Abstract

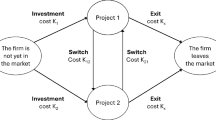

We develop a complete analysis of a general entry–exit–scrapping model. In particular, we consider an investment project that operates within a random environment and yields a payoff rate that is a function of a stochastic economic indicator such as the price of or the demand for the project’s output commodity. We assume that the investment project can operate in two modes, an “open” one and a “closed” one. The transitions from one operating mode to the other one are costly and immediate, and form a sequence of decisions made by the project’s management. We also assume that the project can be permanently abandoned at a discretionary time and at a constant sunk cost. The objective of the project’s management is to maximise the expected discounted payoff resulting from the project’s management over all switching and abandonment strategies. We derive the explicit solution to this stochastic control problem that involves impulse control as well as discretionary stopping. It turns out that this has a rather rich structure and the optimal strategy can take eight qualitatively different forms, depending on the problems data.

Similar content being viewed by others

Notes

Using a trivial re-parametrisation, we can allow for the project to yield a constant payoff rate while it is in its “closed” mode (see Remark 1).

For the same reason, it would make sense in some economic applications to allow for at least \(K_0\) to be negative, as long as \(K_1 + K_0 > 0\). However, such a relaxation would add most significant complexity and would result in a substantially longer paper.

Although this setting is convenient for the problem’s formulation, switching followed by immediate abandonment is never optimal due to the strict positivity of \(K_\ell \), \(\ell = 1, 0\).

The inequality \(\vartheta < n\), where n is defined by (15), is essential for the value function to be finite.

In the description of the five possible regions, we characterise subsets of \(]0,\infty [\) as open or closed relative to the topology on \(]0,\infty [\) that is the trace of the usual topology on \(\mathbb {R}\), for instance, \(]0,a] = ]0,\infty [ \setminus ]a, \infty [\) and \([a, \infty [ = ]0,\infty [ \setminus ]0, a[\) are closed sets.

We use the notation \(\delta _\dagger \) rather than the simpler \(\delta \) because this point will appear in assumptions that we will make in later cases.

References

Bayraktar E, Egami MA (2010) On the one-dimensional optimal switching problem. Math Oper Res 35:140–159

Brekke KA, Øksendal B (1994) Optimal switching in an economic activity under uncertainty. SIAM J Control Optim 32:1021–1036

Brennan MJ, Schwartz ES (1985) Evaluating natural resource investments. J Bus 58:135–157

Carmona R, Ludkovski M (2008) Pricing asset scheduling flexibility using optimal switching. Appl Math Finance 15:405–447

Dixit AK, Pindyck RS (1994) Investment under uncertainty. Princeton University Press, Princeton

Djehiche B, Hamadène S (2009) On a finite horizon starting and stopping problem with risk of abandonment. Int J Theor Appl Finance 12:523–543

Djehiche B, Hamadène S, Popier A (2009) A finite horizon optimal multiple switching problem. SIAM J Control Optim 48:2751–2770

Duckworth K, Zervos M (2001) A model for investment decisions with switching costs. Ann Appl Probab 11:239–260

El Asri B (2010) Optimal multi-modes switching problem in infinite horizon. Stoch Dyn 10:231–261

El Asri B, Hamadène S (2009) The finite horizon optimal multi-modes switching problem: the viscosity solution approach. Appl Math Optim 60:213–235

Elie R, Kharroubi I (2014) BSDE representations for optimal switching problems with controlled volatility. Stoch Dyn 14:1450003

Gassiat P, Kharroubi I, Pham H (2012) Time discretization and quantization methods for optimal multiple switching problem. Stoch Process Appl 122:2019–2052

Guo X, Tomecek P (2008) Connections between singular control and optimal switching. SIAM J Control Optim 47:421–443

Hamadène S, Jeanblanc M (2007) On the starting and stopping problem: application in reversible investments. Math Oper Res 32:182–192

Hamadène S, Zhang J (2010) Switching problem and related system of reflected backward SDEs. Stoch. Process Appl 120:403–426

Johnson TC, Zervos M (2007) The solution to a second order linear ordinary differential equation with a non-homogeneous term that is a measure. Stochastics 79:363–382

Johnson TC, Zervos M (2010) The explicit solution to a sequential switching problem with non-smooth data. Stochastics 82:69–109

Knudsen TS, Meister B, Zervos M (1998) Valuation of investments in real assets with implications for the stock prices. SIAM J Control Optim 36:2082–2102

Korn R, Melnyk Y, Seifried FT (2017) Stochastic impulse control with regime-switching dynamics. Eur J Oper Res 260:1024–1042

Lumley RR, Zervos M (2001) A model for investments in the natural resource industry with switching costs. Math Oper Res 26:637–653

Ly Vath V, Pham H (2007) Explicit solution to an optimal switching problem in the two-regime case. SIAM J Control Optim 46:395–426

Martyr R (2016) Finite-horizon optimal multiple switching with signed switching costs. Math Oper Res 41:1432–1447

Pham H (2007) On the smooth-fit property for one-dimensional optimal switching problem. In: Séminaire de Probabilités XL. pp 187–201

Pham H, Ly Vath V, Zhou XY (2009) Optimal switching over multiple regimes. SIAM J Control Optim 48:2217–2253

René A, Campi L, Langrené N, Pham H (2014) A probabilistic numerical method for optimal multiple switching problems in high dimension. SIAM J Financ Math 5:191–231

Song QS, Yin G, Zhang Q (2009) Stochastic optimization methods for buying-low-and-selling-high strategies. Stoch Anal Appl 27:523–542

Tang SJ, Yong JM (1993) Finite horizon stochastic optimal switching and impulse controls with a viscosity solution approach. Stochastics 45:145–176

Trigeorgis L (1996) Real options: managerial flexibility and strategy in resource allocation. MIT Press, Cambridge

Tsekrekos JM, Yannacopoulos AN (2016) Optimal switching decisions under stochastic volatility with fast mean reversion. Eur J Oper Res 251:148–157

Zervos M (2003) A problem of sequential entry and exit decisions combined with discretionary stopping. SIAM J Control Optim 42:397–421

Zhang Y (2015) Entry and exit decisions with linear costs under uncertainty. Stochastics 87:209–234

Zhang H, Zhang Q (2008) Trading a mean-reverting asset: buy low and sell high. Automatica 44:1511–1518

Acknowledgements

We thank an anonymous referee and an associate editor for comments and suggestions that enhanced our original manuscript. The research of Carlos Oliveira was supported by Fundação para a Ciência e Tecnologia through the Grant SFRH/BD/102186/2014.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Zervos, M., Oliveira, C. & Duckworth, K. An investment model with switching costs and the option to abandon. Math Meth Oper Res 88, 417–443 (2018). https://doi.org/10.1007/s00186-018-0641-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00186-018-0641-5