Abstract

The international comparative evidence on the nexus between finance and growth is ambiguous, owing to the many difficulties in isolating finance, separating its growth effect from that of the other factors. To overcome this problem, we study the effects of financial development on growth from 1960 to 2010 in one country—Italy. Thus, we have the same political, legal and regulatory framework but also sharply differing development conditions between regions. After World War II, Italy achieved an “economic miracle” similar to what China and India are now experiencing, followed by a lengthy phase of decline. Accordingly, we can distinguish the effect of financial development on growth from other potential causal factors while also considering regions with sharply different economic conditions. Our results show that from 1960 to 1980, when the Italian “economic miracle” was still under way, finance played no significant role in favouring the surge in economic growth, which most likely depended on internal consumption. Between 1980 and 2010, by contrast, the great expansion of Italian financial markets and institutions did have a positive effect on regional economic performance, but overall growth rates were nevertheless low. Although our empirical evidence supports the view that finance is more important for growth in less highly developed regions, it also shows that financial development has not helped to overcome the Italian economic divide.

Similar content being viewed by others

Notes

Schumpeter maintains that banks promote growth by selecting the entrepreneurs with the most innovative and productive projects, whereas Robinson contends that enterprise leads and finance follows. For recent surveys on the question, see Pagano (1993), Levine (1997, 2004), Trew (2006), Papaioannou (2007).

Papaioannou (2007) provides evidence that even the mechanism whereby finance affects growth differs with degree of development: in underdeveloped and emerging countries, financial development fosters aggregate growth mainly by lowering the cost of capital, in advanced economies by raising total factor productivity.

The South of Italy includes some of the poorest regions in all of Europe, while in the North, we find many of the richest. Throughout this paper, for brevity, we group all the regions not in the South of Italy, ordinarily defined as “Center”, “North-West” and “North-East”, together as “North”. Likewise, “South” and “Islands” are called collectively “South”.

Some economists (e.g. Graziani 1969) see this export-led characteristic as crucial to the Italian economic success of the postwar period, but this is not the only explanation of the “economic miracle”. Others argue that the main role was played by domestic demand (Ciocca et al. 1975; Zamagni 1992; Onofri et al. 1994). While Ciocca et al. (1975) ascribe the growth between 1950 and 1957 mainly to government housing policy (the “Fanfani plan”), Zamagni (1992) maintains that in the 1960s, most Italian households had no durable goods such as TV, refrigerator and washing machine, and therefore had a powerful drive towards the American pattern of consumption, although with some selectivity and ponderation. This shift of demand towards consumer durables had positive effects on the expansion of domestic industries (Zamagni 1992, pp. 204–205). Onofri et al. (1994) offer a similar argument, suggesting that the adoption of new consumption patterns from abroad may have been a vehicle of growth, while technology appears to have followed the changing patterns produced by international integration (Onofri et al. 1994, p. 60).

The slowdown of the Italian economy over recent decades appears to have both external and domestic causes. The former consist essentially in the rise of new industrializing and industrial countries—at first such relatively small nations as South Korea, Taiwan and Singapore, more recently such emerging giants as China, India and Brazil—which drastically undermined the competitive position of the Italian economy. Among the domestic factors in the decline, many economists include the structure of the Italian production system (unfit to take advantage of technological innovations), the slowdown in productivity growth, the labour market and lack of R&D investment (Orsi and Turino 2010).

The decline was due to both demand and supply effects. On the demand side, economic growth slowed down, while on the supply side, the monetary authorities set lending ceilings for banks in order to curb inflation.

Indeed, the Italian economic miracle started in the 1950s, but, since detailed data are not available at regional level for this decade, our investigation—starting in 1960—does not fully capture this phenomenon. In addition, it is useful to note that in 1999, Istat (the Italian Statistical Institute) introduced a new system of national and regional accounts—SEC95—in accordance with the guidelines of the new ESA95. Hence, for the last decade (2000–2010), our data on value added growth are based on the new accounting system.

Of course, it is difficult from these data to draw conclusions on the relative efficiency of banking institutions throughout the fifty years of our investigation as well as between the two areas of the country. As examples, due to technical progress or institutional changes (e.g. public versus private banks or commercial versus universal banks), the production function of credit institutions changed along our sample period. In addition, relative efficiency of the banks in the North and South may be affected by the different sizes and risks of the borrowers in the two areas of the country.

