Abstract

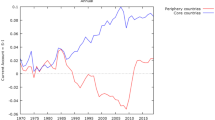

In this paper we test for the existence of a stable long-run savings–investments relationship in 18 OECD economies over the period 1970–2007. Although individual modelling provides only very weak support to the hypothesis of a link between savings and investments, this cannot be ruled out as individual time series tests may have low power. We thus construct a new bootstrap test for panel cointegration robust to short- and long-run dependence across units. This test provides evidence of a long-run savings–investments relationship in most of the countries, with USA the most notable exception. However, the elasticities generally smaller than 1 suggest that market imperfections mostly cause only partial home biases.

Similar content being viewed by others

Notes

Austria, Australia, Belgium, Canada, Denmark, Finland, Germany, Greece, Ireland, Italy, Japan, the Netherlands, Portugal, Sweden, UK and USA.

The survey by Apergis and Tsoumas (2009) lists nearly 200 references.

Since ratios are constrained to lie in the [0,1] interval deterministic trends are out of question, and the tests include only a constant.

The DOLS estimate of the coefficient is -4.32, with a standard error of 0.65, while the FM-OLS estimate is \(-\)2.97, with a standard error of 0.40.

Note that the entire vector of \(T\) block lengths will be used only if \(L_{t} = 1\; \forall t\), a highly unlikely case which in principle cannot nevertheless be ruled out. Typically the number of blocks chained will be much smaller than \(T\).

It may also be added that any proof of validity under dependence will be confined to some specific dependence structure, leaving open the question for other structures.

Note that, although for simplicity we consider here the case of a single right-hand side variable, the algorithm is trivially generalised to the case of multivariate models.

Chang and Nguyen (2012) consider also a test based on the minimum, claimed to be best suited to detect the case of cointegration holding in a small fraction of the units. Our procedure can obviously automatically handle this case, but since we do not believe it to be an empirically interesting hypothesis (in fact, it could be argued that in this case the panel is best defined as not cointegrated) we will not examine it.

Exploratory simulations showed the performances of the test to be independent on the number of independent variables.

Consistent with the tendency to overreject the \(\text{ Max }_\mathrm{HEG}\) test its \(p\)-value is slightly smaller than both the other \(p\)-values. To check the robustness of the results we also computed the tests with other mean block lengths, more precisely 4 and 8, obtaining \(p\)-values differing atmost by 0.02 from those reported here.

In other terms, we compute tests with fixed null and alternative hypotheses (respectively, \(H_{0}\):‘cointegration in no unit’ and \(H_{1}\):‘cointegration in all units’) on a sequence of nested panels of increasing size. Standard sequential tests, such as those proposed by Smeekes (2010), keep sample size and \(H_{0}\) fixed, and change systematically \(H_{1}\) (here: in step 1 ‘cointegration at least in units 1–5’, in step 2 ‘cointegration at least in units 1–6’, etc.).

FM-OLS delivers a broadly consistent picture. Very few contrasting point estimates are easily explained by the rather large standard errors.

Three more countries were dropped from the analysis: Greece, where the two variables have been linked by an inverse relationship not compatible with the FH set-up, the Netherlands and Portugal, where the investment/GDP ratios appear stationary while savings/GDP do not.

References

Apergis N, Tsoumas C (2009) A survey of the Feldstein Horioka puzzle: what has been done and where we stand. Res Econom 63:64–76

Bai J, Carrion-i-Silvestre JL (2005) Testing panel cointegration with unobservable dynamic common factors. mimeo, University of Barcelona

Bai J, Ng S (2004) A PANIC attack on unit roots and cointegration. Econometrica 72:1127–1177

Banerjee A, Carrion-i-Silvestre JL (2006) Cointegration in panel data with breaks and cross-section dependence. Working Paper Series n. 591. European Central Bank, Frankfurt

Banerjee A, Wagner M (2009) Panel methods to test for unit roots and cointegration. In: Mills TC, Patterson K (eds) Palgrave handbook of econometrics, vol 2: applied econometrics. Palgrave Macmillan, London

Banerjee A, Zangheri P (2003) A new look at the Feldstein–Horioka puzzle using an integrated Panel. CEPII, Working Paper No. 2003-22.

