Abstract

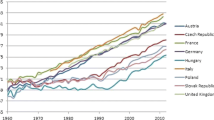

Fertility has long been declining in industrialised countries and the existence of public pension systems is considered as one of the causes. This paper provides detailed evidence on the mechanism by which a public pension system depresses fertility, based on historical data. Our theoretical framework highlights that the effect of a public pension system on fertility is ex ante ambiguous while its size is determined by the internal rate of return of the pension system. We identify an overall negative effect of the introduction of pension insurance on fertility using regional variation across 23 provinces of Imperial Germany in key variables of Bismarck’s pension system, which was introduced in Imperial Germany in 1891. The negative effect on fertility is robust to controlling for the traditional determinants of the first demographic transition as well as to other policy changes.

Similar content being viewed by others

Notes

The literature explaining the decline in fertility has put relatively more emphasis on labour market institutions affecting female labour supply (e.g. Ahn and Mira 2002), the tax system (e.g. Egger and Radulescu 2012), the interaction between the tax system and family policy (e.g. Apps and Rees 2004), and maternity leave legislation (e.g. Berger and Waldfogel 2004).

Reichsgesetzblatt (RGbl) 1899/33.

Also refer to the published law in Reichsgesetzblatt (RGbl) 1889/13.

After 1900 the definition of old age changed slightly and every worker who reached the age of 65 was automatically classified as invalid.

After 30 to 50 years of contribution, this fraction could increase to about half of a worker’s wage in the lowest category and to about 40 % of a worker’s wage in the middle category (Reichsversicherungsamt 1910). Note that detailed regional information on wages is only available for selected professions.

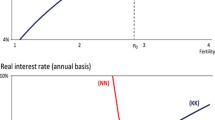

We analyse a PAYG pension system in which the working generations finance the pensions of the retired generations by their contributions in the same period. In particular, we investigate what is known in the literature as a Bismarckian PAYG pension system in which pensions are proportional to contributions.

Note that this assumption can be relaxed. It does, however, correspond to the fact that at the time when the pension system was introduced, unmarried women were supposed to be working, while married women were still supposed to stay at home and care for the children, which is also reflected by the fact that working women were expected to drop out of the pension system such that the law contained a provision for reimbursement of contributions upon marriage (RGbl 1889/13, 30).

Note that this assumption can easily be relaxed by e.g. assuming a u-shaped time cost of children. This would imply that with a certain number of children the cost of rearing each single one diminishes, because the older children can care for the younger children.

How such transfers from adults to their elderly parents can be enforced is subject of an extended literature about implicit contracts within the family, see e.g. Sinn (2004), Cigno (2006), Cigno et al. (2006). Furthermore, it is possible to assume that the per child transfer decreases with more children without affecting the model results, in which case the total transfer could be written as n t b t+1(n t ). As long as the total intra-family transfer is inelastic with respect to the number of children, \(b_{t+1}+\frac {\partial b_{t+1}}{\partial n_{t}}n_{t}>0\), i.e. total transfers remain increasing with more children, the results of the model are unaffected.

10 Note that without the intra-family transfers (b t = b t+1=0) the price of a child increases and is always positive. The only effect of excluding such transfers from the model is a stronger income effect.

11 Population numbers were reported annually until 1895, but afterwards only during census years, i.e. in 1895, 1899, 1900, 1905, 1909, 1910. We use the extrapolated population numbers from Scheubel (2013) for the missing years.

12 In fact, contribution rates only varied between the four/five contribution categories, but not between provinces and not over time.

13 Refer to the 1889 law on pension insurance (Reichsgesetzblatt 1889/13) and the 1899 revision (Reichsgesetzblatt 1899/33).

14 The CMBR can be computed as \(CMBR=(1-illegitimacy\,\,rate_{t})*\frac {{ Number\,\,of\,\,births}_{t}}{1000}\) for all years.

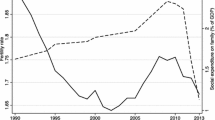

Scheubel (2013) illustrates this by comparing the CMBR to other fertility indices which take into account natural fertility and the age structure of women. As information on age structure is only available for years 1871, 1885, and 1890 while pension insurance was introduced in 1891, we cannot use other fertility measures for the analysis in this paper.

