Abstract

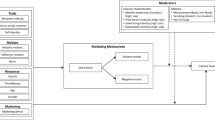

The purpose of our study is to (i) investigate the effects of the number of products, product attributes, and prices on consumer confusion, (ii) conduct a numerical analysis to check the robustness of the results, and (iii) present an example of the cell phone market in Japan. Following an ideal point model and embedding the number of products and product attributes, we clarify how these factors affect consumer confusion and purchase probability. We show that as the number of product attributes increases, the choice probability of each product becomes equal, implying that consumer confusion occurs. This result is robust to the introduction of prices as strategic variables.

Similar content being viewed by others

Notes

Even when assumption 1 or 2 is not assumed, our main result holds. We illustrate this outcome in Sect. 3 using numerical analysis.

This assumption is the standard in the ideal point model. For example, see Freeman et al. (2012). In this study, all consumers purchase the product, and we do not consider non-purchasing behavior because the non-purchasing assumption is not necessary.

See Sibson (1969). As for Kullback–Leibler divergence, \({\text{KL}}(p,q) = \mathop \sum \limits_{n = 1} p(x_{n} )\log \frac{{p(x_{n} )}}{{q(x_{n} )}}\), because the values between \({\text{KL}}(p,q)\) and \({\text{KL}}(q,p)\) can be different, the analysis is complicated (Kullback and Leibler 1951). However, using the IR, comparing the values is simply necessary. Therefore, we adopt the IR.

As pointed out by a referee, we recognize that our formulation is simplified to apply to real-world situations. However, this setting is restricted not only to a relationship between the younger and older generations. Our setting is useful as a first step and can be applicable to two types of consumers, such as informed and uninformed ones, male and female, and so on. We conjecture that our approach is useful for a case of more than two types. If one segments a market based on consumers’ preferences and divide the market into some groups, our method becomes applicable to various situations (Moskowitz and Rabino 1994; Honkanen et al. 2004). This issue remains for future research.

Using the example of the iPhone 4 in the United States, Freeman, Spenner, and Bird discussed the behavior of “not to choose the better alternative” and noted the importance of “simplicity” for corporate strategies (Chen et al. 2009).

See “Second Comparative Report on Featurephone, iPhone, Android User’s Usage” written in Japanese and released by the Mobile Content Forum (October, 2013), http://www.mcf.or.jp/en/index.html. This phenomenon is also seen in other countries. See “World’s cell phone market” (August, 2017), https://www.strategyanalytics.com/strategy-analytics/news/strategy-analytics-press-releases/strategy-analytics-press-release/2017/08/16/, “China’s cell phone market” (June, 2016), https://www.counterpointresearch.com/oppo-becomes-the-leading-smartphone-brand-in-china-in-june-2016/.

See “DENSHISYOSEKI KONTENTSU SHIJOTYOUSA” written in Japanese and released by ICT Reseach & Consulting (October, 2014), http://ictr.co.jp/report/20141015000069.html.

Consider the example presented by Turnbull et al. (2000) of a consumer confusion phenomenon in the cell phone market attributable to similarity among products. They stated that consumer confusion is likely to occur in highly turbulent industries, which are characterized by rapid technological change and evolving competition. They showed that consumer confusion exists in the cell phone market and firms should develop a strong brand image to avoid such confusion.

References

Aguirre I, Cowan S, Vickers J (2010) Monopoly price discrimination and demand curvature. American Economic Review 100:1601–1605

Belleflamme P, Peitz M (2015) Industrial organization: markets and strategies. Cambridge University Press, Cambridge

Bertrand J (1883) Revue de la Theorie Mathematique de la Richesse Sociate et des Recherches sur ies Principles Mathematiques de ta Theorie des Richesses. Journal des Savants 499–508

Chen YC, Shang RA, Kao CY (2009) The effects of information overload on consumers’ subjective state towards buying decision in the internet shopping environment. Electron Commer Res Appl 8:48–58

Chintagunta P, Hanssens DM, Hauser JR (2016) Marketing science and big data. Mark Sci 35:341–342

Chioveanu I, Zhou J (2013) Price competition with consumer confusion. Manage Sci 59:2450–2469

d’Aspremont C, Gabszewicz JJ, Thisse JF (1979) On Hotelling’s stability in competition. Econometrica 47:1145–1150