Banerjee A, Dolado J, Mestre R (1998) Error-correction mechanism tests for cointegration in single-equation framework. J Time Ser Anal 19:267–283

Banerjee A, Marcellino M, Osbat C (2004) Some cautions on the use of panel methods for integrated series of macro-economic data. Econom J 7:322–340

Blanchard O, Giavazzi F (2002) Current account deficits in the Euro area: the end of the Feldstein–Horioka puzzle? Brookings Pap Econom Act 2:147–209

Breitung J, Pesaran MH (2008) Unit roots and cointegration in panels. In: Matyas L, Sevestre P (eds) The econometrics of panel data. Kluwer, Dordrecht

Chakrabarti A (2006) The saving–investment relationship revisited: new evidence from multivariate heterogeneous panel cointegration analyses. J Comp Econom 34:402–419

Chang Y, Nguyen CM (2012) Residual based tests for cointegration in dependent panels. J Econom 167: 501–520

Chang Y, Song W (2009) Testing for unit roots in small panels with short-run and long-run cross-sectional dependencies. Rev Econom Stud 76:903–935

Chinn MD, Ito H (2008) A new measure of financial openness. J Comp Policy Anal Res Pract 10:309–322

Choi C-Y, Hu L, Ogaki M (2008) Robust estimation for structural spurious regressions and a Hausman-type cointegration test. J Econom 142:327–351

Coakley J, Fuertes AM, Spagnolo F (2004) Is the Feldstein Horioka puzzle history? Manch Sch 72:569–590

Di Iorio F, Fachin S (2012) A note on the estimation of long-run relationships in panel equations with cross-section linkages. Economics 6(20):1–18

Engle RF, Granger C (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica 55:251–276

Fachin S (2007) Long-Run trends in internal migrations in Italy: a study in panel cointegration with dependent units. J Appl Econom 22:401–428

Feldstein M (1982) Domestic savings and international capital movements in the long run and in the short run. NBER Working Paper Series n. 947

Feldstein M, Horioka C (1980) Domestic saving and international capital flows. Econo J 90:314–329

Gengenbach C, Palm F, Urbain JP (2006) Panel cointegration testing in the presence of common factors. Oxf Bull Econ Stat 68(S1):683–719

Gonzalo J (1994) Five alternative methods of estimating long-run equilibrium relationships. J Econom 60:203–233

Gregory AW, Hansen BE (1996) Residual-based tests for cointegration in models with regime shifts. J Econom 70:99–126

Gregory AW, Haug AA, Lomuto N (2004) Mixed signals among tests for cointegration. J Appl Econom 19:89–98

Hanck C (2009) For which countries did PPP hold? A multiple testing approach. Empir Econ 37:93–103

Hansen BE (1990) A powerful simple test for cointegration using Cochrane–Orcutt. Working Paper, University of Rochester

Harris D, Harvey DI, Leybourne SJ, Taylor AMR (2009) Testing for a unit root in the presence of a possible break in trend. Econom Theory 25:1545–1588

Jansen WJ (1996) Estimating saving–investment correlations: evidence for OECD countries based on error correction model. J Int Money Finance 15:749–781

Nelson E (2004) Monetary policy neglect and the great inflation in Canada, Australia, and New Zealand. Working Paper 2004–008A, Federal Reserve Bank of St. Louis

Obstfeld M, Rogoff K (2000) The six major puzzles in international macroeconomics: is there a common cause? NBER Working Paper Series n. 7777

Palm FC, Smeekes S, Urbain JP (2008) Cross-sectional dependence robust block bootstrap panel unit root tests. METEOR Research Memoranda n. 48, Maastricht Research School of Economics of Technology and Organization

Paparoditis E, Politis DN (2003) Residual-based block bootstrap for unit root testing. Econometrica 71: 813–855

Parker C, Paparoditis E, Politis DN (2006) Unit root testing via the stationary bootstrap. J Econom 133: 601–638

