Abstract

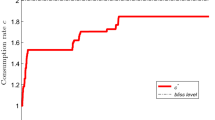

We solve the optimal portfolio problem of an investor in a complete market who is liable to deferred taxes due on capital gains, irrespective of their origin. In a Brownian framework we explicitly determine optimal strategies. Our analysis is based on a modification of the standard martingale method applied to the after-tax utility function, which exhibits a kink at the level of initial wealth, and Clark’s formula. Numerical results show that the Merton strategy is close to optimal under taxation.

Similar content being viewed by others

References

Basak S, Shapiro A (2001) Value-at-risk-based risk management: optimal policies and asset prices. Rev Financ Stud 14: 371–405

Bouchard B, Touzi N, Zeghal A (2004) Dual formulation of the utility maximization problem: the case of nonsmooth utility. Ann Appl Probab 14: 678–717

Cadenillas A, Pliska SR (1999) Optimal trading of a security when there are taxes and transaction costs. Finance Stoch 3: 137–165

Carpenter JN (2000) Does option compensation increase managerial risk appetite?. J Finance 55: 2311–2331

Clark JMC (1970) Representation of functionals of Brownian motion as stochastic integrals. Ann Math Stat 41: 1282–1295

Constantinides GM (1983) Capital market equilibrium with personal tax. Econometrica 51: 611–636

Constantinides GM (1984) Optimal stock trading with personal taxes: implications for prices and the abnormal January returns. J Financ Econ 13: 65–89

Cox JC, Huang C-F (1989) Optimal consumption and portfolio policies when asset prices follow a diffusion process. J Econ Theory 49: 33–83

Cox JC, Huang C-F (1991) A variational problem arising in financial economics. J Math Econ 20: 465–487

Dammon RM, Spatt CS, Zhang HH (2001) Optimal consumption and investment with capital gains taxes. Rev Financ Stud 14: 583–616

Dammon RM, Spatt CS, Zhang HH (2004) Optimal asset location and allocation with taxable and tax-deferred investing. J Finance 59: 999–1037

DeMiguel V, Uppal R (2005) Portfolio investment with the exact tax basis via nonlinear programming. Manag Sci 51: 277–290

Gabih A, Grecksch W, Richter M, Wunderlich R (2006) Optimal portfolio strategies benchmarking the stock market. Math Methods Oper Res 64: 211–225

Huang J (2008) Taxable and tax-deferred investing: a tax-arbitrage approach. Rev Financ Stud 21: 2173–2207

Jouini E, Koehl P-F, Touzi N (1999) Optimal investment with taxes: an optimal control problem with endogenous delay. Nonlinear Anal 37: 31–56

Karatzas I, Shreve SE (1998) Methods of mathematical finance. Springer, New York

Karatzas I, Lehoczky JP, Shreve SE (1987) Optimal portfolio and consumption decisions for a ‘Small Investor’ on a finite horizon. SIAM J Control Optim 27: 1157–1186

Korn R (2005) Optimal portfolios with a positive lower bound on final wealth. Quant Finance 5: 315–321

Korn R, Korn E (2001) Option pricing and portfolio optimization. Oxford University Press, Oxford

Lakner P, Nygren LM (2006) Portfolio optimization with downside constraints. Math Finance 16: 283–299

Merton RC (1969) Lifetime portfolio selection under uncertainty: the continuous-time case. Rev Econ Stat 51: 247–257

Merton RC (1971) Consumption and portfolio rules in a continuous-time model. J Econ Theory 3: 373–413

Pliska SR (1986) A stochastic calculus model of continuous trading: optimal portfolios. Math Oper Res 11: 371–382

Segal U, Spivak A (1990) First order versus second order risk aversion. J Econ Theory 51: 111–125

Tahar IB, Soner HM, Touzi N (2007) The dynamic programming equation for the problem of optimal investment under capital gains taxes. SIAM J Control Optim 46: 1779–1801

Westray N, Zheng H (2009) Constrained nonsmooth utility maximization on the positive real line. Preprint

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Seifried, F.T. Optimal investment with deferred capital gains taxes. Math Meth Oper Res 71, 181–199 (2010). https://doi.org/10.1007/s00186-009-0291-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00186-009-0291-8