Abstract

This paper studies role of agglomeration externalities and market structure in determination of total factor productivity (TFP) of Ukrainian firms, having controlled for individual firm characteristics. We use micro-level data for manufacturing and service sectors in years 2005 and 2013. Our empirical results confirm the importance of various agglomeration externalities as well as competition in determination of TFP of Ukrainian firms. In addition, we find the statistically significant link between the total factor productivity, intangible assets, capital intensity, firm size, ownership status and firm internationalization (exports and imports).

Similar content being viewed by others

1 Introduction

After the collapse of the Soviet Union in 1991, Ukraine emerged as an independent country and followed its own way of economic and political transition. Since the beginning of the 1990s, Ukraine has been struggling with transforming its economy from central planning into an open market economy. The change in the political leadership and declarations for deeper economic reforms as well as recent signing the free trade agreement with the EU create new opportunities and prospects for economic recovery and improved performance of Ukrainian enterprises. However, up to now there have been relatively limited empirical evidence on the performance of Ukrainian enterprises, especially in the regional context.

There have been several studies on the performance of enterprises in Ukraine. However, so far no attempts were made to study empirically the relationship between agglomeration externalities and firm productivity for Ukrainian enterprises in the regional context. Therefore, the primary goal of this paper is to investigate empirically the factors that affect the firm productivity in manufacturing and service industries in Ukraine with the special role devoted to various agglomeration externalities and the market structure. In particular, we distinguish between specialization, diversification and competition externalities.

Aside from the purely academic point of view, the analysis of agglomeration economies and market structure has potentially very important policy implications. Since the 1980s, agglomeration economies have been used to justify cluster policies by national and local governments also in many countries other than Ukraine including Germany, Brazil, Japan, South Korea and Spain. More recently, similar policies were implemented also in France and some of those policies turned out to be very costly. For example, according to Martin et al. (2011) 1.5 billion euro has been devoted to the so-called “competitiveness clusters” policy by the French government from the 2005 to 2008 and 2009 to 2011 periods. Therefore, to be able to better understand whether there is such a case for public intervention it is important first to evaluate empirically the importance of various agglomeration economies. In particular, it is necessary to study whether productivity of a firm indeed increases when other firms from the same industry or from another industry decide to locate nearby.

The structure of this paper is organized as follows. In the next section, we provide the literature review of the existing empirical studies on regional externalities associated with knowledge spillovers. Then, we discuss various measures of agglomeration externalities and market structure. Subsequently, we describe the estimating equation and the properties of the dataset. Finally, we present and discuss our empirical results. The last section concludes with the summary of main findings and directions for future research.

2 Literature review

The interest in studying the role of agglomeration economies in determining firm productivity goes back at least to Marshall (1890) who proposed a number of reasons for existence of agglomeration externalities. In the modern terminology, Marshallian externalities may arise because of (i) knowledge spillovers between firms, (ii) highly specialized labor force based on the accumulation of human capital, (iii) backward and forward linkages associated with large local markets. The idea that increasing returns are external to the firm but internal to the industry was later employed in many theoretical models including those proposed by Arrow (1962) and Romer (1986).Footnote 1 In the seminal empirical study Glaeser et al. (1992) called the aforementioned type of externalities Marshall–Arrow–Romer (MAR) spillovers. Moreover, according to the MAR approach monopoly should be associated with faster firm growth because the firm can internalize innovations more efficiently in a monopolistic market, in which there are no other firms to imitate its ideas.

In contrast, Jacobs (1969) in her highly influential book argued that knowledge spillovers are related to urbanization, in which diversity of technologies and industries should lead to the faster flows of ideas and higher productivity. In particular, she claimed that the close proximity of firms from various industries would stimulate productivity and firm growth within cities. According to her view, diversity of various industries should speed up the transfer of knowledge between individuals and motivate the innovations in firms. In addition, she postulated that a more competitive market structure should be associated with faster innovation. In the context of urbanization, she argued that even if a city is specialized in some sets of industries, the demand for raw materials and even other final goods and services could lead to the birth and growth of other industries within the same region.