Pedroni P (1999) Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf Bull Econ Stat 61:653–670

Pedroni P (2004) Panel cointegration, asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econom Theory 20:597–625

Pelgrin F, Schich S (2008) International capital mobility: what do national saving–investment dynamics tell us? J Int Money Finance 27:331–344

Pesaran HM, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econom 16:289–326

Phillips PCB (1986) Understanding spurious regression in econometrics. J Econom 33:311–340

Phillips PCB, Ouliaris S (1990) Asympotic properties of residual based tests for cointegration. Econometrica 58:165–93

Politis DN, Romano JP (1994) The stationary bootstrap. J Am Stat Assoc 89:1303–1313

Savin NE (1984) Multiple hypothesis testing. In: Griliches Z, Intriligator M (eds) Handbook of econometrics, vol 2, chap 14. North-Holland, Amsterdam

Smeekes S (2010) Bootstrap sequential tests to determine the stationary units in a panel. Working Paper, Maastricht University

Taylor AM (2002) A century of current account dynamics. J Int Money Finance 21:725–748

Westerlund J (2008) Panel cointegration tests of the Fisher effect. J Appl Econom 23:193–233

Westerlund J, Constantini M (2009) Panel cointegration and the neutrality of money. Empir Econ 36:1–26

Westerlund J, Edgerton D (2007) A panel bootstrap cointegration test. Econom Lett 97:185–190

Acknowledgments

This is a completely revised version of a paper previously circulated with a similar title. Research supported by the Department of Political Sciences of the University of Naples Federico II, University of Rome ‘La Sapienza’ and MIUR. A GAUSS programme implementing the bootstrap panel cointegration test can be downloaded from http://w3.uniroma1.it/fachin/. Research supported by ‘La Sapienza’ grant n. 2011C26A1145RM and MIUR PRIN grant 2010J3LZEN. We are grateful to participants to seminars at the University of Rome ‘Tor Vergata’ and the Treasury Department of the Italian Ministry of Economy and Finance for comments and suggestions, to Massimo Franchi for many discussions, and to Yoosoon Chang and Chi Mai Nguyen for sharing their programmes for the computation of the IV test. Special thanks to two anonymous referees for their careful and extremely helpful reports. The usual disclaimers apply.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Asympotic validity of the RSB no cointegration test

The panel cointegration statistics proposed in this paper are akin to the group mean tests by Pedroni (1999, 2004). We will thus analogously investigate the asymptotic properties of the statistics by means of sequential limit arguments with T assumed to grow large prior to N. A detailed discussion of the implication of this type of asymptotics can be found in Pedroni (2004). For convenience, let us first recall the general set-up already introduced in Sect. 3.2. Let \(z_{it}=({y} _{it},x_{it})^{\prime }\), where \(t=1,\ldots , T\) and \(i = 1,\ldots , N\) index, respectively, the time periods and the cross section units, be integrated bivariate processes such that \( x_{it}=x_{it-1}+u_{it}^{x},y_{it}=\beta _{i}x_{it}+u_{it}^{y}\), where \( u_{it}^{x}\sim N(0,\sigma _{xi}^{2})\) and \(u_{it}^{y}\) may be either stationary (under cointegration, in which case \(\beta _{i}\) is the long-run elasticity of \(y_{it}\) to \(x_{it}\)) or not (in which case \(\beta _{i}\) is the short-run elasticity). Define further for a given unit \(i\) the AR(1)-filtered process \(v_{it}\) mapping the null hypothesis of no cointegration through the parameter \(\rho _{i}:\)

To establish the asymptotic validity of our panel bootstrap procedure we first of all need to prove, for a given unit \(i,\) that the results presented in PPP for unit root tests also hold when the object of interest is a vector of estimated cointegrating residuals. Recalling that in our case the unit root test is applied to the second-step residuals \(\widetilde{u}_{it}\), defined in Eq. (7), we need to show that the empirical coefficient statistic:

where \(\widetilde{\nu }_{it}=\widetilde{u}_{it}^{y}-\widetilde{\rho }_{i} \widetilde{u}_{it-1}^{y}\), and the bootstrap coefficient statistic:

where \(\widetilde{u}_{it}^{*}\) and \(\widetilde{v}_{it}^{*}\) are the analogues of \(\widetilde{u}_{it}\) and \(\widetilde{\nu }_{it}\) in the bootstrap world, have the same limiting distributions.

