Abstract

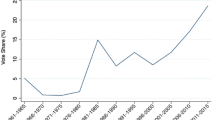

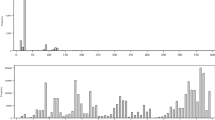

This paper investigates the impact of US partisan conflict index (PCI) on international stock markets. It extracts innovations from a VAR model and estimates regression specifications. The results document that PCI has a substantial explanatory power. This effect is unique given that (i) traditional disagreement measures per se have no explanatory power, and (ii) neither macroeconomic, nor financial uncertainty measures can undermine the power of PCI. The effect appears to be stronger during periods when the Republican Party is in power. Findings further suggest that this linkage could be seen through the prism of both macroeconomic activity and discount rates.

Similar content being viewed by others

References

Ang A, Bekaert G (2002) International asset allocation with regime shifts. Rev Financial Stud 15:1137–1187

Atmaz A, Basak S (2018) Belief dispersion in the stock market. J Finance 73:1225–1279

Azzimonti M (2018) Partisan conflict and private investment. J Monet Econ 93:114–131

Azzimonti M (2019a) Partisan conflict, news, and investors’ expectations. J Money Credit Bank 47:1223–1238

Azzimonti M (2019b) Does partisan conflict deter FDI inflows to the US? J Int Econ 120:162–178

Baker SR, Bloom N, Davis SJ (2016) Measuring economic policy uncertainty. Q J Econ 131:1593–1636

Bali TG, Brown SJ, Caglayan MO (2014) Macroeconomic risk and hedge fund returns. J Financial Econ 114:1–19

Banerjee S (2011) Learning from prices and the dispersion in beliefs. Rev Financial Stud 24:3025–3068

Belsley DA, Kuh E, Welsch RE (1980) Regression diagnostics: identifying influential data and sources of collinearity. Wiley, New York

Bilgin MH, Gozgor G, Lau CK, Sheng X (2018) The effects of uncertainty measures on the price of gold. Int Rev Financial Anal 58:1–7

Bloom N (2009) The impact of uncertainty shocks. Econometrica 77:623–685

Cai Y, Wu Y (2019) Time-varied causality between US partisan conflict shock and crude oil return. Energy Econ. https://doi.org/10.1016/j.eneco.2019.104512

Caldara D, Iacoviello M (2018) Measuring geopolitical risk. International Finance Discussion Paper, No. 1222, Board of Governors of the Federal Reserve System

Campbell JY, Giglio S, Polk C, Turley R (2018) An intertemporal CAPM with stochastic volatility. J Finance Econ 128:207–233

Ceylan Ö (2015) Limited information-processing capacity and asymmetric stock correlations. Quant Finance 15:1031–1039

Cheng CHJ, Hankins WB, Chiu C-W (2016) Does US partisan conflict matter for the Euro area? Econ Lett 138:64–67

Choi H, Mueller P, Vedolin A (2017) Bond variance risk premiums. Rev Finance 21:987–1022

Christiano LJ, Eichenbaum M, Evans CL (2005) Nominal rigidities and the dynamic effects of a shock to monetary policy. J Polit Econ 113:1–45

Claude Beaulieu M, Jean-Claude C, Naceur E (2005) The impact of political risk on the volatility of stock returns: the case of Canada. J Int Bus Stud 36:701–718

D’Mello R, Toscano F (2020) Economic policy uncertainty and short-term financing: the case of trade credit. J Corp Finance. https://doi.org/10.1016/j.jcorpfin.2020.101686

Davis SJ (2016) An index of global economic policy uncertainty. NBER working paper series, working paper 22740

Dungey M, Fry R, Gonzalez-Hermosillo B, Martin VL (2005) Empirical modeling of contagion: a review of methodologies. Quant Finance 5:9–24

Elliott G, Rothenberg TJ, Stock JH (1996) Efficient tests for an autoregressive unit root. Econometrica 64:813–836

Engle R (2002) Dynamic conditional correlation. J Bus Econ Stat 20:339–350

Goyal A, Welch I (2008) A comprehensive look at the empirical performance of equity premium prediction. Rev Financial Stud 21:1455–1508

Greenwood J, Hercowitz Z, Huffman GW (1988) Investment, capacity utilization, and the real business cycle. Am Econ Rev 78:402–417

Gupta R, Muteba Mwamba JW, Wohar ME (2018a) The role of partisan conflict in forecasting the U.S. equity premium: a nonparametric approach. Finance Res Lett 25:131–136

Gupta R, Pierdzioch C, Selmi R, Wohar ME (2018b) Does partisan conflict predict a reduction in US stock market (realized) volatility? Evidence from a quantile-on-quantile regression model. North Am J Econ Finance 43:87–96

Hoerl AE, Kennard RW (1970) Ridge regression: biased estimation for nonorthogonal problems. Technometrics 12:55–67

Jiang X, Shi Y (2018) Does US partisan conflict affect US-China bilateral trade? Int Rev Econ Finance. https://doi.org/10.1016/j.iref.2018.12.005

Jiang Y, Ren Y-S, Ma C-Q, Liu J-L, Sharp B (2020) Does the price of strategic commodities respond to U.S. partisan conflict? Resour Policy. https://doi.org/10.1016/j.resourpol.2020.101617

Jurado K, Ludvigson SC, Ng S (2015) Measuring uncertainty. Am Econ Rev 105:1177–1216

Kang W, Ratti RA (2015) Policy uncertainty in China, oil shocks and stock returns. Econ Transit 23:657–676

Karolyi GA, Stulz RM (2003) Are financial assets priced locally or globally? In: Constantinides GM, Harris M, Stulz RM (eds) Handbook of the economics of finance. Elsevier North-Holland, Amsterdam, pp 975–1020

Liu L, Zhang T (2015) Economic policy uncertainty and stock market volatility. Financial Res Lett 15:99–105

Matousek R, Panopoulou E, Papachristopoulou A (2020) Policy uncertainty and the capital shortfall of global financial firms. J Corp Finance. https://doi.org/10.1016/j.jcorpfin.2020.101558

Moore RE, Aguinaldo J (2020) Blue chip economic indicators. https://doi.org/10.7910/DVN/M2WNLO, Harvard Dataverse, V4

O’Brien RM (2007) A caution regarding rules of thumb for variance inflation factors. Qual Quant 41:673–690

Passari E, Rey H (2015) Financial flows and the international monetary system. Econ J 125:675–698

Pastor L, Veronesi P (2018) Political cycles and stock returns. NBER working paper, no. 23184

Peng L, Xiong W, Bollerslev T (2007) Investor attention and time-varying comovements. Eur Financial Manag 13:394–422

Pham AV (2019) Political risk and cost of equity: the mediating role of political connections. J Corp Finance 56:64–87

Santa-Clara P, Valkanov R (2003) The presidential puzzle: political cycles and the stock market. J Finance 58:1841–1872

Shanken J (1992) On the estimation of beta-pricing models. Rev Financial Stud 5:1–33

Funding

The authors did not receive support from any organization for the submitted work.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no relevant financial or non-financial interests to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Apergis, N., Chatziantoniou, I. US partisan conflict shocks and international stock market returns. Empir Econ 63, 2817–2854 (2022). https://doi.org/10.1007/s00181-022-02237-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-022-02237-1