Abstract

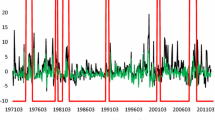

A significantly positive risk-return relation for the S&P 500 market index is detected if the squared implied volatility index (VIX) is allowed for as an exogenous variable in the conditional variance equation of the parsimonious GARCH(1,1) model. This result holds for both daily and weekly observations, for extended conditional mean and variance specifications, and is robust to sub-samples. We show that the conditional variance obtained from the GARCH model with VIX has better predictive ability for realized volatility than the conditional variance from GARCH without VIX and VIX itself, thereby documenting an important information content of VIX for conditional variance. The results are interpreted as evidence that adding VIX squared in the conditional variance equation yields a better measure of conditional variance which, subsequently, uncovers a strong risk-return relation.

Similar content being viewed by others

References

Baillie R, DeGennaro R (1990) Stock returns and volatility. J Financ Quant Anal 25: 203–214

Bali TG, Peng L (2006) Is there a risk-return trade-off? Evidence from high-frequency data. J Appl Econom 21: 1169–1198

Banerjee P, Doran J, Peterson DR (2007) Implied volatility and future portfolio returns. J Bank Financ 31: 3183–3199

Blair BJ, Poon SH, Taylor SJ (2001) Forecasting S&P 100 volatility: the incremental information content of implied volatilities. J Econom 105: 5–26

Bollerslev T, Zhou H (2006) Expected stock returns and variance risk premia. Finance and Economics Discussion Papers, 11, Board of Governors of the Federal Reserve System

Brandt MW, Kang Q (2004) On the relationship between the conditional mean and volatility of returns: a VAR approach. J Financ Econ 72: 217–257

Brennan MJ, Wang AW, Xia Y (2001) Intertemporal capital asset pricing and the Fama-French three-factor model. Working Paper, UCLA

Campbell J (1987) Stock returns and the term structure. J Financ Econ 12: 373–399

Canina L, Figlewski S (1993) The informational content of implied volatility. Rev Financ Stud 6: 659–681

Carr P, Wu L (2004) A tale of two indices. In: 20th annual risk management conference

Christensen BJ, Prabhala NR (1998) The relation between implied and realized volatility. J Financ Econ 50: 125–150

Chung H, Sun EY, Shih KC (2008) Do HAR and MIDAS models outperform implied volatility model? Working Paper, Oversea Chinese Institute of Technology

Conrad C, Mammen C (2006) A specification test for a class of GARCH-in-mean models. Working Paper, ETH Zurich

Day TE, Lewis CM (1992) Stock market volatility and the information content of stock index options. J Econom 52: 267–287

Diavatopoulos D, Doran S, Peterson DR (2008) The information content of implied idiosyncratic volatility and the cross-section of stock returns: evidence from the options markets. J Future Mark 28: 1013–1039

Elliott G, Rothenberg TJ, Stock JH (1996) Efficient tests for an autoregressive unit root. Econometrica 64: 813–836

Fama E, French K (1993) Common risk factors in the returns on stocks and bonds. J Financ Econ 33: 3–56

Fleming J, Ostdiek B, Whaley RE (1995) Predicting stock market volatility: a new measure. J Future Mark 15: 265–302

French K, Schwert W, Stambaugh R (1987) Expected stock returns and volatility. J Financ Econ 19: 3–29

Giot P, Laurent S (2007) The information content of implied volatility in the light of jump/continuous decomposition of volatility. J Future Mark 27: 337–359

Ghysels E, Santa-Clara P, Valkanov R (2005) There is a risk-return tradeoff after all. J Financ Econ 19: 3–29

Glosten L, Jagannathan R, Runkle D (1993) On the relation between the expected value and volatility of the nominal excess return on stocks. J Financ 48: 1779–1801

Goyal A, Santa-Clara P (2003) Idiosyncratic risk matters. J Financ 58: 975–1007

Guo H, Whitelaw RF (2006) Uncovering the risk-return relation in the stock market. J Financ 15: 1433–1463

Guo H, Neely CJ (2008) Investigating the intertemporal risk-return relation in international stock markets with the component GARCH model. Econom Lett 99: 371–374

Hahn H, Lee J (2006) Yield spreads as alternative risk factors for size and book-to-market. J Financ Quant Anal 41: 245–269

Harrison P, Zhang H (1999) An investigation of the risk and return relation at long horizons. Rev Econ Stat 81: 1–10

Harvey C (1991) The world price of covariance risk. J Financ 46: 111–157

Kalev S, Liu WM, Pham PK, Jarnecic E (2004) Public information arrival and volatility of intraday stock returns. J Bank Financ 28: 1441–1467

Kelly PJ (2003) Real and inflationary macroeconomic risk in the Fama and French size and book-to-market portfolios. Paper presented at the 2003 EFMA Conference, Helsinki. Available at SSRN: http://ssrn.com/abstract=407800 or doi:10.2139/ssrn.407800

Konstantinidi E, Skiadopoulos G, Tzagkaraki E (2008) Can the evolution of implied volatility be forecasted? Evidence from European and US implied volatility indices. J Bank Financ 32: 2401–2411

Koopman SJ, Jungbacker B, Hol E (2005) Forecasting daily variability of the S&P 100 stock index using historical, realized and implied volatility measurements. J Empir Financ 12: 445–475

Lamoureux CG, Lastrapes WD (1990) Heteroscedasticity in stock return data: volume versus GARCH effects. J Financ 45: 221–229

Li QJ, Yang C, Chang Y-J (2005) The relationship between stock returns and volatility in international stock markets. J Empir Financ 12: 650–665

Lettau M, Ludvigson S (2003) Measuring and modeling variation in the risk-return trade-off. Working Paper, New York University

Liew J, Vassalou M (2000) Can book-to-market, size and momentum be risk factors that predict economic growth. J Financ Econ 57: 221–246

Lundblad C (2007) The risk return tradeoff in the long run: 1836–2003. J Financ Econ 85: 123–150

Merton RC (1973) An intertemporal capital asset pricing model. Econometrica 41: 867–887

Nelson DB (1991) Conditional heteroscedasticity in asset returns: a new approach. Econometrica 59: 349–370

Pagan A, Hong Y (1991) Nonparametric estimation and the risk premium. In: Barnett W, Powell J, Tauchen GNonparametric and semiparametric methods in econometrics and statistics. Cambridge University Press, Cambridge

Rabemananjara R, Zakoian JM (1993) Threshold arch models and asymmetries in volatility. J Appl Econometr 8: 31–49

Vassalou M (2003) News related to future GDP growth as a risk factor in equity returns. J Financ Econ 68: 47–73

White H (1980) A heteroscedasticity-consistent covariance matrix estimator and a direct test for Heteroscedasticity. Econometrica 48: 817–838

Whitelaw R (1994) Time variations and covariations in the expectation and volatility of stock market returns. J Financ 49: 515–541

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kanas, A. The risk-return relation and VIX: evidence from the S&P 500. Empir Econ 44, 1291–1314 (2013). https://doi.org/10.1007/s00181-012-0639-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-012-0639-4