This approach also helps us to reproduce previous findings on the first demographic transition, which shows that our proxies capture the main determinants that have been identified in the literature.

Before 1895 population censuses were conducted almost every year. After 1895 population censuses were conducted in 1899, 1900, 1905, 1909 and 1910.

Women’s wages were lower such that almost only women contributed in the lowest contribution category (Haerendel 2001).

As discussed above, this may be related to the fact that our measure of workers includes those working in mining. Miners’ associations provided pension insurance before the introduction of comprehensive health insurance (Jopp 2013). Hence, any positive correlation between the share of workers and birth rates may be confounded by the negative correlation between the share working in mining and the birth rate.

We refrain from discussing the option of using a random effects model here; it is obvious that we have to control for non-random unobserved province-specific effect. This notion is also confirmed by a simple Hausman test.

There were three major changes to legislation during the period we study: changes to the Gewerbeordnungsnovelle (amendments to the Industrial Code) in 1878 and 1891 and a law banning child labour in 1903 (Boentert 2007). Importantly, the amendments to the Industrial Code did not affect child labour in all areas of production. The 1878 amendment prohibited children below the age of 14 to work in factories. After 1891, this prohibition was extended to workshops and production at home, such as spinning and weaving. The general law from 1903 extended this also to agricultural production. Probably, the changes in 1891 had the comparatively largest impact on household income. However, birth rates only started their sustained decline during the 1900s in all provinces.

The appropriate lag of at least 15 years is only given for years 1900 or later. Thus, it should not be surprising to see the expected negative effect mainly for years after 1900.

References

Ahn N, Mira P (2002) A note on the changing relationship between fertility and female employment rates in developedcountries. J Popul Econ 15:667–682

Anselin L (1988) Spatial econometrics: methods and models. Kluwer Academic Publishers, Dordrecht

Apps P, Rees R (2004) Fertility, taxation and family policy. Scand J Econ 106:745–763

Barro RJ, Becker GS (1986) Altruism and the economic theory of fertility. Popul Develop Rev 12:69– 76

Barro RJ, Becker GS (1988) A reformulation of the economic theory of fertility. Q J Econ 103:1–25

Barro RJ, Becker GS (1989) Fertility choice in a model of economic growth. Econometrica 57:481–501

Becker GS (1960) An economic analysis of fertility. In: NBER (ed) Demographic and economic change in developed countries. Princeton University Press, Princeton, pp 225–256

Becker GS (1965) A theory of the allocation of time. Econ J 75:493–517

Becker GS (1988) Family economics and macro behavior. Amer Econ Rev 78:1–13

Becker GS, Murphy KM (1988) The family and the state. J Law Econ 31:1–18

Becker GS (1991) A treatise on the family. Harvard University Press, Harvard

Becker GS (1992) Fertility and the economy. J Popul Econ 5:185–201

Becker GS, Tomes N (1976) Child endowments and the quantity and quality of children. J Polit Econ 84:S143–S162

Becker SO, Cinnirella F, Wössmann L (2010) The trade-off between fertility and education: evidence from before the demographic transition. J Econ Growth 15:177–204

Becker SO, Cinnirella F, Wössmann L (2011a) The effect of investment in children’s education on fertility in 1816 Prussia. Cliometrica 6:1–16

Becker SO, Hornung E, Wössmann L (2011b) Education and catch-up in the industrial revolution. Amer Econ J Macroecon 3:92–126

Becker SO, Wössmann L (2009) Was weber wrong? A human capital theory of protestant economic history. Q J Econ 124:531–596

Bental B (1989) The old age security hypothesis and optimal population growth. J Popul Econ 1:285–301

Berger LM, Waldfogel J (2004) Maternity leave and the employment of new mothers in the United States. J Popul Econ 17:331–349

Billari FC, Galasso V (2009) What explains fertility? Evidence from italian pension reforms. CESifo Working Paper