To this end, we need to assume the error processes and the estimators involved in (15) and (16) to satisfy some conditions. More precisely, we assume for each unit \(i\):

-

A1

The vector \(\eta _{it}^{\prime }=(u_{it}^{x},v_{it})\) is an independent component stationary ergodic process with zero mean and finite variance (see Phillips and Ouliaris 1990, henceforth PO, condition C1 and Eq. 3). Hence, \(\eta _{it}=\sum _{j=-\infty }^{\infty }A_{ij}\xi _{it-j}\) with \(\sum _{j=-\infty }^{\infty }\left\| A_{ij}\right\| <\infty \) and \(A_{i}(1)=\sum _{j=-\infty }^{\infty }A_{ij},\) where the \(\xi _{it-j}^{\prime }s\) are i.i.d. \((0,\Sigma _{i} )\) with \( \Sigma _{i} \) positive definite. All stationary ARMA processes satisfy these conditions.

-

A2

For the vector process \(\eta _{it}\) it holds that \(S_{iT}(r)=T^{-1/2}\sum _{t=1}^{[Tr]}\eta _{it}\rightarrow B_{i}(r)\), \(r \in [0,1],\) where \(B_{i}(r)\) is a bivariate Brownian motion with covariance matrix

$$\begin{aligned} \Omega _{i} =\underset{T\rightarrow \infty }{\lim }T^{-1}E\left[ \left( \sum _{t=1}^{T}\eta _{it}\right) ^{\prime }\left( \sum _{t=1}^{T}\eta _{it}\right) \right] . \end{aligned}$$ -

A3

For \(v_{it}\) and \(u_{it}^{y}\) conditions (i)–(v) in PPP hold, so that:

-

(i)

\(\mathrm I\!E \left| v_{it}\right| ^{6+\delta }<\infty \);

-

(ii)

\(\mathrm I\!E \left| u_{it}^{y}\right| ^{6+\delta }<\infty ;\)

-

(iii)

\((\alpha \)-mixing): \(\sum _{k}k^{2}[\alpha _{v_{i}}(k)]^{\frac{\delta }{6+\delta }}<\infty ;\)

-

(iv)

if \(\rho _{i}=1,\) \(\sum _{k}k^{2}[\alpha _{u_{i}^{y}}(k)]^{\frac{\delta }{6+\delta }}<\infty ;\)

-

(v)

the spectral density of \(v_{it}\), \(f_{v_{i}},\) satisfies \(f_{v_{i}}(0)>0.\)

Conditions (i)–(iv) are needed to ensure the asymptotic validity of the Stationary Bootstrap (Politis and Romano 1994), while condition (v) is introduced, as in PPP, to exclude the degenerate case \(var(\sqrt{T}\textit{m}(v_{i}))=0,\) where \( \textit{m}(v_{i})=T^{-1}\sum _{t=1}^{T}v_{it}\).

-

(i)

-

A4

The estimator \(\widehat{\rho }_{i}\) of the AR(1) coefficient in Eq. (14) satisfies:

$$\begin{aligned} \widehat{\rho }_{i}=\rho _{i}+\left\{ \begin{array}{l} o_{p}(1) \\ O_{p}(T^{-1}) \end{array} \right. \begin{array}{l} \text{ if } \rho _{i}<1 \text{(cointegration) } \\ \text{ if } \rho _{i}=1 \text{(no } \text{ cointegration) } \end{array} \end{aligned}$$The estimator \(\widehat{\beta }_{i}^{d}\) of the cointegrating coefficient satisfies:

$$\begin{aligned} \widehat{\beta }_{i}^{d}=\beta _{i}+\left\{ \begin{array}{l} O_{p}(T^{-1}) \\ O_{p}(T^{-\frac{1}{2}}) \end{array} \right. \begin{array}{l} \text{ if } \rho _{i}<1 \text{(cointegration) } \\ \text{ if } \rho _{i}=1 \text{(no } \text{ cointegration) } \end{array} \end{aligned}$$Assumptions A1 ensure that the Stationary Bootstrap can be applied to \( \Delta x_{it}=u_{it}^{x}\). Assumptions A1–A2 ensure that the no cointegration statistic \(T(\widetilde{\rho }_{i}-1)\) has the same limiting distribution of the coefficient statistic for a unit root (Hansen 1990, Theorem 2). Finally, Assumptions A3–A5 allow us to state Lemma 1 below, which extends to the estimated residuals \(\left\{ \widehat{ \widehat{u}}_{it}^{d}\right\} \) point (\(i\)) of PPP’s Lemma 3. Building on Lemma 1, we shall first state Proposition 1, our counterpart of PPP’s Theorem 1, and finally, in Propositions 2 and 3, state the asymptotic validity of the bootstrap cointegration and panel cointegration tests.

Propositions 1 and 2 below are on the asymptotic behaviour as \( T\rightarrow \infty \) for a given unit \(i\); we will introduce the panel dimension in Proposition 3.

Lemma 1

Let \(\overline{u}_{it}^{d}=\widehat{\widehat{u}}_{it}^{d}-\frac{1}{T-1} \sum _{\tau =2}^{T}\widehat{\widehat{u}}_{i\tau }^{d}\) and \( \overline{v}_{it}=v_{it}-\frac{1}{T-1}\sum _{\tau = 2}^{T}v_{i\tau }\) . For a given unit i, define \(u_{it}^{d*}\) and \(v_{it}^{*},\) obtained applying the Stationary Bootstrap, respectively, to \(\overline{u} _{it}^{d}\) and \(\overline{v}_{it},\) and \(\mathbb E ^{*}(\cdot )\) the expectation in the bootstrap world. Recall that \(\theta _{T}\) is the coefficient of the geometric distribution employed in the resampling algorithm. Then, under Assumptions A3–A5, if \(\theta _{T}\rightarrow 0\) and \( \sqrt{T}\theta _{T}\rightarrow \infty \):

Proof

First of all, recall that the residual \(\widehat{\widehat{u}} _{it}^{d}\) from Eq. (6) can be rewritten as

Expanding \(y_{it}\) as \(y_{it}=\beta _{i}x_{it}+u_{it}^{y}\) and in turn \(u_{it}^{y}\) as \(u_{it}^{y}\) \(=\rho _{i}u_{it-1}^{y}+v_{it}\) we obtain:

so that the centred residual \(\overline{u}_{it}^{d}\) turns out to be the sum of the unobservable noise \(v_{it}\) (centred on the mean) and three other terms:

Taking into account the block structure (cf. steps 2.1–2.4), the (normalised) sum of these residuals can be written as:

To prove the Lemma we need to show that \(B,C\) and \(D\) converge to zero uniformly in \(r\). Let us examine \(C\) first. Following PPP (proof of Eq. (19), p. 622) we need to show that \(\mathbb E ^{*}(C^{2})\rightarrow 0,\) or, equivalently (PPP, Eq. (26), p. 623) that

First of all define \(\overline{x}_{it}=x_{it}-T^{-1}\sum _{\tau =2}^{T}x_{i\tau }\) and \(V_{im}^{*}=\sum _{s=1}^{L_{m}}\overline{x}_{i\varsigma _{m+s-1}}\); note that \(\mathbb E ^{*}(V_{im}^{*})=0\) (PPP, Eq. (24), p. 622). Next, recall that \(x_{it}\) is the cumulated sum of the stationary process \(u_{it}^{x}.\) Then,

so that \(\mathbb E ^{*}\left( \overline{x}_{i\varsigma _{m+s-1}}^{2}\right) =Var^{*}(\overline{x}_{i\varsigma _{m+s-1}})\le \mathbb E ^{*}(x_{i\varsigma _{m+s-1}}^{2})=O_{p}(T)\). From this result and PPP Eq. (30) we obtain

