Abstract

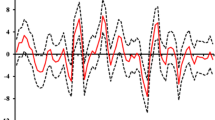

This article first estimates inflationary expectations using a Blanchard–Quah VAR model by decomposing the nominal interest rate into expected inflation and the ex ante real interest rate. Then I utilize this expected inflation along with other macroeconomic variables as inputs to the monetary policy function in a recursive VAR model to identify exogenous policy shocks. To calculate inflationary expectations, I assume that ex ante real interest rate shocks do not have a long-run effect on the nominal interest rate. This article finds that the public expects lower inflation for the future during periods of high inflation. Estimated results from the recursive VAR suggest that a contractionary policy shock increases the real interest rate, appreciates domestic currency, and lowers inflationary expectations and industrial output. However, I find a lagged policy response from Bangladesh Bank to higher inflationary expectations.

Similar content being viewed by others

References

Anderson N, Sleath J (2001) New estimates of the UK real and nominal yield curves. Bank of England Working Paper, No. 126

Bank of Thailand (2009) Inflation report. Nakhon District, Bangkok

Bhuiyan R (2011) Identifying a forward-looking monetary policy in an open economy. Economica. doi:10.1111/j1468-0335.2011.00907.x

Bhuiyan R, Lucas RF (2007) Real and nominal effects of monetary policy shocks. Can J Econ 40: 679–702

Bidarkota P (2003) Do fluctuations in US inflation rates reflect infrequent large shocks or frequent small shocks?. Rev Econ Stat 49: 1493–1519

Blanchard OJ, Quah D (1989) The dynamic effect of aggregate supply and demand disturbances. Am Econ Rev 79: 655–673

Booth G, Ciner C (2000) The relationship between nominal interest rate and inflation: international evidence. J Multinatl Financ Manag 11: 269–280

Campbell J, Shiller R (1987) Interpreting cointegrated models. J Econ Dyn Control 2: 505–522

Chowdhury A, Dao MQ, Wahid AN (1995) Monetary policy, output, and inflation in Bangladesh: a dynamic analysis. Appl Econ Lett 2: 51–55

Christiano LJ, Eichenbaum M, Evans CL (2006) The effects of monetary policy shocks: evidence from the flow of funds. Rev Econ Stat 78: 16–34

Crowder W, Hoffman D (1996) The long-run relationship between nominal interest rates and inflation: Fisher equation revisited. J Money Credit Bank 28: 102–118

Engle R, Granger C (1987) Cointegration and error correction: representation, estimation, and testing. Econometrica 55: 391–407

Enders W (2003) Applied econometric time series, 2nd edn. Wiley, New York

Gottschalk J (2001) Measuring the expected inflation and the ex ante real interest rate in the Euro area using structural vector auto regressions. Working Paper, Keil Institute of World Economics, Keil

Hall A, Anderson H, Granger C (1992) A cointegration analysis of treasury bills yields. Rev Econ Stat 74: 116–126

Johansen S (1991) Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econometrica 59: 1551–1580

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on cointegration with application to demand for money. Oxf Bull Econ Stat 52: 169–209

Johansen S, Juselius K (1994) Identification of the long-run and the short-run structure: an application to the ISLM model. Oxf Bull Econ Stat 63: 7–36

Jumah A, Kunst R (2002) On mean reversion in real interest rates: an application of threshold cointegration, Economics series. Institute for Advance Studies, Vienna

Kahn M, Kandel S, Sarig O (2002) Real and nominal effects of central bank monetary policy. J Monet Econ 49: 1493–1519

Kandel S, Ofer A, Sarig O (1996) Real interest rates and inflation: an ex ante empirical analysis. J Fiance 51: 205–225

Kilian L (1998) Small-sample confidence intervals for impulse response functions. Rev Econ Stat 80: 218–230

Mishkin F (1992) Is the Fisher effect real. J Monet Econ 30: 195–215

Ng S, Perron P (1995) Unit root tests in ARMA models with data-dependent methods for the selection of the truncation lag. J Am Stat Assoc 90: 268–281

Rose A (1988) Is the real interest rate stable. J Monet Econ 43: 1090–1112

Sims C (1992) Interpreting the macroeconomic time series facts: the effects of monetary policy. Eur Econ Rev 36: 975–1011

St-Amant P (1996) Decomposing U.S. nominal interest rates into expected inflation and ex ante real interest rates using structural VAR methodology. Working Paper, Bank of Canada

Strongin S (1995) The identification of monetary policy disturbances: explaining the liquidity puzzle. J Monet Econ 35: 463–493

Taslim MA (1982) Inflation in Bangladesh: a reexamination of the structuralist-monetarist controversy. Bangladesh Dev Stud 10: 23–52

Waggoner DF (1997) Spline methods for extracting interest rate curves from coupon bond prices. Working Paper, No 97-10, Federal Reserve Bank of Atlanta

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bhuiyan, R. Inflationary expectations and monetary policy: evidence from Bangladesh. Empir Econ 44, 1155–1169 (2013). https://doi.org/10.1007/s00181-012-0595-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-012-0595-z