Abstract

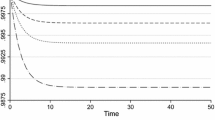

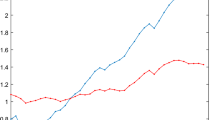

We examine the effect of source-based capital taxation on capital accumulation in countries with endogenous fertility and free international capital mobility. When fertility is constant, a tax cut accelerates domestic capital accumulation through international arbitrage and exerts negative influences on the welfare of a foreign country. In contrast, with endogenous fertility, a tax cut by an economy with a higher tax rate and exporting capital may deter capital accumulation and hence lower the welfare in not only domestic but also foreign economies in the long term, although the tax cut may accelerate domestic capital accumulation in the short term.

Similar content being viewed by others

Notes

Thus, the possibility of tax cut competition has been pointed out. For arguments on tax competition in the framework of a noncooperative game, see, for example, Hamada (1966), Wildasin (1988), and Huizinga and Nielsen (1997), while for tax harmonization, see, for example, Razin and Sadka (1991a) and Razin and Yuen (1996). From the viewpoint of securing tax revenues from capital taxation, however, international cooperation in the form of international exchange of savings information can be considered. See Huizinga and Nielsen (2008). Mendoza and Tesar (1998) among others more recently examined the international transmission of tax reforms in a dynamic model and showed that normative and positive implications of tax reforms are significantly different in open economies from those in closed economies. However, none of the literature cited above considered endogenous fertility.

The tax cuts in OECD countries may be attributed to the fact that they moved from boom to recession during the period. On the other hand, Devereux et al. (2002) also showed that the average statutory corporate income tax rates in the European Union and the USA have fallen dramatically from 48 % in 1982 to 35 % in 2001.

Momota and Futagami (2005) examined the effects of demographic structure on international lending and borrowing in a two-country model of Blanchard–Weil overlapping generations.

The gross rate of return stands for one plus the rate of return.

For example, Fanti and Gori (2009) explicitly take into account material costs of child rearing. With material costs, the number of children tends to depend positively on wage income, which is in turn positively related to the capital labor ratio, the state variable. However, the positive relation between fertility and income does not necessarily seem to be supported empirically. Thus, we assume only forgone income costs of child rearing in the present study. An increase in the after-tax wage rate raises the opportunity (time) cost of child rearing, decreasing the number of children.

We may incorporate human capital accumulation during childhood into the model without altering our results essentially.

See Section 5.2 and Appendix B of the for the plausibility of the assumption.

Even under the tax credit schemes by which capital exporting countries allow taxes paid to foreign governments by firms investing abroad to be credited against domestic tax liabilities, double taxation may not be avoided if the source-based capital tax rates in other economies are high. Bond and Samuelson (1989) showed that strategic behavior by the two countries involved leads to the elimination of trade in capital if the source country can restrict capital flows. See also Giovannini (1989), Frenkel et al. (1991), Razin and Sadka (1991b), and Gordon and Hines (2002).

We may assume instead a constant-elasticity-of-substitution production function. In that case, the results will be complicated, although the qualitative properties of the results are expected to hold basically by choosing parameters properly.

So far, we have assumed that n 1 = n 2. If n 1 > n 2, i.e., if ρ 1 > ρ 2 + [ τ 1 α/ (1 − α)](1 + ρ 2), we have \(s^{1}\left ( {k_{\text {a}}^{1}} \right )=\left ( {1-zn^{1}} \right )n^{1}k_{\text {a}}^{1} \) as an asymptotic long-term equilibrium since 1/ l t → 0 as t → ∞, while if ρ 1 < ρ 2 + [ τ 1 α / (1 − α)](1 + ρ 2) and n 1 < n 2, we will have \(s^{2}\left ( {k_{\text {a}}^{2}} \right )=\left ( {1-zn^{2}} \right )n^{2}k_{\text {a}}^{2} \) since l t → 0 as t → 8.

See Section 3 for the derivation.

Starting alternatively with a symmetric situation in which τ 1 = τ 2 and ρ 1 = ρ 2, the capital labor ratio in country 2 is affected by capital outflows to country 1 in the short term, although there would be no long-term effect on country 2 since the population weight of country 2 approaches one. However, as mentioned in Section 1, we are concerned with a more realistic case of τ 1 ≠ τ 2.

The effect on savings is given by \(\left ( {\partial s_{t}^{1} /\partial k_{t}^{1}} \right )\left ( {dk_{t}^{1} /d\tau ^{1}} \right )+\partial s_{t}^{1} /\partial \tau ^{1}\), with its ambiguous sign from (37).

However, owing to the capital taxation–expenditure policy, the capital labor ratios after period t + 2 might increase through increased savings.

See Fig. A3 in Appendix A of the ESM.

For the conventional results on tax incidence, see, for example, Kotlikoff and Summers (1987).

We assume here that condition α > ρ i/(1 + 2 ρ i) is satisfied. This is true for plausible parameters.

