Abstract

Research on program evaluation, and in particular on firm cooperation policies, has been scant on the impact of space-specific characteristics on program impacts. Few studies have analyzed how spatial features, that are sticky and non-mobile, may affect the intensity of a program’s effect on the targeted economic outcome. This paper uses a regional program (ERGON1) aimed at fostering the creation of Network Contracts to shed light on the contribution of spatial features to policy effectiveness. Network Contracts have been introduced in Italy with Law 9 April 2009, N. 33 to stimulate the formation of firm aggregations and to increase economic efficiency for network members. Empirical results, using Propensity Score Matching Estimates, suggest a positive and causative relation between membership in a Network Contract and firm productivity. Furthermore, evidence suggests that matching for urban characteristics significantly improves matching quality. Evidence is thus provided on the relevance of spatial features in shaping the returns to policies, thereby suggesting that ignoring such features may provide a biased picture of the true effect of a program.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

A vast literature underlines the importance for firms of cooperation and collaboration strategies, in particular regarding access to external knowledge and the development and commercialization of new products (Laursen and Salter 2004; Edquist 2005; Chesbrough 2003). For this reason, we can expect the majority of the policies aimed at promoting firm cooperation to yield positive results.

However, despite substantial evidence being available on the role of context characteristics in driving firm performance, mainly through agglomeration economies arguments, few studies have analyzed how spatial features, that are sticky and non-mobile, may affect the intensity of a program’s effect on the targeted economic outcome. The debate on whether policies should be targeting cities and regions (place-based policies) or people (space-blind policies) is still open, even if it is reasonable to imagine that territorial spillovers will affect the impact of most policies.

This paper addresses this debate by looking at the spatial differentials in the impact of a (partially) space-blind policy.Footnote 1 In particular, we assess the impact of a regional program fostering the creation of Network Contracts among firms in Italy. Network Contracts (henceforth, NC) have been introduced in Italy with Law 9 April 2009, N. 33. NC allows the creation of firm aggregations with an ad hoc contract, without resorting to mergers. NCs are meant to increase economic efficiency for all firms involved in the contract, with the rationale of addressing the missed opportunity of firms not cooperating for innovation purposes, thereby not maximizing their potential impact.

Theoretical arguments justifying the rationale for firms failing to cooperate for innovation, and, therefore, miss the associated opportunity, are numerous. For instance, cooperation for innovation tends to be particularly difficult when it takes place with competitors and public research organizations; when foreign partners are involved; when firms collaborate with suppliers; and for small firms (Lhuillery and Pfister 2009). Along the same line, the complexity of the object of the innovative activity may also play a crucial role in determining the success of cooperative activities, with firms engaging in product innovation (a product that innovates w.r.t. existing ones) being more likely to succeed in their endeavor (Tether 2002).

In this paper, we analyze the potentially growth-enhancing effect of the ERGON1Footnote 2 program issued by the Lombardy Region’s Directorate General (henceforth, DG) Industry, Handcraft, Construction and Cooperation to co-finance the creation of NCs.

Furthermore, we assess whether the urban context where firms funded by this program are located has an impact on the policy effectiveness.

The standard program evaluation literature tends to ignore spatial features (on this point, see the excellent review in Imbens and Wooldridge 2009), thus leaning toward the space-blind approach, other than for statistical purposes (for instance, because the location of target firms or workers is part of the policy selection criteria). Caliendo and Kopeinig (2008) suggest two possible strategies for stressing specific groups of variables, such as those related to the location of the target units.

A first possibility is to find units in the comparison group that are identical in terms of the variables identifying groups; alternatively, matching can be carried out on subpopulations. Lechner (2002) is a good example of the first approach. He evaluates the impact of heterogeneous active labor market programs on the estimated size of the impact, with the size of the region where firms are targeted included only as a policy-relevant control. Heckman et al. (1997, 1998) adopt instead the second strategy and match independently for four demographic groups; in this second approach, the whole matching procedure must be repeated. However, in neither approach, specific attention is paid to the way spatial features affect the estimated intensity of a policy treatment.

Spatial characteristics are expected to play a decisive role in shaping the expected returns from any local policy. All else being equal, firms located in areas rich in social capital are expected to complete contracts more effectively, incur lower transaction costs, and informally sanction deviant behavior (Akcomak and Ter Weel 2012). This first factor is particularly relevant in the case of a policy-enhancing network formation. Formal education is analogously expected to lead to higher policy effectiveness. Educated workers are not only more productive, but also net generators of positive externalities (Winters 2013). Both these externalities lie within the externality field of agglomeration economies, i.e., all cost savings and productivity advantages accruing to both consumers and firms locating in urban areas. Lastly, firms located in metropolitan regions also benefit from higher levels of accessibility. Policies stimulating the formation of firm networks are thus expected to be more effective in areas where communication and transportation costs are lower.

Our findings first suggest that, as expected, the ERGON1 policy aimed at promoting the development of Network Contracts is effective. Secondly, results document that the inclusion of urban features (agglomeration economies, human and social capital, and accessibility) in the Propensity Score Matching (henceforth, PSM) procedure determines a decrease in the estimated program impact. These findings suggest the need to include context features in applied policy evaluations, lest policy impacts are systematically overestimated. Moreover, the use of PSM represents a methodological innovation of the paper, in that PSM is typically less widely adopted as an identification strategy in the urban economics literature (Baum-Snow and Ferreira 2015). In this sense, our work provides further evidence about the need to also match for territorial characteristics when data are organized in a nested structure, as recently suggested (Li et al. 2013; Zubizarreta and Keele 2017), thereby reaching beyond the traditional use of propensity score matching with the use of unstructured data.

To illustrate our findings, we proceed as follows. In Sect. 2, two major strands of literature needed to frame our empirical analyses are critically summarized: first, we discuss the urban factors that may influence policy effectiveness; next, we summarize possible approaches to identification in urban economics, with specific reference to the program evaluation literature. In Sect. 3, we specifically discuss the policy being evaluated, viz. regional support to the formation of Network Contracts. Next, Sect. 4 discusses data collected for the empirical analyses while Sect. 5 presents the research design adopted to answer the paper's research questions. Section 6 answers the research questions: the policy is shown to have a significant impact and policy impact estimates are shown to crucially hinge on the inclusion of urban context features in the policy evaluation process. Finally, Sect. 7 draws our conclusions and derives policy implications.

2 Do urban characteristics influence policy effectiveness?

2.1 Urban factors influencing policy effectiveness

Several factors should be taken into account for a correct appraisal of the effectiveness of policies fostering the creation of inter-firm networks and their public funding. While many of these factors are related to the characteristics of the firms being funded, some are instead inherently place-specific and related to the urban context where such policies are enacted.