See Sect. 1 for some references.

It is necessary to briefly address here two issues: to what extent investments proxy the demand for loans, and which is the role of regional loans in the supply of finance to the firms belonging to that specific region. Broadly speaking, firms can finance investments through the capital market and the loan market. However, Italian firms are generally found to be undercapitalized, and the Italian financial system is widely recognized to be bank-based. Moreover, also government-financed investments were funded by the banking system. Regarding the supply of finance, although firms close to the regional border may rely also on banks located in other regions, Alessandrini et al. (2005) have shown that geographic closeness to the headquarter of the bank is a relevant issue for Italian firms even in recent years, suggesting that cross-border finance may not be a relevant issue. However, according to the Bank of Italy, the relevant local market for loans in Italy is the regional market.

Piedmont, Valle D’Aosta, Lombardy, Liguria, Veneto, Trentino Alto Adige, Friuli Venezia Giulia, Emilia Romagna, Tuscany, Umbria, Marche, Lazio, Abruzzo, Molise, Campania, Basilicata, Puglia, Calabria, Sicily and Sardinia. We take the regional level for lack of more disaggregated data, but it is worth noting again that the Bank of Italy considers the region as the relevant market area for bank lending.

Even though the loan/GDP ratio and the number of workers in the financial sector are widely used in the literature as financial development indicators, they are not without problems. Total loans are affected by monetary policy as well as by the demand for loans, which may be external to banking behaviour. Moreover, the number of workers in the financial sector may not fully capture the contribution of finance to growth if there is technical progress, which significantly increases workers’ productivity in the banking and financial sectors. Taking account that our data involve half a century, this is certainly the case. Therefore, the conclusions derived later are based on problematic indicators. Nonetheless, our results show that these variables are significant in the decades in which technical progress was more effective.

Nevertheless, we consider FINWORK to be a more reliable indicator of financial development; LOANSGDP is weakened by occasional changes in the way of banks’ loans were recorded in the accounts, at the instructions of the Bank of Italy.

This is also one of the findings of Rajan and Zingales (1998): industries that invest heavily grow faster in countries with more highly developed financial markets (p. 583).

We ran all the regressions for five-year periods as well, but the results are practically identical, so we do not report them here (they are available upon request).

We follow the classification used by Bank of Italy. Hence, “North-West” comprises Piedmont, Valle D’Aosta, Lombardy and Liguria; “North-East” covers Veneto, Trentino Alto Adige, Friuli Venezia Giulia and Emilia Romagna; “Center” is Tuscany, Umbria, Marche and Lazio; “South” comprises Abruzzo, Molise, Campania, Basilicata, Puglia, Calabria, Sicily and Sardinia.

We were obliged to use collective consumption rather than public works spending (probably a better proxy for the role of government intervention) for lack of data prior to 1970. In any event, for the thirty years in which both data series are available, the two are quite closely correlated.

Exports and consumption are commonly not included in theoretical growth models. However, we incorporate them in the econometric specification because the main literature related to the Italian economic growth (e.g. Ciocca et al. 1975; Graziani 1969) holds that these two variables were the main sources of the Italian development since World War II (see also Sect. 2). Moreover, we aim to test their role as alternative sources of growth.

However, the use of start-of-period values as an instrument to avoid endogeneity fails in the presence of forward-looking expectations.

We have also checked whether our instruments are weak (i.e. whether they are weakly correlated with the endogenous variables). For the purpose, among the various tests suggested by Stock et al. (2002), we have used the Anderson-Rubin statistics (Anderson and Rubin 1949), whose null hypothesis is that the coefficients of the endogenous regressors in the structural equation are jointly equal to zero. Since in our estimations the null hypothesis is rejected at the 1 % level (with a chi-square value of 21.28), our instruments can be regarded as valid under this respect.

It should be noted that a Granger causality test does not resolve conclusively the issue of the causation link between finance and growth, which is more complex and needs a thorough understanding of the relationships between the main economic variables.

A better time horizon for our investigation would have been 1950–2010, but no region-level data are available before 1960.

