Abstract

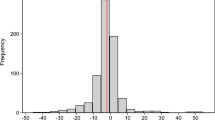

Rapid, large-scale U.S. deployment of wind turbines is expected to continue in the coming years. Because some of that deployment is expected to occur in relatively populous areas, concerns have arisen about the impact of turbines on nearby home values. Previous research on the effects of wind turbines on surrounding home values has been limited by small home-sale data samples and insufficient consideration of confounding home-value factors and spatial dependence. This study examines the largest set of turbine-proximal sales data to date: more than 50,000 home sales including 1,198 within 1 mile of a turbine (331 of which were within a half mile). The data span the periods well before announcement of the wind facilities to well after their construction. We use ordinary least squares and spatial-process difference-in-difference hedonic models to estimate the home-value impacts of the wind facilities, controlling for value factors existing prior to the wind facilities’ announcements, the spatial dependence of home values, and value changes over time. A series of robustness models provide greater confidence in the results. We find no statistical evidence that home values near turbines were affected in the turbine post-construction or post-announcement/pre-construction periods.

Similar content being viewed by others

Notes

Assuming 2-MW turbines, the 2012 U.S. average (AWEA 2013), and 5.5 GW of annual capacity growth.

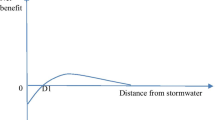

Disamenities and amenities are defined respectively as disadvantages (e.g., a nearby noxious industrial site) and advantages (e.g., a nearby park) of a location.

Throughout this report, the terms “announced/announcement” and “constructed/construction” represent the dates on which the proposed wind facility (or facilities) entered the public domain and the dates on which facility construction began, respectively. Home transactions can either be pre-announcement (PA), post-announcement/pre-construction (PAPC), or post-construction (PC).

Heintzelman and Tuttle do not appear convinced that the effect they found is related to the PAPC period, yet the two counties in which they found an effect (Clinton and Franklin Counties, NY) had transaction data produced almost entirely in the PAPC period.

This analysis is available upon request from the authors.

For example, Sunak and Madlener (2012) find larger effects related to the turbines in a city that is farther from the turbines than they find in a town which is closer. Additionally, they find stronger effects in the center of a third town than they do on the outskirts of that town, which do not seem related to the location of the turbines.

See Jackson (2003) for a further discussion of the Hedonic Pricing Model and other analysis methods.

Because it is assumed that nuisance effects from turbines come in the form of, for example, views of, sounds from and/or shadow flicker from turbines, and that the models do not test for these effects directly, the one-mile and half-mile models, therefore, act as a proxy. Previous research has shown that distance is a good proxy for these effects, that these effects are likely to fade beyond one half mile, and that, therefore, the half-mile models are more likely to coincide with these effects than the one-mile models (e.g., Hoen et al. 2009; Hoen et al. 2011).

A “block group” is a US Census Bureau geographic delineation that contains a population between 600 to 3,000 persons.

The dataset does not include “participating” landowners, those that have turbines situated on their land, but does include “neighboring” landowners, those adjacent to or nearby the turbines. One reviewer notes that the estimated average effects also include any effects from payments “neighboring” landowners might receive that might transfer with the home. Based on previous conversations with developers (see Hoen et al. 2009), we expect that the frequency of these arrangements is low, as is the right to transfer the payments to the new homeowner. Nonetheless, our results should be interpreted as “net” of any influence whatever “neighboring” landowner arrangements might have.

Unlike the vector of home, site, and neighborhood characteristics, sale price inflation/deflation and seasonal changes were not expected to vary substantially across various counties in the same states in our sample and therefore the interaction was made at the state level. This assumption was tested as part of the robustness tests though, where they are interacted at the county level and found to not affect the results.

In part because of the rural nature of many of the study areas included in the research sample, these census tracts are large enough to contain sales that are located close to the turbines as well as those farther away, thereby ensuring that they do not unduly absorb effects that might be related to the turbines. Moreover each tract contains sales from throughout the study periods, both before and after the wind facilities’ announcement and construction, further ensuring they are not biasing the variables of interest.

