Abstract

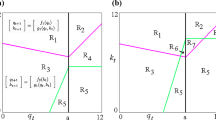

Boom and bust cycles are widely documented in the literature on industry dynamics. Rigidities and delays in capacity adjustment in combination with bounded rational behavior have been identified as central driving forces. We construct a model that features only these two elements and we show that this is indeed sufficient to reproduce some stylized facts of a boom and bust cycle. The bifurcation diagrams summarizing the dynamic behavior reveal complex cycles and in particular also abrupt changes in the nature of these cycles. We apply new insights from the mathematical theory of piecewise smooth dynamic systems—in particular, results from the theory of border collision bifurcations—and show that the very existence of borders such as capacity constraints or nonnegativity constraints may lie behind abrupt changes in the dynamic behavior of economic variables.

Similar content being viewed by others

Notes

1Not only locally, but also globally, as contact bifurcations and homoclinic bifurcations of cycles.

References

Agliari A, Commendatore P, Foroni I, Kubin I (2011) Border collision bifurcations in a footloose capital model with “first nature firms”. Comput Econ 38:349–366

Aramburo SA, Castañeda Acevedo JA, Moralesa YA (2012) Laboratory experiments in the system dynamics field. Syst Dyn Rev 28(1):94–106

Aronson DG, Chory MA, Hall GR, McGehee RP (1982) Bifurcations from an invariant circle for two-parameter families of maps of the plane: a computer assisted study. Commun Math Phys 83:303–354

Athanasiou G, Karafyllis I, Kotsios S (2008) Price stabilization using buffer stocks. J Econ Dyn Control 32:1212–1235

Besanko D, Doraszelski U (2004) Capacity dynamics and endogenous asymmetries in firm size. RAND J Econ 35(1):23–49

Caulkins JP, Baker D (2010) Cobweb dynamics and price dispersion in illicit drug markets. Socio-Econ Plann Sci 44:220–230

Currie M, Kubin I (1995) Non-linearities and partial analysis. Econ Lett 49:27–31

Currie M, Kubin I (1997) Investment in fixed capital and competitive industry dynamics. Oxf Econ Pap 49:521–542

Declerck F, Cloutier LM (2010) The financial value of corporations in a cobweb economy; champagne industry dynamics. Int J Wine Bus Res 22(3):269–287

Dieci R, Westerhoff F (2010) Interacting cobweb markets. J Econ Behav Organ 75:461–481

Dosi G, Gary MS, Lovallo D (2008) In: Hodgkinson GP, Starbuck WH (eds) The Oxford handbook of organizational decision making. Oxford University Press, New York, pp 33–55

Gardini L, Sushko I, Naimzada AK (2008) Growing through chaotic intervals. J Econ Theory 143:541–557

Gardini L, Merlone U, Tramontana F (2011) Inertia in binary choices: continuity breaking and big-bang bifurcation points. J Econ Behav Organ 80(1):153–167

Gouel C (2001) Agricultural price instability and optimal stabilization policies. PhD thesis, École Polytechnique—Département d’Économie, Paris.

Grandmont GM, Pintus P, de Vilder R (1998) Capital labor substitution and competitive nonlinear endogenous business cycles. J Econ Theory 80:14–59

Hommes CH (2008) Bounded rationality and learning in complex markets. In: Barkley Rosser Jr J (ed) Handbook of economic complexity. Edward Elgar, Cheltenham

Lu Y, Poddar S (2005) Mixed oligopoly and the choice of capacity. Res Econ 59:365–374

Nusse HE, Yorke JA (1992) Border-collision bifurcations including period two to period three for piecewise smooth systems. Physica D 57:39–57

Nusse HE, Yorke JA (1995) Border-collision bifurcations for piecewise smooth one-dimensional maps. Int J Bifurc Chaos 5:189–207

Paich M, Sterman JD (1993) Boom, bust, and failures to learn in experimental markets. Manage Sci 39(12):1439–1458

Saari DG (1985) Iterative price mechanisms. Econometrica 53(5):1117–1131

Sterman JD (1989) Misperceptions of feedback in dynamic decision making. Org Behav Human Decis Process 43:301–335

Sterman JD (2000) Business dynamics: systems thinking and modeling for a complex world. McGraw-Hill, New York

Sterman JD, Henderson R, Beinhocker ED, Newman LI (2007) Getting big too fast: strategic dynamics with increasing returns and bounded rationality. Manage Sci 53(4):683–696

Sushko I, Gardini L, Puu T (2010) Regular and chaotic growth in a Hicksian floor/ceiling model. J Econ Behav Organ 75:77–94

Tramontana F, Gardini L, Puu T (2009) Cournot duopoly when the competitors operate multiple production plants. J Econ Dyn Control 33:250–265

Tramontana F, Westerhoff F, Gardini L (2010) On the complicated price dynamics of a simple one-dimensional discontinuous financial market model with heterogeneous interacting traders. J Econ Behav Organ 74:187–205

Tramontana F, Westerhoff F, Gardini L (2011) Heterogeneous speculators and asset price dynamics: further results from a one-dimensional discontinuous piecewise-linear model. Comput Econ 38:329–347

Tversky A, Kahneman D (1974) Judgment under uncertainty: heuristics and biases. Science, New Series 185(4157):1124–1131

Author information

Authors and Affiliations

Corresponding author

Additional information

This work has been performed within the activity of the project PRIN 2009, MIUR, Italy, and under the auspices of the COST Action IS1104 “The EU in the new complex geography of economic systems: models, tools and policy evaluation”.

Rights and permissions

About this article

Cite this article

Kubin, I., Gardini, L. Border collision bifurcations in boom and bust cycles. J Evol Econ 23, 811–829 (2013). https://doi.org/10.1007/s00191-012-0300-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-012-0300-6