Since \(\mathbb E ^{*}(V_{im}^{*})=0\), \(\mathbb E (\sum _{m=1}^{K_{\lfloor Tr\rfloor }}V_{im}^{*})^{2}=\mathbb E ^{*}(K_{\lfloor Tr\rfloor })\mathbb E ^{*}(V_{im}^{*})^{2}=O_{p}(\theta _{T}^{-1}T^{2})\) (PPP, p. 624). Finally, since Assumption A5 ensures that under the null hypothesis of no cointegration \((\widehat{\beta } _{i}^{d}-\beta _{i})=O_{p}(T^{-\frac{1}{2}}),\) it follows that

uniformly in \(r\). By Slutsky’s theorem the same proof can be applied to \(D\), so that

uniformly in \(r\). Finally, recall that under the null hypothesis \(\rho _{i}=1 \) and the \(u_{it}^{y\prime }s\) are the cumulated sum of the stationary process \(v_{it},\) while under Assumption A4, \((\widehat{\rho }_{i}-\rho _{i})=O_{p}(T^{-1}).\) Then the same arguments used above apply to \(B\), so that

uniformly in \(r.\) This completes the proof. \(\square \)

Convergence in mean square of the estimated residuals to the unobservable noise allows us to exploit all the results contained in PPP’s Lemmas 3 and 4. Of particular importance is the convergence in probability in the bootstrap world (denoted by \(\overset{p^{*}}{\rightarrow }\)) of the variance of \(u_{it}^{d*},\) \(\widehat{\sigma }_{iT}^{*2}=Var^{*}(T^{-1}\sum _{t=1}^{T}u_{it}^{d*}),\) to the variance of \(v_{it}^{*},\) \(\sigma _{iT}^{*2}=Var^{*}(T^{-1}\sum _{t=1}^{T}v_{it}^{*})\), and to the long-run variance of \(v_{it},\sigma _{i\infty }^{2}=2\pi f_{v_{i}}(0)\):

We can now state Proposition 1.

Proposition 1

Define the partial sum process \(S_{iT}^{*}(r),\) \(r\in [0,1],\) where \(S_{iT}^{*}(r)=\frac{1}{\sqrt{T}\widehat{\sigma } _{ir}^{*}}\sum _{t=1}^{[Tr]}u_{it}^{d*}.\) Under A3–A5, if \(\theta _{T}\rightarrow 0\) and \(\sqrt{T}\theta _{T}\rightarrow \infty ,\) when \(T\rightarrow \infty \) it holds that \(S_{iT}^{*}(\cdot ) \overset{d^{*}}{\rightarrow }W_{i}\) in probability, where \(\overset{d^{*} }{\rightarrow }\) denotes convergence in distribution in the bootstrap world and \(W_{i}\) is a standard Wiener process.

Proof

First of all, define the process \(R_{iT}(r)\), partial sum of the noises \(\overline{v}_{it}\):

By (33) in PPP, \(R_{iT}(r)\overset{d^{*}}{\rightarrow }W\). Further, from our Lemma 1 and (17) above and PPP’s Lemma 3 it holds that \(S_{iT}^{*}(r)-R_{iT}(r)\overset{p^{*}}{\rightarrow }0\) uniform in \(r\). It then follows that \(S_{iT}^{*}\overset{d^{*}}{\rightarrow } W_{i}\) and the proof is complete. \(\square \)

Proposition 1 allows us to extend (either directly or by straightforward application of the continuous mapping theorem) Lemma 5 in PPP (which includes a set of convergence results entirely analogous to those of Lemma 1 in Phillips 1986) to quantities derived from the estimated cointegrating residuals.

