Abstract

We examine the effect of an increase in life expectancy on portfolio choices of individuals and, thereby, on economic growth in a simple endogenous growth model populated by overlapping generations, in which money is introduced based on the money-in-the-utility-function approach. It is shown that an increase in longevity raises the balanced growth rate and lowers the inflation rate, offsetting the Tobin effect, if spillovers from accumulated capital to labor productivity sufficiently raise wage income and real savings, and, if not, it may retard economic growth and aggravate inflation. Under plausible conditions, the former will be the case.

Similar content being viewed by others

Notes

van der Ploeg and Alogoskoufis (1994) suggested that the birth of new generations and the absence of intergenerational bequests may bring about an adverse relationship between inflation and economic growth in a continuous time overlapping generations model. This relationship holds for our model, too.

We assume in this study that the retirement age is given institutionally.

We assume that an individual does not hold real balances at the end of his second period.

For the interpretation, see, for example, Wigger (1999).

We assume here that 0<μ<1, for example, on an annual base, but it is not necessarily needed for our result.

This is a version of the AK model, and therefore, there is no transition. π is a jump variable.

A greater η and/or a higher r tend to make the left-hand side smaller, while higher r is associated with higher ω/a under the assumption that 1>(af′/f)[1-(af″/f′)]. The condition is satisfied when f(a)=Aa α(0<A;0<α<1).

We have (∂ɛ/∂π)−(∂ϕ/∂π)>0 (see Appendix). It should be noted that π may not be monotonic in λ when the growth rate of money supply, μ, is constant and relatively high enough for Eq. (19) to be satisfied. If the inflation rate reaches π=η[1/(1+r)+(1−η)]+(1−η)[μ/(ω/a)]-1, either from above or from below, an increase in life expectancy no longer affects the inflation rate and, thus, economic growth.

The negative relation between growth and inflation is often documented in cross-country data, e.g., Gomme (1993). Roubini and Sala-i-Martin (1992) argued that the negative correlation is likely to be spurious as both are caused by policies of financial repression. The negative correlation obtained in our study is conditional on the life expectancy variable.

A smaller η makes the inflation rate slightly lower and the growth rate slightly higher in each case. We have similar numerical results in the case of a CES production function.

For a survey of different approaches and the results, see, for example, Orphanides and Solow (1990). Based on the cash-and-credit-goods approach with a cash-in-advance constraint a la Lucas and Stokey (1983) and Batina and Ihori (2000), we can show that an increase in life expectancy leads to higher growth and lower inflation.

References

Abel AB (1987) Optimal monetary growth. J Monet Econ 19:437–450

Arrow KJ (1962) The economic implications of learning by doing. Rev Econ Stud 29:155–173

Barro RJ, Sala-i-Martin X (2004) Economic growth, 2nd edn. MIT Press, Cambridge, MA

Batina R, Ihori T (2000) Consumption tax policy and the taxation of capital income. Oxford University Press, New York

Chari VV, Manuelli RE, Jones LE (1995) The growth effects of monetary policy. Q Rev–Fed Reserve Bank Minneapolis 19:18–32

de la Croix D, Licandro O (1999) Life expectancy and endogenous growth. Econ Lett 65:255–263

Drazen A (1981) Inflation and capital accumulation under a finite horizon. J Monet Econ 8:247–260

Ehrlich I, Chuma H (1990) A model of the demand for longevity and the value of life extension. J Polit Econ 98:761–782

Ehrlich I, Lui F (1991) Intergenerational trade, longevity, and economic growth. J Polit Econ 99:1029–1059

Gomme P (1993) Money and growth revisited: measuring the costs of inflation in an endogenous growth model. J Monet Econ 32:51–77

Grossman GM, Yanagawa N (1993) Asset bubbles and endogenous growth. J Monet Econ 31:3–19

Kalemli-Ozcan S (2002) Does the mortality decline promote economic growth? J Econ Growth 7:411–443

Kalemli-Ozcan S, Ryder HE, Weil DN (2000) Mortality decline, human capital investment, and economic growth. J Dev Econ 62:1–23

Lee R, Tuljapurkar S (1997) Death and taxes: how longer life will affect social security. Demography 34:67–82

Lucas RE, Stokey NL (1983) Optimal fiscal and monetary policy in an economy without capital. J Monet Econ 12:55–93

Mino K, Shibata A (1995) Monetary policy, overlapping generations, and patterns of growth. Economica 62:179–194

Miyazawa K (2003) Demographic transition and income inequality in an accidental bequest model. Mimeo, Nanzan University

Orphanides A, Solow RM (1990) Money, inflation and growth. In: Friedman BM, Hahn FH (eds) Handbook of monetary economics. North Holland, Amsterdam, pp 223–261

Philipson TJ, Becker GS (1998) Old-age longevity and mortality: contingent claims. J Polit Econ 106:551–573

Romer PM (1986) Increasing returns and long-run growth. J Polit Econ 94:1002–1037