Boentert A (2007) Kinderarbeit im Kaiserreich 1871-1914. Schöningh, Paderborn

Boldrin M, Nardi MD, Jones LE (2015) Fertility and social security. J Demograph Econ 81:261–299

Borjas GJ (1999) Immigration and welfare magnets. J Labor Econ 17:607–637

Bourdieu J, Kezstenbaum L (2007) Surviving old age in an ageing world: old people in france 1820-1940. Population 62:183–211

Brown JC, Guinnane TW (2007) Regions and time in the European fertility transition: problems in the princeton project’s statistical methodology. Econ Hist Rev 60:574–595

Caldwell JC (1978) A theory of fertility: from high plateau to desestabilization. Popul Develop Rev 4:553–577

Cigno A (1993) Intergenerational transfers without altruism. Family, market and state. Eur J Polit Econ 9:505–518

Cigno A, Casolaro L, Rosati FC (2003) The impact of social security on saving and fertility in Germany. FinanzArchiv 59:189–211

Cigno A, Ermisch J (1989) A microeconomic analysis of the timing of births. Eur Econ Rev 33:737–760

Cigno A, Rosati FC (1992) The effects of financial markets and social security on saving and fertility behaviour in Italy. J Popul Econ 5:319–341

Cigno A, Rosati FC (1996) Jointly determined saving and fertility behaviour: theory, and estimates for Germany, Italy, UK and USA. Eur Econ Rev 33:1561–1589

Cigno A, Gianelli GC, Rosati FC, Vuri D (2006) Is there such a thing as a family constitution? A test based on credit rationing. Review of Economics of the Household 4: 183–204

Cigno A (2006) A constitutional theory of the family. J Popul Econ 19:259–283

Cigno A, Werding M (2007) Children and pensions. MIT Press, Cambridge

Coale A, Watkins S (1986) The decline of fertility in Europe. Princeton University Press, Princeton

Coale AJ (1965) Factors associated with the development of low fertility: a historic summary. United Nations, New York

Coale AJ (1969) The decline of fertility in Europe from the French Revolution to World War II. University of Michigan Press, Ann Arbor

Conley TG, Molinari F (2007) Spatial correlation robust inference with errors in location or distance. J Econom 140:76–96

Cremer H, Gahvari F, Pestieau P (2008) Pensions with heterogenous individuals and endogenous fertility. J Popul Econ 21:961–981

Dowrick S, Gemmell N (1991) Industrialisation, catching up and economic growth: a comparative study across the world’s capitalist economies. Econ J 101:263–275

Driscoll JC, Kraay AC (1998) Consistent covariance matrix estimation with spatially depedent panel data. Rev Econ Stat 80:549–560

Easterlin RA (1975) An economic framework for fertility analysis. Stud Fam Plan 6:54–63

Egger P, Radulescu D (2012) Family policy and the number of children: evidence from a natural experiment. Eur J Polit Econ 28:524–539

Ehrlich I, Kim J (2007) Social security and demographic trends: theory and evidence from the international experience. Rev Econ Dyn 10:55–77

Ehrlich IB, Zhong J-G (1998) Social security and the real economy. Amer Econ Rev 88:151–157

Feldstein M (1974) Social security, induced retirement, and aggregate capital accumulation. J Polit Econ 82:905–926

Fenge R, Werding M (2004) Ageing and the tax implied in public pension schemes. Fiscal Studies 25:159–200

Fenge R, Meier V (2005) Pensions and fertility incentives. Can J Econ 38:28–48

Fenge R, Meier V (2009) Are family allowances and fertility-related pensions perfect substitutes? Int Tax Public Fin 16:137–163

Fenge R, von Weizsäcker J (2010) Mixing bismarck and child pension systems: an optimum taxation approach. J Popul Econ 23:805–823

Galloway PR, Hammel EA, Lee RD (1994) Fertility decline in prussia, 1875-1910: a pooled cross-section time series analysis. Popul Stud 48:135–158

Galloway PR, Hammel EA, Lee RD (1998) Urban versus rural: fertility decline in the cities and rural districts of prussia, 1875 to 1910. Eur J Popul 14:209–264

Gollin D, Parente S, Rogerson R (2002) The role of agriculture in development. Amer Econ Rev 92:160–164