SARAR refers to a “spatial-autoregressive model with spatial autoregressive residuals”.

The most recent sale weights the transactions to those occurring after announcement and construction that are more recent in time. One reviewer wondered if the frequency of sales was affected near the turbines, which is also outside the scope of the study, though this “sales volume” was investigated in Hoen et al. (2009), where no evidence of such an effect was discovered. Another correctly noted that the most recent assessment is less accurate for older sales, because it might overestimate some characteristics of the home (e.g., sfla, baths) that might have changed (i.e., increased) over time. This would tend to bias those characteristics’ coefficients downward. Regardless, it is assumed that this occurrence is not correlated with proximity to turbines and therefore would not bias the variables of interest.

As discussed in more detail in the Data Section, approximately 60 % of all the data obtained for this study (that obtained from CoreLogic) used the most recent assessment to populate the home and site characteristics for all transactions of a given property.

See the EV Energy Map, which is part of the Velocity Suite of products at www.ventyx.com.

See www.corelogic.com.

The 15 acre screen was used because of a desire to exclude from the sample any transaction of property that might be hosting a wind turbine, and therefore directly benefitting from the turbine’s presence (which might then increase property values). To help ensure that the screen was effective, all parcels within a mile of a turbine were also visually inspected using satellite and ortho imagery via a geographic information system.

See www.orps.state.ny.us

Baths was calculated in the following manner: full bathrooms + (half bathrooms x 0.5). Some counties did not have baths data available, so for them baths was not used as an independent variable.

The distribution of sfla1000 is skewed, which could bias OLS estimates, thus lsfla1000 is used instead, which is more normally distributed. Regression results, though, were robust when sfla1000 was used instead.

This variable allows the separate estimations of the 1st acre and any additional acres over the 1st.

Age and agesqr together account for the fact that, as homes age, their values usually decrease, but further increases in age might bestow countervailing positive “antique” effects.

See footnote 14.

Before the distances were calculated, each home inside of 1 mile was visually inspected using satellite and ortho imagery, with x/y coordinates corrected, if necessary, so that those coordinates were on the roof of the home.

Cleaning involved the removal of all data that did not have certain core characteristics (sale date, sale price, sfla, yrbuilt, acres, median age, etc.) fully populated as well as the removal of any sales that had seemingly miscoded data (e.g., having a sfla that was greater than acres, having a yrbuilt more than 1 year after the sale, having less than one bath) or that did not conform to the rest of the data (e.g., had acres or sfla that were either larger or smaller, respectively, than 99 % or 1 % of the data). OLS models were rerun with those “nonconforming” data included with no substantive change in the results in comparison to the screened data presented in the report.

Age could be as low as−1 (for a new home) for homes that were sold before construction was completed.

The OLS models are estimated using the areg procedure in Stata with robust (White’s corrected) standard errors (White 1980). The spatial error models are estimated using the gstslshet routine in the sphet package in R, which also allows for robust standard errors to be estimated. See: http://cran.r-project.org/web/packages/sphet/sphet.pdf

The controlling variables’ coefficients were similar across the base models, so only the one-mile results are summarized here.

The possible adverse effects of these collinearities were fully explored both via the removal of the variables and by examining VIF statistics. The VOI results are robust to controlling variable removal and have relatively low (<5) VIF statistics.

The removal of this, as well as the other block group census variables, however, did not substantively influence the results of the VOI.

p-values are not shown in the table can but can be derived from the standard errors, which are shown.

All DD estimates for the OLS models were calculated using the post-estimation “lincom” test in Stata, which uses the stored results’ variance/covariance matrix to test if a linear combination of coefficients is different from 0. For the SEM models, a similar test was performed in R.

All differences in coefficients are converted to percentages in the table as follows: exp(coef)-1.

Although not discussed in the text, this trend continues with homes between 1 and 2 miles being less negative/more positive than homes closer to the turbines (e.g., those within 1 mile).

Results were also estimated for the one-mile OLS models for each of the robustness tests and are available upon request: the results do not substantively differ from what is presented here for the half-mile models. Because of the similarities in the results between the OLS and SEM “base” models, robustness tests on the SEM models were not prepared as we assumed that differences between the two models for the robustness tests would be minimal as well.