Recalling that \(\sigma _{i\infty }^{2}\) is the asymptotic variance of \( v_{it},\) and defining \(\sigma _{i} ^{2}\) as the asymptotic variance of its cumulated sums (see e.g. Phillips 1986, p. 314), in our case we have:

-

(a)

\(T^{-2}\sum _{t=2}^{T}\widetilde{u}_{it-1}^{*2} \overset{d^{*}}{\rightarrow }{\sigma _{i}^{2}} \int _{0}^{1}W_{i}^{2}(r)\text{ d }r. \)

-

(b)

\(T^{-1}\sum _{t=2}^{T}\widetilde{u}_{it-1}^{*} \widetilde{v}_{it}^{*}\overset{d^{*}}{\rightarrow }\frac{1}{2} (\sigma _{i} ^{2}W_{i}^{2}(1)-\sigma _{i\infty }^{2}).\)

-

(c)

\(T^{-3/2}\sum _{t=2}^{T}\widetilde{u}_{it-1}^{*} \overset{d^{*}}{\rightarrow }\sigma _{i} \int _{0}^{1}W_{i}(r)\text{ d }r.\)

-

(d)

\(T^{-1/2}\sum _{t=1}^{T}\widetilde{v}_{it}^{*}\overset{d^{*}}{\rightarrow }\sigma _{i\infty }W_{i}(1).\)

The proofs are based on Proposition 1, consistency of the two-step estimator \(\beta _{i}^{d*}\) for the bootstrap population parameter \(\widehat{\beta }_{i}^{d},\) and standard arguments. For instance, for result (a):

Since \(\beta _{i}^{d*}\overset{p}{\rightarrow }\widehat{\beta }_{i}^{d}\) the limit depends only on \((\sum _{s=1}^{t-1}u_{is}^{d*})^{2},\) which by Proposition 1 and continuos mapping theorem is known to converge to \(\sigma _{i} ^{2}\int _{0}^{1}W_{i}^{2}(r)\text{ d }r\). We can now state the following proposition, which generalises PPP’s Theorem 2 to tests of no cointegration.

Proposition 2

For a given unit i, assume that \(\eta _{it}^{\prime }=(u_{it}^{x},v_{it})\) satisfies assumptions A1–A3. Then

where \(P^{*}\) is the bootstrap distribution and \(P_{0}\) is the probability measure obtained under the true null hypothesis of no cointegration.

Proof

Consider (15) and (16). By Proposition 1 and the extension of PPP’s Lemma 5 presented in (a)–(d) above, all partial sums appearing in both statistics have the same limit distribution. Hence, by the continuous mapping theorem \(T(\widetilde{\rho }_{i}-1)\) and \(T(\widetilde{ \rho }_{i}^{*}-1)\) have the same limiting distribution also. \(\square \)

Proposition 2 ensures that a test based on the empirical bootstrap distribution will be asymptotically valid, as this distribution will be close to the true null distribution. The final step is stating the asymptotic validity under independence of a no cointegration panel test computed as the mean of the individual tests.

Proposition 3

Assume that \(E(\eta _{it}\eta _{js}^{\prime })=0\) for each \(i\ne j\) and each \(s,t\). Then:

where \(P^{*}\) is the bootstrap distribution and \(P_{0}\) is the probability measure obtained under the null hypothesis of no cointegration.

Proof

From Proposition 2 and the continuous mapping theorem. \(\square \)

PPP point out that their Theorem 1 is general enough to expect tests based on other statistics, such as the Dickey–Fuller test, to be asymptotically valid. Since Proposition 1 extends PPP’s Theorem 1 to cointegration residuals we can then expect a no cointegration panel test constructed as the mean of the individual HEG tests to be asymptotically valid also.

1.2 Data source and definitions

The data, in national currencies at current prices, have been downloaded from the OECD.stat database. Definitions are as follows: investment Gross capital formation (transaction code: P5S1); savings Net savings (transaction code B8NS1) plus Consumption of fixed capital (transaction code K1S1); gross domestic product transaction code B1_GS1.

Rights and permissions

About this article

Cite this article

Di Iorio, F., Fachin, S. Savings and investments in the OECD: a panel cointegration study with a new bootstrap test. Empir Econ 46, 1271–1300 (2014). https://doi.org/10.1007/s00181-013-0722-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-013-0722-5