In our estimation, we include only the interaction between the investment intensity and financial development variables, in line with previous studies on similar topics (e.g. Rajan and Zingales 1998; Manning 2003; Fernandez de Guevara and Maudos 2009; Laeven and Valencia 2013; Fernandez et al. 2013). When we also add INVVA and FINWORK as separate variables, it comes out that none of them exhibits a significant coefficient (both individually and jointly); at the same time, the \(INVVA \times FINWORK\) term loses its significance. Considering LOANSGDP in place of FINWORK leads to the same result.

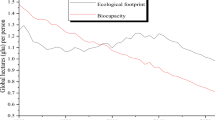

Figure 1 shows that the trend lines for the GDP growth rate in Italy before and after 1980 are sharply different.

All the unreported estimation tables of the paper are available upon request.

References

Alessandrini P, Croce M, Zazzaro A (2005) The geography of banking power: the role of functional distance. Banca Nat Lav Q Rev 63:129–167

Anderson TW, Rubin H (1949) Estimation of the parameters of a single equation in a complete system of stochastic equations. Ann Math Stat 20:46–63

Beck T, Levine R (2004) Stock markets, banks, and growth: Panel evidence. J Bank Financ 28:423–442

Beck T, Levine R, Loayza N (2000) Finance and the sources of growth. J Financ Econ 58:261–300

Carlino G, DeFina R (1999) The differential regional effects of monetary policy: evidence from the U.S. States. J Reg Sci 39:339–358

Cetorelli N, Gambera M (2001) Banking market structure, financial dependence and growth: international evidence from industry data. J Financ 56:617–648

Ciocca P, Filosa R, Rey G (1975) Integration and development of the Italian economy, 1951–1971: a re-examination. Banca Nat Lav Q Rev 29:284–320

Clausen V, Hayo B (2006) Asymmetric monetary policy effects in EMU. Appl Econ 38:1123–1134

Davidson R, MacKinnon JG (1993) Estimation and inference in econometrics. Cambridge University Press, New York

Dedola L, Lippi F (2000) The monetary transmission mechanism: evidence from the industry data of five OECD countries. CEPR Discuss Paper, 2508

Demetriades PO, Hussein KA (1996) Does financial development cause economic growth? Time series evidence from sixteen countries. J Dev Econ 51:387–411

Eckaus R (1961) The North–South differential in Italian economic development. J Econ Hist 20:285–317

Favara G (2003) An empirical reassessment of the relationship between finance and growth. IMF Working Paper, 123

Fernandez de Guevara J, Maudos J (2009) Regional financial development and bank competition: effects on firms’ growth. Reg Stud 43:211–228

Fernandez AI, Gonzalez F, Suarez N (2013) How do bank competition, regulation, and institutions shape the real effect of banking crises? International evidence. J Int Mon Fin 33:19–40

Fisman R, Love I (2004) Financial development and growth in the short and long run. NBER Working Paper, 10236

Gillman M, Kejak M (2005) Inflation and balanced-path growth with alternative payment mechanisms. Econ J 115:247–270

Granger CWJ (1969) Investigating casual relations by econometric models and cross-spectral methods. Econometrica 37:424–438

Graziani A (1969) Lo sviluppo di un’economia aperta (The development of an open economy). ESI, Naples

Guiso L, Sapienza P, Zingales L (2004) Does local financial development matter? Q J Econ 119:929–969

Hayo B, Uhlenbrock B (2000) Industry effects of monetary policy in Germany. In: Von Hagen J, Waller C (eds) Regional aspects of monetary policy in Europe. Kluwer, Boston, pp 127–158

Hesse H (2008) Export diversification and economic growth. Commission on Growth and Development Working paper, 21

King RG, Levine R (1993) Finance and growth: Schumpeter might be right. Q J Econ 108:717–738

La Porta R, Lopez-de-Silanes F, Shleifer A, Vishny RW (1998) Law and finance. J Polit Econ 106:1113–1155

Laeven L, Valencia F (2013) The real effects of financial sector interventions during crises. J Mon Credit Bank 45:147–177

Levine R (1997) Financial development and economic growth: views and agenda. J Econ Lit 35:688–726

Levine R (2004) Finance and growth: theory and evidence. NBER Working Paper, 10766