In fact, places are not neutral as opposed to the type of funding received, the receptivity to different types of policies, and their return. In particular, four main context factors are expected to play a decisive role in fostering or hampering the effect of local policies, because of their unequal geographical distribution and their tendency to be relatively less mobile than physical capital, with ensuing hysteretic effects that make their role sticky over time. Such factors include (1) social capital, (2) human capital, (3) agglomeration economies, and (4) geographic accessibility.

In this subsection, these four factors are discussed in terms of their potential impact on program evaluation. Each factor is associated with a table summarizing the microfoundations of this potential impact, thus paving the way for the empirical analyses of the paper.

2.1.1 Social capital

Social capital represents the set of place-specific informal institutions that lubricates market mechanisms (Alesina and Giuliano 2015). Recent evidence presented in (Hamilton et al. 2016) suggests that the wealth embodied in trust and social capital can be quite substantial (up to 28 percent of total wealth).

This chiefly place-specific factor should not be ignored in the evaluation of a program’s impact. Cities where social capital is higher are better places for cooperation; beyond the intuitive channel of being more cooperative where trust is higher, cooperation among firms is also enhanced because transaction costs are lower where social capital is higher.

Spatial features of social capital are inherently linked to its microfoundations. The latter, as classified in Glaeser et al. (2002), is shown in Table 9 in the Technical Appendix, along with a set of channels through which they translate into implications for program evaluations in an urban context.

2.1.2 Human capital

Human capital is also a strongly space-specific production factor. Skilled workers tend to sort in large urban agglomerations (Combes et al. 2008), and, as a consequence, returns to education are in their turn not spatially neutral. Spatial disparities in the distribution of skilled workforce affect the productivity impact of a policy fostering firm cooperation.

Following the logic of Table 9, Table 10 provides three possible rationales for the spatial heterogeneity of human capital and the implications this has for program evaluations in an urban context.

Cities crucially affect the spatial distribution of both human capital levels and their associated returns. Skilled people are unevenly distributed in space, the majority tending to concentrate in urban areas to reap the benefits of both higher salaries and better amenities.Footnote 3 Sorting processes also tend to be self-reinforcing, causing more productive companies to co-locate to reap the benefits of matching, sharing, and learning (Duranton and Puga, 2004); and the productivity effect that accrues to non-urban workers agglomerating in urban areas remains with them even after moving again to non-urban areas (Glaeser and Maré 2001; De la Roca and Puga 2017).

2.1.3 Agglomeration economies

Agglomeration economies include all positive externalities accruing to firms and individuals locating in urban areas. Behrens et al. (2014) theoretically break down these effects into: economies external to firms, forming at the city level and generating city-specific increasing returns; sorting effects, whereby more skilled individuals sort themselves in large urban areas; and selection effects implying that large urban areas, because of their large markets nature, enhance competition. Consequently, only the most productive firms remain on the market.

Agglomeration economies represent the main argument for economic actors to opt for an urban location, against the many backdrops (congestion, crime, and other relevant disamenities) associated with this locational choice.

Table 11 provides a synthetic classification of the way agglomeration economies have been described from different angles, each providing a different micro-foundation for the reason why program evaluation should be taking care of this context factor. While synthesizing the agglomeration literature is not within the scope of the paper, Table 11 suggests a set of commonalities in different approaches to the explanation of their effect which also paves the way for understanding their role in mediating network contract policy effectiveness.

2.1.4 Geographic accessibility

Second-nature geographyFootnote 4 can also foster (or hamper) the positive effect of local policies. Higher accessibility can directly impact firms’ productivity (Holl 2016) while also mediating the effect of local public policies (Haynes et al. 2004). Besides, vast evidence exists about the positive impact of both geographic-based as well as intangible networks on firm productivity (Cassiman and Veugelers 2002). The economic rationale of the use of this last variable, thus, lies in the accessibility–productivity–easier access to external networks causal chain (Table 12).

2.2 Identification in spatial program evaluation

The impact of urban factors on policy impact evaluation intertwines with the crucial issue of identification. The effect of omitting urban characteristics depends on the strategy assumed for evaluating programs: while Instrumental Variables (henceforth, IV) tend to be prevalent in the urban economics literature (Oreopulos 2006), more recently other approaches have been adopted, including Regression Discontinuity Design (RDD), Differences-In-Differences (DiD), and Propensity Score Matching (PSM).

As for IV, the two commonest approaches entail the use of geographic and historical instruments for assessing causal links in policy evaluations (Baum-Snow and Ferreira 2015). Over the last few years, RDD has gained more attention in the field of urban economics; Lee and Lemieux (2010) summarize the use of geographical features in RDD policy evaluations, from the seminal work in Black (1999) through Bayer et al. (2007). As for DiD, the technique has a relatively less widespread diffusion in urban economics, although over the last 15 years, it has increasingly gained consensus. Among some seminal contributions in this sense, Bogart and Cromwell (2000) use DiD to test whether rezoning decreases house prices in proximity to public schools, while Greenstone and Gallagher (2008) estimate local welfare impacts of the Superfund-sponsored remediation of hazardous waste sites.

This leads us to PSM, which is seldom used in urban economics. To the best our knowledge, to date very few program evaluations using, this method has been published in field or generalist journals (among the few examples, O’Keefe 2004; Kemeny et al. 2015). The reasons for this relatively under-exploitation of this methodology in the field of urban economics may be manifold, but are mostly related to the difficult justification of the conditional independence and common support assumptions.

This paper enters this niche but growing literature and provides a PSM-based evaluation of the support to the creation of Network Contracts in the Lombardy region.

3 Network contracts and other firm cooperation policies

The competitiveness of a firm depends not only on its internal resources and capabilities, but also on its ability and willingness to cooperate with other economic players (Gomes-Casseres 1997; Helsley and Strange 2007; Gadde et al. 2010).

Comparing networks with other ways of firm collaboration and cooperation, Cagliano et al. (2000) highlight how the former is in an intermediate position in terms of balancing between control structure and access to complementary skills, competencies, and assets (Breschi and Lenzi, 2016). On the one hand, networks are less stable and more vulnerable to loss of effectiveness as opposed to consortia, informal/formal agreements, joint ventures, and equity operations; on the other hand, they allow to access tacit knowledge (Nonaka and Takeuchi 1995) more easily than through other forms of collaboration such as licensing, contracting or outsourcing.

Networking is extremely diffused among firms (Mouzas and Ford 2012) as well as within them (Saint-Paul 2001; Krackhardt and Hanson 1993), and it usually has an extremely informal structure. Cross et al. (2002) argue that this may represent a weakness and can negatively affect the impact of collaborations because of the incomplete identification of the boundaries of the network, the unpredictability of the outcome of the interaction, appropriability issues, the transferability of the generated know-how, and, finally, governance difficulties.

