Abstract

This paper investigates how rural families in China use marital and post-marital transfers to compensate their sons for unequal schooling expenditures. Using a common behavioral framework, we derive two methods for estimating the relationship between parental transfers and schooling investments: the log-linear and multiplicative household fixed-effects regression models. Using data from a unique household-level survey, we strongly reject the log-linear specification. Results from the multiplicative model suggest that when a son receives 1 yuan less in schooling investment than his brother, he obtains 0.47 yuan more in transfers as partial compensation. Since our measure of transfers represents a substantial fraction of total parental transfers, sons with more schooling likely enjoy higher lifetime consumption. Redistribution within the household may be limited by either the parents’ desire for consumption equality or bargaining constraints imposed by their children. Controlling for unobserved household heterogeneity and a fuller accounting of lifetime transfers are quantitatively important.

Similar content being viewed by others

Notes

Menchik (1980, 1988) argued that most parents divided their estates equally among the children. Tomes (1981) disagreed. Using a sample of wealthy US families, Wilhelm (1996) showed that most parents give equal bequests to their children. Among the children receiving unequal parental bequests, the differences are related to differences in their incomes.

Our concerns are largely unrelated to the second literature which studies family insurance against exogenous high frequency (annual) income shocks.

Parents regularly provide/transfer resources to children but most of these frequent inter vivos transfers are small.

Significant differences in environments and the fraction of lifetime transfers that are observed between our study and theirs make these comparisons less than perfect.

When a family has more than two children, consumption of the other children is subsumed in parental consumption.

In Appendix A, we derive the optimal consumption under the unitary and collective model.

It is similar in spirit to the inter-temporal labor supply elasticity which holds the marginal utility of wealth constant. In that context, lifetime wealth is held constant and the elasticity measures how current labor supply responds to an increase in the current wage relative to wages in all other periods.

Lundberg et al. (1997) have a nice test of this nature. They show that the consumption basket of a household changes when the government changes the assignment of a family subsidy from the husband to the wife. In this case, the change in the distribution of the contribution to family wealth by household members has changed in a lump sum manner but the household utility function should remain unchanged under the unitary model.

In Section 4.4 we relax the homogeneity assumption and discuss how it will affect our results.

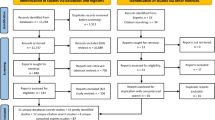

The three counties, Fengrun, Zhaoxian, and Chicheng, were selected after extensive analysis of county and township level economic and demographic information from the 1980s to the 1990s. Fengrun is the richest of the three in terms of per capita GDP, and Chicheng is the poorest. Within each county, townships were ranked on the basis of incomes, and then one was randomly selected from each quintile. Two villages were then randomly selected in each township: one from the upper half of the income distribution, and one from the lower half. Finally, from each village, 20 households satisfying age requirements for the household head and his spouse were randomly selected.

There are, in total, 103 households (17 %) having more than three married children. The selection criteria for picking children in these households were: (1) Choose the first and the most recently married child; (2) If the two selected children are of the same sex, choose a third of the opposite sex (43 households); and (3) If the two selected children are of the opposite sex, we randomly selected a third child (60 households).

In the multiple-son sample used in our study, the minimum age is 22. Since we focus on the married sons, we are ignoring those adult sons (older than 18) in the sampled family but remained unmarried. However, they only account for 2 % of all adult sons in the sampled family.

For these cases, implications of the model’s corner solution need to be derived, which is the basis for future work.

The mean of this imputed variable is around 300 yuan, which represents approximately 20 % of average educational expenditure on sons.

We also examine educational expenditures on daughters over the same period. In the 1980s, spending on girls’ education was below that on boys, but by the mid-1990s, investments in children’s human capital are about the same between genders.

The cash transfer paid by the groom’s family, which accounts for about 20 % of the bride-price, is usually given directly to the bride’s family. However, once the bride’s parents receive this cash payment, they can either keep it or use it to purchase items for the dowry. The dowry financed by the cash component of the bride-price is often referred to as “indirect dowry” in the sociology literature (see Goody (1973)). According to our data, on average, nearly all of the cash in the bride-price became indirect dowry. This suggests that the cash component in the bride-price should be included in the marital transfers enjoyed by the grooms, even though they are initially given to the bride’s parents as inter-familial transfers.

National Bureau of Statistics, China Statistical Yearbook (2007)

We assume that the share of land in value-added is 50 %. Because of discounting, increasing the number of years does not significantly change the value of the inheritance.