Guinnane T (2011) The historical fertility transition: a guide for economists. J Econ Lit 49:589–614

Guinnane T, Ogilvie S (2008) Institutions and demographic responses to shocks: Württemberg, 1634-1870. University of Yale Economics Department Working Paper No 44

Haerendel U (2001) Die Anfänge der gesetzlichen Rentenversicherung in Deutschland. Die Invaliditäts- und Alterssicherung von 1889 im Spannungsfeld von Reichsverwaltung, Bundesrat und Parlament. Forschungsinstitut für öffentliche Verwaltung, Speyer

Haines MR (1976) Population and economic change in nineteenth-century eastern europe: Prussian upper silesia, 1840-1913. J Econ Hist 36:334–358

Henry L (1961) Some data on natural fertility. Eugenics Quarterly 8:81–91

Hirazawa M, Kitaura K, Yakita A (2014) Fertility, intra-generational redistribution, and social security sustainability. Can J Econ 47:98–114

Hornung E (2014) Immigration and the diffusion of technology: the huguenot diaspora in prussia. Amer Econ Rev 104:84–122

Jopp T (2013) Insurance, fund size, and concentration: Prussian Miners’ Knappschaften in the nineteenth- and early twentieth-centuries and their quest for optimal scale. Akademie Verlag, Berlin

Kaschke L, Sniegs M (2001) Kommentierte Statistiken zur Sozialversicherung in Deutschland von ihren Anfngen bis in die Gegenwart. Band 1: Die Invaliditäts- und Alterssicherung im Kaiserreich (1891-1913). St. Katharinen, Scripta Mercature Verlag

Khoudor-Cásteras D (2008) Welfare state and labor mobility: the impact of bismarck’s social legislation on german emigration before world war I. J Econ Hist 68:211–243

Knodel JE (1974) The decline of fertility in Germany, 1871-1939. Princeton University Press, Princeton

Lotz W (1905) Der Fiskus als Arbeitgeber im deutschen Staatsbahnwesen. Archiv für Sozialwissenschaft und Sozialpolitik 21:612–658

Marschalck P (1982) The Federal Republic of Germany with an explanatory hypothesis. In: Eversley D, Köllmann W (eds) Population change and social planning. Erward Arnold, London, pp 62–87

McNicoll G (1980) Institutional determinants of fertility change. Popul Develop Rev 6:441–462

Murphy KM, Shleifer A, Vishny R (1989) Income distribution, market size, and industrialization. Q J Econ 104:537–564

Nugent JB (1985) The old-age security motive for fertility. Popul Develop Rev 11:75–97

O‘Brien PK, de la Escosura LP (1992) Agricultural productivity and European industrialization 1890-1980. Econ Hist Rev 45:514–536

Prinz A (1990) Endogenous fertility, altruistic behavior across generations, and social security systems. J Popul Econ 3:179–192

Puhakka M, Viren M (2012) Social security, saving and fertility. Fin Econ Papers 25:28–42

Reichsversicherungsamt (1910) Das Reichsversicherungsamt und die Deutsche Arbeiterversicherung. Verlag von Behrend & Co., Berlin

Richards T (1977) Fertility decline in Germany: an econometric appraisal. Popul Stud 31:537–553

Scheubel BD (2013) Bismarck’s institutions—a historical perspective on the social security hypothesis. Mohr Siebeck, Tübingen

Schultz TP (1969) An economic model of family planning and fertility. J Polit Econ 77:153–180

Sinn H-W (2000) Why a funded pension system is useful and why it is not useful. International Tax and Public Finance 7:389–410

Sinn H-W (2004) The pay-as-you-go system as a fertility insurance and enforcement device. J Public Econ 88:1335–1357

Smith H (1989) Integrating theory and research on the institutional determinants of fertility. Demography 26:171–184

Sniegs M (1998) Statistik als Steuerungsinstrument in der historischen Entwicklung der Invaliditäts- und Altersversicherung, Bremen, pp 1891–1911