Davenport TH (2005) The coming commoditization of process. Harvard Bus Rev 83:100–108

de Silva Garza AG (2017) An introduction to and comparison of computational creativity and design computing. Artif Intell Rev Forthcom. doi:10.1007/s10462-017-9557-3

Ebina T, Kinjo K (2014) Too many attributes and consumer’s dysfunction. In: Neves-Silva R, Tsihrintzis GA, Uskov V (eds) Smart Digital Futures 2014. IOS Press, Amsterdam, pp 112–122

Ebina T, Matsushima N, Shimizu D (2015) Product differentiation and entry timing in a continuous time spatial competition model. Eur J Oper Res 247:904–913

Freeman K, Spenner P, Bird A (2012) What do consumers really want? simplicity. Harvard business review HBR blog network (See http://blogs.hbr.org/2012/05/what-do-consumer-really-want-s/). Accessed 25 May 2017

Gourville JT, Soman D (2005) Overchoice and assortment type: when and why variety backfires. Mark Sci 24:382–395

Hastie T, Tibshirani R, Friedman JJH (2001) The elements of statistical learning. Springer, New York

Honkanen P, Olsen SO, Myrland Ø (2004) Preference-based segmentation: a study of meal preferences among Norwegian teenagers. J Consum Behav 3:235–250

Indurkhya B (2016) On the role of computers in creativity-support systems. In: Skulimowski AMJ, Kacprzyk J (eds) Knowledge, Information and Creativity Support Systems: Recent Trends, Advances and Solutions. Springer, Cham, pp 213–227

Iyengar SS, Lepper MR (2000) When choice is demotivating: can one desire too much of a good thing? J Pers Soc Psychol 79:995–1006

Jaccard J, Brinberg D, Ackerman LJ (1986) Assessing attribute importance: a comparison of six methods. J Consum Res 12:463–468

Jacoby J (1984) Perspectives on information overload. J Consum Res 10:432–435

Jacoby J, Speller DE, Berning CK (1974a) Brand choice behavior as a function of information load: replication and extension. J Consum Res 1:33–42

Jacoby J, Speller DE, Kohn CA (1974b) Brand choice behavior as a function of information load. J Mark Res 11:63–69

Kinjo K, Ebina T (2015) Paradox of choice and consumer nonpurchase behavior. AI Soc 30:291–297

Kinjo K, Ebina T (2017) Case-based decision model matches ideal point model: application to marketing decision support. J Intell Inf Syst Forthcom. doi:10.1007/s10844-017-0463-6

Kuksov D, Villas-Boas JM (2010) When more alternatives lead to less choice. Mark Sci 29:507–524

Kullback S, Leibler RA (1951) On information and sufficiency. Ann Math Stat 22:79–86

Lee E, Staelin R (1997) Vertical strategic interaction: implications for channel pricing strategy. Mark Sci 16:185–207

Mackay DB, Easley RF, Zinnes JH (1995) A single ideal point model for market structure analysis. J Mark Res 32:433–443

Moon Y (2005) Break free from the product life cycle. Harvard Bus Rev 83:86–94

Moskowitz HR, Rabino S (1994) Sensory segmentation: an organizing principle for international product concept generation. J Global Mark 8:73–94

Nagpal A, Khare A, Chowdhury T, Labrecque LI, Pandit A (2011) The impact of the amount of available information on decision delay: the role of common features. Mark Lett 22:405–421

Nikkei Publishing (2015) NIKKEIGYOKAICHIZU 2016. Nikkei Publishing, Tokyo

Ortoleva P (2013) The price of flexibility: towards a theory of thinking aversion. J Econ Theory 148:903–934

Safari E, Babakhani M, Sadjadi JS, Shahanaghi K, Naboureh K (2015) Determining strategy of pricing for a web service with different QoS levels and reservation level constraint. Appl Math Model 13:3784–3813

Schwartz B (2004) The paradox of choice: why more is less. Harper Collins, New York

Shaked A, Sutton J (1982) Relaxing price competition through product differentiation. Rev Econ Stud 49:3–13

Sibson R (1969) Information radius. Zeitschrift für Wahrscheinlichkeitstheorie und verwandte Gebiete 14:149–160