3.1 The distinctive nature of network contracts

The Network Contract is able to overcome the limits of informal networks to which firms typically resort. In the first place, it reduces the vagueness of the network boundaries by identifying and sanctioning actors part of the network and the conditions under which new players can become part of, or leave, the network. Moreover, the Network Contract defines a common purpose and a program of action that regulates the roles of actors in the network. Finally, governance and coordination can be adapted to the size, nature and purpose of the actors who constitute the network: they can be entrusted to a governing body that can be one of the companies, composed of representatives of the companies, or also an external manager (Tunisini 2014).

The network contract aims at enhancing the following firm-specific activities:

-

Cooperation among firms;

-

Exchange of knowledge, know-how, sharing commercial of industrial intellectual property;

-

Joining production activities.

As such, the network contract leaves vast room for firms to decide how to implement their cooperation, in increasingly more structured ways, starting with basic unstructured cooperation to reach full-fledged joint production.

Because of its relatively recent introduction, the real impact of this policy instrument has been insufficiently explored. Bentivogli et al. (2013) have limited their analyses to the characteristics of the companies entering the contract. Their results suggest that companies that have entered a Network Contract have larger total assets and grow faster than those which did not, despite lower net profitability. Moreover, companies in the network tend to be less present in manufacturing sectors with low technological content, or in the service sector.

Cantele et al. (2016) have explored by means of case studies the evaluations of the entrepreneurs who entered this form of collaborations. Their findings suggest that Networks Contracts could help to work together around a common project with a financial investment lower than in formal M&As, with greater flexibility and control and, if needed, the possibility of an easier exit.

Along the same lines, Capuano et al. (2015) investigate the benefits gained by firms belonging to twelve Network Contracts. Their findings suggest that these firms are characterized by a better performance in terms of turnover and employees as opposed to comparable firms working alone. Moreover, the majority of the Networks had better relationships with the local financial institutions.

From an appraisal perspective, a more formal approach to the generation and evolution of firm networks also allows to keep track of the creation of these legal entities and to more precisely appraise their impact on firm productivity (Tiscini and Martiniello 2015). Benefits due to a more formal and structured interaction among companies include also better coordination and lower transaction costs as opposed to similar but looser forms of networks (Ventura et al. 2017).

Awareness of a network’s benefits is not always sufficient to stimulate its formation, because networks can have costs: conflicts of interest among participants, free riding, and uncertainty about whether joint goals are being achieved (Bentivogli et al. 2013). The pursuit of a collective strategy can be hampered by the inability to understand the immediate returns of such strategy (Dietz et al. 2003), engendering a classical market failure calling for possible state intervention.

3.2 Public support to network contracts

Governments at different administrative levels have developed incentive programs for this specific form of collaboration. According to the Bologna Charter (OECD 2001), (1) network policies should provide support both in terms of length, as well as in terms of financial resources involved; (2) networks should be open also to universities, technical schools and research institutes; and (3) their concrete objectives should be market-driven and not determined by the legislation.

Over the 2007–2013 planning cycle of the EU Structural Funds, European regions have also devoted resources to measures favoring firm aggregation such as Network Contracts. Bortoli and Rizzi (2015) identified in the 2010–2014 period 113 regional interventions including also companies aggregating in the form of Network Contracts. By the same token, Capuano et al. (2015) show how 7 out of 12 Networks used financial aids provided by regional tenders aimed at fostering the adoption of the Network Contract, almost all located in Northern Europe.

While statistical evidence about the diffusion of policies aiming at stimulating the formation of firm networks is relatively abundant, especially for the European case, to date no econometric evidence has been provided on the effectiveness of these policies, and in particular on the possible relevance of urban factors in strengthening, or hampering, the effects of such policies. Besides, so far the policy evaluation literature in the field of urban economics has shied away from using PSM to evaluate public policies. As a result, we have scarce evidence about the role played by urban features in driving policy effectiveness. This paves the way for the two research questions of this paper:

RQ1 | Is public support to Network Contracts effective? |

RQ2 | Do urban features influence the effectiveness of public support to Network Contracts? |

As explained in the following section, we will focus on the ERGON1 program, launched in Italy in 2011, to support the creation of Network Contracts.

4 Data description: the ERGON1 program

Data analyzed in this paper represent the universe of 1,518 companies financed by the ERGON1 program. The ERGON1 program, issued by the Lombardy Region’s DG Industry, Handcraft, Construction and Cooperation, aimed at fostering the creation of NCs among firms active in a selected set of industries. Launched in 2011, the program was endowed with 18.5 Million Euros. Projects eligible for being funded included plans for developing networks with the goal to increase productivity, create joint support services, stimulate product and/or process innovation, increase quality controls, develop new distribution channels, and strengthen the presence of firms on international markets. The ERGON1 program promoted the creation of Network Contracts by co-financing the costs related to these cooperative activities and projects; furthermore, it co-financed the related administrative costs. Public funding granted with this program could reach a maximum of 50 percent of the firm-specific investment, thus requiring some degree of participation of the treated firms. Within the regulatory framework, there is no difference across network contracts: This is a legal setting that favors cooperation among firms, without imposing ex ante structures.Footnote 5

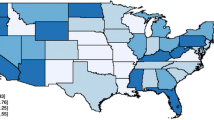

Firms funded within this program are characterized by sufficient geographic and industrial heterogeneity to allow satisfactory identification of network contracts effects. Figure 1a shows the geographic distribution of firms financed by ERGON 1. A strong concentration of the treated group is evident for the Lombardy Region, although a small percentage of companies is also located in other regions.Footnote 6 Figure 1b represents the frequency of firms financed by ERGON 1 per Italian province.Footnote 7 Firms financed by ERGON 1 are largely headquartered in Lombardy (about 99 percent of the sample); within such sub-sample, the province of Milan alone is home to 45 percent of the analyzed companies.

The relative frequency of the main sector of activity of the companies in the treated group (Fig. 2) suggests the presence of a wide range of specializations. Overall, Fig. 2 shows a picture of fragmentation of skills of the treated group, although this policy instrument seems to be catering mostly to firms active in industries classified as medium–high tech or high-tech manufacturing and services.

The nature of the Network Contract as a tool aimed at increasing the cooperative capacity of SMEs is evidenced by the higher frequency of firms of this size. Among those financed by ERGON 1, more than half has nine employees or less, thus falling into the category of micro-enterprises; 47% can be classified as SME (workforce between 10 and 249 employees); and only 0.5% have more than 249 employees, thus being classified as a large enterprise (Fig. 3).Footnote 8

Class | Percent |

|---|---|

0–10 | 60.16% |

11–25 | 23.52% |

26–50 | 9.62% |

51–100 | 3.94% |

100–250 | 2.11% |

> 250 | 0.65% |

5 Network contracts and firm performance: methodology and empirical model

5.1 Research design

The PSM procedure involves first an estimation of the propensity score, i.e., the probability (typically represented in binary form, 0/1) to access the treatment, given the characteristics of the observed unit. In the evaluation problem analyzed in this paper, this first step involves estimating the determinants of the probability of accessing financing by ERGON 1 on the basis of the characteristics of the firms participating in the program as well as those who did not participate and that are therefore part of the control group. As this stage entails the estimation of the determinants of a binary variable, typically logit or probit models are used. In this case, we resort to the Probit model. The choice of PSM is based on the availability of data that allows us to verify the unconfoundedness assumption.Footnote 9 Were we to have less information available about the treatment preconditions, we would have to reply on alternative identification methodologies, explicitly allowing selection on unobservables, such as the difference-in-differences (DID) and instrumental variables. Regression discontinuity design (RDD) would instead not fit the structure of our data, as the treatment is not based on continuous values of a selection criterion, since support to network contracts within the ERGON program was not based on cutoff thresholds, but, rather, based on rankings based on scoring three criteria related to the quality of the network contract project proposal, and its implementation strategy (Region Lombardy 2011).