Finally, Porter (1990) proposed an alternative view on the role of knowledge spillovers and the market structure that combined some elements of the two previous approaches. On the one hand, he emphasized the positive role of increased specialization, while on the other tougher competition in the faster industry growth. Similar to the MAR approach, Porter (1990) claimed that there is a positive impact of intra-industry externalities on growth which means that the increased specialization should stimulate growth. However, similar to Jacobs (1969) he also argued that more local competition among the firms of the same industry could facilitate the flows of ideas between economic agents.

The empirical studies of externalities have a long history in the economic literature. The majority of empirical work focused on static externalities related to immediate information about current economic conditions. Two main types of static externalities were distinguished: (i) localization economies in which a firm benefits from the presence of other local firms in the same industry Henderson et al. 1995 and (ii) urbanization economies in which a firm benefits from overall local urban scale and diversity.

In contrast, dynamic externalities deal with the role of prior information accumulations in the local area on current productivity. Such accumulations are fostered by a history of interactions and cultivated long-term relationships. This results in a buildup of local knowledge available to firms in a given area. Similarly to the case of static externalities also two main types of dynamic externalities were distinguished: (i) Marshall–Arrow–Romer (MAR) localization economies that concern knowledge spillovers between local firms in the same industry and (ii) Jacobs (1969) urbanization economies which derive from the transfer of knowledge from outside the core industry.

The MAR hypothesis also predicts that local monopoly encourages growth since it restricts the flows of ideas to other firms and allows potential externalities to be internalized by the innovator. However, this view has been questioned by Porter (1990) who generally agrees with the MAR hypothesis that knowledge spillovers in specialized geographically concentrated industries stimulate growth but argues instead that local competition, as opposed to local monopoly, fosters the pursuit and rapid adaptation of innovation.

The empirical literature on the role of agglomeration economies was initiated by two empirical studies on localization and urbanization economies that were undertaken for the US cities and metropolitan areas in the early 1990s. In particular, in their seminal study Glaeser et al. (1992) employed the OLS method to test for these externalities using industry-level data on 170 largest US cities during the period 1956–1987. According to their findings, urban diversity and local competition, but not regional specialization encouraged employment growth in industries. This means knowledge spillovers occur between rather than within industries which was consistent with the Jacobs hypothesis and contradicted the MAR hypothesis.

In the follow-up study, Henderson et al. (1995) used a very similar approach to Glaeser et al. (1992). Their dataset included eight different industries of about 224 metropolitan statistical areas in the USA during the period 1970–1987. However, in contrast to the previous study, they divided industries into two main categories: mature industries and new high-tech industries. For the mature industries, they found evidence of MAR externalities but not of Jacobs externalities. However, for the new high-tech industries they reported evidence of both Jacobs and MAR externalities.

In the later years, many empirical studies for other countries followed. Positive, negative and insignificant impacts of three types of externalities were found in those studies.Footnote 2 Recent examples of such studies include de Groot and de Vor (2010) and Pessoa (2014). However, up to now there is very limited literature on Ukrainian enterprises that is based on firm-level data to study determinants of productivity. None of them, however, studies the role of agglomeration externalities in the determination of firm-level productivity.

For example, Brown et al. (2006) studied the effect of privatization on total productivity using comprehensive panel data on initially state-owned manufacturing firms in four economies—Hungary, Romania, Ukraine and Russia. They employed preferred random growth estimates and found positive total factor productivity effects of 15% in Romania, 8% in Hungary and 2% in Ukraine, but a − 3% effect in Russia, also the positive influence of foreign privatization at the level of 18–35% higher TFP in all countries.

More recently, Gorodnichenko and Grygorenko (2008) used data of 2000 Ukrainian joint stock enterprises and controlling for the endogeneity of ownership found that vertically integrated financial groups (‘oligarchs’)in Ukraine tend to have higher productivity growth than firms not owned by oligarchs. Earle et al. (2014), using the panel of 7000 manufacturing enterprises, demonstrated that political favoritism, in the context of weak institutions, can have substantial redistributional impact on economic productivity. Kostenko (2014) confirmed that innovation activity had a positive impact on labor productivity of Ukrainian firms.