Roubini N, Sala-i-Martin X (1992) Financial repression and economic growth. J Dev Econ 39:5–30

van der Ploeg F, Alogoskoufis GS (1994) Money and endogenous growth. J Money Credit Bank 26:771–791

Wigger BU (1999) Public pensions and growth. Finanzarchiv 56:241–263

World Bank (1993) World development report. World Bank, Washington, DC

Yakita A (1989) The optimal rate of inflation and taxation. J Public Econ 38:369–385

Yakita A (2001) Uncertain lifetime, fertility and social security. J Popul Econ 14:635–640

Zhang J, Zhang J, Lee R (2001) Mortality decline and long-run economic growth. J Public Econ 80:485–507

Zhang J, Zhang J, Lee R (2003) Rising longevity, education, savings, and growth. J Dev Econ 70:83–101

Acknowledgements

The author thanks Kazutoshi Miyazawa, the referees and the editor of this journal, and the seminar participants at Chukyo University for their helpful comments and suggestions. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Alessandro Cigno

Appendices

Uniqueness of balanced growth equilibrium

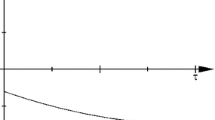

From Eq. (18),

and

as depicted in Fig. 1. ϕ(π) is a quadratic function of π and has two intersections with the horizontal axis at −1 and \({\left\{ {{{\left[ {1 - \eta \frac{{1 + \rho }}{{2 + \rho - \lambda }}} \right]}} \mathord{\left/ {\vphantom {{{\left[ {1 - \eta \frac{{1 + \rho }}{{2 + \rho - \lambda }}} \right]}} {{\left[ {{\left( {1 + r} \right)}{\left( {1 - \frac{{1 + \rho }}{{2 + \rho - \lambda }}} \right)}} \right]}}}} \right. \kern-\nulldelimiterspace} {{\left[ {{\left( {1 + r} \right)}{\left( {1 - \frac{{1 + \rho }}{{2 + \rho - \lambda }}} \right)}} \right]}}} \right\}} - 1\), while ɛ(π) is a line and intersects the abscissa at \({\left\{ {{\left( {1 + r} \right)}{\left[ {1 - {\left( {1 - \eta } \right)}\frac{{1 + \rho }}{{2 + \rho - \lambda }}\frac{\mu }{{1 + \mu }}} \right]}} \right\}}^{{ - 1}} - 1\). Since we can easily see that \({\left\{ {{{\left[ {1 - \eta \frac{{1 + \rho }}{{2 + \rho - \lambda }}} \right]}} \mathord{\left/ {\vphantom {{{\left[ {1 - \eta \frac{{1 + \rho }}{{2 + \rho - \lambda }}} \right]}} {{\left[ {{\left( {1 + r} \right)}{\left( {1 - \frac{{1 + \rho }}{{2 + \rho - \lambda }}} \right)}} \right]}}}} \right. \kern-\nulldelimiterspace} {{\left[ {{\left( {1 + r} \right)}{\left( {1 - \frac{{1 + \rho }}{{2 + \rho - \lambda }}} \right)}} \right]}}} \right\}} - 1 > {\left\{ {{\left( {1 + r} \right)}{\left[ {1 - {\left( {1 - \eta } \right)}\frac{{1 + \rho }}{{2 + \rho - \lambda }}\frac{\mu }{{1 + \mu }}} \right]}} \right\}}^{{ - 1}} - 1\) for λ, η ∈ (0,1), Eq. (18) has two real roots, \(\pi _{{\ell }} \) and π h , such that \( - 1 < \pi _{{\ell }} < {\left\{ {{\left( {1 + r} \right)}{\left[ {1 - {\left( {1 - \eta } \right)}\frac{{1 + \rho }}{{2 + \rho - \lambda }}\frac{\mu }{{1 + \mu }}} \right]}} \right\}}^{{ - 1}} - 1 < \pi _{h} \) (see Fig. 1). With condition (19), however, the smaller root, \(\pi _{{\ell }} \), is not a solution to our model. Therefore, solving Eq. (18) for π, we obtain

where

from which it follows that

This implies that \(\frac{{\partial \varepsilon }}{{\partial \pi }} - \frac{{\partial \phi }}{{\partial \pi }} > 0\). Thus, we have \(sign{\left( {\frac{{d\pi }}{{d\lambda }}} \right)} = sign{\left( {\frac{{\partial \phi }}{{\partial \lambda }} - \frac{{\partial \varepsilon }}{{\partial \lambda }}} \right)}.\)

Increase in the growth rate of money supply

Differentiating ɛ(π; μ), we have

from which it follows that

Since we can easily see that

while taking Eq. (19) into account, it follows that

The curve ϕ(π) does not depend on μ, so the upward shift of ɛ(π, μ) increases the inflation rate.

Rights and permissions

About this article

Cite this article

Yakita, A. Life expectancy, money, and growth. J Popul Econ 19, 579–592 (2006). https://doi.org/10.1007/s00148-005-0017-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-005-0017-z