Abstract

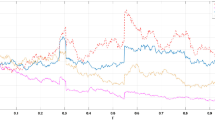

Existing closed-form formulas for implied volatilities perform differently for options with different moneyness and maturities. When the accuracy requirement is high, one usually resorts to Newton’s method to obtain accurate results. While this method works well, the procedure is no longer a closed-form expression and an unknown number of iterations are required. To achieve high accuracy over a wide range of moneyness and maturities without losing their closed-form nature, we propose to use Householder’s method to enhance the existing formulas. We derive the general form of the high order derivatives (with respect to volatility) of the Black–Scholes pricing function and its reciprocal function, which leads to the iterative formula of Householder’s method in closed-form. Our numerical analysis demonstrates the performance improvements when Householder’s method is applied to three best formulas in the literature and discusses how the required level of accuracy depends on moneyness and maturities.

Similar content being viewed by others

References

Alefeld G (1981) On the convergence of Halley’s method. Am Math Mon 88(7):530–536

Brenner M, Subrahmanyam MG (1988) A simple formula to compute the implied standard deviation. Financ Anal J 44(5):80–83

Bharadia MAJ, Christofides N, Salkin GR (1995) Computing the Black–Scholes implied volatility: generalization of a simple formula. Adv Futures Options Res 8:15–30

Cont R, Fonseca J (2002) Dynamics of implied volatility surfaces. Quant Finance 2:45–60

Corrado CJ, Miller TW (1996) A note on a simple accurate formula to compute implied standard deviations. J Bank Finance 20:595–603

Curtis CE, Carriker GL (1988) Estimating implied volatility directly from “nearest-to-the-money” commodity option premiums. Working Paper 081588. Department of Agricultural Economics, Clemson University

Faà di Bruno F (1857) Note sur une nouvelle formule de calcul differentiel [On a new formula of differential calculus]. Q J Pure Appl Math (in French) 1:359–360

Householder AS (1970) The numerical treatment of a single nonlinear equation. McGraw-Hill, New York

Jäckel P (2015) Let’s be rational. Wilmott Mag 75:40–53

Li S (2005) A new formula for computing implied volatility. Appl Math Comput 170(1):611–625

Li M (2008) Approximate inversion of the Black–Scholes formula using rational functions. Eur J Oper Res 185(2):743–759

Merton RC (1976) Option pricing when underlying stock returns are discontinuous. J Financ Econ 3:125–144

Mininni M, Orlando G, Taglialatela G (2021) Challenges in approximating the Black and Scholes call formula with hyperbolic tangents. Decis Econ Finance 44:73–100

Orlando G, Taglialatela G (2017) A review on implied volatility calculation. J Comput Appl Math 320:202–220

Orlando G, Taglialatela G (2021) On the approximation of the Black and Scholes call function. J Comput Appl Math 384:113154

Acknowledgements

The authors acknowledge the support from the Ministry of Science and Technology of Taiwan under the Grant Number 107-2410-H-011-005.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Miao, D.WC., Lin, X.CS. & Lin, CY. Using Householder’s method to improve the accuracy of the closed-form formulas for implied volatility. Math Meth Oper Res 94, 493–528 (2021). https://doi.org/10.1007/s00186-021-00763-9

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00186-021-00763-9