Most recently, Shepotylo and Vakhitov (2015) employed a large database of Ukrainian firms in 2001–2007 to identify the effect of services liberalization on total factor productivity (TFP) of manufacturing firms. The results indicated that an increase in services liberalization was associated with an increase in TFP. The effect was stronger for firms with high productivity, bringing about a reallocation of resources within an industry. Industry-level results showed that the effect of reallocation on industry productivity was almost as strong as the within-firm effect. The dynamic interaction of services liberalization and TFP through the investment channel reinforced the effect of reallocation. In particular, it is more pronounced for domestic and small firms.

Kim et al. (2015) also documented a variation across observed firms’ characteristics, and the accompanying macroeconomic volatility, often related to political turmoil for Ukrainian manufacturing firms. They used an annual firm-level data for the period from 2001 to 2009 and employed functional principal component analysis. The overall improvements in firm productivity in Ukraine’s manufacturing in 2001–2009 were found to vary substantially by industry, trade status and with firm turnover, while regional effects were less important.

However, no attempts have been made to study the systematic relationship between productivity and agglomeration externalities, having controlled for a relatively large set of firm characteristics for Ukrainian enterprises. Therefore, we aim to fill at least a part of the existing gap in the literature. Our study is based on the Ukrainian firm-level data for the transition period for two years: 2005 and 2013. This allows us to evaluate the role of agglomeration externalities in the determination of productivity in manufacturing and service sectors that may be significantly different in both sectors and changing over time with the progress of economic transition in Ukraine.

In our study, we use TFP as a measure of overall productivity calculated by the Levinsohn–Petrin method. This method aims at the estimation of the production function based on such inputs as capital, labor and intermediate goods. The method uses intermediate inputs as the factor correlating with unobservable productivity shock in the residual. TFP can be estimated in Stata using command ‘levpet’ that implements the estimators of input shares on the basis of log data for total revenues, capital stock, number of employees and cost of materials (raw materials, electricity, fuel). The TFP-based measure of productivity is better compared to the simple measure of labor productivity used in earlier studies as it takes into account the productivity of other factors of production.

In our study, we take into account both manufacturing and service firms and control for industry and region-specific fixed effects. We devote a special attention to the role of agglomeration externalities and market structure in determining firm productivity. In addition, we also study the role of individual firm characteristics such as intangible assets, factor intensity, firm size, private ownership, as well as firm internationalization measured by foreign capital participation.

3 Measures of externalities

Henderson et al. (1995) used in their early study a very simple measure of specialization based on the geographical concentration of economic activity that is measured using the ratio of regional industrial employment to the total local area:

where \(L_\mathrm{irt}\) is the total employment for industry “i” in region “r” at time “t”, area \(_\mathrm{rt}\) is the whole area of region “r” at time “t” in square kilometers. The bigger the value of this measure the higher the geographical concentration of employment.

In our study, we use two alternative measures of specialization to study two separate aspects of specialization. One of them is within regional concentration that measures the level of concentration of the industry within the respective region. The higher value of this index shows that there is more employment concentrated in that industry in the given region. This measure was used by Henderson et al. (1995) and Cingano and Schivardi (2004).

Definition of i, r, t and L are as previous and N is the number of all industries in the region. De Lucio et al. (2002) used productivity instead of employment in this measure, which can provide a different interpretation. The second index is within industry concentration that measures the level of concentration of the region within the respective industry in the whole sample. This measure shows how big the industry of region is relative to the total industry. The bigger value of this index determines the higher specialization of the region and bigger economic activity.

where i, r, t and L define as previously and R is the total number of regions that have this industry. De Lucio et al. (2002) used this measure to show within industry concentration of the value added.

Various measures of diversification can be found in the literature. The most commonly used measure of diversification is the Hirschman–Herfindahl index (HHI).Footnote 3 This index is defined as the sum of squares of share of other industries employment in the region relative to the total employment of the region except the respective industry in question:

where \(i'\) denotes all industries in the region other than the respective one under analysis, and definitions of r, i, t and L are the same as before. This measure shows the within regional concentration of industries other than the respective one under investigation. The value of this index ranges between 1 / N and 1, and the higher value of this index shows less diversity in the region. In fact, if all of the economic activities other than the respective industry are agglomerated in one industry, this measure receives the value of 1.

