Abstract

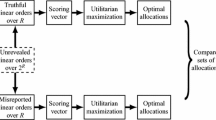

It is well known that any decision efficient, budget balanced, and envy-free mechanism for allocating a single object with transfers is vulnerable to manipulation. In this paper we examine whether the possible manipulations can have a serious impact on the outcome. Specifically, we examine which allocations are realized in the direct revelation game of any rule satisfying certain normative properties. For this class of rules we show that decision efficient, budget balanced, and envy-free allocations are the only ones realized through an ɛ-Nash equilibrium for any sufficiently small ɛ > 0.

Similar content being viewed by others

References

Alcalde J (1996) Implementation of stable solutions to marriage problems. J Econ Theory 69: 240–254

Alkan A, Demange G, Gale D (1991) Fair allocation of indivisible goods and criteria of justice. Econometrica 59: 1023–1039

Ando K, Kato M, Ohseto S (2008) Strategy-proof and symmetric allocation of an indivisible good. Math Soc Sci 55: 14–23

Beviá C (1996) Identical preferences lower bound solution and consistency in economies with indivisible goods. Soc Choice Welf 13: 113–126

Beviá C (2001) Manipulation games in economies with indivisible goods. mimeo, Universitat Autònoma de Barcelona

Bochet O, Sakai T (2007) Strategic manipulations of multi-valued solutions in economies with indivisibilities. Math Soc Sci 53: 53–68

Bochet O, Sakai T (2008) Preference manipulations lead to the uniform rule. mimeo, University of Bern and Yokohama National University

Clarke E (1971) Multi-part pricing of public goods. Public Choice 11: 17–33

Foley D (1967) Resource allocation and the public sector. Yale Econ Essays 7: 45–98

Fujinaka Y, Sakai T (2007a) The manipulability of fair solutions in allocation of an indivisible object with money. J Public Econ Theory 9: 993–1011

Fujinaka Y, Sakai T (2007b) Maskin monotonicity in economies with indivisible goods with money. Econ Lett 94: 253–258

Fujinaka Y, Sakai T (2008) Mechanism design and the manipulation games of fair division. mimeo, Osaka University and Yokohama National University

Fujinaka Y, Wakayama T (2008) Secure implementation in economies with indivisible objects and money. Econ Lett 100: 91–95

Groves T (1973) Incentives in teams. Econometrica 41: 617–631

Holmström B (1979) Groves’ scheme on restricted domains. Econometrica 47: 1137–1144

Hurwicz L (1979) On the interaction between information and incentives in organization. In: Krippendorf K (eds) Communications and interactions in society. Scientific Publishers, New York, pp 123–147

Littlechild SC, Owen G (1973) A simple expression for the shapley value in a special case. Manage Sci 20: 370–372

Ma J (1995) Stable matchings and rematching-proof equilibria in a two-sided matching market. J Econ Theory 66: 352–369

Maskin E (1999) Nash equilibrium and welfare optimality. Rev Econ Stud 66: 23–38

Miyagawa E (2001) House allocation with transfers. J Econ Theory 100: 329–355

Moulin H (1990) Fair division under joint ownership: recent results and open problems. Soc Choice Welf 7: 149–170

Moulin H (1992) An application of the shapley value to fair division with money. Econometrica 60: 1331–1349

Ohseto S (1999) Strategy-proof allocation mechanisms for economies with an indivisible good. Soc Choice Welf 16: 121–136

Ohseto S (2000) Strategy-proof and efficient allocation of an indivisible good on finitely restricted preference domains. Int J Game Theory 29: 365–374

Ohseto S (2004) Implementing egalitarian-equivalent allocation of indivisible goods on restricted domains. Econ Theory 23: 659–670

Ohseto S (2006) Characterizations of strategy-proof and fair mechanisms for allocating indivisible goods. Econ Theory 29: 111–121

Otani Y, Sicilian J (1982) Equilibrium and Walras preference games. J Econ Theory 27: 47–68

Otani Y, Sicilian J (1990) Limit properties of equilibrium allocations of Walrasian strategic games. J Econ Theory 51: 295–312

