Abstract

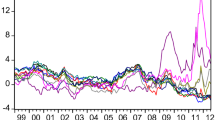

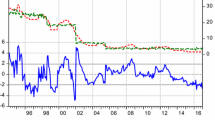

This article estimates a two-factor term structure model to analyze the time-varying mean-reverting levels of the UK real and nominal short-term interest rates. Before and during British membership in the ERM, the mean-reverting levels of real and nominal short rates have a strong negative correlation. Afterward, when the UK implemented an inflation targeting policy, the mean-reverting levels have a strong positive correlation. The article also reports empirical evidence of a link between the time-varying central tendencies and inflation in the disinflation period before the implementation of the inflation targeting policy.

Similar content being viewed by others

References

Anderson N, Sleath J (1999) New estimates of the UK real and nominal yield curves. Bank Engl Q Bull November:384–392

Ang A, Piazzesi M (2003) A no-arbitrage vector autoregression of term structure dynamics with macroeconomic and latent variables. J Monetary Econ 50: 745–787

Babbs SH, Nowman KB (1999) Kalman filtering of generalized Vasicek term structure models. J Financ Quant Anal 34: 115–130

Balduzzi P, Das SR, Foresi S (1998) The central tendency: a second factor in bond yields. Rev Econ Stat 80: 62–72

Barr DG, Campbell JY (1997) Inflation, real interest rates and the bond market: A study of UK nominal and index-linked government bond prices. J Monetary Econ 39: 361–383

Beaglehole DR, Tenney M (1991) General solution of some interest rate-contingent claim pricing equations. J Fixed Income 1: 69–83

Benati L (2008) The “Great Moderation” in the United Kingdom. J Money Credit Bank 40: 121–147

Brown RH, Schaefer SM (1994) The term structure of real interest rates and the Cox, Ingersoll, and Ross model. J Financ Econ 18: 3–42

Campbell JY (1995) Some lessons from the yield curve. J Econ Perspect 9: 129–152

Campbell JY, Shiller R (1996) A scorecard for indexed government debt. In: Bernanke BS, Rotemberg JJ (eds) NBER macroeconomics annual. MIT Press, London

Campbell JY, Viceira LM (2001) Who should buy long-term bonds. Am Econ Rev 91: 99–127

Chan K, Karolyi G, Longstaff F, Sanders A (1992) An empirical comparison of alternative models of the short-term interest rate. J Finance 47: 1209–1227

Cox JC, Ingersoll J, Ross SA (1985) A theory of the term structure of interest rates. Econometrica 53: 385–407

Dewachter H, Lyrio M (2006) Macro factors and the term structure of interest rates. J Money Credit Bank 38: 119–140

Duffee GR (1996) Idiosyncratic variation of Treasury bill yields. J Finance 51: 527–552

Duffie D, Kan R (1996) A yield factor model of interest rates. Math Finance 6: 379–406

Evans C, Marshall D (2007) Economic determinants of the nominal Treasury yield curve. J Monetary Econ 54: 1986–2003

Evans MDD (1998) Real rates, expected inflation, and inflation risk premia. J Finance 53: 187–218

Goto S, Torous W (2002) Evolving inflation dynamics, monetary policy and the Fisher hypothesis. UCLA Working Paper

Piazzesi M (2007) Affine term structure models. In: Ait-Sahalia Y, Hansen LP (eds) Handbook of financial econometrics. Elsevier Science, Amsterdam

Reschreiter A (2010) Inflation and the mean-reverting level of the short rate. Manch Sch 78: 76–91

Sack B (2000) Deriving inflation expectations from nominal and inflation-indexed Treasury yields. J Fixed Income 10: 6–17

Vasicek O (1977) An equilibrium characterization of the term structure. J Financ Econ 5: 77–188

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Reschreiter, A. Real and nominal UK interest rates, ERM membership, and inflation targeting. Empir Econ 40, 559–579 (2011). https://doi.org/10.1007/s00181-010-0345-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-010-0345-z