In this study, we use two alternative competition measures: the first measure concerns competition between industries within the same region, while the second is a proxy for local competition between firms of the same industry. The first measure is defined in the following way:

Since the larger number of industries (N) can increase the level of competition, and the lower value of the HHI means more even distribution of industrial activities in the region, the lower value of “\({C}_{1}\)” is associated with the higher degree of competition in the region. The second measure is the standard HHI that measures the degree of competition within the industry.

4 Research methodology and data description

In this study, we analyze empirically the determinants of firm productivity with the special focus on the role of agglomeration externalities and competition. We also take into account firm and industry characteristics that may affect firm productivity such as the firm’s intangible assets, capital intensity, size, ownership status, firm internationalization (exports and imports). To investigate empirically the relationship between firm productivity, measured by its TFP, and its determinants we estimate the following regression:

Note: some independent variables are only used in the sensitivity analysis.

where TFP\(_{\mathrm{ijr}}\) is the productivity level of firm j in industry i in region r, intan\(_{\mathrm{ijr}}\) is the ratio of intangible assets to fixed assets of the firm, size\(_{\mathrm{ijr}}\) is the firm size measured in terms of full-time employees, KLratio\(_{\mathrm{ijr}}\) is the stock of fixed assets per full-time employeeTheil\(_{\mathrm{ijk}}\) is the topographic Theil indicator, imports\(_{\mathrm{ijr}}\) is a dummy variable indicating whether the firm is importing or not, export\(_{\mathrm{ijr}}\) is a dummy variable indicating whether the firm is exporting or not, private \(_{\mathrm{ijr}}\) is a dummy variable indicating whether the firm is privately owned or not, foreign\(_{\mathrm{ijr}}\) is a dummy variable indicating whether the firm has foreign ownership or not, and HHI\(_{\mathrm{j}}\) is the Herfindahl–Hirschman index calculated for the NACE 2-digit industry, \(S_{2}\) is the measure of within regional concentration of the industry, \(S_{3}\) is the measure of concentration of the region within the respective industry, \(D_{1}\) is the measure of diversification, \(v_{\mathrm{j}}\) is a dummy variable measuring the industry-specific fixed effect, \(u_{\mathrm{r}}\) is a dummy variable measuring the region-specific fixed effect, \(\varepsilon \) \(_{\mathrm{ijr}}\) is the error term which is assumed to be independent of explanatory variables, and \(\alpha \)s are parameters to be estimated.

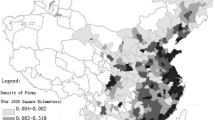

The data for the empirical study come from several statistical sources and cover two years: 2005 and 2013. The main source of data is the State Committee of Statistics of Ukraine (http://www.ukrstat.gov.ua). The statistical information can be received for the purpose of scientific research. These data reflect the balance and income statement indicators related to fixed assets, total revenues, total labor cost, cost of materials, etc. Data on employment (total number of full-time workers) are received from employment authorities. Data on export and import operations come from External Economic Activity Database of the State Committee of Statistics of Ukraine. Data on domestic and foreign ownership come from the State Committee of Statistics of Ukraine.

The data are classified according to the KVED statistics which include both manufacturing and services. KVED is Ukraine’s national classification developed by the agency State Committee for Technical Regulation and Consumer Policy to collect information on economic activity. There is KVED-2005 and KVED-2010 classification. Both of them are the equivalents of international industry classification standards. The KVED 10 classification at 2-digit level is comparable to ISIC (Rev. 4—2008), at 4 digit level and to the EU classification NACE (Rev. 2—2006). In the KVED-2010, active from January 1st, 2012, the number of services sectors has been increased (the higher level of disaggregation) in comparison with KVED-2005. Before that KVED-2005 classification was used.Footnote 4 In our analysis, we converted all data to KVED-2005 classification in order to have the comparable set of data for 2005 and 2013.

