Abstract

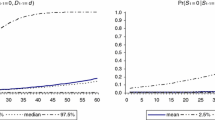

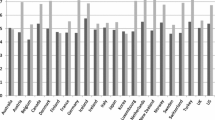

The business cycles literature shows that the likelihood of an expansion or contraction ending increases with its age, i.e. they exhibit positive duration dependence. This evidence rests on the assumption that the magnitude of duration dependence is the same over time. However, we assume that the degree of likeliness of an expansion or contraction ending as it gets older might indeed change after a specific duration. Estimating a continuous-time Weibull model for a group of 13 industrial countries over the period 1948–2009 and allowing for the presence of a change-point in the duration-dependence parameter; we conclude that the evidence of positive duration dependence is no longer present when an expansion surpasses 10 years of duration.

Similar content being viewed by others

References

Abderrezak A (1998) On the duration of growth cycles: an international study. Int Rev Econ Fin 7: 343–355

Allison P (1982) Discrete-time methods for the analysis of event histories. Sociol Methodol 13: 61–98

Andrews D (1993) Tests for parameter instability and structural change with unknown change point. Econometrica 61: 821–856

Andrews D (2003) Tests for parameter instability and structural change with unknown change point: a corrigendum. Econometrica 71: 395–397

Bai J (1997) Estimation of a change point in multiple regression models. Rev Econ Stat 79: 551–563

Bry G, Boschan C (1971) Cyclical analysis of time series: selected procedures and computer program. NBER, New York

Castro V (2010) The duration of economic expansions and recessions: more than duration dependence. J Macroecon 32: 347–365

Davig T (2007) Change-points in US business cycle durations. Studies in nonlinear dynamics and econometrics 11(2), Article 6

Di Venuto N, Layton A (2005) Do the phases of the business cycle die of old age?. Aust Econ Pap 44: 290–305

Diebold F, Rudebusch G (1990) A nonparametric investigation of duration dependence in the American business cycle. J Political Econ 98: 596–616

Diebold F, Rudebusch G, Sichel D (1990) International evidence on business cycle duration dependence. Institute for Empirical Macroeconomics DP 31

Diebold F, Rudebusch G, Sichel D (1993) Further evidence on business cycle duration dependence. In: Stock JH, Watson MW (eds) Business cycles, indicators, and forecasting. University of Chicago Press, Chicago, pp 87–116

Durland M, McCurdy T (1994) Duration-dependent transitions in a Markov model of US GNP growth. J Bus Econ Stat 12: 279–288

Gutierrez R, Carter S, Drukker D (2001) On boundary-value likelihood-ratio tests. Stata Tech Bull 60:15–18. Reprinted in Stata Technical Bulletin Reprints, vol 8, pp 233–236

Hamilton J (1989) A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica 57: 357–384

Iiboshi H (2007) Duration dependence of the business cycle in Japan: a Bayesian analysis of extended Markov switching model. Jpn World Econ 19: 86–111

Kiefer N (1988) Economic duration data and hazard functions. J Econ Lit 26: 646–679

Kim C, Nelson C (1998) Business cycle turning points, a new coincident index, and tests of duration dependence based on a dynamic factor model with regime switching. Rev Econ Stat 80: 188–201

Lam P (2004) A Markov-switching model of GNP growth with duration dependence. Int Econ Rev 45: 175–204

Lancaster T (1990) The econometric analysis of transition data. Cambridge University Press, Cambridge

Lara-Porras A, Alvarez E, Garcia-Leal J, Quesada-Rubio J (2005) Weibull survivals with changepoints and heterogeneity. In: Proceedings of the conference on applied stochastic models and data analysis of the quantitative methods in business and industry society, Brest (France) 17–20 May 2005 (http://conferences.telecom-bretagne.eu/asmda2005/article8fd3.html?id_article=37)

Layton A, Smith D (2007) Business cycle dynamics with duration dependence and leading indicators. J Macroecon 29: 855–875

Ohn J, Taylor L, Pagan A (2004) Testing for duration dependence in economic cycles. Econom J 7: 528–549

Perruchoud A (2008) Analyzing the Swiss business cycle. Appl Econ Q 54: 255–291

Sichel D (1991) Business cycle duration dependence: a parametric approach. Rev Econ Stat 73: 254–260

Zellner A (1990) Some properties of the durations of economic expansions and contractions. Am Econ 34: 20–27

Zhou H, Rigdon S (2008) Duration dependence in US business cycles: an analysis using the modulated power law process. J Econ Fin 32: 25–34

Zuehlke T (2003) Business cycle duration dependence reconsidered. J Bus Econ Stat 21: 564–569

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Castro, V. The duration of business cycle expansions and contractions: are there change-points in duration dependence?. Empir Econ 44, 511–544 (2013). https://doi.org/10.1007/s00181-011-0544-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-011-0544-2