See Fig. A4 in Appendix A of the ESM.

The first- and second-period consumption and children are assumed to be superior goods in the present study.

See Appendix B of the ESM.

References

Bond EW, Samuelson L (1989) Strategic behavior and the rules for international taxation of capital. Econ J 99(398):1099–1111

Devereux MP, Griffith R, Klemm A (2002) Corporate income tax reforms and international tax competition. Econ Policy 17(36):451–495

Fanti L, Gori L (2009) Population and neoclassical economic growth: a new child policy perspective. Econ Lett 104(1):27–30

Frenkel JA, Razin A, Sadka E (1991) International taxation in an integrated world. MIT, Cambridge

Giovannini A (1989) National tax system versus the European capital market. Econ Policy 9(2):346–386

Gordon RH (1986) Taxation of investment and savings in a world economy. Am Econ Rev 76(5):1086–1102

Gordon RH, Hines JR (2002) International taxation. In: Auerbach AJ, Feldstein MS (eds) Handbook of public economics, vol 4. North Holland, Amsterdam, pp 1935–1995

Hamada K (1966) Strategic aspects of taxation on foreign investment income. Q J Econ 80(3):362–375

Harberger AC (2008) Corporate tax incidence: reflections on what is known, unknown, and unknowable. In: Diamond JW, Zodrow GR (eds) Fundamental tax reform: issues, choices and implications. MIT, Cambridge

Helliwell JF (2004) Demographic changes and international factor mobility. National Bureau of Economic Research working paper no 10945

Higgins M (1998) Demography, national savings, and international capital flow. Int Econ Rev 39(2):343–369

Huizinga H, Nielsen SB (1997) Capital income and profit taxation with foreign ownership of firms. J Int Econ 42(1–2):149–165

Huizinga H, Nielsen SB (2008) Must losing taxes on saving be harmful? J Public Econ 92(5–6):1183–1192

Ihori T (1991) Capital income taxation in a world economy: a territorial system versus a residence system. Econ J 101(407):958–965

Ito H, Tabata K (2010) The spillover effects of population aging, international capital flows, and welfare. J Popul Econ 23(2):665–702

Kemp MC, Wong KY (1995) Gains from trade with overlapping generation. Econ Theory 6(2):283–303

Kotlikoff LJ, Summers LH (1987) Tax incidence. In: Auerbach AJ, Feldstein MS (eds) Handbook of public economics, vol 2. North Holland, Amsterdam, pp 1043–1092

Lührmann M (2003) Demographic change, foresight and international capital flow. MEA working paper 38, University of Mannheim, Institute for the Economics of Aging

Mendoza EG, Tesar LL (1998) The international ramifications of tax reforms: supply-side economics in a global economy. Am Econ Rev 88(1):226–245

Momota A, Futagami K (2005) Demographic structure, international lending and borrowing in growing interdependent economies. J Jpn Int Econ 19(1):135–162

Razin A, Sadka E (1991a) International tax competition and gains from tax harmonization. Econ Lett 37(1):69–76

Razin A, Sadka E (1991b) Efficient investment incentives in the presence of capital flight. J Int Econ 31(1–2):171–181

Razin A, Yuen C-W (1996) Capital income taxation and long-run growth: new perspectives. J Public Econ 59(2):239–263

Sibert A (1988) Capital accumulation and foreign investment taxation. Rev Econ Stud 52(2):331–345

Sibert A (1990) Taxing capital in a large, open economy. J Public Econ 41(3):297–317

van Groezen B, Leers T, Meijdam L (2003) Social security and endogenous fertility: pensions and child allowances as Siamese twins. J Public Econ 87(2):233–251

Wildasin D (1988) Nash equilibria in models of fiscal competition. J Public Econ 35(2):229–240

Yakita A (2012) Different demographic changes and patterns of trade in a Heckscher–Ohlin setting. J Popul Econ 25(3):853–870

Zhang J, Zhang J, Lee R (2001) Mortality decline and long-run economic growth. J Public Econ 80(3):485–507

Zodrow GR (2010) Capital mobility and capital tax competition. Nat Tax J 64(4/2):865–902

Acknowledgments

The author is indebted to two anonymous referees for their constructive suggestions and comments. He also thanks Toshihiro Ihori, Jun-ichi Itaya, Ryuta Kato, Hisahiro Naito, Yasuyuki Osumi, Tadashi Yagi, and the seminar participants at the 27th Annual Congress of the European Economic Association (University of Málaga, Spain), Doshisha University, Hokkaido University, the University of Hyogo, the Institute of Statistical Research (Tokyo), and the Nagoya Macroeconomics Workshop, for the helpful comments and suggestions on earlier versions.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Alessandro Cigno

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Yakita, A. Effects of capital taxation on economies with different demographic changes: short term versus long term. J Popul Econ 27, 257–273 (2014). https://doi.org/10.1007/s00148-013-0480-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-013-0480-x