This trend also continues outside of 1 mile, with those coefficients being less negative/more positive than those within 1 mile.

References

American Wind Energy Association (AWEA) (2013). AWEA U.S. wind industry - fourth quarter 2012 market report - executive summary. Washington, DC: American Wind Energy Association.

Anderson v. Board of Assessors of the Town of Falmouth (2013). Commonwealth of Massachusetts Appellate Tax Board (MAATB). August 27, 2013. File no. F314689 (2011) and F316333 (2012).

Anselin, L. (1988). Spatial econometrics: methods and models. Berlin: Springer.

Anselin, L. (2002). Under the Hood Issues in the Specification and Interpretation of Spatial Regression Models. Agricultural Economics, 27(3), 247–267.

Anselin, L., & Lozano-Gracia, N. (2008). Errors in Variables and Spatial Effects in Hedonic House Price Models of Ambient Air Quality. Empirical Economics, 34(1), 5–34.

Arraiz, I., Drukker, D. M., Kelejian, H. H., & Prucha, I. R. (2009). A Spatial Cliff-Ord-type Model with Heteroskedastic Innovations: Small and Large Sample Results. Journal of Regional Science, 50(2), 592–614.

Bateman, I., Day, B., & Lake, I. (2001). The effect of road traffic on residential property values: a literature review and hedonic pricing study. Edinburgh, Scotland: Scottish Executive and the Stationary Office.

Baxter, J., Morzaria, R., & Hirsch, R. (2013). A Case–control Study of Support/Opposition to Wind Turbines: Perceptions of Health Risk, Economic Benefits, and Community Conflict. Energy Policy, 61, 931–943.

Bloomberg New Energy Finance (Bloomberg) (2013). Q1 2013 North America wind market outlook. New York: Bloomberg New Energy Finance.

Bond, S. (2008). Attitudes Towards the Development of Wind Farms in Australia. Journal of Environmental Health Australia, 8(3), 19–32.

Bond, S. (2010). Community Perceptions of Wind Farm Development and the Property Value Impacts of Siting Decisions. Pacific Rim Property Research Journal, 16(1), 52–69.

Boyle, M. A., & Kiel, K. A. (2001). A Survey of House Price Hedonic Studies of the Impact of Environmental Externalities. Journal of Real Estate Research, 9(2), 117–144.

Braunholtz, S., & Scotland, M. O. R. I. (2003). Public attitudes to windfarms: a survey of local residents in Scotland. Edinburgh, Scotland: Scottish Executive.

Brown, J., Pender, J., Wiser, R., Lantz, E., & Hoen, B. (2012). Ex Post Analysis of Economic Impacts from Wind Power Development in U.S. Counties. Energy Economics, 34(6), 1743–1745.

Carter, J. (2011). The effect of wind farms on residential property values in Lee County, Illinois. Master’s thesis. Normal, IL: Illinois State University.

Cook, R. D. (1977). Detection of Influential Observations in Linear Regression. Technometrics, 19(1), 15–18.

Cook, R. D., & Weisberg, S. (1982). Residuals and influence in regression. New York: Chapman & Hall.

Currie, J., Davis, L., Greenstone, M., & Walker, R. (2012). Do housing prices reflect environmental health risks? Evidence from more than 1600 toxic plant openings and closings. Working Paper 12–30. Cambridge, MA: Massachusetts Institute of Technology, Department of Economics.

Devine-Wright, P. (2005). Beyond Nimbyism: Towards an Integrated Framework for Understanding Public Perceptions of Wind Energy. Wind Energy, 8(2), 125–139.

Donovan, G. H., Champ, P. A., & Butry, D. T. (2007). Wildfire Risk and Housing Prices: a Case Study from Colorado Springs. Land Economics, 83(2), 217–233.

Freeman, A. M. (1979). Hedonic Prices, Property Values and Measuring Environmental Benefits: a Survey of the Issues. Scandinavian Journal of Economics, 81(2), 154–173.

Gipe, P. (1995). Wind energy comes of age. New York: Wiley Press.