Levine R, Zervos S (1998) Stock markets, banks, and economic growth. Am Econ Rev 88:537–558

Levine R, Loayza N, Beck T (2000) Financial intermediation and growth: causality and causes. J Monet Econ 46:31–77

Lutz V (1962) Italy: a study in economic development. Oxford University Press, London

Mankiw NG, Romer D, Weil DN (1992) A contribution to the empirics of economic growth. Q J Econ 107:407–437

Manning MJ (2003) Finance causes growth: can we be so sure? Contributions to macroeconomics. BE J Macroecon 3(1):12

Mauro L, Podrecca E (1994) The case of Italian regions: convergence or dualism? Econ Notes 23:447–472

Onida F (2010) Vantaggi competitivi internazionali dell’Italia e loro prospettive nella dinamica dei mercati e dei concorrenti (Competitive advantages of Italy and perspectives in relation to the dynamics of the markets and of the competitors). Unpublished paper presented at the Conference “Il modello di sviluppo dell’economia italiana dopo mezzo secolo (The Italian economic development model after fifty years)”, Università della Calabria, Italy, April 26–27

Onofri P, Paruolo P, Salituro B (1994) On the sources of fluctuation of the Italian economy: a structural VAR analysis. In: Baldassarri M, Annunziato P (eds) Is the economic cycle still alive?. St. Martin’s Press, New York, pp 33–64

Orsi R, Turino F (2010) The last fifteen years of stagnation in Italy. Dipartimento Scienze Economiche Working Paper, 707. University of Bologna, Bologna

Paci R, Saba A (1998) The empirics of regional economic growth in Italy: 1951–1993. Riv Int Sci Econ Commun 45:515–542

Pagano M (1993) Financial markets and growth: an overview. Eur Econ Rev 37:613–622

Papaioannou E (2007) Finance and growth. A macroeconomic assessment of the evidence from a European angle. ECB Working Paper, 787

Peersman G, Smets F (2002) The industry effects of monetary policy. ECB Working Paper, 165

Pindyck RS, Rubinfeld DL (1991) Econometric models and economic forecasts. McGraw Hill, New York

Rajan R, Zingales L (1998) Financial dependence and growth. Am Econ Rev 88:559–587

Reinhart CM, Rogoff KS (2009) This time is different. Eight centuries of financial folly. Princeton University Press, Princeton

Rioja F, Valev N (2004) Does one size fit all? A reexamination of the finance and growth relationship. J Dev Econ 74:429–447

Robinson J (1952) The rate of interest and other essays. Macmillan, London

Romero Avila D (2007) Finance and growth in the EU: new evidence from the harmonisation of the banking industry. J Bank Financ 31:1937–1954

Rousseau PL, Wachtel P (2000) Equity markets and growth: cross-country evidence on timing and outcomes, 1980–1995. J Bank Financ 24:1933–1957

Rousseau PL, Wachtel P (2009) What is happening to the impact of financial deepening on economic growth? Vanderbilt University Working Paper, 09–W15

Schumpeter JA (1912) The theory of economic development (translated by R. Opie). Harvard University Press, Cambridge

Stock JH, Wright JH, Yogo M (2002) A survey of weak instruments and weak identification in generalized method of moments. J Bus Econ Stat 20:518–529

Trew A (2006) Finance and growth: a critical survey. Econ Rec 82:481–490

Zamagni V (1992) The Italian ‘economic miracle’ revisited: new markets and American technology. In: Di Nolfo E (ed) Power in Europe, vol 2. De Gruyter, Berlin, pp 197–226

Acknowledgments

We wish to thank an anonymous referee, the participants to the IV International MAF Conference (Ravello, Italy), the International Workshop on “The Pro-Development Role of Banking and Finance in the Economic Periphery” (Bellagio, Italy), the 51th SIE Conference (Catania, Italy), and the 4th GEBA International Conference (Iasi, Romania) for helpful comments and discussions on earlier drafts of this paper. All remaining errors are our own responsibility.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Coccorese, P., Silipo, D.B. Growth without finance, finance without growth. Empir Econ 49, 279–304 (2015). https://doi.org/10.1007/s00181-014-0844-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-014-0844-4