In our survey, we asked parents about any other transfers larger than 100 yuan given to their children after they marry. Only 43 sons (16 % of the total sample of sons) received other post-marital transfers, with an average of 1,700 yuan. This value is only about a third of the mean bride-price these sons received. The evidence suggests that large post-marital transfers are not a common practice in rural Chinese villages.

We also estimate our model adding these post-marital transfers and the value of assets other than land received as part of household division to our new measure of inter vivos transfers. The results are not significantly changed from those obtained only by using land and the bride-price.

Some of these papers use the inverse hyperbolic sine (IHS), sinh− 1(y ih ) = log(y ih + (y 2 ih + 1)1/2) transformation because it is similar to the ln(y ih ) transformation and it admits zero transfers as a value.

There are differences in the sample size between panels A and B. Therefore, we replicate panel A using the same restricted sample as panel B. We find that most of the coefficients are very similar, and only the coefficient on height, which becomes smaller in magnitude and insignificant, is sensitive to the use of the more restricted sample.

R-squared increases from 0.01 in column (1) to 0.75 in column (2)

Aside from genetic factors, variation in heights may be due to time-varying exogenous environmental factors such as the Great Leap Famine, agricultural reform, etc., as well as family-level shocks.

k 0 w h in this figure are estimated from specification (8) in panel A, Table 4.

We also replicate panel A of Table 4 using households with land divisions. The compensation coefficient in the regression with full controls is 0.22 as well.

Children in our sample have on average 8 years of schooling, and get married at the age of 23. Assuming that they start school at age 7, this implies that 8 years pass after they complete school before they get married. A back-of-the envelope calculation of the return to schooling at the time of marriage will be r = (1 + i)8, where i is the annual marginal return on education expenditure. Assuming that 0.09 < r < 0.15, then 2 < r < 3.

We also try specifications where all of the attributes are interacted with the schooling investments regardless of the way we control for k ih . The conclusions are essentially the same.

Appendix D provides an illustrative explanation on why first sons can have both lower k ih and lower (1 − μ ih )r ih at the same time.

Deposit rates on savings are reported in the annual Zhongguo Jinrong Nianjian (Almanac of China’s Finance and Banking).

Choosing a different baseline for the discounting will generate the same trend.

We cannot reject the hypothesis of some attenuation bias if measurement errors in schooling expenditure and years of schooling are positively correlated.

Recent empirical evidence like Fitzsimons and Malde (2014) shows that e¢ ceincy in childrenís education investment does not depend on number of children in the family.

Efficiency is reached when all family members recieve equal weights: k 1 = k 2 = 1 − k 1 − k 2 = 1/3.

For consistency we need \( \operatorname{cov}\left(\varDelta \frac{X}{1+ D{\delta}_h},{\upsilon}_h\right)=0 \) in (25). This condition is ensured under the efficient schooling investment assumption.

This conclusion is similar to Greene (2004). Using Monte Carlo methods, he finds that the coefficients in the Tobit model with fixed effects are "unaffected" by the incidental parameter problem. He observes that the estimators’ behavior in models with a continuous dependent variable (whether truncated or not) are quite different from binary choice models.

For simplicity, we assume that w h = w for all h.

On average, educational expenditure, brideprice, and brideprice plus land for the first son are 1386 yuan, 4440 yuan, and 6492 yuan, respectively. Mean value for the same set of variables for the other sons are 1601 yuan, 5299 yuan, and 7697 yuan, respectively.

References

Altonji JG, Fumio H, Kotlikoff LJ (1997) Parental altruism and inter vivos transfers: theory and evidence. J Polit Econ 105(6):1121–1166

Becker GS (1991) A treatise of the family, Enlargedth edn. Harvard University Press, Cambridge

Behrman JR, Rosenzweig MR, Taubman P (1994) Endowments and the allocation of schooling in the family and in the marriage market: the twins experiment. J Polit Econ 102(6):1131–1174

Chiappori PA (1988) Rational household labor supply. Econometrica 56(1):63–90

Chiappori PA (1992) Collective labor supply and welfare. J Polit Econ 100(3):437–467

Dunn TA, Phillips JW (1997) The timing and division of parental transfers to children. Econ Lett 54(2):135–137

Fitzsimons E, Malde B (2014) Empirically probing the quantity and quality model. J Popul Econ 27(1):33–68

