Abstract

We assess the effects of the population age structure and the population dynamics on economic growth. Following recent research, we focus on the generational turnover effect to characterize the influence of birth and death rates, depending on the age profile of individual consumption, the extent of annuity market imperfections, and the willingness of households to shift consumption over time. Using data from the National Transfer Accounts on age profiles of consumption for a number of different countries, we assess—in a comparative way—the sign and the magnitude of the generational turnover effect and its impact on economic growth. We find considerable cross-country differences and trace them back to the underlying variation in demography and in the age structure of consumption.

Similar content being viewed by others

Notes

In an early contribution on the role of population change for economic growth, Kuznets (1960) is observing this but not pursuing the point analytically.

There is a slight tension between this finding and the overwhelming micro evidence of hump-shaped age profiles of consumption (as surveyed, e.g., in Fernandez-Villaverde and Krueger 2007; Attanasio and Weber 2010). Middle-aged individuals typically experience peak earnings over their life cycle. Thus, they can afford higher consumption levels, while they are, at the same time, saving to an extent that their propensity to save is highest over the life cycle.

Annuities guarantee individuals a fixed income stream over their remaining life cycle and, thereby, insure the individual against longevity risks. If priced in an actuarially fair way, the return to annuities adjusts to the remaining life expectancy. Private annuity markets are typically rather thin, but public pension entitlements constitute an important form of mandatory annuitization (Hosseini 2015).

To the best of our knowledge, Heijdra and Ligthart (2000) were the first to employ the term “generational turnover effect,” which has been adopted as a convenient terminology in many subsequent works involving continuous-time OLG models. Recently, Mierau and Turnovsky (2014a, 2014b) have provided a detailed analysis of the generational turnover effect and its role for balanced growth economies.

A similar mechanism is at work within R&D-based endogenous growth models with an overlapping generations structure such as Prettner (2013), Banz et al. (2014), Kuhn and Prettner (2016), and Prettner and Trimborn (2016). In a related contribution, Schneider and Winkler (2016) endogenize the rate of mortality in an overlapping generations AK type of growth model and analyze the growth and welfare implications of individual health investments in the presence of moral hazard when annuities condition on average mortality.

While per se our analysis does not rely on general equilibrium relationships, the underlying life-cycle problem assumes the absence of liquidity constraints and income shocks.

It can be shown analytically that in a model in which individuals are not credit constrained, the life-cycle distribution of accidental bequests is unrelated to the life-cycle pattern of consumption. The present value of accidental bequests only determines the level of consumption of the newborn cohort.

Note that for \(c^{\dag }\left (t\right )/c(t,t) \geq \beta /\bar {\mu }\) the impact is always negative, regardless of the elasticity of intertemporal substitution and the (im-)perfection of the annuity market.

Inspection of the individual Euler equation (5) in Appendix A shows that the term \(-\left (\overline {\mu }/\sigma \right ) (1-\theta )\left [ c^{\dag }\left (t\right ) /c\left (t\right ) \right ] \) is not part of the generational turnover effect in a strict sense. We nevertheless include it in Ω(t) as a growth drag that is structured in analogy to—and in fact magnifying—the loss of aggregate consumption through the death of a part of the population. The magnitude of this particular channel is identified in Table 2 further on below, where the last column reports the proportion of the growth drag that is explained by incomplete annuitization at 𝜃 = 0.5.

This is most clearly seen for the case where \(\beta =\overline {\mu }\) and, therefore, π = 0. We then have \(\dot {c}\left (t\right ) /c\left (t\right ) =\sigma ^{-1}\left [ r(t)-\rho \right ] -\left [ \overline {\mu }c\left (t,t\right ) /c\left (t\right ) \right ] \left \{ \left [ 1+\sigma ^{-1}\left (1-\theta \right ) \right ] c^{\dag }\left (t\right ) /c\left (t,t\right ) -1\right \}\) , which is unambiguously falling in the rate of demographic turnover, \(\overline {\mu }.\)

For the sake of the argument, we may assume here that altruistic parents are allocating consumption to their children in a way that is reflecting the optimal life-cycle allocation. To mitigate possible errors in the estimation of the consumption level of children, we consider the weighted average over the age groups 0–20.

Broadly, one could say that the growth drag and the share of the growth drag explained by annuities increases with the elasticity of intertemporal substitution.