Among the determinants of access to treatment, features typically include the official eligibility criteria for accessing the policy measure evaluated. In the case of ERGON 1, however, these criteria are relatively broad, so that they do not substantially discriminate among firms participating in the program. In fact, eligible firms include micro, small and medium-sized companies in industries as diverse as trade, handcraft, manufacturing, although mostly these are concentrated in the NACEFootnote 10 one-digit industries “manufacturing” and “construction,” with a smaller share of firms active in the service sector (Lombardy Region 2011; see also Sect. 4).

Two assumptions are required for the validity of the causality link, viz. conditional independence and common support. Conditional independence requires that there exists a set X of observable characteristics such that after controlling for them outcomes are independent of treatment (\(\left({Y}_{1},{Y}_{0}\right)\perp D|X\)).Footnote 11 Common support requires instead that for each value of X, there exists a positive probability of being either treated or untreated (\(P\left(D=1|X>0\right)\)).

For our empirical analyses, a sample of 8,960 untreated companies comparable to the treated units in terms of size and NACE business sector has been selected. The choice of the control group allows us to conclude that the randomization process is sufficiently precise and causes modest distortions (represented in Fig. 4), and in the order of ± 7% in terms of average size class and NACE industrial composition.

The quality of the matching procedure is also evidenced by t-tests for mean differences shown in Table 1, which presents the comparisons between key statistics concerning the characteristics on the basis of which matching was carried out. Table 1 suggests that the control group only presents a distortion in terms of average size, with treated firms being statistically larger (employer a larger labor force) as opposed to untreated units at the 90% confidence level.

5.2 Empirical model and database

Our empirical model takes on the following reduced form:

where Yi,t is a measure of firm performance, sizei,t indicates the number of employees, fini,t the financial structure of companies measured by the debt/equity ratio, crisisi,t a crisis dummy, capturing whether in year t the Country experienced a contraction for longer than two quarters, NCI,t the date of activation of a Network Contract, and finally, ERGON1i,t the date since the enterprise is financed by ERGON 1. In Eq. (1.), index t denotes the year in which each variable is measured, and index i indicates firms.

Among many possible choices for measuring Yi,t, in this paper, we resort to firm productivity growth. We follow Levinsohn and Petrin (2003), and calculate firm-specific Total Factor Productivity by instrumenting firms’ capital stocks with per capita costs of production. In fact, the problem of simultaneity in the firm’s decision is now a well-established result; this means that the factors driving firm productivity are in fact correlated with residuals. The Levinsohn and Petrin estimator provides a solution to this problem, alternative to other approaches previously proposed to address it (e.g., Olley and Pakes 1996). Simultaneity is due to the fact that firms react endogenously to productivity shocks they observe. This usually causes OLS estimates of the capital share to be underestimated, and labor shares to be overestimated. The intuition behind the Levinsohn and Petrin estimator is that intermediate input prices can be used as instruments precisely to control for unobserved productivity shocks. This is due to the fact that, in perfect competition, the intermediate input's demand function is a monotonic function of productivity.

The database is structured as a balanced panel covering the universe of companies (1,518), participating in ERGON 1 and observed over a decade (2004–2013). Data and sources of firm-specific information are described in Table 2.

Data concerning the intensity of factor endowment in firms are collected from the standard source in the literature, i.e., Bureau Van Dijk’s AIDA. AIDA is the Italian subset of the global data covering digital balance sheets, Orbis. Orbis is used as a reference benchmark for the vast coverage of firm’s reporting activities (Bajgar et al. 2020), and for its good coverage of information on both tangibles and intangibles (Nakatani 2023). As a consequence, Orbis has been frequently used in prior studies applying the Levinsohn and Petrin approach to measuring firm productivity (see for instance Maffini and Mokkas 2011; Cardamone 2020; Rungi and Biancalani 2019; Fons-Rosen et al. 2021, among many). Despite being based on a (self-) selection of firms into submitting digital balance sheets, Orbis is characterized by substantial degrees of representativeness; in fact, it covers around “60% of aggregate employment and output and around 40% of aggregate value added” (Bajgar et al. 2020, p. 18).

An additional element of novelty of this paper is also to take account of the urban context where policies are carried out. Table 3 displays city and region-specific data, indicators and sources used to further corroborate PSM estimates of the ERGON 1 funding on the formation of Network Contracts. Data are time-varying and mostly collected at the municipal level, but also comprise data collected at the provincial level.

6 Empirical results: identification issues and urban externalities

6.1 PSM analysis—conditioning on firm-specific characteristics

This section discusses the PSM results of the analysis performed to answer RQ1 (“Is public support to Network Contracts effective?”), thereby evaluating the effect of ERGON 1 in stimulating firm TFP growth. Throughout this section, matching is based on the Kernel procedure with replacement. This is a nonparametric process that uses the weighted averages of all individuals in the control group to build the counterfactual, or untreated units (Caliendo and Kopeining 2008). The advantage of this procedure lies mainly in the achievement of a more precise (i.e., characterized by lower variance) matching, despite the inevitable difficulties associated with matching along several continuous characteristics (Dehejia and Wahba 2002).

Table 4 shows the results of estimating the determinants of matching;Footnote 12 it suggests that the probability of being funded by ERGON 1 is positively and significantly associated with firm size. It is reasonable to assume that larger firms reach the threshold of managerial skills needed to access and manage these programs. In Table 4, no other variable is significant. The statistical significance associated with the firm size parameter may suggest that larger firms have the managerial skills needed on the one hand to decode the complex knowledge needed to meet public call criteria, while on the other hand allowing firms to successfully apply for funding. As for the parameter magnitude, estimates shown in Table 4 suggest that each additional employee in the labor force increases the probability of funding by 0.07%.

At the second stage, PSM involves the analysis of statistical differences between dependent variables predicted by the estimation model for treated units, compared to those that were not treated. This analysis is shown in Table 5.

Table 5 shows that TFP grew faster in the treated group (last row of the table) as opposed to the control group. Other things being equal, companies financed by ERGON 1, and therefore activating a Network Contract utilizing the funding received, outperformed those that were not treated.

