Abstract.

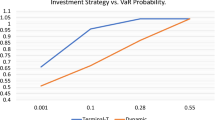

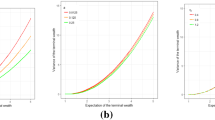

This paper presents a closed form solution of the mean-variance portfolio selection problem for uncorrelated assets that precludes short sells. We also study the problem with the consideration of transaction cost. When the asset holding can be explicitly become available, one can have a better understanding of the behavior of efficient frontier. Our algorithm solves the mean-variance portfolio selection with uncorrelated risky assets plus one risk free asset. The algorithm is based on a continuous dynamic programming and provides a general closed form solution that is a function of expected returns and variances of all assets. The implementation of the algorithm is presented by some practical examples.

Similar content being viewed by others

Author information

Authors and Affiliations

Additional information

Manuscript received: September 2003/Final version received: December 2003

Rights and permissions

About this article

Cite this article

Sadjadi, S., Aryanezhad, M. & Moghaddam, B. A dynamic programming approach to solve efficient frontier. Math Meth Oper Res 60, 203–214 (2004). https://doi.org/10.1007/s001860400367

Issue Date:

DOI: https://doi.org/10.1007/s001860400367