Abstract

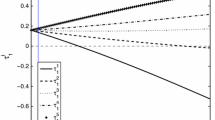

This paper examines the growth and welfare effects of physical capital taxation and labor income taxation. It is found that the impact of a rise in the physical capital tax rate on the balanced growth rate is crucially related to the birth rate, but a rise in the labor income tax rate definitely reduces the balanced growth rate regardless of the birth rate. It is also found that an increase in the physical capital income tax rate will harm the older but will benefit the younger, while an increase in the labor income tax rate will benefit the older but will harm the younger.

Similar content being viewed by others

Notes

In the Ramsey case, there is no disconnectedness in the economy, which corresponds to λ = β = 0. The Blanchard (1985) model of selfish agents with “finite horizons” and a constant population corresponds to λ = β > 0. The Weil (1989) case of overlapping families with infinitely lived agents is associated with λ = 0 and β > 0. Finally, the Buiter (1988) model corresponds to λ > 0, β > 0 and λ ≠ β.

This result stems from the specific functional form for human capital production. We are grateful to an anonymous referee for bringing this point to our attention.

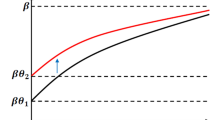

Given the above explanation, the effect of a rise in the physical capital tax on the consumption–capital ratio z is determined by the relative strength of the consumption channel and the intergenerational channel. It is shown that the strength of the consumption channel is relatively greater than that of the intergenerational channel, and hence, a rise in the physical capital tax leads to a rise in z. To be more specific, the effect of the physical capital tax s k on the consumption–capital ratio z can be expressed as Eq. 17b.

Meijdam (1998) and Yakita (2001) assume that both physical capital and labor (human capital) can be accumulated, human capital is not a market good, and human capital cannot be secured by life insurance. Similar to our finding, they find that physical capital taxation stimulates economic growth. This result implies that the marketability of the human capital does not exclusively determine the growth effect of the physical capital tax.

In their infinitely lived household model, Milesi-Ferretti and Roubini (1998) find that the growth effect of labor income taxation crucially depends on the marketability of the human capital. To be more specific, if the production of human capital involves the use of human capital only, the economy’s balanced growth rate is independent of labor income taxation if human capital is not a market good, and labor income taxation reduces the steady-state growth if human capital is a market good.

It should be noted that a rise in lump-sum transfers stemming from an increase in the tax rate on physical capital income is equally distributed among generations, and thus, the lump-sum transfer effect on all generations is equal.

It should be noted that at the balanced growth equilibrium r* = αx* is true (reported in Eq. 21d), and hence, Eq. 22d can be alternatively expressed by \( {d{\left[ {{\left( {1 - s_{k} } \right)}r*} \right]}} \mathord{\left/ {\vphantom {{d{\left[ {{\left( {1 - s_{k} } \right)}r*} \right]}} {ds_{\operatorname{k} } }}} \right. \kern-\nulldelimiterspace} {ds_{\operatorname{k} } } = \alpha x*{\left[ {{d{\left( {1 - s_{\operatorname{k} } } \right)}} \mathord{\left/ {\vphantom {{d{\left( {1 - s_{\operatorname{k} } } \right)}} {ds_{\operatorname{k} } }}} \right. \kern-\nulldelimiterspace} {ds_{\operatorname{k} } }} \right]} + {\left( {1 - s_{\operatorname{k} } } \right)}\alpha {\left[ {{dx*} \mathord{\left/ {\vphantom {{dx*} {ds_{\operatorname{k} } }}} \right. \kern-\nulldelimiterspace} {ds_{\operatorname{k} } }} \right]} = 0 \).

References

Blanchard OJ (1985) Debt, deficits and finite horizons. J Polit Econ 93(2):223–247

Blanchard OJ, Fischer S (1989) Lectures on macroeconomics. MIT Press, Cambridge

Bovenberg AL, van Ewijk C (1997) Progressive taxes, equity, and human capital accumulation in an endogenous growth model with overlapping generations. J Public Econ 64(2):153–179

Buiter WH (1988) Death, productivity growth and debt neutrality. Econ J 98(391):279–293

Buiter WH (1993) Saving and endogenous growth: a survey of theory and policy. In: Heertje A (ed) World savings, theory and policy. Blackwell Publishers, Oxford, pp 64–99

Chamley C (1986) Optimal taxation of capital income in general equilibrium with infinite lives. Econometrica 54(3):607–622