6.2 PSM analysis—conditioning on city-specific characteristics

In this second empirical subsection, we tackle the second research question of the paper, i.e., Do urban features affect the effectiveness of Network Contracts?. This point is closely related to the crucial assumption PSM relies on, which is the SUTVA (Stable Unit Treatment Value Assumption; Rubin 1974). “SUTVA requires that the response of a particular unit depends only on the treatment to which he himself was assigned, not the treatments of others around him” (Bloome 2009), which means that each firm receiving support to join a network contract does not decide to do so through spillover mechanisms. While PSM does not typically take potential spillover effects into account (with the exclusion of the interesting attempt in De Castris and Pellegrini 2015), in this section we target this issue indirectly, by conditioning scores on territorial characteristics that may affect policy effectiveness.

In fact, it is reasonable to assume that context-specific features (the quality of informal institutions, the level of human capital, the intensity of agglomeration economies, and geographic accessibility) may influence the receptivity of firms to a specific policy. Thus, not conditioning on these factors when matching treated and untreated firms may significantly bias the picture of the true effect of a policy targeting the creation of firm networks.

Results of the PSM estimates including these four characteristics are shown in Table 6.

Table 6 suggests that, while remaining positive and statistically significant, the estimated impact of being funded for the formation of Network Contracts decreases after taking account of city-specific features that help explain the context where firms operate and the structure of incentives they face. This is also graphically shown in Fig. 5, where the differential impact is shown to decrease as urban features are included in the PSM conditioning factors.Footnote 13

This result is rather new to the urban economics literature and calls for a sound reassessment of policy evaluations at the local level. In light of our findings, in fact, the latter may be structurally over-emphasizing the true effect of schemes funding local competitiveness.Footnote 14

6.3 Robustness checks

Analyses previously shown are remarkably stable across different specifications. However, some of our findings could be in principle driven by omitted variables, or crucially affected by the presence of observations outlying for some specific factor.

In Table 7 we present several such consistency checks. All estimates imply a robustness check as opposed to the fourth line (general model) in Table 6.

In the first line, we present results of estimating the general model by keeping SMEs in the sample only; we run this check by excluding companies with less than 500 employees. In fact, given the fact that Network Contracts are aimed at stimulating cooperation mostly among small and medium companies; it may be argued that large firms could be more inclined to cooperate (because of more complex internal structures and a higher number of external nodes) and thus drive our findings.Footnote 15 This first robustness check suggests that this is not the case; our main results are confirmed both in terms of sign as well as in terms of magnitude.Footnote 16

The second robustness check relates to the matching procedure; in fact, the choice of different matching procedures usually provides evidence of the robustness of the empirical findings (Dehejia 2005). Throughout the paper, kernel matching has been adopted. Following Leuven and Sianesi (2003), three main types of matching can be performed, including traditional, simple smoothing, and weighted smoothing matching estimators. As for the former type of matching, we run a k-nearest neighbor procedure (Table 11, line 2), obtaining qualitatively identical results. While instead kernel, matching is usually classified in the second type of procedure, we also run a second type of simple smoothing procedure, based on the radius approach. Results, in this case, are stronger and more significant, if anything. Lastly, we run a Mahalanobis matching, using urban characteristics as discriminating factors. In this case, while the main findings remain qualitatively similar, a decrease in the significance of the estimated policy impact is identified, although firms treated are still found to be more productive as opposed to non-treated units (at the 90% confidence interval).

A last type of robustness check relates to the use of bootstrapped standard errors. Although the program evaluation literature is rather fuzzy about the true benefit deriving from this procedure (Austin and Small 2014), bootstrapping is still among the most exploited techniques to make inference about the estimates standard errors; for PSM estimates, anecdotal evidence suggests that their use would reduce sampling errors, thereby increasing the accuracy of propensity score estimates (Bai 2013). Our last check (Table 7, last line) suggests that the estimated impact coefficient still lies in the same order of magnitude as the baseline estimates.

6.4 Additional robustness checks: matching for alternative specifications of territorial indicators

This last subsection is dedicated to verifying the robustness of our findings to changing the specifications of territorial indicators used in the process of matching. Results of these verifications are presented in Table 8.

The first block of lines shows the results of verifying the robustness of our findings to a different specification of the geographical features of the municipality where the main branch of surveyed firms is located. In prior specifications, accessibility was proxied only with the mean altitude of each municipality. In this case, we calculated a composite indicator of three geographical characteristics of each municipality, maintaining information on the municipality elevation, but also adding the cumulative count of fires that took place over the estimation period and the degree of seismicity of the municipality. Data come from ISTAT’s Atlante Statistico Comunale (“Municipal statistical Atlas”). Variance in the three vectors has been synthesized by means of Principal Components Analysis, and the first component (the only with its associated eigenvector larger than one in modulus, = 1.4, with 47 percent of total variance explained) is retained as indicator of geographical features. Results again confirm that treated firms tend to register significantly faster TFP growth.

A second robustness check looks at whether the inclusion of the human capital indicator measured at the NUTS3 level hampers the validity of our identification process. To circumvent this issue, we use ISTAT data from the recent permanent census (data covering the 2018 cross section), with information on the population of 7,982 municipalities with a breakdown by levels of education achieved. These data are next processed by calculating the percentage of municipality population with at least a first degree (up to a second degree or Ph.D.), and the vector is used to match treated and untreated units. Results are presented in the second block of Table 8, again showing that the use of this alternative specification does not cause a loss in the statistical significance of our findings.

A third additional robustness check verifies whether the use of social capital institutions, rather than the pure count of volunteers, affects our findings. To this aim, we retrieved information on the number of local units of the third sector, i.e., the umbrella for not-for-profit organizations (Collins Dictionary 2024). Data have been collected from the 2011 Italian census and include information on the number of local units active in the third sector (NACE code 913) with an average count for 2001–2009. Results prove robust to the choice of this alternative indicator of social capital, as shown in the third block of Table 8.

A fourth and last robustness check deals with the possible detachment of firm density from population density as a proxy for urbanization economies. In fact, a recent literature starting from Glaeser et al. (2001)Footnote 17 has questioned traditional, Marshallian approaches to the identification of the urban productivity premium only based on pure density (on this point, Camagni et al. 2016), suggesting that some cities may thrive on production-related amenities, while some others may grow out of their nature of consumption hubs. In order to rule out the possibility that firm density may be offering a different picture, the fourth block in Table 8 shows the results of matching our estimates based on firm, rather than population, size. Data come from the universe of Italian firms identified in the 2001 ISTAT census. Matching for this vector collected at the municipal level also confirmed our main findings.

7 Concluding remarks

This paper presents an empirical assessment of the impact of funding the creation of Network Contracts in Italy’s Lombardy Region by means of the ERGON1 regional program.

In light of possible endogeneity issues, PSM is employed to assess causality links. These analyses suggest two key results:

-

Financing by means of ERGON1 is positively and significantly associated with better performing funded firms;

-

Once place-specific (in particular urban) characteristics are taken into account, PSM-based estimates of the policy impact decrease in magnitude.

