribution, Cost Competitiveness and Crisis. Camb J Econ 39(3):959–986

Storm S, Naastepad CWM (2015c) NAIRU economics and the Eurozone crisis. Int Rev Appl Econ 29(6):843–877

Storm S, Naastepad C W M (2016) Myths, Mix-ups, and Mishandlings: Understanding the Eurozone Crisis. Int J Polit Econ 45(1):46–71

Tan P N, Steinbach M, Kumar V (2005) Introduction to data mining. Boston, Pearson

Vermeiren M (2017) One-size-fits-some! Capitalist diversity, sectoral interests and monetary policy in the euro area. Rev Int Polit Econ 24(6):929–957

Visser M, Gesthuizen M, Kraaykamp G, Wolbers M (2016) Trends in labour force participation of older men: Examining the influence of policy reforms, normative change and deindustrialization in the Netherlands, 1992-2009. Econ Ind Democr 37 (3):425–447

Wooldridge J (2010) Econometric analysis of cross section and panel data, 2nd edn. The MIT Press, Cambridge

Zucman G (2014) Taxing across borders: Tracking personal wealth and corporate profits. J Econ Perspect 28(4):121–148

Zucman G (2015) The hidden wealth of national: The scourge of tax havens. Chicago University Press, Chicago

Funding

Open access funding provided by Johannes Kepler University Linz. Supported by funds of the Oesterreichische Nationalbank (Austrian Central Bank, 747 Anniversary Fund, project number: 17383).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interests

The authors declare that they have no conflict of interest.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supported by funds of the Oesterreichische Nationalbank (Austrian Central Bank, Anniversary Fund, project number: 17383). The data as well as all code required to replicate the empirical exercises in the paper are available on Github: https://github.com/graebnerc/structural-changeThe raw data are also published as (Gräbner et al. 2019).

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Gräbner, C., Heimberger, P., Kapeller, J. et al. Structural change in times of increasing openness: assessing path dependency in European economic integration. J Evol Econ 30, 1467–1495 (2020). https://doi.org/10.1007/s00191-019-00639-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-019-00639-6