Greiner A, Hanusch H (1998) Growth and welfare effects of fiscal policy in an endogenous growth model with public investment. Int Tax Public Financ 5(3):249–261

Judd KL (1985) Redistributive taxation in a simple perfect foresight model. J Public Econ 28(1):59–83

King RG, Rebelo ST (1990) Public policy and economic growth: developing neoclassical implications. J Polit Econ 98(5):S126–S150

Lucas RE (1988) On the mechanics of economic development. J Monet Econ 22(1):3–42

Meijdam L (1998) Taxes, growth and welfare in an endogenous growth model with overlapping generations. Center for Economic Research Discussion Paper 98133, Tilburg University

Milesi-Ferretti GM, Roubini N (1998) On the taxation of human and physical capital in models of endogenous growth. J Public Econ 70(2):237–254

Mino K (1996) Analysis of a two-sector model of endogenous growth with capital income taxation. Int Econ Rev 37(1):227–253

Saint-Paul G (1992) Fiscal policy in an endogenous growth model. Q J Econ 107(4):1243–1259

Stokey NL, Rebelo ST (1995) Growth effects of flat-rate taxes. J Polit Econ 103(3):519–550

Weil P (1989) Overlapping families of infinitely lived agents. J Public Econ 38(2):183–198

Yaari ME (1965) Uncertain lifetime, life insurance, and the theory of the consumer. Rev Econ Stud 32(2):137–150

Yakita A (2001) Taxation in an overlapping generations model with human capital. Int Tax Public Financ 8(5):775–792

Acknowledgment

The authors are indebted to two anonymous referees for their constructive suggestions and insightful comments on an earlier version of this paper. Any errors or shortcomings are the authors’ responsibility.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Alessandro Cigno

Appendix

Appendix

1.1 Appendix 1

This appendix provides a detailed derivation of the welfare function (i.e., the discounted sum of indirect utility function) \( U*{\left( {v,t} \right)} \), the present discounted value of the household’s future lump-sum transfers G*(t), and real total assets a*(v,t) along the balanced growth path.

From Eq. 2a, we have:

Using integration by parts, Eq. A1 can be expressed by:

Substituting Eq. 3a into Eq. A2, we have:

From Eqs. 8b and 8c with x = Y 1/K, we have the following steady-state relationship:

where r* and w* denote the steady-state values of r(t) and w(t), respectively.

Let c*(v,t) denote the goods consumption at time t of a consumer born at time v along the balanced growth path, respectively. From Eq. 4a we have the following steady-state expression:

Substituting Eqs. A4 and A6 into Eq. A3, we have the welfare function of cohort v evaluated at time t, namely, U*(v,t):

Substituting Eq. 10 into Eq. 4b, we have:

Substituting Eqs. A4 and A5 into Eq. A8 yields the following steady-state value of G(t):

In the balanced growth equilibrium, we have \( {{\mathop K\limits^ \cdot }} \mathord{\left/ {\vphantom {{{\mathop K\limits^ \cdot }} K}} \right. \kern-\nulldelimiterspace} K = {{\mathop H\limits^ \cdot }} \mathord{\left/ {\vphantom {{{\mathop H\limits^ \cdot }} H}} \right. \kern-\nulldelimiterspace} H = Bu* + \beta \theta - \delta _{\operatorname{h} } \) and \( {{\mathop L\limits^ \cdot }} \mathord{\left/ {\vphantom {{{\mathop L\limits^ \cdot }} L}} \right. \kern-\nulldelimiterspace} L = \beta - \lambda \). As a result, we can infer:

Substituting Eqs. A10 and A11 into Eq. A9 gives rise to:

From Eqs. 8c and 9b we can further infer the following:

Equation 15a leads to the following steady-state relationship:

Substituting Eq. A14 into Eq. A13 yields:

where P* denotes the steady-state value of P(t).

Moreover, by substituting Eq. A15 into Eq. 2c, we obtain the following relationship along the balanced growth path:

Equations A7, A12, A16, and A4 are identical to Eqs. 21a, 21b, 21c, and 21d in the main text, respectively.

Rights and permissions

About this article

Cite this article

Chin, CT., Lai, CC. Physical capital taxation and labor income taxation in an endogenous growth model with new generations. J Popul Econ 22, 1–21 (2009). https://doi.org/10.1007/s00148-007-0183-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-007-0183-2