Thakur LS, Nair SK, Wen KW, Tarasewich P (2000) A new model and solution method for product line design with pricing. J Oper Res Soc 51:90–101

Turnbull PW, Leek S, Ying G (2000) Customer confusion: the mobile phone market. J Mark Manag 16:143–163

Villas-Boas JM (2009) Product variety and endogenous pricing with evaluation costs. Manage Sci 55:1338–1346

Walsh G, Hennig-Thurau T, Mitchell VW (2007) Consumer confusion proneness: scale development, validation, and application. J Mark Manag 23:697–721

Zhang Y, Wang J, Wang F (2016) Equilibrium pricing strategies in retrial queueing systems with complementary services. Appl Math Model 40:5775–5792

Acknowledgements

The authors are grateful to the session participants at the 6th International Conference on Intelligent Decision Technologies. Ebina acknowledges a Grant-in-Aid for Young Scientists (B) from the Japanese Ministry of Education, Science, Sports, and Culture (15K17047). Kinjo acknowledges financial support from a Grant-in-Aid for Young Scientists (16K17203) from the Japan Society for the Promotion of Science.

Author information

Authors and Affiliations

Corresponding author

Additional information

A part of this paper in Sects. 1, 2 and 3.1, which are respectively the introduction, a description of our model, and a part of the numerical analysis, is included in Ebina and Kinjo (2014), the proceedings of Smart Digital Futures 2014 under the title, “Too Many Attributes and Consumer’s Dysfunction.

Appendix: case study

Appendix: case study

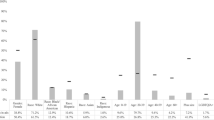

For example, in our results, consider the case of Japan’s cell phone market. NTT DoCoMo, Inc., the predominant cell phone operator in Japan, provides various smartphones, such as the REGZA Phone (Toshiba), Xperia acro (Sony), Medias (NEC), and Galaxy (Samsung). These smartphones have many attributes, such as color, size, mail functions, presence or non-presence of camera, carrier, and operating system. In addition to these physical attributes, customers must also choose a contract type, including fee structure (fixed fee plus variable fee) and time span.Footnote 6 According to 2011 data, none of these products monopolizes the market, and each product has approximately the same market share (Table 1).Footnote 7

The similar phenomena are observed in several markets in Japan. One example of this is electronic book market. The number of electronic book store comprises genre of specialty, the number of contents offered, usage method, supported OS, discount, free contents, and so on and so forth. A share of each electronic book store in Japan is roughly as follows; Kobo presented by Rakuten kobo 15.5%, Kindle store by Amazon 15.3, honto 8.7% by 2Dfacto established by NTT DOCOMO and Dai Nippon Printing, iBookstore 8.0% by Apple, Line Manga 6.8% by LINE, ReaderStore 8.0% by Sony, GooglePlay books 6.6% by Google, eBookJapan 6.1%, BookLive! 5.6%, BPOOKWALKER 4.2%, and others 15.3%.Footnote 8 In addition, this phenomenon is seen in Internet service provider market. The attributes comprises line services (upstream/downstream), setup cost, e-mail address, packet capacity, cashback, the number of account registration, and so on. In particular, since many firms set up and practice their campaign, this campaign causes consumers to be complicated to choose among the goods with many attributes, and consumers need to choose which one is the best for them. Concretely, the share of top three firms is about the same roughly as follows: NTT communications 18.0%, KDDI 16.5%, Softbank 13.4%(Nikkei Publishing 2015).Footnote 9

One may think that the factors determining the probability of each product purchased are both consumer confusion and the diversity of consumer preference. In Subsection 3.1, this study investigates not only the case in which consumers with identical preferences exist but also the case, in Subsection 3.2, in which some consumers have identical preferences but others have different preferences. In both cases, we find the same result—that the probability of each product’s purchase is identical. We indicate that consumer confusion (having no preference for attributes) becomes a reason for our result to hold.

Rights and permissions

About this article

Cite this article

Ebina, T., Kinjo, K. Consumer confusion from price competition and excessive product attributes under the curse of dimensionality. AI & Soc 34, 615–624 (2019). https://doi.org/10.1007/s00146-017-0771-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00146-017-0771-y