Abstract

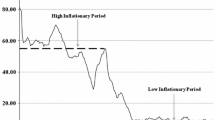

This article investigates the pricing behaviour of Turkish firms over the period 1988–2006 on the basis of firm-level micro data. The duration of prices is found to be 3.9 months on average. There is no clear heterogeneity across main groupings in the frequency of price changes, but more dependence on imported goods reduces price stickiness. Price decreases are less frequent than price increases, indicating downward rigidity in prices. There is evidence in favour of both time and state-dependent price setting behaviours. Further, there is a low degree of synchronization of price changes across firms, whereas price increases tend to be more synchronized than price decreases. Ordered probit models show that price adjustments depend on the type of the shock: the pass-through of a change in the cost is faster than changing demand. Besides, estimated probabilities of price adjustments with 5-years rolling windows reveal that inflation targeting has succeeded in bringing down the probability of price increases, whereas downward price rigidity has not weakened yet.

Similar content being viewed by others

References

Alper CE, M (1998) Some observations on Turkish inflation: a random walk down the past decade. Bogazici J 12: 7–38

Altissimo F, Ehrmann M, Smets F (2006) Inflation persistence and price setting behaviour in the euro area. A summary of the IPN evidence. ECB occasional paper no. 46

Ball L, Romer D (1990) Real rigidities and the non-neutrality of money. Rev Econ Stud 57: 183–203

Baudry L, Le Bihan H, Sevestre P, Tarrieu S (2004) Price rigidity—evidence from French CPI micro-data. ECB working paper no. 384

Bils M, Chang Y (1999) Understanding how price responds to costs and production. NBER working paper no. 7311

Bils M, Klenow PJ (2004) Some evidence on the importance of sticky prices. J Political Econ 112: 947–985

Bils M, Klenow PJ, Malin BA (2009) Reset price inflation and the impact of monetary policy shocks. NBER working paper no. 14787

Buckle RA, Carlson JA (2000) Inflation and asymmetric price adjustment. Rev Econ Stat 82: 157–160

Calvo GA (1983) Staggered prices in a utility-maximizing framework. J Monet Econ 12: 383–398

Çağlayan M, Filiztekin A (2003) Nonlinear impact of inflation on relative price variability. Econ Lett 79: 213–218

Çağlayan M, Filiztekin A (2006) A disaggregated analysis of price dynamics, the Turkish economy. In: Altug S, Filiztekin A (eds) The real economy, corporate governance and reform. Routledge, London, pp 128–146

Caplin A, Spulber DF (1987) Menu costs and the neutrality of money. Q J Econ 102: 703–725

Carlson JA (1992) Some evidence on lump sum versus convex costs of changing prices. Econ Inq 30: 322–331

Carlton D (1986) The rigidity of prices. Am Econ Rev 76: 637–658

Cecchetti S (1986) The frequency of price adjustment: a study of the newsstand prices of magazines. J Econom 31: 255–274

Dhyne E, Álvarez LJ, Le Bihan H, Veronese G, Dias D, Hoffman J, Jonker N, Lünnemann P, Rumler F, Vilmunen J (2005) Price setting in the euro area: some stylised facts from individual consumer price data. ECB working paper no. 524

Dotsey M, King RG, Wolman AL (1999) State-dependent pricing and the general equilibrium dynamics of money and output. Q J Econ 114: 655–690

Eichenbaum M, Jaimovich N, Rebelo S (2008) Reference prices and nominal rigidities. NBER working paper no. 13829

Fabiani S, Druant M, Hernando I, Kwapil C, Landau B, Loupias C, Martins F, Mathä TY, Sabbatini R, Stahl H, Stokman A (2005) The pricing behaviour of firms in the euro area: new survey evidence. ECB working paper no. 535

Fisher TCG, Konieczny JD (2000) Synchronization of price changes by multiproduct firms: evidence from Canadian newspaper prices. Econ Lett 68: 271–277

Kara H, Öğünç F (2005) Exchange rate pass-through in Turkey: it is slow, but is it really low? Emerg Mark Financ Trade 44:52–66

Karasulu M (1998) Relative price variability and inflation: empirical evidence from Turkey. ISE Rev 2: 1–26

Kashyap A (1995) Sticky prices: new evidence from retail catalogs. Q J Econ 110: 245–274

Kehoe PJ, Midrigan V (2008) Temporary price changes and the real effects of monetary policy. Federal Reserve Bank of Minneapolis Research Department Staff Report no. 413

Klenow P, Kryvstov O (2008) State-dependent or time-dependent pricing: does it matter for recent U.S. inflation?. Q J Econ 123(3): 863–904

Lach S, Tsiddon D (1992) The behaviour of prices and inflation: an empirical analysis of dissagregated price data. J Political Econ 100: 349–389

Leigh D, Rossi M (2002) Exchange rate pass-through in Turkey. IMF working paper no. 02/204

Lünnemann P, Mathä T (2005) Regulated and services’ prices and inflation persistence. ECB working paper no. 466

Nakamura E, Steinsson J (2008) Five facts about prices: a reevaluation of menu cost models. Q J Econ 123(4): 1415–1464

Parkin M (1986) The output-inflation trade-off when prices are costly to change. J Political Econ 94: 200–224

Peneva EV (2009) Factor intensity and price rigidity: evidence and theory. FEDS working paper no. 2009-07

Şahinöz S, Saraçoğlu B (2008) Investigating inflation persistence in Turkey. Yapi Kredi Econ Rev 19: 3–14

Şahinöz S, Saraçoğlu B (2008b) Price setting behaviour in Turkish industries: evidence from survey data. Dev Econ 46: 363–385

Stigler G, Kindhal J (1970) The behaviour of industrial prices, NBER general series, no. 90. Columbia University Press, New York

Taylor JB (1980) Aggregated dynamics and staggered contracts. J Political Econ 88: 1–24

Vermeulen P, Dias D, Hernando I, Sabbatini R, Sevestre P, Stahl H (2005) Price setting in the euro area: some stylised facts from individual producer price data and producer surveys. Mimeo

Vermeulen P, Dias D, Dossche M, Gautier E, Hernando I, Sbbattini R, Stahl H (2007) Price setting in the euro area: some stylised facts from individual producer price data. Banco de Espana working paper no. 0703

Volkan A, Saatçioğlu C, Korap L (2007) Impact exchange rate changes on domestic inflation: the Turkish experience. Turkish Economic Association discussion paper, no. 2007/6

Willis JL (2000) Estimation of adjustment costs in a model of state-dependent pricing. Kansas City Federal Reserve Bank Research working paper no. 00-07

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Şahinöz, S., Saraçoğlu, B. How do firms adjust their prices in Turkey? Micro-level evidence. Empir Econ 40, 601–621 (2011). https://doi.org/10.1007/s00181-010-0347-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-010-0347-x