Postlewaite A, Wettstein D (1989) Feasible and continuous implementation. Rev Econ Stud 56: 603–611

Saijo T, Sjöström T, Yamato T (2007) Secure implementation. Theor Econ 2: 203–229

Saijo T, Tatamitani Y, Yamato T (1996) Toward natural implementation. Int Econ Rev 37: 941–980

Sakai T (2005) Fair waste pricing: an axiomatic analysis to the NIMBY problem. mimeo, Yokohama National University

Sakai T (2007) Fairness and implementability in allocation of indivisible objects with monetary compensations. J Math Econ 43: 549–563

Schummer J (2000) Eliciting preferences to assign positions and compensation. Games Econ Behav 30: 293–318

Shapley LS (1953) A value for n-person games. In: Kuhn HW, Tucker AW (eds) Contributions to the theory of games, vol II. Ann Math Stud 28:307–317

Shin S, Suh S-C (1996) A mechanism implementing the stable rule in marriage problems. Econ Lett 51: 185–189

Sobel J (1981) Distortion of utilities and the bargaining problem. Econometrica 49: 597–619

Sönmez T (1997) Games of manipulation in marriage problems. Games Econ Behav 67: 677–689

Sprumont Y (1991) The division problem with single-peaked preferences: a characterization of the uniform allocation rule. Econometrica 59: 509–519

Svensson LG (1983) Large indivisibles: an analysis with respect to price equilibrium and fairness. Econometrica 51: 939–954

Svensson L-G, Larsson B (2002) Strategy-proof and nonbossy allocation of indivisible goods and money. Econ Theory 20: 483–502

Tadenuma K, Thomson W (1993) The fair allocation of an indivisible good when monetary compensations are possible. Math Soc Sci 25: 117–132

Tadenuma K, Thomson W (1995a) Games of fair division. Games Econ Behav 9: 191–204

Tadenuma K, Thomson W (1995b) Refinements of the no-envy solution in economies with indivisible goods. Theory Decis 39: 186–206

Takamiya K (2009) Preference revelation games and strong cores of allocation problems with indivisibilities. J Math Econ 45: 199–204

Tatamitani Y (1994) Coalition formation in games of fair division. Econ Lett 44: 371–376

Thomson W (1984) The manipulability of resource allocation mechanisms. Rev Econ Stud 51: 447–460

Thomson W (1987) The vulnerability to manipulative behavior of resource allocation mechanisms designed to select equitable and efficient outcomes. In: Groves T, Radner R, Reiter S (eds) Information, incentives, and economic mechanisms: essays in honor of leonid hurwicz. University of Minnesota Press, Minnesota, pp~375–396

Thomson W (1988) The manipulability of the Shapley value. Int J Game Theory 17: 101–127

Thomson W (2004) Manipulation of solutions to the problem of fair division when preferences are single-peaked. mimeo, University of Rochester

Thomson W (2008) Fair allocation rules In: Arrow K, Sen A, Suzumura K (eds) Handbook of social choice and welfare. North-Holland, Amsterdam (forthcoming)

Vickrey W (1961) Counterspeculation, auctions, and competitive sealed Tenders. J Finance 16: 8–37

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper was formerly circulated under the title “Allocations most realizable through strategic manipulation”. The authors are grateful to an anonymous referee, Shinji Ohseto, and Rakesh Vohra for their very detailed comments. They also thank seminar/conference participants at Kobe University, Osaka University, Kyoto University, University of Tokyo, the Spring 2006 meeting of Japanese Economic Association at Fukushima University, and the eighth international meeting of the Society for Social Choice and Welfare in Istanbul for helpful comments. Sakai acknowledges the financial support by KAKENHI (19310031).

Rights and permissions

About this article

Cite this article

Fujinaka, Y., Sakai, T. The positive consequence of strategic manipulation in indivisible good allocation. Int J Game Theory 38, 325–348 (2009). https://doi.org/10.1007/s00182-009-0156-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00182-009-0156-7

Keywords

- Consequence of strategic manipulation

- Nash implementation

- Mechanism design

- Existence of ɛ-Nash equilibrium

- Strategy-proofness

- Indivisible good