The sectors in 2005 differ from the sectors in 2013 due to the change in the classification KVED which follows changes in international NACE classification. In 2005, Ukrainian enterprises reported according to the old classification system (3 agricultural sectors, 5 mining sectors, 23 manufacturing sectors and 28 services sectors).Footnote 5 In 2013, all the Ukrainian enterprises had to report according to the new system—KVED-2010 (3 agricultural sectors, 5 mining sectors, 25 manufacturing sectors, 56 services sectors). There are 310,482 enterprises in 2005 and 198,405 enterprises in 2013 in manufacturing and services together. The firms of various types of organizational forms are present—joint stock companies, limited liability companies, self-employed individuals. The enterprises are distributed among the economic sectors adequately to the structure of the economy of Ukraine. The regional location is also present and complies with the geographical distribution of the Ukrainian industry.Footnote 6 It should be noted that regressions are estimated for 2005 and 2013 years separately and jointly.Footnote 7

The definitions of variables used in our empirical are reported in Table 1.

The dependent variable is our measure of the level of TFP calculated on the basis of the Levinsohn and Petrin (2003) methodology. The levpet function in STATA used the following variables to calculate the input shares at the 2-digit sector level: total revenues (UAH), fixed assets at the end of period (UAH), the number of employees (the number of people), the cost of materials (materials, fuels, electricity, UAH).Footnote 8

Input shares for the TFP estimation were calculated on the basis on the panel data of enterprises for the period from 2005 to 2013 year. The estimation procedure to calculate input shares is the same for manufacturing and services. To estimate the input shares in 2006, we have 331,431 enterprises, in 2007—355,902 enterprises, in 2008—339,790 enterprises, in 2009—352,805 enterprises, in 2010—296,521 firms, in 2011—243,422 firms, in 2012—133,383 enterprises. The enterprises belong to manufacturing and services sector (sectors 15–95 of KVED-2005 classification).

The degree of competition within the sector was measured by the Herfindahl–Hirschman Index (HHI). This is a commonly used measure of market concentration in the empirical industrial organization literature. It is calculated for each of the available KVED-2005 sectors so that \(\mathrm{HHI}=\sum \nolimits _{i=1}^N {(\frac{TR_\mathrm{i} }{\sec TR}\times 100)_\mathrm{i} ^{2}} \), where N the number of enterprises in sector i, TR the total revenues of the enterprise i, secTR the sum of total revenues of all enterprises in sector i. Sectors are ranging from 15 to 95 (manufactures and services) according to KVED-2005. The higher value of Herfindahl–Hirschman index is indicating greater level of industry concentration.

Firm exports is a dummy variable which is equal to 1 if the firm is receiving proceeds in the foreign currency from abroad and 0 in the opposite case.Footnote 9 Firm imports is a dummy variable which is equal to 1 if the firm is making payments abroad and 0 in the opposite case.

Private is the dummy variable which is equal to 1 when the firm is owned fully by private individuals or entities. Foreign is the dummy variable which is equal to one if a share of the company is owned by foreign individuals or entities.

The summary statistics for year 2013 (one with the largest number of available variables) are reported in Table 2.Footnote 10

5 Estimation results

In this section, we present our empirical results. First, we report the pooled estimations covering the whole period 2005–2013 with two alternative measures of regional specialization, \({S}_{3}\) and Theil index, respectively. Then, we show the results of our sensitivity tests obtained for the reduced sample that consists of two particular years only (2005 and 2013), for which we were able to obtain a larger number of firm-level characteristics.

In Table 3, we present baseline estimation results covering years 2005-2013.

In column (1) of Table 3, we present the estimation results obtained from the benchmark specification, without controlling for time- and region-specific effects. It turns out that the majority of explanatory variables are statistically significant already at the 1 percent level of statistical significance and in the majority of cases they display the expected signs which confirms that agglomeration effects matter for determination of firm-level TFP.

On the one hand, the level of firm productivity increases with the higher values of specialization measures \({S}_{1}\), \({S}_{2}\) and \({S}_{3}\). All three variables are statistically significant at 1% level. On the other hand, \(D_{1}\) index—measuring the regional diversification (which shows the within regional concentration of industries other than the respective one)—displays a negative sign and is statistically significant at the 1 % level. This means that diversification is positively related to firm-level TFP as the higher value of this index shows less diversity in the region. Hence, this result also reveals a positive impact of regional spillovers.

Finally, the standard measure of competition between firms within the industry (HHI) is statistically significant but reveals a negative sign which means that more concentration (less competition) is negatively related to firm-level TFP. This finding supports the view of Jacobs and Porter on the positive role of competition in stimulating firm productivity.