References

Ashraf Q H, Weil D N, Wilde J (2013) The effect of fertility reduction on economic growth. Popul Dev Rev 39:97–130

Attanasio O P, Weber G (2010) Consumption and saving: models of intertemporal allocation and their implications for public policies. J Econ Lit 48:693–751

Banz L, Prettner K, Werner K (2014) Endogenous growth and realistic demography. Mimeo

Blanchard O (1985) Debt, deficits and finite horizons. J Polit Econ 93(2):223–247

Bloom D E, Canning D (2008) Global demographic change: dimensions and economic significance. Popul Dev Rev 34:17–51

Bloom D E, Canning D, Graham B (2003) Longevity and life-cycle savings. Scand J Econ 105:319–338

Bloom D E, Canning D, Mansfield R K, Moore M (2007) Demographic change, social security systems, and savings. J Monetary Econ 54:92–114

Bloom D E, Canning D, Fink G (2010) Implications of population ageing for economic growth. Oxford Rev Econ Pol 26(4):583–612

Chetty R (2006) A new method of estimating risk aversion. Am Econ Rev 96 (5):1821–1834

Crespo Cuaresma J, Lutz W, Sanderson W (2014) Is the demographic dividend an education dividend? Demography 51:299–315

d’Albis H (2007) Demographic structure and capital accumulation. J Econ Theory 132:411–434

d’Albis H, Augeraud-Véron E (2009) Competitive growth in a life-cycle model: existence and dynamics. Int Econ Rev 50:459–484

d’Albis H, Moosa D (2015) Generational economics and the national transfer accounts. J Demographic Econ 81(4):409–441

Erlandsen S, Nymoen R (2008) Consumption and population structure. J Popul Econ 21:505–520

Fair R C, Dominguez K M (1991) Effects of the changing U.S. age distribution on macroeconomic equations. Am Econ Rev 81:1276–1294

Fernandez-Villaverde J, Krueger D (2007) Consumption over the life cycle: facts from consumer expenditure survey data. Rev Econ Stat 89:552–565

Guvenen F (2006) Reconciling conflicting evidence on the elasticity of intertemporal substitution: a macroeconomic perspective. J of Monetary Econ 53:1451–1472

Hansen G D, Imrohoroglu S (2008) Consumption over the life cycle: the role of annuities. Rev Econ Dyn 11:566–583

Heijdra B J, Ligthart J E (2000) The dynamic macroeconomic effects of tax policy in an overlapping generations model. Oxford Econ Pap 52:677–701

Heijdra B J, Mierau J O (2012) The individual life-cycle, annuity market imperfections and economic growth. J Econ Dyn Control 36:876–890

Heijdra B J, Mierau J O, Reijnders L S M (2013) A tragedy of annuitization? Longevity insurance in general equilibrium. Macroecon Dyn 18(7):1607–1634

Hosseini R (2015) Adverse selection in the annuity market and the role for social security. J Polit Econ 123:941–984

Human Mortality Database (2014) Human mortality database. University of California, Berkeley (USA), and Max Planck Institute for Demographic Research (Germany). Available at www.mortality.org

Kuhn M, Prettner K (2016) Growth and welfare effects of health care in knowledge based economies. J Health Econ 46:100–119

Kuznets S (1960) Population change and aggregate output. In: National bureau of economic research demographic and economic change in developed countries. Columbia University Press, New York

Lau S -H P (2009) Demographic structure and capital accumulation: a quantitative assessment. J Econ Dyn Control 33:554–567

Lee R, Mason A (2010a) Some macroeconomic aspects of global population aging. Demography 47:S151–S172

Lee R, Mason A (2010b) Fertility, human capital, and economic growth over the demographic transitions. Eur J Popul 26:159–182

Lee R, Mason A (2011) Population aging and the generational economy. a global perspective. Edward Elgar, Cheltenham UK and Northampton, MA, USA

Lee R., Mason A. (2014) National Transfer Accounts. Website: www.ntaccounts.org

Lee R, Mason A, Members of the NTA Network (2014) Is low fertility really a problem? Population aging, dependency, and consumption. Science 346:229–234

Mason A, Lee R, Jiang J X (2016) Demographic dividends, human capital, and saving. J Econ Ageing 7:106–122

Mierau J O, Turnovsky S J (2014a) Demography, growth, and inequality. Econ Theor 55:29–68

Mierau J O, Turnovsky S J (2014b) Capital accumulation and the sources of demographic change. J Popul Econ 27:857–894

Prettner K (2013) Population aging and endogenous economic growth. J Popul Econ 26(2):811–834

Prettner K, Trimborn T (2016) Demographic change and R&D-based economic growth: reconciling theory and evidence. Economica, in press

Prettner K, Bloom D E, Strulik H (2013) Declining fertility and economic well-being: do health and education ride to the rescue. Labour Econ 22:70–79

Prettner K, Canning D (2014) Increasing life expectancy and optimal retirement in general equilibrium. Econ Theor 56:191–217

Sánchez-Romero M (2013) The role of demography on per capita output growth and saving rates. J Popul Econ 26:1347–1377

Sánchez-Romero M, Patxot C, Rentería E, Souto G (2013) On the effects of public and private transfers on capital accumulation: some lessons from the NTA aggregates. J Popul Econ 26:1409–1430

Sánchez-Romero M, Abio G, Patxot C, Souto G (2016) Contribution of demography to the Spanish economic growth from 1850 to 2000. Mimeo