This last point clearly resonates with the frequent critique in the field of regional science—no one size fits all, as recently argued in Ortega-Argilés (2022); regional policies ignoring territorial specificities are bound to at least partially miss their targets.

Some possible limitations of these analyses should be taken into consideration. On the one hand, the validity of our results is limited by the small size of the analyzed sample, both in terms of the overall number of treated firms, as well as in terms of the absolute figures involved in the funding process.

A second critical consideration, particularly relevant for policymakers, concerns the relative effectiveness of the funding provided in terms of the relationship between public funds invested and the return achieved. The yield estimated in this paper (TFP growth faster by 2.35% for treated units; see Sect. 6) should be weighed against the amount of resources made available with the first round (18.5 million Euros).

This cost–benefit analysis entails two fundamental steps. On the one hand, it is first necessary to establish the policy goals; if policies also aim at just enabling different combinations of activities, beyond the short-term horizon of economic results, this tool is indeed effective, although in a manner that is not easy to quantify with the methods adopted in this paper.

Secondly, it is also necessary to establish the time frame over which this type of policy should be assessed. If the estimated present impact is not fully satisfactory, our findings suggest an upward shift in the equilibrium long-run TFP growth, which, in the absence of changes in context conditions, could well accrue over a long horizon. It thus becomes crucial to carry out a sound cost–benefit analysis, based on the choice of a suitable time period, for fully assessing the validity of the policy instrument here analyzed.

A last word of caution on the role played by urban characteristics in correctly assessing the impact of the policy is also needed. Our findings suggest that omitting context factors when conditioning for PSM analyses causes estimate precision to decrease by 1 to 5 percent. This is admittedly not a relevant figure in absolute terms, but one that may well blur the actual picture for policymakers interested in correctly assessing the potential returns from a policy.

Notes

As argued later in the empirical section, the policy is (partially) space-blind in that it targets firms and not places in a region or a Country. Indeed, in the case studied in this paper, since funding comes from a Regional Authority, recipients are mostly located in the region. We consider this a more difficult setting to prove our hypothesis, and thus believe that testing the impact of (fully) space-blind policies in larger areas would lead to even more significant results.

ERGON is an acronym for “Eccellenze Regionali a supporto della Governance e dell'Organizzazione dei Network di imprese” (Regional excellences supporting governance and the creation of firm networks).

The spatially uneven distribution of skilled workers, in particular due to their disproportionately urban location, also influences the degree to which recent technological transformations such as robotization affect productivity and wages (Capello and Lenzi 2023), and with a specific effect on tertiary activities in the urban setting (Camagni et al. 2023).

First-nature [geography includes] location, proximity, physical geography, [while] second-nature geography [encompasses] economic structure, agglomeration, economic potential (Arvanitopoulos et al. 2021, p. 2880).

As this paper is being written, recent statistics (released Jan 3, 2024) suggest that a grand total of 47,243 firms have entered a network contract, for a total 8,909 contracts signed (Registro Imprese 2024).

It is important to stress that the Network Contracts analyzed in this paper include at least one firm whose headquarter is located in Lombardy. Hence, the sample is not restricted to the region alone.

Italian provinces correspond to the third layer of the European NUTS (Nomenclature of Units for Territorial Statistics) classification. They roughly correspond to the size of US counties.

More in detail, the following table supports the highly skewed distribution in the data, with more than 60 percent of the sample analyzed with ten employees and only .65% in the ‘large’ class.

“Unconfoundedness requires that Y(0), Y(1) ∐D∣X, where ∐ denotes independence, i.e., given a set of observable covariates X which are not affected by treatment, potential outcomes are independent of treatment assignment” (Caliendo and Kopeinig 2008, p. 35).

NACE (standing from French “Nomenclature statistique des activités économiques dans la Communauté européenne”) is the official European classification of economic activities and can be roughly compared to the US NAICS.

This is equivalent to assuming that funding is, although not exactly random, just as valid. This hypothesis is formally defined “selection on the basis of observable characteristics” (Heinrich et al. 2010).

Additional details on the determinants and quality of the matching procedure are discussed in the Technical Appendix.

The Technical Appendix also graphically shows the quality of matching before and after treatment.

Prior work (see, e.g., Chagas et al. 2012 ; Negret et al. 2020) has formally included spatial autocorrelation in classical identification methodologies such as PSM used for our analyses. However, in this paper, we take on a different angle: we strive to account for all relevant space-specific characteristics that may influence the effectiveness of these policies, and whose context nature—if omitted—would cause the bias corrected by means of spatial econometric models (Corrado and Fingleton 2012). Merging the two approaches could be a very promising future research avenue.

This is in line with a germane literature dealing with the determinants of firm-university cooperation. For instance, Laursen and Salter (2004) find that he results suggest that firms who invest in R&D are more likely to learn from universities.

Indeed, SMEs represent 2.64% of the analyzed sample: the limited relevance of this sub-sample may co-explain this result.

See also Caragliu et al. (2022) for a recent estimate of the relative strength of consumption-related against production-related amenities.

References

Akçomak IS, Ter Weel B (2012) The impact of social capital on crime: evidence from the Netherlands. Reg Sci Urban Econ 42(1–2):323–340

Alesina A, Giuliano P (2015) Culture and institutions. J Econ Lit 53(4): 898–944

Arrow KJ (1962) The economic implications of learning by doing. Rev Econ Stud 29(3):155–173

Arvanitopoulos T, Monastiriotis V, Panagiotidis T (2021) Drivers of convergence: the role of first-and second-nature geography. Urban Stud 58(14):2880–2900

Arzaghi M, Henderson JV (2008) Networking off Madison avenue. Rev Econ Stud 75(4):1011–1038

Austin PC, Small DS (2014) The use of bootstrapping when using propensity–score matching without replacement: a simulation study. Stat Med 33(24): 4306–4319

Bai H (2013) A bootstrap procedure of propensity score estimation. J Exp Educ 81(2):157–177

Bajgar M et al (2020) Coverage and representativeness of Orbis data. OECD Science, technology and industry working papers, No. 2020/06, OECD Publishing. https://doi.org/10.1787/c7bdaa03-en

Barrios Garcia JA, Rodriguez Hernandez JE (2007) Housing and urban location decisions in Spain: an econometric analysis with unobserved heterogeneity. Urban Stud 44(9):1657–1676

Baum-Snow N, Ferreira F (2015) Causal inference in urban and regional economics. In: Duranton G, Vernon Henderson J, Strange WC (eds) Handbook of regional and urban economics, vol 5. Elsevier, Amsterdam, pp 3–68

Bayer P, Ferreira F, McMillan R (2007) A unified framework for measuring preferences for schools and neighborhoods. J Polit Econ 115(4):588–638