Goody J (1973) Bride price and dowry in Africa and Eurasia in bride wealth and dowry. In: Goody J, Tambiah SJ (eds) Bride wealth and dowry, Cambridge Papers in Social Anthropology. No. 7. Cambridge University Press, Cambridge

Greene WH (2004) Fixed effects and the incidental parameters problem in the Tobit model. Econ Rev 23(2):125–148

Hochguertel S, Ohlsson H (2009) Compensatory inter vivos gifts. J Appl Econ 24(6):993–1023

Li H, Rosenzweig MR, Zhang J (2010) Altruism, favoritism, and guilt in the allocation of family resources: Sophie’s choice in Mao’s mass send down movement. J Polit Econ 118(1):1–38

Liu M, Xu Z, Tao R, Su X (2006) Study on the dynamics of farmer’s education fees burden before and after the rural tax reform. Working Paper

Lundberg SJ, Pollak RA, Wales TJ (1997) Do husbands and wives pool their resources? Evidence from the United Kingdom child benefit. J Hum Resour 32(3):463–480

McGarry K, Robert FS (1997) Transfer behavior within the family: results from the asset and health dynamics study. J Gerontol Ser B Psychol Sci Soc Sci 52:S82

McGarry K, Schoeni RF (1995) Transfer behavior in the Health and Retirement Study: measurement and the redistribution within the family. J Hum Resour 30:S184–S226

Menchik PL (1980) Primogeniture: equal sharing and the US distribution of wealth. Q J Econ 94(2):299–316

Menchik PL (1988) Unequal estate division: Is it altruism, reverse bequests, or simply noise? In: Kessler D, Masson A (eds) Modeling the accumulation and distribution of wealth. Clarendon, Oxford

Min H, Eades JS (1995) Brides, bachelors and brokers: the marriage market in rural Anhui in an era of economic reform. Mod Asian Stud 29(4):841–869

National Bureau of Statistics (2007) China statistical year book. China Statistics Press, Beijing

Neyman J, Scott EL (1948) Consistent estimates based on partially consistent observations. Econometrica 16(1):1–32

Nordblom K, Ohlsson H (2011) Bequests, gifts, and education: links between intergenerational transfers. Empir Econ 40(2):343–358

Park C (2003) Are children repaying parental loans? Evidence from Malaysia using matched child-parent pairs. J Popul Econ 16(2):243–263

Plug E, Vijverberg W (2003) Schooling, family background, and adoption: is it nature or is it nurture? J Polit Econ 111(3):611–641

Qian N (2008) Missing women and the price of tea in China: the effect of sex-specific earnings on sex imbalance. Q J Econ 123(3):1251–1285

Siu HF (1993) Reconstituting dowry and bride price in South China. In: Davis D, Harrell S (eds) Chinese families in the Post-Mao era. University of California Press, Berkeley

Tomes N (1981) The family, inheritance, and the intergenerational transmission of inequality. J Polit Econ 89(5):928–958

Wei SJ, Zhang X (2011) The competitive saving motive: evidence from rising sex ratios and savings rates in China. J Polit Econ 119(3):511–564

Wilhelm MO (1996) Bequest behavior and the effect of heir’s earnings: testing the altruistic model of bequests. Am Econ Rev 86(4):874–892

Wolff FC, Spilerman S, Attias-Donfut C (2007) Transfers from migrants to their children: evidence that altruism and cultural factors matter. Rev Income Wealth 53(4):619–644

Zhang W (2000) Dynamics of marriage in Chinese rural society in transition: a study of a Northern Chinese village. Popul Stud 54(1):57–69

Zhongguo Jinrong Nianjian (Almanac of China’s finance and banking). Various Years, China Finance Publishing House, Beijing

Acknowledgments

We thank the seminar participants of the Australian National University, the CLSRN 2008 Annual Conference, the China Summer Institute 2008 Annual Conference, 2011 Asian Meeting of the Econometric Society, ESPE, LSE, Queens University, and the University of Toronto. Loren Brandt and Aloysius Siow thank SSHRC for financial support. Hui Wang thanks CLSRN, Humanities and Social Science Foundation from China Ministry of Education (project no. 13YJC790144), and Chinese Service Center for Scholarly Exchange (CSCSE) for financial support.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Junsen Zhang

Appendices

Appendix

A. A framework for parental investments and transfers

This appendix provides a general framework of intra-household resource allocation. Decisions are made in two stages. In the first stage, parents choose schooling investments (s ih ) among different children; in the second stage, consumption is allocated among family members.

