Abstract

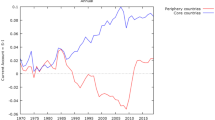

The purpose of this paper is to analyze the dynamics of national saving-investment relationship in order to determine the degree of capital mobility in 12 Latin American countries. The analytically relevant correlation is the short-term one, defined as that between changes in saving and investment. Of special interest is the speed at which variables return to the long run equilibrium relationship, which is interpreted as being negatively related to the degree of capital mobility. The long run correlation, in turn, captures the coefficient implied by the solvency constraint. We find that heterogeneity and cross-section dependence completely change the estimation of the long run coefficient. Besides we obtain a more precise short run coefficient estimate compared to the existent estimates in the literature. There is evidence of an intermediate degree of capital mobility, and the coefficients are extremely stable over time.

Similar content being viewed by others

References

Ahmed S, Rogers JH (1996) Government budget deficits and trade deficits: are present value constraints satisfied in the long-term data. J Monet Econ 36: 351–374

Bagnai A, Manzocchi S (1996) Unit root tests of capital mobility in less developed countries. Weltwirtschaftliches Archiv 132(3): 544–556

Chortareas G, Kapetanios G, Uctum M (2004) An investigation of current account solvency in Latin America using non linear nonstationary tests. Stud Nonlinear Dyn Econom 8(1): 1200

Coakley J, Kulasi F, Smith R (1996) Current account solvency and the saving-investment puzzle. Econ J 106(436): 620–627

Coakley J, Fuertes AM, Smith R (2001) Small sample properties of panel time-series estimators with I(1) erros. Birkbeck College Discussion Paper no. 03/2001

Coakley J, Fuertes A, Spagnolo F (2004) Is the Feldstein–Horioka puzzle history? Manchester School 72: 569–590

Corbin A (2001) Country specific effect in the Feldstein-Horioka paradox: a panel data analysis. Econ Lett (72) 3: 297–302

Dooley M, Frankel J, Mathieson D (1987) International capital mobility: what do saving-investment correlations tell us? IMF Staff Papers 34(3): 503–530

Feldstein M, Horioka C (1980) Domestic saving and international capital flows. Econ J 90: 314–329

Harberger AC (1980) Vignettes on the world capital market. American Economic Review, vol 70, Papers and Proceedings, pp 331–337

Jansen WJ (1996) Estimating saving-investment correlations: evidence for OECD countries based on an error correction model. J Int Money Finance 5: 749–781

Jansen WJ, Schulze GG (1996) Theory-based measurement of the saving-investment correlation with an application to Norway. Econ Inquiry XXXIV: 116–132

Mamingi N (1997) Saving-investment correlations and capital mobility: the experience of developing countries. J Policy Model 19(6): 605–626

Montiel P (1994) Capital mobility in developing countries: some measurement issues and empirical estimates. World Bank Econ Rev 8(3): 311–350

Moreno R (1997) Saving-investment dynamics and capital mobility in the US and Japan. J Int Money Finance 16(6): 837–863

Murphy RG (1984) Capital mobility and the relationship between saving and investment in OECD countries. J Int Money Finance 3: 327–342

Murphy RG (1986) Productivity shocks, non-traded goods and optimal capital accumulation. Euro Econ Rev 30: 1081–1095

Obstfeld M (1986) Capital mobility in the world economy: theory and measurement. Carnegie–Rochester conference series on public policy, Spring, 1–24

Obstfeld M, Rogoff R (2000) The six major puzzles in international macroeconomics: is there a common cause? NBER Working Paper 7777

Pelgrin F, Schich S (2004) Natinal saving-investment dynamics and international capital mobility. Working paper 2004-14, Bank of Canada

Pesaran MH, Smith RP (1995) Estimating long-run relationships from dynamic heterogeneous panels. J Econom 68: 79–113

Pesaran MH (2003a) Estimation and inference in large heterogeneous panels wit cross-section dependence. Cambridge Working Papers in Economics no. 0305

Pesaran MH (2003b) A simple panel unit root test in the presence of cross section dependence. Cambridge Working Papers in Economics no. 0346

Summers LH (1988) Tax policy and competitiveness. In: Frenkel JA (eds) International aspects of fiscal policy, NBER Conference Report, Chicago. Chicago University Press, Chicago, pp 349–375

Trehan B, Walsh C (1991) Testing intertemporal budget constraints : theory and application to US Federal budget deficits and current account deficits. J Money Credit Bank 23(2): 206–223

Wong D (1990) What do saving-investment relationships tell us about capital mobility? J Int Money Finance 9: 60–74

Wu J-L (2000) Mean-reversion of the current account: evidence from the panel data unit root tests. Econ Lett 66(2): 215–222

Wu J-L, Chen S-L, Lee H-Y (2001) Are current account deficits sustainable? Evidence from panel cointegration. Econ Lett 72(2): 219–224

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Rocha, F. Heterogeneity, saving-investment dynamics and capital mobility in Latin America. Empir Econ 36, 611–619 (2009). https://doi.org/10.1007/s00181-008-0215-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-008-0215-0

Keywords

- Solvency

- Capital mobility

- Panel error correction models

- Heterogeneity

- Cross section dependence

- Latin American countries