Haurin, D. R., & Brasington, D. (1996). School Quality and Real House Prices: inter-and Intrametropolitan Effects. Journal of Housing Economics, 5(4), 351–368.

Heintzelman, M. D., & Tuttle, C. (2012). Values in the Wind: a Hedonic Analysis of Wind Power Facilities. Land Economics, 88, 571–588.

Hinman, J. L. (2010). Wind farm proximity and property values: a pooled hedonic regression analysis of property values in central Illinois. Master’s thesis. Normal, IL: Illinois State University.

Hoen, B., Wiser, R., Cappers, P., Thayer, M., & Sethi, G. (2009). The impact of wind power projects on residential property values in the United States: a multi-site hedonic analysis. Report no. LBNL-2829E. Berkeley, CA: Lawrence Berkeley National Laboratory.

Hoen, B., Wiser, R., Cappers, P., Thayer, M., & Sethi, G. (2011). Wind Energy Facilities and Residential Properties: the Effect of Proximity and View on Sales Prices. Journal of Real Estate Research, 33(3), 279–316.

Hubbard, H. H., & Shepherd, K. P. (1991). Aeroacoustics of Large Wind Turbines. Journal of the Acoustical Society of America, 89(6), 2495–2508.

Intergovernmental Panel on Climate Change (IPCC). (2011). Special report on renewable energy sources and climate change mitigation. Cambridge, UK and New York: Cambridge University Press.

Jackson, T. O. (2001). The Effects of Environmental Contamination on Real Estate: a Literature Review. Journal of Real Estate Research, 9(2), 93–116.

Jackson, T. O. (2003). Methods and Techniques for Contaminated Property Valuation. The Appraisal Journal, 71(4), 311–320.

Kane, T. J., Riegg, S. K., & Staiger, D. O. (2006). School Quality, Neighborhoods, and Housing Prices. American Law and Economics Review, 8(2), 183–212.

Kelejian, H. H., & Prucha, I. R. (1998). A Generalized Spatial Two-stage Least Squares Procedure for Estimating a Spatial Autoregressive Model with Autoregressive Disturbances. Journal of Real Estate Finance and Economics, 17(1), 99–121.

Kelejian, H. H., & Prucha, I. R. (2010). Specification and Estimation of Spatial Autoregressive Models with Autoregressive and Heteroskedastic Disturbances. Journal of Econometrics, 157(1), 53–67.

Kenney v. The Municipal Property Assessment Corporation (MPAC) (2012). Ontario Assessment Review Board (ARB). File no. WR 113994

Kroll, C. A., & Priestley, T. (1992). The effects of overhead transmission lines on property values: a review and analysis of the literature. Washington, DC: Edison Electric Institute.

Kuethe, T. H. (2012). Spatial Fragmentation and the Value of Residential Housing. Land Economics, 88(1), 16–27.

Lantz, E., & Tegen, S. (2009). Economic development impacts of community wind projects: a review and empirical evaluation. Conference paper no. NREL/CP-500-45555. Golden, CO: National Renewable Energy Laboratory.

Laposa, S. P., & Mueller, A. (2010). Wind Farm Announcements and Rural Home Prices: Maxwell Ranch and Rural Northern Colorado. Journal of Sustainable Real Estate, 2(1), 383–402.

Loomis, D., & Aldeman, M. (2011). Wind farm implications for school district revenue. Normal, IL: Illinois State University, Center for Renewable Energy.

Loomis, D., Hayden, J., & Noll, S. (2012). Economic impact of wind energy development in Illinois. Normal, IL: Illinois State University, Center for Renewable Energy.

Malpezzi, S. (2003). Hedonic pricing models: a selective and applied review. In T. O’Sullivan & K. Gibb (Eds.), Housing Economics and Public Policy: Essays in Honour of Duncan Maclennan (pp. 67–85). Hoboken, NJ: Wiley-Blackwell.

Palmer, J. (1997). Public acceptance study of the Searsburg Wind Power Project - one year post construction. Waterbury Center, VT: Vermont Environmental Research Associates, Inc.

Ready, R. C. (2010). Do Landfills Always Depress Nearby Property Values? Journal of Real Estate Research, 32(3), 321–339.