We start from the second stage of the problem. Taking s ih as given, consumption levels are determined by solving (P1):

subject to the household budget constraint:

It is convenient to impose a homothetic assumption on U h (·), say u(c) = ln(c) (see, Becker (1991)). Then optimal consumption levels are proportional to the total family wealth:

This consumption allocation solution can be rationalized through either a unitary or collective model. Their difference lies in the interpretation of k ih . In the context of the unitary model, equation (P1) represents the utility function of altruistic parents, who allocate consumption among family members. k ih can be interpreted as the relative weight they put on their children’s welfare relative to their own. Under Chiappori’s (1988, 1992) collective model, family members bargain efficiently over the division of family wealth to obtain their own consumption. The efficient bargaining results can be implemented through maximizing a "household welfare" function as in (P1), where k ih represents an individual’s bargaining power. In general,

When μ > 0, the parents’ marginal utility from a child’s consumption is increasing in the child’s earnings from schooling expenditure relative to family wealth.

In the first stage, parents make decisions on schooling to maximize their own utility function (assumed to be homothetic as well), while taking into account the allocation decisions (20)–(22):

where b ih are the relative weights they put on their children’s welfare relative to their own.

Notice that our framework is equivalent to Becker’s benchmark unitary model when b ih = k ih and μ = 0.

The value of μ is crucial for the efficiency of schooling investments. When μ = 0, k ih is independent of schooling attainment. Optimal schooling investments s * ih (a 1h , a 2h , m h ) satisfy:

i.e., the efficient schooling investment level (s * i ) will maximize total family wealth.Footnote 39 This is true under both the unitary and collective model. Even when household members bargain over the division of family wealth and parents have their own private interests, schooling investment is chosen to maximize total family wealth. Although parental preferences may differ from the bargaining weights, (b ih ≠ k ih ), the best the parents can do given the allocation constraints (20)–(22) is to maximize total family wealth. This result is reminiscent of Becker’s Rotten Kid Theorem.

When μ > 0, schooling investment will not be wealth maximizing. Under the unitary model, b i (s i ) = k i (s i ). The optimal solution for child i’s schooling s ′ ih satisfies the first-order condition of (P2):

When \( {k}_{ih}>1-{k}_{1 h}-{k}_{2 h},\frac{\partial {w}_h}{\partial {s}_{ih}}<0 \), hence s ′ ih > s * ih ; when \( {k}_{ih}<1-{k}_{1 h}-{k}_{2 h},\frac{\partial {w}_h}{\partial {s}_{ih}}>0 \), hence s ′ ih < s * ih , i.e., parents will over/under invest (relative to the wealth maximizing level) in one child’s schooling if he receives a higher/lower weight in the parental utility function than do the parents.Footnote 40

Under the collective model, b ih (s ih ) ≠ k ih (s ih ). The optimal solution for child i’s schooling s ′ ′ ih satisfies:

In particular, if b ih < k ih (s ′ ′ ih ) for i = 1, 2, then \( \frac{\partial {w}_h}{\partial {s}_{ih}}>0 \) and therefore s ′ ′ ih < s * ih . This means that, if at the wealth maximizing schooling level, children’s bargaining powers are greater than their parents would like them to be, the parents will invest less in children’s schooling relative to the efficient level.

B. Estimation of the multiplicative model

Given a random sample of households h = 1,…, H, each with 2 children i = 1, 2, consider the regression:

where y ih is the dependent variable; D ih and X ih are vectors of children’s characteristics; and ω h is the household fixed effect.Footnote 41 The parameters to be identified are θ = (δ, {ω h } H h = 1 , b).

A nonlinear least squares (NLS) estimator of \( \theta, \widehat{\theta} \), solves:

To reduce the computational burden of a global search for all parameters, we take advantage of the partial linearity in (24): given a value of δ, δ 0, equation (24) is a linear model. {ω h } H h = 1 and b can be estimated through OLS. Denoting these estimators as {ω ols h (δ 0|X ih , D ih )} H h = 1 and b ols(δ 0|X ih , D ih ), our problem is to find:

Given \( \widehat{\delta} \), the final estimator \( \widehat{\theta} \) is:

C. The incidental parameter problem

The least square estimators outlined above are subjected to a so-called "incidental parameter" problem. As first observed by Neyman and Scott (1948), standard estimators of nonlinear panel data models are usually inconsistent if the length of the panel is small relative to the number of observations. In this case, the finite sample bias in the fixed effects parameters ({ω h } H h = 1 in our context) will contaminate estimates of other parameters (δ and b in (24)).

