Abstract

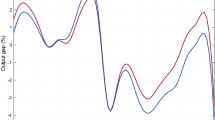

The canonical New Keynesian Phillips curve specifies inflation as the present-value of future real marginal costs. This paper exploits projections of future real marginal costs generated by VAR models to assess the model’s ability to match the behavior of actual inflation in the Euro area. The model fits the data well at first sight. A set of bias-corrected bootstrapped confidence bands, however, reveals that this result is consistent with both a well fitting and a failing model. These findings also hold for the hybrid version of the Phillips curve.

Similar content being viewed by others

References

Calvo GA (1983) Staggered prices in a utility maximizing framework. J Monet Econ 12: 383–398

Campbell JY, Shiller RJ (1987) Cointegration and tests of present value models. J Polit Econ 95: 1062–1088

Coenen G, Wieland V (2005) A small estimated Euro area model with rational expectations and nominal rigidities. Eur Econ Rev 49: 1081–1104

Eichenbaum M, Fisher JDM (2007) Estimating the frequency of price re-optimization in Calvo-style models. J Monet Econ 54: 2032–2047

Galí J, Gertler M, López-Salido JD (2001) European inflation dynamics. Eur Econ Rev 45: 1237–1270

Jondeau E, Le Bihan H (2005) Testing for the New Keynesian Phillips curve: additional international evidence. Econ Model 22: 521–550

Kilian L (1998) Small-sample confidence intervals for impulse response functions. Rev Econ Stat 80: 218–230

Kurmann A (2005) Quantifying the uncertainty about the fit of a New Keynesian pricing model. J Monet Econ 52: 1119–1134

Smets F, Wouters R (2003) An estimated stochastic dynamic general equilibrium model of the euro area. J Eur Econ Assoc 1: 1123–1175

Woodford M (2003) Interest and prices. Princeton University Press, Princeton

Author information

Authors and Affiliations

Corresponding author

Additional information

I am grateful to two anonymous referees for helpful comments and suggestions. I thank Heinz Herrmann, Mathias Hoffmann, Oliver Holtemöller, and Karl-Heinz Tödter for insightful comments on an earlier draft. This paper was partly written while I was visiting researcher at the Deutsche Bundesbank. I am grateful for the research department’s generous hospitality. Furthermore, I thank seminar participants at the Bundesbank, Dortmund University, the European Commission (DG ECFIN), the first meeting of the DFG network “Quantitative Macroeconomics”, the IWH Macroeconometric Workshop 2006, the University of Mainz, and the EEA conference in Amsterdam for helpful comments. The views expressed in this paper are those of the author and not necessarily those of the Swiss National Bank. All remaining errors are mine.

Rights and permissions

About this article

Cite this article

Tillmann, P. The New Keynesian Phillips curve in Europe: does it fit or does it fail?. Empir Econ 37, 463–473 (2009). https://doi.org/10.1007/s00181-008-0241-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-008-0241-y