Rogers, W. H. (2006). A Market for Institutions: Assessing the Impact of Restrictive Covenants on Housing. Land Economics, 82(4), 500–512.

Rosen, S. (1974). Hedonic Prices and Implicit Markets: Product Differentiation in Pure Competition. Journal of Political Economy, 82(1), 34–55.

Simons, R. A., & Saginor, J. D. (2006). A Meta-analysis of the Effect of Environmental Contamination and Positive Amenities on Residential Real Estate Values. Journal of Real Estate Research, 28(1), 71–104.

Sims, S., & Dent, P. (2007). Property Stigma: Wind Farms are just the Latest Fashion. Journal of Property Investment & Finance, 25(6), 626–651.

Sims, S., Dent, P., & Oskrochi, G. R. (2008). Modeling the Impact of Wind Farms on House Prices in the UK. International Journal of Strategic Property Management, 12(4), 251–269.

Sirmans, G. S., Macpherson, D. A., & Zietz, E. N. (2005). The Composition of Hedonic Pricing Models. Journal of Real Estate Literature, 13(1), 3–42.

Slattery, M. C., Lantz, E., & Johnson, B. L. (2011). State and local Economic Impacts from Wind Energy Projects: a Texas Case Study. Energy Policy, 39(12), 7930–7940.

Sunak, Y., & Madlener, R. (2012). The impact of wind farms on property values: a geographically weighted hedonic pricing model. FCN working paper no. 3/2012. Aachen, Germany: Institute for Future Energy Consumer Needs and Behavior (ACN), RWTH Aachen University.

Tiebout, C. M. (1956). A pure Theory of Local Expenditures. Journal of Political Economy, 64(5), 416–424.

Vyn, R. J., & McCullough, R. M. (2014). The effects of wind turbines on property values in Ontario: does public perception match empirical evidence? Canadian Journal of Agricultural Economics, doe:10.1111/cjag.12030.

White, H. (1980). A Heteroskedasticity-consistent Covariance Matrix Estimator and a Direct Test for Heteroskedasticity. Econometrica, 48(4), 817–838.

Wiggins v. WPD Canada Corporation (2013). Superior Court of Justice, Ontario, CA. May 22, 2013. File no. CV-11-1152.

Wisconsin Realtors Association, Wisconsin Builders Association, Wisconsin Towns Association, Morehouse, & Selik v. Public Service Commission of Wisconsin (2014). Wisconsin 3rd District Court of Appeals, March 25, 2014. Cir. Ct. no. 2012CV1203.

Wolsink, M. (2007). Planning of Renewables Schemes: Deliberative and Fair Decision-Making on Landscape Issues Instead of Reproachful Accusations of Non-cooperation. Energy Policy, 35(5), 2692–2704.

Zabel, J. E., & Guignet, D. (2012). A Hedonic Analysis of the Impact of Lust Sites on House Prices. Resource and Energy Economics, 34(4), 549–564.

Acknowledgments

This work was supported by the Office of Energy Efficiency and Renewable Energy (Wind and Water Power Technologies Office) of the U.S. Department of Energy under Contract No. DE-AC02-05CH11231. For funding and supporting this work, we especially thank Patrick Gilman, Cash Fitzpatrick, and Mark Higgins (U.S. DOE). For providing the data that were central to the analysis contained herein, we thank Cameron Rogers (Fiserv) and Joshua Tretter (CoreLogic Inc.), both of whom were highly supportive and extremely patient throughout the complicated data-acquisition process. Finally, we would like to thank the many external reviewers for providing valuable comments on an earlier draft version of the report. Of course, any remaining errors or omissions are our own. The views expressed herein are those of the authors and may not be attributed to the Lawrence Berkeley National Laboratory, the Federal Reserve Bank of Kansas City, Texas A&M University or San Diego State University.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Hoen, B., Brown, J.P., Jackson, T. et al. Spatial Hedonic Analysis of the Effects of US Wind Energy Facilities on Surrounding Property Values. J Real Estate Finan Econ 51, 22–51 (2015). https://doi.org/10.1007/s11146-014-9477-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-014-9477-9