The majority of our control variables are also statistically significant. In particular, the variable KLratio displays positive sign and is statistically significant at 1 percent level, which is in line with expectations as productivity can be usually higher in more capital intensive firms and industries. However, the estimated coefficient on the firm size variable is also statistically significant but displays a negative sign which is not in line with standard expectations. This result is probably driven by the composition of our sample in which firms operating in the services’ sector are far more numerous compared to the firms that operate in the manufacturing sector. The scale economies do increase efficiency in the case of manufacturing sector, but usually not in the case of services’ sectors.Footnote 11 Finally, the variable Intan measuring the stock of intangible assets accumulated by the firm is not statistically significant, and hence it has no effect on firm’s productivity in this specification.

In columns (2) and (3) of Table 3, we report estimation results obtained having controlled for first region-specific and then region- and time-specific effects, respectively. These results are very similar, and the only difference is that the sign of \(S_{3}\) variable does change to a negative one, when we control for time and regional effects. Thus, it can mean that the role of the concentration of the region within the respective industry (\(S_{3}\)) has changed over the analyzed period.

The robustness of the analysis based on basic indicators of specialization and diversification (\({S}_{1}\), \({S}_{2}\), \({S}_{2}\) and \({D}_{1}\)) can be tested using the topographic Theil indicator measuring agglomeration effects. Thus, in Table 4 we present sensitivity analysis, in which we replaced \(S_{3}\) index by the Theil indicator. These two variables measures of the degree of diversification are highly correlated in our sample (0.9308; see Correlation Table in “Appendix”). The particular columns in Table 4 are the direct counterparts of the columns in Table 3. The estimation results do not differ much across columns of Table 4.

For example, the results of estimations, when region- and time-specific effects are controlled for, reported in column (3) of Table 4 are very similar to the results reported in column (3) in Table 3. It turns out that the majority of explanatory variables is statistically significant already at the 1 percent level of statistical significance and they display the expected signs. In particular, the estimated parameter on the Theil indicator is statistically significant at the 1 percent level, but the estimated value is close to zero. The estimator of intangible assets variable remains statistically not significant.

In some empirical studies on the determinants of TFP, the additional firm-level characteristics were used. In many cases, the authors took into consideration the ownership status (private or public) and the role of internationalization of firms, which can be proxied by the foreign ownership status and the role of exports and imports in the performance of individual firms. Unfortunately, in the case of Ukraine we had no access to these firms’ characteristics for the whole analyzed period (2005–2013), but we had these data for two particular years: 2005 and 2013. Thus, we extended our sensitivity tests using the aforementioned variables, for the pooled dataset that consists of two years: 2005 and 2013 only. The results of these estimations are presented in Tables 5 and 6, respectively.

The results for agglomeration indicators obtained having controlled for time and regional effects, which are reported in column (3) of Table 5, are very similar to the baseline results from column (3) of Table 3. The \(S_{1}\) and \(S_{2}\) variables are statistically significant at 1 percent level, and their signs are positive, while the signs of \(S_{3}\) and \(D_{1}\) variables remained negative and statistically significant. Moreover, the statistical significance and signs of size, KLratio and HHI variables remained unchanged.

The estimated coefficients on the variables measuring internationalization of firms, including exports and imports, are positive and statistically significant 1 percent level, which is in line with expectation. It means that firms that have contacts with more competitive foreign markets are probably more efficient. Moreover, the variable intan, measuring the importance of intangible assets, became positive and statistically significant at 5 percent level. Thus, the firms with higher ratio of intangible assets to fixed assets probably have an advantage positively affecting their productivity.

Interestingly, the estimated parameter on the variables measuring foreign and private owner status is statistically not significant in the specification with time- and region-specific effects reported in column (3) of Table 5. The nonsignificance of foreign ownership variable can probably reflect a limited scope of FDI in Ukraine. There are also no visible differences, in terms of TFP, between private- and state-owned firms.Footnote 12

In Table 6, we present additional sensitivity tests, in which \(S_{3}\) variable was replaced by the Theil indicator.