Given the partial nonlinearity feature of our model, an alternative approach that can help get around the incidental parameter problem is quasi-differencing. To see this, divide (24) by 1 + D ih δ on both sides, and then take the sibling difference within the same household to obtain:

where \( \varDelta \frac{x}{1+ D{\delta}_h}=\frac{x_{1 h}}{1+{D}_{1 h}\delta}-\frac{x_{2 h}}{1+{D}_{2 h}\delta} \) and \( {\upsilon}_h=\frac{\varepsilon_{1 h}}{1+{D}_{1 h}\delta}-\frac{\varepsilon_{2 h}}{1+{D}_{2 h}\delta} \). Notice that household fixed effects are eliminated in (25). The parameters to be determined are (δ, b), which can be consistently estimated through NLS.Footnote 42

In order to compare the accuracy and efficiency between our least-square estimate and the above quasi-differencing estimate, we conduct Monte Carlo experiments. The number of households is 140, consistent with our multiple-sons sample. In each simulation, each household is endowed with a k 0 w h , which is assumed to be log normal distributed. Its distribution parameters are calibrated from the moments of the household fixed effects {w h } H h = 1 that we estimate from the data.

Each household has two children, one of whom is the "first son". We randomly generate two other attributes of the children, "indicator of the taller son" (D taller ih ) and "indicator of living with parents post marriage" (D livep ih ), such that their variance-covariance matrices with the first son indicator (D 1stson ih ) replicate the ones in the actual data.

We regress schooling expenditure on k 0 w h and children’s attributes using the actual dataset. We then use the coefficients and the distribution parameters of the error terms to generate the simulated schooling investments. Note that the error terms here serve as the ability endowments of the children. The intervivos transfers are simulated using equation (17) with error terms randomly generated to match the sample moments of the marital transfers (t ih ). The resulting data set is {s ih , t ih , D taller ih , D livep ih , D 1stson ih }. We estimate the model:

with the "true" parameters being set as (β,δ 1, δ 2,δ 3) = (−0.3, 0.2, 0.4, −0.2). Note that we allow cov(s ih , ω h ) > 0 and cov(s ih , D ih ) > 0, but keep cov(s ih , ε ih ) = 0 in the simulated data, which are the basic identification assumptions maintained throughout our paper.

We conduct a Monte Carlo analysis with 500 simulations. The results are reported in an appendix table available online. Our results show that, the least square approach used in our paper delivers highly precise estimates. By contrast, the quasi-differencing results exhibit larger bias and larger standard errors, especially when all three attributes of the children are controlled for simultaneously. Footnote 43We conclude that, even though our least square estimates may be theoretically inconsistent, their finite sample bias is negligible and they are more efficient than the consistent quasi-differencing estimates. We therefore base our inferences on the least squared results in our paper.

D. An illustrative explanation for why the first son can have both smaller k ih and smaller (1–μ ih )r ih at the same time

In an appendix figure available online, we show, in an illustrative way, the fitted linear relationship between educational expenditure and the transfers for the first son and his sibling (denoted as the second son).Footnote 44 The readers are referred to that figure for the discussion below. By definition, the two lines in the figure should pass through the sample mean for the two sons, denoted by point A and B, respectively. Their relative positions in the figure are due to the fact that, on average, eldest sons receive less schooling investments and intervivos transfers than their siblings in the data.Footnote 45

Subfigure (1) illustrates the case of Table 4, where the slopes of the two fitted lines, i.e. the marginal compensation coefficients, are assumed to be the same. But intercepts of the lines can be different, which identifies δ in equation (17) for the first son. The assumption that the two lines are parallel, along with the relative position of point A and B, determines that l 1 lies below l 2, which is consistent with the negative value for δ for the first son in Table 4.

Subfigure (2) illustrates the case of Table 6, where the slopes of the two lines are allowed to be different. Notice that the coefficient on the interaction between the first son dummy with the educational expenditure in Table 6 is positive, which means that the marginal coefficient is smaller for the first son. This result, along with the relative position of A and B, determines that magnitude of δ for the first son should be larger in Table 6 than in Table 4, which is consistent with our results.

Rights and permissions

About this article

Cite this article

Brandt, L., Siow, A. & Wang, H. Compensating for unequal parental investments in schooling. J Popul Econ 28, 423–462 (2015). https://doi.org/10.1007/s00148-014-0528-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-014-0528-6