Behrens K, Duranton G, Robert-Nicoud F (2014) Productive cities: sorting, selection, and agglomeration. J Polit Econ 122(3):507–553

Bentivogli C, Quintiliani F, Sabbatini D (2013) “Le reti di imprese”, Questioni di economia e Finanza, Occasional Papers no. 152. Banca d’Italia, Rome

Black SE (1999) Do better schools matter? Parental valuation of elementary education. Quart J Econ 114(2):577–599

Bloome, D. (2009). “Violations of SUTVA”, retrieved online on Jan. 4, 2024. https://blogs.iq.harvard.edu/violations_of_s

Bogart WT, Cromwell BA (2000) How much is a neighborhood school worth? J Urban Econ 47(2):280–305

Bortoli M, Rizzi E (2015) Le Regioni a favore delle Reti d’Impresa. Studio sui finanziamenti per le aggregazioni. Confindustria

Breschi S, Lenzi C (2016) Co-invention networks and inventive productivity in US cities. J Urban Econ 92:66–75

Cagliano R, Chiesa V, Manzini R (2000) Differences and similarities in managing technological collaborations in research, development and manufacturing: a case study. J Eng Tech Manag 17(2):193–224

Caliendo M, Kopeinig S (2008) Some practical guidance for the implementation of propensity score matching. J Econ Surv 22(1):31–72

Camagni R, Capello R, Caragliu A (2016) Static versus dynamic agglomeration economies. Spatial context and structural evolution behind urban growth. Pap Region Sci 95(1):133–159

Camagni R, Capello R, Lenzi C, Perucca G (2023) Urban crisis vs urban success in the era of 4.0 technologies: Baumol’s model revisited. Pap Region Sci 102(3):589–612

Cantele S, Vernizzi S, Ricciardi F (2016) The emerging wave of agility-oriented business networks in Italy: a new strategy for facing global competition. World Rev Entrepreneurs Manag Sustain Dev 12(2/3):270–284

Capello R, Lenzi C (2023) Automation and labour market inequalities: a comparison between cities and non-cities. NPJ Urban Sustain 3(1):56

Capuano G, Tunisini A, Conte MA, Arrigo T, Consolati L, Granata G, Tassani T, De Lucia LF (2015) Imprese e territori nel Contratto di rete. Giannini, Naples

Caragliu A, De Dominicis L, De Groot HLF (2016) Both Marshall and Jacobs were right! Econ Geogr 92(1):87–111

Caragliu A, Smit M, Van Oort F (2022) “Who's right, weber or glaeser?”, paper presented at the 2022 online ASSA conference. https://www.aeaweb.org/conference/2022/preliminary/paper/KR35TYiB

Cardamone P (2020) Productivity and spatial proximity: evidence from the Italian food industry. Int Rev Appl Econ 34(3):327–341

Cassiman B, Veugelers R (2002) R&D cooperation and spillovers: some empirical evidence from Belgium. Am Econ Rev 92(4):1169–1184

Carter S, Sutch R (1999) Historical background to current immigration issues. In: Smith JP, Edmonston B (eds) The immigration debate: studies on the economic, demographic and fiscal effects of immigration. National Academy Press, Washington, pp 289–366

Chagas ALS, Toneto R, Azzoni CR (2012) A spatial propensity score matching evaluation of the social impacts of sugarcane growing on municipalities in Brazil. Int Reg Sci Rev 35(1):48–69

Chesbrough H (2003) Open innovation. Harvard University Press, Cambridge

Coleman JS (1988) Social capital in the creation of human capital. Am J Sociol 94(Supplement):S95–S120

Collins Dictionary (2024) “Third sector”, retrieved onlone on Jan. 23, 2024 at the. https://www.collinsdictionary.com/dictionary/english/third-sector

Combes PP, Duranton G, Gobillon L (2008) Spatial wage disparities: Sorting matters!. J urban Econ 63(2): 723–742

Corrado L, Fingleton B (2012) Where is the economics in spatial econometrics? J Reg Sci 52(2):210–239

Cross R, Nohria N, Parker A (2002) Six myths about informal networks—and how to overcome them. MIT Sloan Manag Rev 43(3):67–75

Dehejia R (2005) Practical propensity score matching: a reply to smith and Todd. J Econom 125(1–2):355–364

De Castris M, Pellegrini G (2015) Neighborhood effects on the propensity score matching. Tor Vergata WP No. 0515

Duranton G, Puga D (2004) Micro-foundations of urban agglomeration economies. In Handbook of regional and urban economics (Vol. 4, pp 2063–2117). Elsevier

De La Roca J, Puga D (2017) Learning by working in big cities. Rev Econ Stud 84(1):106–142

Dietz T, Ostrom E, Stern PC (2003) The struggle to govern the commons”. Science 302(5652):1907–1912

Edquist C (2005) Systems of innovation: perspectives and challenges. In: Fagerberg J, Mowery D, Nelson R (eds) The Oxford handbook of innovation. Oxford University Press, Oxford

Ellison G, Glaeser EL (1999) The geographic concentration of industry: does natural advantage explain agglomeration? Am Econ Rev 89(2):311–316

Ellison G, Glaeser EL, Kerr WR (2010) What causes industry agglomeration? evidence from coagglomeration patterns. Am Econ Rev 100(3):1195–1213

Fons-Rosen C, Kalemli-Ozcan S, Sørensen BE, Villegas-Sanchez C, Volosovych V (2021) Quantifying productivity gains from foreign investment. J Int Econ 131:103456

Frenken K, Oort FV, Verburg T (2007) Related variety, unrelated variety and regional economic growth. Reg Stud 41(5):685–697

Gadde LE, Håkansson H, Persson G (2010) Supply network strategies. Wiley, Chichester

Gallup JL, Sachs JD, Mellinger AD (1999) Geography and economic development. Int Reg Sci Rev 22(2):179–232

Glaeser EL, H D, Scheinkman JA, Shleifer A (1992) Growth in cities. J Pol Econ 100(6): 1126–1152

Glaeser EL, Maré DC (2001) Cities and skills. J Law Econ 19(2):316–342

Glaeser EL, Kolko J, Saiz A (2001) Consumer city. J Econ Geogr 1(1):27–50

Glaeser EL, Laibson D, Sacerdote B (2002) An economic approach to social capital. Econ J 112(483):F437–F458

Gomes-Casseres B (1997) Alliance strategies of small firms. Small Bus Econ 9(1):33–44

Greenstone M, Gallagher J (2008) Does hazardous waste matter? Evidence from the housing market and the Superfund Program. Quart J Econ 123(3):951–1003

Hamilton K, Helliwell JF, Woolcock M (2016) Social capital, trust and well-being in the evaluation of wealth (No. w22556). NBER

Heckman J, Ichimura H, Todd P (1997) Matching as an econometric evaluation estimator: evidence from evaluating a job training programme. Rev Econ Stud 64(4):605–654