The results of estimations, when we controlled for region- and time-specific effects (column (3) of Table 6), are very similar to those reported in column (3) of Table 5. It turns out that the majority of explanatory variables are statistically significant already at the 1 percent level and in the majority of cases they display expected signs. The sign of Theil indicator is also statistically significant at 1 percent level, meaning that Theil index is probably a better measure of spillovers effects, in comparison with \(S_{3}\) index. The estimator of intangible assets variable lost its 5% level statistical significance.

6 Conclusions

In this paper, we investigated the determinants of productivity of Ukrainian firms with the special attention given to the role of agglomeration externalities and competition effects. The study was based on the firm-level data including both manufacturing and services sectors and covered the period 2005–2013. Moreover, we made supplementary pooled estimations, with additional firm-level characteristics, which were available for years 2005 and 2013 only.

We found that the agglomeration effects matter for determination of TFP in Ukraine. In particular, we found that firm productivity increases with geographical concentration of economic activity (\(S_1\)), physical concentration of economic activities (\(S_2\): within regional concentration of the industry). The reduction of regional diversification (measured by D\(_1\)) leads to spillovers and increased firm productivity in Ukraine. On the other hand, the concentration of the region within the respective industry (\(S_{3}\)) does not affect positively the productivity levels. The application of topographic Theil index (instead of \(S_{3}\) indicator) shows that the topographic concentration can also increase regional spillover effects.

In addition, we found that the firm’s TFP is positively related to the firm’s capital–labor ratio, which is in line with expectations. However, the other results for the whole sample are somewhat puzzling. In particular, the estimated coefficient on the firm size variable displays a negative sign, which is not in line with standard expectations for manufacturing firms and reflects probably the large share of services firms in our sample. The analysis of competition effects leads to less clear-cut results, because the measure of industry concentration (HHI) reveals the negative sign.

Our estimations results for two particular years 2005 and 2013 allowed us to analyze the role of additional firm-level determinants of TFP related to internationalization. The estimators of variables measuring the level of exports and imports are positive, which means that firms having more intensive contacts with foreign markets are more efficient. Moreover, the firms with the higher ratio of intangible assets to fixed assets are also more productive. On the other hand, we could not confirm that the ownership status (foreign and private) affects productivity of the firm.

One of the limitations of our study was the inability to distinguish precisely between the location of the firm’s head office and the plant, which can be especially important for manufacturing firms. Therefore, in the future studies it would be useful to use plant-level data with precise location coordinates, once it becomes available, instead of only legal addresses, as in the current study. This sort of data should allow to use spatial econometric techniques (such as spatial autoregressive models) to analyze the spillovers between the firms located in the different regions of Ukraine. This would also allow validating the hypothesis that inter-regional spillovers in Ukraine are of smaller magnitude compared to high-income countries with more developed transportation infrastructure.

Notes

In one of the earliest theoretical studies on the sources of economic growth, Romer (1986) proposed a formal model in which knowledge of other firms was assumed to be an important input in the production function of an individual firm leading to increasing returns.

For example, Beaudry and Schiffauerova (2009) provided an extensive survey of 67 previous empirical studies on the role of various agglomeration externalities.

For example, in 2005, 4548 enterprises were big enterprises (employment more than 250 people), 14,530—medium enterprises (50–246 employees), 282,966 enterprises—small enterprises (less than 50 employees). The number of firms for each year is reported in Table 7 in “Appendix”.

Only legal addresses of firms are available. For example, the biggest mobile operator Kyivstar has only one entry in the dataset with the consolidated financial figures, located in Kyiv, the headquarter’s city. The data are available as reported to the statistics committee and government. There is no distinction between production and sales units.

In our study of export performance, we use data for individual enterprises from 2005 and 2013, but the dataset is not balanced. An enterprise can be present in all years from 2005 to 2013, but in most cases the enterprise is only active in several years inside 2005–2013 period. 36% of manufacturing firms operating in 2005 remained in 2013. 74% of manufacturing firms in 2013 were still active in 2005. 29% services enterprises in 2005 kept on operating in 2013. 43% of services enterprises in 2013 were active in 2005. 30% of firms (manufacturing and services pooled) operating in 2005 still operated in 2013. 46% of 2013 firms were still present in 2005.