Schneider M T, Winkler R (2016) Growth and welfare under endogenous lifetime. Bath Economics Research Papers No. 47/16

Tung A -C (2011) Population aging and the generational economy. A global perspective. In: Lee R, Mason A (eds). Edward Elgar, Cheltenham UK and Northampton, MA, USA

Acknowledgments

We would like to thank two anonymous referees, Alessandro Cigno, Bernhard Hammer, Dirk Krueger, Alexia Prskawetz, and Miguel Sánchez-Romero for valuable comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Responsible editor: Alessandro Cigno

Appendices

Appendix A: Derivations

1.1 A.1 The aggregate Euler equation

Maximizing Eq. 1 subject to Eq. 2 implies that the optimal consumption path of an individual is characterized by

which corresponds to the standard Euler equation in case of complete annuity markets (𝜃 = 1). By contrast, uninsured mortality within an incomplete annuity market (𝜃 < 1) implies a downward drag on consumption growth. This is the more realistic case on which we focus our attention: as μ(t − t 0) becomes large for age a = t − t 0 approaching D, it follows that consumption declines toward the end of life. Given that the interest rate exceeds the rate of time preference, this will generate the hump-shaped age profiles of consumption that are typically observed in the data (see Hansen and Imrohoroglu 2008; Heijdra and Mierau 2012).

We can write aggregate consumption as

where \(n\left (t_{0},t\right ) =\beta e^{-\pi \left (t-t_{0}\right ) -M\left (t-t_{0}\right ) }\) is the population share at time t of the cohort born at time t 0, given the survival function \(e^{-M\left (t-t_{0}\right ) }\). Differentiating with respect to time, we obtain

where we use \(\dot {N}\left (t\right ) =\pi N\left (t\right ) \). Defining average consumption across the deceased by

allows us to write the aggregate Euler equation as

where

with c(t) = C(t)/N(t) being per capita consumption.

1.2 A.2 The balanced growth path for an AK production structure

Following Mierau and Turnovsky (2014a), we assume a production function

where Y i is output of firm i, K i (t) is its capital stock, L i (t) is its employment level, α ∈ [0, 1] denotes the elasticity of output with respect to capital, and A(t) = A k(t)1−α refers to the productivity index as a function of learning-by-doing spillovers. In this case, the aggregate production function is of the AK type. Denoting the rate of depreciation by δ ∈ [0, 1] , we obtain r(t) = α A − δ and, thus, a balanced growth path of

In this case, an increase in the generational turnover effect, Ω(t), would also predict an increase in the growth rate of capital accumulation and, thus, an increase in the gross savings rate and in the per capita growth rate of the economy. Solving the interior equation yields

implying a negative relationship between the consumption/capital ratio and the generational turnover effect, Ω(t).

Appendix B: Data

The National Transfer Accounts (NTA) project consists of research teams in more than 40 countries. The teams are measuring how people at each age consume and save. The particular advantage of NTA data over other data is that they include the evolution of intergenerational transfers. Hence, the data allow to keep track of the true underlying consumption-savings profiles over the life cycle. For a detailed description of the NTA project and the data, see: http://www.ntaccounts.org/web/nta/show/.

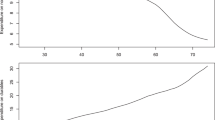

Figure 1 contains the private consumption level of each age group (from birth to 89 years in 1-year steps and for the group 90 + ) divided by average labor income at ages 30 to 49 for the following countries for which the necessary data of both sources (the National Transfer Accounts and the Human Mortality Database) were available: Austria, Chile, Finland, Germany, Japan, Slovenia, Spain, Sweden, Taiwan, and the USA. We clearly observe a steep consumption-age profile for the USA, while the profile is rather flat for Taiwan.

Appendix C: Robustness

To assess the sensitivity of the results with respect to the elasticity of intertemporal substitution, we present the results regarding the generational turnover effect and the growth drag for the cases of σ = 1, σ = 2, and σ = 4 in Tables 3, 4, and 5. The cases σ = 1 and σ = 4 can be considered as the lower and upper bounds of reasonable estimates of σ (cf. Chetty 2006; Guvenen 2006). We see that neither the generational turnover effect nor the growth drag change their signs. However, we see that the larger is σ (which implies a lower elasticity of intertemporal substitution), the smaller is the negative effect of incomplete annuitization on economic growth. Note that this is intuitively clear because, ceteris paribus, a higher elasticity of intertemporal substitution implies a stronger drag of mortality on individual consumption change.

Rights and permissions

About this article

Cite this article

Kuhn, M., Prettner, K. Population age structure and consumption growth: evidence from National Transfer Accounts. J Popul Econ 31, 135–153 (2018). https://doi.org/10.1007/s00148-017-0654-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-017-0654-z

Keywords

- Demography

- Economic growth

- Generational turnover

- Age structure of consumption

- National Transfer Accounts