Verhandlungen des Reichstages (1888) Stenographische Berichte über die Verhandlungen des Reichstages, 7. Legislaturperiode - IV. Session 1888/1889, vierter Band, erster Anlageband. Julius Sittenfeld, Berlin

Willis RJ (1979) The old-age security hypothesis and population growth. NBER Working Paper

Acknowledgments

We would like to thank Kathrin Weny for valuable research assistance. We are also grateful to Tobias Jopp as well as the editor and the two anonymous referees of this journal for their for helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Alessandro Cigno

We would like to thank Kathrin Weny for valuable research assistance. We are also grateful to Tobias Jopp as well as to the editor and the two anonymous referees of this journal for their for helpful comments and suggestions. This paper should not be reported as representing the views of the European Central Bank (ECB). The views expressed are those of the author and do not necessarily reflect those of the ECB.

Appendices

Appendix A: details on the theoretical model

1.1 A.1 Second order conditions

In the model of the Bismarckian pay as you go pension system the second derivatives of Eqs. 5, 6 and 7 are given by:

The second-order conditions for a maximum of problem (4) are satisfied since V nn is negative and the following conditions hold true:

This demonstrates that the objective function V(n t ,s t ,b t ) is strictly concave in the decision variables.

1.2 A.2 The savings effect of the Bismarckian PAYG pension system

The impact of extending the pension system on savings is given by:

With the negative denominator savings decrease with a higher contribution rate to the PAYG system if the numerator is negative.

In the case of the Bismarckian pension system the numerator is given by

Since the price of a child is positive, R t+1((1−τ)w t f ′(n t ) + π t )−(b t+1−Ω t+1 τ w t f ′(n t ))>0, the numerator is negative if the following condition for the intra-family transfer b t+1 holds: \(\tau w_{t}f^{\prime }(n_{t})<\frac {b_{t+1}}{{\Omega }_{t+1}} <w_{t}f^{\prime }(n_{t})+\pi _{t}\). If this condition holds, savings decrease with a higher contribution rate in the Bismarckian system. The condition is equivalent to: \(-\frac {\partial p_{t+1}^{BIS}}{\partial n_{t}} <b_{t+1}<{\Omega }_{t+1}((1-\tau )w_{t}f^{\prime }(n_{t})+\pi _{t})-\frac { \partial p_{t+1}^{BIS}}{\partial n_{t}}\). Note that the Bismarckian pension decreases in the number of children because the pension is proportional to contributions and income which decreases with more children. Thus, we have according to Eq. 9: \(\frac {\partial p_{t+1}^{BIS}}{ \partial n_{t}}<0.\) We can rewrite the condition for a negative savings effect as \({\Omega }_{t+1}((1-\tau )w_{t}f^{\prime }(n_{t})+\pi _{t})>b_{t+1}+ \frac {\partial p_{t+1}^{BIS}}{\partial n_{t}}>0\) which can be interpreted as follows.

Assume that a higher contribution rate reduces the number of children, i.e. the income effect is larger than the price effect. The second part of the inequality condition means that the loss of intra-family transfer due to fewer children in the second period is higher than the gain of a larger Bismarckian pension. Thus, having fewer children reduces income and decreases consumption in the second period. Then the first part of the condition implies that the discounted reduction of (opportunity) costs for children in the first period is higher than the loss of income in the second period due to fewer children. Hence, a lower number of children increases income and consumption in the first period by more than it reduces consumption in the second period. This implies that the parents react with lower savings in order to re-establish their preferred consumption profile and compensate the negative effect of the contribution rate on the number of children. If saved costs of fewer children in the first period are higher than the income loss in the second period a lower number of children induces lower savings.

Proposition 2

Savings effect The introduction or expansion of the PAYG system reduces savings if the lower number of children raises income in the first period to a larger extent than it lowers income in the second period.

1.3 A.3 The effect of a Bismarckian PAYG pension system on the intra-family transfer

The effect of a higher contribution rate on the intra-family transfer is given by:

The numerator can be calculated as:

With R t+1>Ω t+1 and a positive price of a child, R t+1((1−τ)w t f ′(n t ) + π t )−(b t+1−Ω t+1 τ w t f ′(n t ))>0, the parents reduce the intra-family transfer if the PAYG system is extended: \(\frac {\partial b_{t}}{ \partial \tau }<0.\) The intuition for this result is that a higher contribution rate together with R t+1>Ω t+1 reduces lifetime income since the contribution contains an implicit tax on wage income. The parents reduce their transfer to the grandparents in order to compensate for this loss in lifetime income. This reduces the old-age consumption of the grandparents.

