Abstract

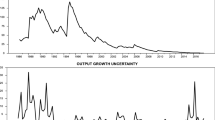

This study examines the transmission and response of inflation uncertainty and output uncertainty on inflation and output growth in the UK using a bi-variate EGARCH model. Results suggest that inflation uncertainty has positive and significant effects on inflation before the inflation-targeting period, but that the effect is significantly negative after the inflation-targeting period. On the other hand, output uncertainty has a negative and significant effect on inflation and a positive effect on growth, while oil price rises significantly increase inflation for the UK. Results also indicate that inflation uncertainty significantly reduces output growth before and after the inflation-targeting period. These findings are robust and the Generalized impulse response functions corroborate the conclusions. These results have important implications for an inflation-targeting monetary policy, and for stabilization policy in general.

Similar content being viewed by others

References

Alogoskoufis G (1992) Monetary accommodation, exchange rate regimes and inflation persistence. Econ J 102: 461–480

Ball L (1992) Why does high inflation raise inflation uncertainty?. J Monet Econ 29: 371–388

Bera A, Jarque C (1980) Efficient tests for normality, heteroscedasticity and serial independence of regressions. Econ Lett 6: 255–259

Berument H, Dincer NN (2005) Inflation and inflation uncertainty in the G-7 countries. Phys A 34(8): 371–379

Berument H, Yalcin Y, Yildirim JO (2010) The inflation and inflation uncertainty relationship for Turkey: a dynamic framework, Empir Econ, Published online, 16 June, 2010

Bhar R, Hamori S (2004) The link between inflation and inflation uncertainty: evidence from G7 countries. Empir Econ 29: 825–853

Black F (1976) Studies of stock market volatility changes. Proc Am Stat Ass Bus Econ Stud Sect 177–181

Conrad C, Karanasos M (2005) On the inflation-uncertainty hypothesis in the USA, Japan and the UK: a dual long memory approach. Jpn World Econ 17: 327–343

Caporale GM, Kontonikas A (2009) The Euro and inflation uncertainty in the European Monetary Union. J Int Money Finance 28: 954–971

Daal E, Naka A, Sanchez B (2005) Re-examining inflation and inflation uncertainty in developed and emerging countries. Econ Lett 89: 180–186

Darbar SM, Deb P (2002) Cross-market correlations and transmission of information. J Futur Mark 22: 1059–1082

Engle RF, Ng VK (1993) Measuring and testing the impact of news on volatility. J Finance 48: 1749–1778

Fountas S, Ioannidis A, Karanasos M (2004) Inflation, inflation uncertainty and common European Monetary Policy. Manchester School 72(2): 221–242

Fountas S, Karanasos M, Kim J (2006) Inflation uncertainty, output growth uncertainty and macroeconomic performance. Oxford Bull Econ Stat 68: 319–343

Friedman M (1977) Nobel lecture: inflation and unemployment. J Polit Econ 85: 451–472

Golob JE (1994) Does inflation uncertainty increases with inflation?. Econ Rev 3: 27–38

Grier K, Henry O, Olekalns N, Shields K (2004) The asymmetric effects of uncertainty on inflation and output growth. J Appl Econ 19: 551–565

Grier K, Perry M (2000) The effects of uncertainty on macroeconomic performance: bivariate GARCH evidence. J Appl Econ 15: 45–58

Grier K, Tullock G (1989) An empirical analysis of cross–national economic growth, 1951–80. J Monet Econ 24: 259–276

Gurlaynak RS, Levin A, Swanson E (2010) Does, inflation targeting anchor long-run inflation expectations? Evidence from the US, UK and Sweden. J Eur Econ Assoc 8(6): 1208–1242

Hamilton JD (2003) What is an oil shock?. J Econ 113: 363–398

Hanabusa K (2009) Causality relationship between the price of oil and economic growth in Japan. Energy Policy 37: 1953–1957

Hooker M A (2002) Are oil shocks inflationary? Asymmetric and nonlinear specifications versus changes in regime. J Money Credit Bank 34(2): 540–561

Johnson DR (2002) The effect of inflation targeting on the behaviour of expected inflation: evidence from an 11 country panel. J Monet Econ 49: 1521–1538

Kim C-J (1993) Unobserved-component models with Markov switching heteroscedasticity: changes in regime and the link between inflation rates and inflation uncertainty. J Bus Econ Stat 11(3): 341–349

Kontonikas A (2004) Inflation and inflation uncertainty in the United Kingdom: evidence from GARCH modelling. Econ Model 21: 525–543

Kormendi RC, Meguire PG (1985) Macroeconomic determinants of growth: cross-country evidence. J Monet Econ 16: 141–163

Ljung T, Box G (1979) On the measure of lack of fit in time series models. Biometrika 66: 66–72

Mallik G, Chowdhury A (2002) Inflation, government and real income in the long-run. J Econ Stud 29: 240–250

Nelson DB (1991) Conditional heteroskedasticity in asset returns: a new approach. Econometrica 59: 347–370

Okun A (1971) The mirage of steady inflation. Brookings Papers Econ Act 2: 485–498

Pesaran MH, Shin Y (1998) Generalized impulse response analysis in linear multivariate models. Econ Lett 58: 17–29

Shields K, Olekalns N, Henry OT, Brooks C (2005) Measuring the response of macroeconomic uncertainty to shocks. Rev Econ Stat 87: 362–370

Wilson BK (2006) The link between inflation, inflation uncertainty and output growth: new time series evidence from Japan. J Macroecon 28(3): 609–620

Wright JH (2009) Term premia and inflation uncertainty: empirical evidence from an international panel dataset. http://econ.jhu.edu/People/Wright/intyields.pdf

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bhar, R., Mallik, G. Inflation uncertainty, growth uncertainty, oil prices, and output growth in the UK. Empir Econ 45, 1333–1350 (2013). https://doi.org/10.1007/s00181-012-0650-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-012-0650-9