Heckman J, Ichimura H, Smith J, Todd P (1998) Characterizing selection bias using experimental data. Econometrica 66(5):1017–1098

Heinrich C, Maffioli A, Vazquez G (2010) A primer for applying propensity-score matching. Inter-American Development Bank, Impact-Evaluation Guidelines Technical Notes No. IDB-TN-161, August 2010

Helsley RW, Strange WC (2007) Urban interactions and spatial structure. J Econ Geogr 7(2):119–138

Höll A (2016) “Highways and productivity in manufacturing firms. J Urban Econ 93(23):131–151

Imbens GW, Wooldridge JM (2009) Recent developments in the econometrics of program evaluation. J Econ Lit 47(1):5–86

Jacob J (1969) The Economy of Cities. New York, Penguin Books

Jones C, Hesterly WS, Borgatti SB (1999) A general theory of network governance: exchange conditions and social mechanisms

Kemeny T, Feldman M, Ethridge F, Zoller T (2015) The economic value of local social networks. J Econ Geogr 16(5):1101–1122

Krackhardt D, Hanson JR (1993) Informal networks: the company behind the chart. Harv Bus Rev 71(4):104–111

Laursen K, Salter A (2004) Searching low and high: what types of firms use universities as a source of innovation? Res Policy 33(8):1201–1215

Lechner M (2002) Program heterogeneity and propensity score matching: an application to the evaluation of active labor market policies. Rev Econ Stat 84(2):205–220

Lee DS, Lemieux T (2010) Regression discontinuity designs in economics. J Econ Lit 48(2):281–355

Levinsohn J, Petrin A (2003) Estimating production functions using inputs to control for unobservables. Rev Econ Stud 70(2):317–341

Lhuillery S, Pfister E (2009) R&D cooperation and failures in innovation projects: empirical evidence from French CIS data. Res Policy 38(1):45–57

Li F, Zaslavsky AM, Landrum MB (2013) Propensity score weighting with multilevel data. Stat Med 32(19):3373–3387

Maffini G, Mokkas S (2011) Profit shifting and measured productivity of multinational firms. Oxford Bull Econ Stat 73(1):1–20

Marshall A (1920) Principles of economics. Macmillan and Co, London

Moretti E (2004) Estimating the social return to higher education: evidence from longitudinal and repeated cross-sectional data. J Econom 121(1–2):175–212

Mouzas S, Ford D (2012) Leveraging knowledge-based resources: the role of contracts. J Bus Res 65(2):153–161

Nakatani R (2023) Debt maturity and firm productivity—the role of intangibles. Res Econ 77(1):116–121

Negret PJ, Marco MD, Sonter LJ, Rhodes J, Possingham HP, Maron M (2020) Effects of spatial autocorrelation and sampling design on estimates of protected area effectiveness. Conserv Biol 34(6):1452–1462

Nonaka I, Takeuchi H (1995) The knowledge creating company: how Japanese companies creates the dynamics of innovation. Oxford University Press, New York

Noulas A, Scellato S, Lambiotte R, Pontil M, Mascolo C (2012) A tale of many cities: universal patterns in human urban mobility. PLoS ONE 7(9):1–10

OECD (2001) Enhancing SME competitiveness: the OECD bologna ministerial conference. OECD, Paris

O’Keefe S (2004) Job creation in California’s enterprise zones: a comparison using a propensity score matching model. J Urban Econ 55(1):131–150

Olley G, Pakes A (1996) The dynamics of productivity in the telecommunications equipment industry. Econometrica 64(6):1263–1297

Oreopoulos P (2006) Estimating average and local average treatment effects of education when compulsory schooling laws really matter. Am Econ Rev 96(1):152–175

Ortega-Argilés R (2022) The evolution of regional entrepreneurship policies: no one size fits all. Ann Reg Sci 69:585–610

Ottaviano GI, Peri G (2006) The economic value of cultural diversity: evidence from US cities. J Econ Geogr 6(1): 9–44

Rauch JE (1993) Productivity gains from geographic concentrations of human capital: evidence from cities. J Urban Econ 34:380–400

Region Lombardy (2011) “D.d.u.o. 4 ottobre 2011 - n. 8950 Programma regionale Ergon. Determinazioni in merito alla d.g.r. n. IX/1989 del 13 luglio 2011: approvazione del bando per la creazione di aggregazioni di imprese (Azione 1)”. Retrieved online on Jan. 23, 2024. https://www.finlombarda.it/c/document_library/get_file?uuid=0604d7ce-a8a2-4709-bac3-2575a88bef20&groupId=1004759

Registro Imprese (2024) “Contratti di rete”, retrieved online on Jan. 23, 2024. https://contrattidirete.registroimprese.it/reti/

Romer PM (1986) Increasing returns and long-run growth. J Polit Econ 94(5):1002–1037

Rosenthal SS, Strange WC (2004) Evidence on the nature and sources of agglomeration economies. In: Henderson JV, Thisse J-F (eds) Handbook of regional and urban economics, vol 4. Elsevier, Amsterdam, pp 2119–2171

Rubin DB (1974) Estimating causal effects of treatments in randomized and nonrandomized studies. J Educ Psychol 66(5):688

Rungi A, Biancalani F (2019) Heterogeneous firms and the north–south divide in Italy. Ital Econ J 5(3):325–347

Saint-Paul G (2001) On the distribution of income and worker assignment under intra-firm spillovers, with an application to ideas and networks. J Polit Econ 109(1):1–37

Takhteyev Y, Gruzd A, Wellman B (2012) Geography of Twitter networks. Soc Netw 34(1):73–81

Tether BS (2002) Who co-operates for innovation, and why: an empirical analysis. Res Policy 31(6): 947–967

Tiscini R, Martiniello L (2015) Italian network contracts: a new instrument for successful cooperation. J Bus Manag 4(2):45–61

Tunisini A (2014) Il contratto di rete: opportunità e trappole da evitare. Economia e diritto del terziario no. 1, pp 41–52

Ventura F, D’Arienzo MC, Martino G (2017) Italian network contracts viewed from the perspective of transaction cost economics. In: Martino G, Karantininis K, Pascucci S, Dries L, Codron JM (eds) It’s a jungle out there—the strange animals of economic organization in agri-food value chains. Wageningen Academic Publishers, Wageningen, pp 105–117

Winters JV (2013) Human capital externalities and employment differences across metropolitan areas of the USA. J Econ Geogr 13(5):799–822

Zubizarreta JR, Keele L (2017) Optimal multilevel matching in clustered observational studies: a case study of the effectiveness of private schools under a large-scale voucher system. J Am Stat Assoc 112(518):547–560

Funding

Open access funding provided by Politecnico di Milano within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

Appendix A: Literature review synthesis tables

See Tables 9 , 10 , 11 , and 12

.

Appendix B: Probit estimates of the probability of being matched

See Table

13.

Appendix C: Quality of matching

See Fig.

6.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.