The estimation of input shares was performed for all 2-digit sectors. Due to the limited number of observations, some of the sectors were merged. The way in which sectors were merged is reported in “Appendix”.

For example, in the case of the service sector financial institutions may have clients from abroad.

The correlations between our explanatory variables are reported in “Appendix”.

The positive sign is of size variable exists in the case of majority of empirical studies for manufacturing firms. Our estimation (not shown here) made for manufacturing sector only confirms this phenomenon. The scale economies are less obvious in the case of services’ sectors.

The variable private ownership is statistically significant at 5% level and displays the expected positive sign but only in the specification with no time and regional effects.

References

Arrow K (1962) The economic implications of learning by doing. Rev Econ Stud 29:155–172

Beaudry C, Schiffauerova A (2009) Who’s right, Marshall or Jacobs? The localization versus urbanization debate. Res Policy 38:318–337

Brown JD, Earle JS, Telegdy Á (2006) The productivity effects of privatization: longitudinal estimates from Hungary, Romania, Russia, and Ukraine. J Polit Econ 114(1):61–99. doi:10.1086/499547

Cingano F, Schivardi F (2004) Identifying the sources of local productivity growth. J Eur Econ Assoc 2:720–742

de Groot HLF, de Vor F (2010) Agglomeration externalities and localized employment growth: the performance of industrial sites in Amsterdam. Annals Reg Science 44(3):409–431

De Lucio J, Herce J, Goicolea A (2002) The effects of externalities on productivity growth in Spanish industry. Reg Sci Urban Econ 32:241–258

Derzhkomstat (2015) Derzhavniy Komitet Statystyky Ukrainy. www.ukrstat.gov.ua

Duranton G, Puga D (2000) Diversity and specialisation in cities why, where and when does it matter? Urban Stud 37:533–555

Earle J, Gehlbach S (2014) The productivity consequences of political turnover: firm-level evidence from Ukraine’s orange revolution, IZA discussion paper, No. 8510, Sept 2014. http://ftp.iza.org/dp8510.pdf

Glaeser EL, Kallal HD, Scheinkman J (1992) Growth in cities. J Polit Econ 100:1126–1152

Henderson V, Kuncoro A, Turner M (1995) Industrial development in cities. J Polit Econ 103:1067–1085

Huynh KP, Jacho-Chavez DT, Kryvtsov O, Shepotylo O, Vakhitov V (2015) The evolution of firm-level distributions for Ukrainian manufacturing firms. J Comp Econ. doi:10.1016/j.jce.2015.10.004. Forthcoming

Jacobs J (1969) The economies of cities. Random House, New York

Kostenko T (2014) Assessment of the impact of innovations on labour productivity in domestic enterprises. Adv Sci J 4:24–30. doi:10.15550/asj.2014.04.024

Levinsohn J, Petrin A (2003) Estimating production functions using inputs to control for unobservables. Rev Econ Stud 70(2):317–341. doi:10.1111/1467-937X.00246

Marshall A (1890) Principles of economics. McMillan, London

Marshall A (1920) Principles of economics. McMillan, London

Martin P, Mayer T, Mayneris F (2011) Spatial concentration and plant-level productivity in France. J Urban Econ 69:182–195

Pessoa A (2014) Agglomeration and regional growth policy: externalities versus comparative advantages. Annals Reg Science 53(1):1–27

Porter M (1990) The competitive advantage of nations. Macmillan, London

Romer PM (1986) Increasing returns and long-run growth. J Polit Econ 94:1002–1037

Shepotylo O, Vakhitov V (2015) Services liberalization and productivity of manufacturing firms. Econ Transit 23(1):1–44

World Bank (2015) World Bank Development Indicators. http://data.worldbank.org/indicator

Yu G, Ye G (2008) Are oligarchs productive? IZA discussion paper no. 3282, Jan 2008. http://ftp.iza.org/dp3282.pdf

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Cieślik, A., Gauger, I. & Michałek, J.J. Agglomeration externalities, competition and productivity: empirical evidence from firms located in Ukraine. Ann Reg Sci 60, 213–233 (2018). https://doi.org/10.1007/s00168-017-0851-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00168-017-0851-4