Proposition 3

Effect on intra-family transfer The introduction or expansion of the PAYG system induces the parents to reduce the intra-family transfer to the grandparents.

1.4 A.4 Lack of capital markets

1.4.1 A.4.1 The fertility effect

If we assume that individuals have no possibility to provide for old age by savings the budget constraints in both periods are given by:

where the pension in a Bismarckian system is determined by Eq. 8. Again, the first-order condition (5) holds. The implicit function theorem yields:

and V nn<0 by Eq. 26 and

satisfy the second-order condition. Hence, the fertility response with respect to an introduction or extension of the pension system is determined by the sign of V n τ V bb−V nb V b τ :

If R t+1>Ω t+1, a higher contribution rate τ decreases the marginal price of a child which incites more children:

The second summand on the RHS is again the income effect. A higher contribution rate decreases income in the first period by w t (1−f(n t )) and raises pension income in the second period by Ω t+1 w t (1−f(n t )). Reducing the number of children compensates the income loss in period 1 by the expenditure (1−τ)w t f ′(n t ) + π t per child and decreases the income in period 2 if b t+1>Ω t+1 τ w t f ′(n t ), in other words, if the intra family transfer is larger than the Bismarck pension loss due to another child. Smoothing consumption across periods increases utility of the household so that due to the income effect fertility decreases with a higher contribution rate.

Hence, the size of the intra-family transfer determines the income effect and whether it is larger than the first (price) effect in which case fertility decreases with a higher contribution rate.

Corollary

Constrained investment effect in a pay as you go Bismarckian pension system In economies with lacking capital markets to provide for old-age the introduction or expansion of a Bismarckian pay-as-you-go pension scheme reduces the number of children if the intra-family transfers are sufficiently large.

1.4.2 A.4.2 The effect on intra-family transfer

In this case, the effect on intra-family transfer is given by:

With a positive denominator (39) the effect of intra-family transfer by a larger PAYG system depends on the sign of the numerator:

The sign is ambiguous, in particular if b t+1>Ω t+1 τ w t f ′(n t ).

Appendix B: supplementary (online) table on a comparison of estimators

Table 6 presents an OLS model in column (1), our baseline model in column (2) and a first differences estimator in column (3).

A standard OLS model would suffer from several endogeneity issues, such as clustered standard errors and serial, potentially also spatial correlation. Presenting the OLS model (with standard errors robust to at least serial correlation and clustering at the province level) in this context helps to illustrate the importance of controlling for the unobserved fixed effects. In particular, note that the OLS estimates differ in two important respects from our baseline model. First, the coefficients from our baseline model tend to be either overestimated or underestimated by the OLS approach. Second, even though standard errors are adjusted for some clustering as well as for serial correlation, the OLS model sometimes indicates significant estimates while the fixed effects model does not. At the same time, the OLS model is able to indicate the relative size of the different effects fairly well.

In theory, first differencing should yield exactly the same inference as a fixed effects model when the fixed effects model is applied to only two time periods. This is illustrated when comparing columns (2) and (3). The coefficients are the same while standard errors are larger in the model in first differences. This should not be surprising given that the first differences model is less efficient. Losing a degree of freedom in a model with only a small number of cross-sectional observations potentially has a big impact on the precision of the estimates. However, the coefficients in the first differences model are not substantially different from our baseline model and as conjectured.

Rights and permissions

About this article

Cite this article

Fenge, R., Scheubel, B. Pensions and fertility: back to the roots. J Popul Econ 30, 93–139 (2017). https://doi.org/10.1007/s00148-016-0608-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-016-0608-x

Keywords

- Public pension

- Fertility

- Transition theory

- Historical data

- Social security hypothesis

- European fertility decline

- PAYG pension scheme