Abstract.

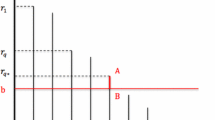

Effective risk management requires adequate risk measurement. A basic problem herein is the quantification of market risks: what is the overall effect on a portfolio if market rates change? First, a mathematical problem statement is given and the concept of `Maximum Loss' (ML) is introduced as a method for identifying the worst case in a given set of scenarios, called `Trust Region'. Next, a technique for calculating efficiently the Maximum Loss for quadratic functions is described; the algorithm is based on the Levenberg-Marquardt theorem, which reduces the high dimensional optimization problem to a one dimensional root finding.

Following this, the idea of the `Maximum Loss Path' is presented: repetitive calculation of ML for growing trust regions leads to a sequence of worst case scenarios, which form a complete path; similarly, the path of `Maximum Profit' (MP) can be determined. Finally, all these concepts are applied to nonquadratic portfolios: so-called `Dynamic Approximations' are used to replace arbitrary profit and loss functions by a sequence of quadratic functions, which can be handled with efficient solution procedures. A description of the overall algorithm rounds off the discussion of nonlinear portfolios.

Similar content being viewed by others

Author information

Authors and Affiliations

Additional information

Manuscript received: January 1999

Rights and permissions

About this article

Cite this article

Studer, G. Risk measurement with maximum loss. Mathematical Methods of OR 50, 121–134 (1999). https://doi.org/10.1007/s001860050039

Issue Date:

DOI: https://doi.org/10.1007/s001860050039